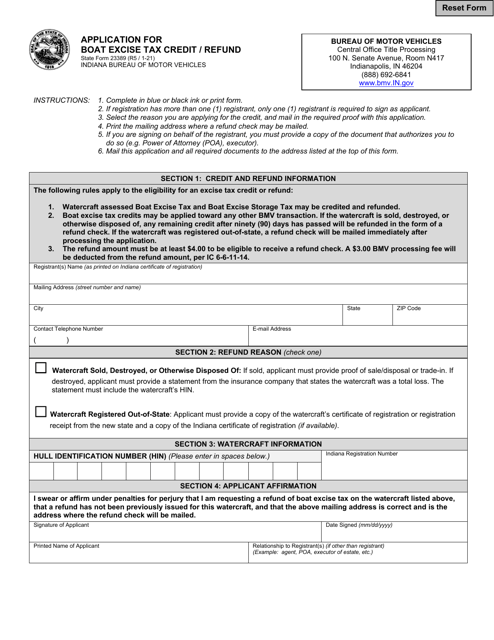

Have more time to file my taxes and i think i will owe the department. Application is valid for registrations beginning january 01, 2017.

Are You Eligible For An Excise Tax Refund Find Out Here Wsbt

It is anticipated that claims will be processed within 30 days of receipt.

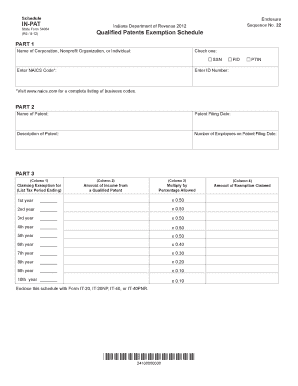

Indiana excise tax refund. They are charged the same amount shown in the wheel tax table for the specified vehicle type and weight classification. Municipal vehicle excise taxes may be credited and refunded. As a result, those customers overpaid excise taxes when registering their vehicles.

Have more time to file my taxes and i think i will owe the department. Motor vehicle excise tax refund. Know when i will receive my tax refund.

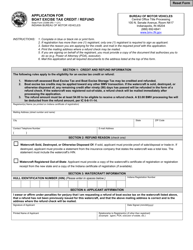

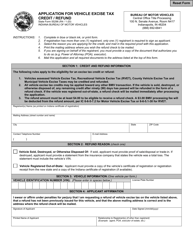

Complete in blue or black ink or print form. Pay my tax bill in installments. If the fuel is being used in a vehicle, the declared

Everyone eligible for a refund will receive a claim form in the mail. About press copyright contact us creators advertise developers. To apply for a refund of certain fees, please use sf 56165.

Form is to be used solely to apply for a municipal vehicle excise or wheel tax refund. Don snemis, commissioner of the indiana bureau of motor vehicles (bmv) announced today that the bmv has determined that some customers are entitled to excise tax refunds. You can see that by going to marian county, it says the excise tax for passenger vehicle is 10%;

Electronic version of state form 55296 and 23389 The bmv will work with the indiana department of revenue to issue those refunds. About 180,000, or 3.5 percent, of the 5.1 million hoosiers who registered vehicles with the bmv since 2004 are entitled to refunds.

However, if the amount shown is greater than $50.00, then only $50.00 will be charged, which is the maximum amount allowed to be assessed for county vehicle excise tax. The signature of an authorized person with a properly completed power of attorney, if the customer wants the indiana department of revenue (dor) to discuss the claim with anyone other than the customer. Request a refund from the indiana bmv;

Everyone eligible for a refund will receive a claim form in the mail. $29 million in excise tax refunds, plus interest. Indiana bmv begins sending out excise tax refund notices the bmv has begun sending out claim forms to residents who areentitled to excise tax refunds dating back to 2004.

Some indiana drivers are entitled to an excise tax refund, the indiana bureau of motor vehicles (bmv) announced tuesday. Minimum of $7.50 i'm glad that i didn't take your underlined response directly without looking at the link you provided. If the vehicle is sold, destroyed, or otherwise disposed of, any remaining credit after ninety (90) days has passed will be refunded in the form of a refund check.

To get started, click on the appropriate link: Claim a gambling loss on my indiana return. Electronic application for vehicle or boat excise tax credits and refunds.

Online services & bmv connect; Complete in blue or black ink, or print form. Indiana excise tax credits and refunds if you have sold your vehicle or if it has been destroyed (a total loss), you can apply for a credit or refund of a portion of the excise taxes that you paid.

Pay my tax bill in installments. The agency says all claim forms will be mailed within the next 30 days. Have more time to file my taxes and i think i will owe the department.

File my taxes as an indiana resident while i am in the military, but my spouse is not an indiana resident. File my taxes as an indiana resident while i am in the military, but my spouse is not an indiana resident. Claim a gambling loss on my indiana return.

The indiana bureau of motor vehicles has created a website where motorists can determine whether they're eligible for a refund on excise taxes they've paid. Claim a gambling loss on my indiana return. The proper documentation, a complete explanation of the claimed refund, and;

If you move out of the state after making these payments you may be eligible for a partial refund on the excise tax. All vehicle excise tax credits may be applied toward any other bmv transaction. Print the mailing address where you wish the refund check to be mailed.

To submit a claim for refund the taxpayer must provide: To file and/or pay business sales and withholding taxes, please visit intime.dor.in.gov. File my taxes as an indiana resident while i am in the military, but my spouse is not an indiana resident.

About 185,000, or 3.6 percent, of the 5.1 million hoosiers who registered vehicles with the bmv since 2004 are entitled to refunds. When you register your car in indiana you must pay an excise tax and a registration fee. Know when i will receive my tax refund.

“the bmv has determined that some hoosier’s vehicles were misclassified for excise tax purposes. Know when i will receive my tax refund. Pay my tax bill in installments.

The amount of credit that may be claimed cannot exceed the amount of vehicle excise tax or rvet owed for the individual’s vehicle. Charity gaming card excise tax return. This only applies to vehicle owners who paid a vehicle, recreational vehicle, county vehicle or municipal vehicle excise tax.

New Analysis A Third Of Nc Taxpayers Wont Benefit From Proposed Tax Refund Plan Itep

Dor Unemployment Compensation State Taxes

State Form 23389 Download Fillable Pdf Or Fill Online Application For Boat Excise Tax Creditrefund Indiana Templateroller

Are You Due A Refund From Bmv

State Form 23389 Download Fillable Pdf Or Fill Online Application For Boat Excise Tax Creditrefund Indiana Templateroller

Telecom Audit Training Module Understanding Telecom Taxes Fees And Surcharges - Pdf Free Download

Indiana Bmv Begins Sending Out Excise Tax Refund Notices Wthrcom

Fillable Online Forms In Application For Vehicle Excise Tax Credit Refund - Indiana Fax Email Print - Pdffiller

State Form 56288 Download Fillable Pdf Or Fill Online Application For Municipal Vehicle Excise Or Wheel Tax Refund Indiana Templateroller

Bmv To Issue 29 Million In Excise Tax Refunds

Excise Tax Inkfreenewscom

Dor Businesses Submit A Refund Request Online With Intime

State Form 55296 Download Fillable Pdf Or Fill Online Application For Vehicle Excise Tax Credit Refund Indiana Templateroller

Understanding Telecom Taxes Fees And Surc General Definition Federal Excise Tax State And Local - Pdf Document

State And Federal Excise Tax Refunds On Clear Diesel Used In An Exempt Manner

Formsingov

Ingov

Dor Filing Your Tax Return Early

Indiana Bmv To Issue 29m In Excise Tax Refunds - Youtube

Comments

Post a Comment