251 followers · political candidate. Upcoming workshops of note for ld1 residents:

Town Of North Hempstead - News

The workshop consists of a presentation on:

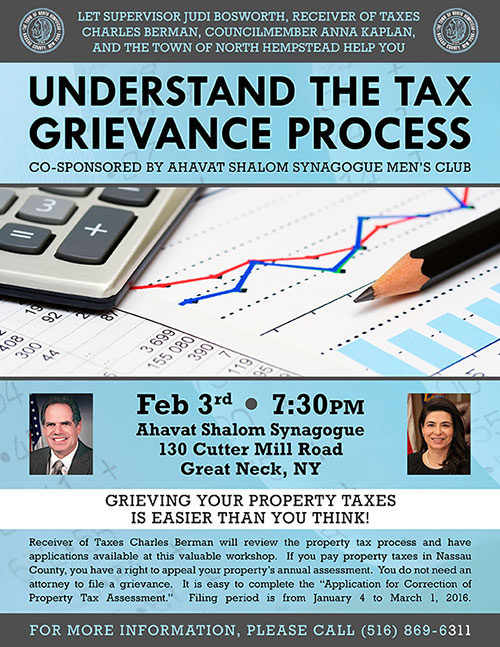

Nassau county tax grievance workshop. During these webinars, property owners who disagree with the assessed value of their property can learn how to navigate the grievance process, utilize online research tools, and. Hundreds tuned in to watch nassau county legislator arnold w. The workshop will be led by town supervisor judi bosworth, receiver of taxes charles berman and councilwoman anna kaplan.

Legislator abrahams, arc host virtual tax grievance workshop. (last appointment is at 2:45 p.m.). How to check your grievance status.

If you pay taxes on property in nassau county, you. All workshops are from 11 a.m. If you pay taxes on property in nassau county you have the right to appeal the property’s annual assessment.

The seminar will take place at 7 p.m. During these webinars, property owners who disagree with the assessed value of their property can learn how to navigate the grievance process, utilize online research tools, and. Drucker videos property tax grievance workshop.

242 followers · political candidate. Dates, times and locations for the property assessment grievance workshops are: For more information on your property, visit www.lrv.nassaucountny.gov.

The deadline to challenge the assessment on your home was recently extended to thursday, april 2 nd. In the great neck house at 14 arrandale ave. Nassau county legislator joshua lafazan (woodbury) is partnering with the nassau county assessment review commission to host a pair of online tax grievance workshops.

Legislator norma gonsalves will be holding property assessment grievance workshops for any homeowner who disagrees with the new tentative property tax assessment as shown on their nassau county property tax impact disclosure notice. By filing a grievance application for correction of property tax assessment during the formal grievance period. 526 followers · public figure.

Contingency fee 50% of 1st year’s savings. Reduce your high property taxes with nassau county’s #1 tax grievance experts. Nassau county legislator joshua lafazan (woodbury) is partnering with the nassau county assessment review commission to host a pair of online tax grievance workshops.

The assessment review commission is pleased to announce a series of community grievance workshops for the 19 nassau county legislative districts and local municipalities. Nassau county legislator joshua lafazan (woodbury) is partnering with the nassau county assessment review commission to host a pair of online tax grievance workshops. How to use the arow portal on the arc website.

There is a new assessment for each year. Receiver of taxes charles berman speaks with residents at a property assessment grievance workshop. Charles berman, receiver of taxes 2018 grievance workshops we will review the property assessment and grievance processes, and explain how to fill out the grievance application (on paper or online).

The time to appeal a new assessment ends before the taxes based on that assessment are billed. This seminar is offered in partnership with county legislator josh lafazan and the nassau county assessment review commission. The workshop will be held on thursday, march 28th, at 7 p.m.

Town of oyster bay supervisor joseph saladino is joining nassau county legislators rose marie walker and laura schaefer in hosting a free grievance workshop for residents looking to acquire information on how to challenge their property tax assessments. It will cover key points on how to file a grievance of your tax assessment with the nassau county assessment review commission. During these webinars, property owners who disagree with the assessed value of their property can learn how to navigate the grievance process, utilize online research tools, and.

Staff members will be on hand with applications for your convenience.

Town Property Assessment Grievance Workshops - Long Island Weekly

Property Tax Assessment Grievance Workshop Herald Community Newspapers Liheraldcom

Legislator Steve Rhoads - The Weather Outside May Be Frightful But Its Sunny And 75 On The Internet Tonights Assessment Grievance Seminar Is Still On Join Me On-line At 7 Pm Tonight

News Flash Nassau County Ny Civicengage

Nassau County Reassessment Prompts Barrage Of Political Mailers Newsday

Town Of North Hempstead - News

All Sides Agree Grieve Your Nassau Tax Assessment Updated

News Flash Nassau County Ny Civicengage

Tax Grievance Workshop Announced For Port Washington Port Washington Ny Patch

Property Tax Grievance Workshops On March 24th And 25th Canceled Town Of Oyster Bay

Property Tax Grievance Workshop Jericho Public Library

Nassau County Property Tax Reduction Tax Grievance Long Island

Nassau County District 18 Updates - Next Tuesday Join Us And The Nassau County Assessment Review Commission For A Free Virtual Tax Grievance Workshop All Property Owners In Nassau County Can File

Town County Partner To Host Free Property Tax Grievance Workshop In Hicksville Town Of Oyster Bay

Legislator Holds Online Tax Grievance Workshop Mid-island Times

Nc Property Tax Grievance E-file Tutorial - Youtube

Tax Grievance Workshop Pet Food Drive Syosset Advance

News Flash Nassau County Ny Civicengage

Looking To Grieve Nassau Or Suffolk Property Taxes Heller Consultants Have A Proven Track Record In Saving You Money Longislandcom

Comments

Post a Comment