3.25% of taxable value which decreases by 35% annually. In oklahoma, you must pay an excise tax of 3.25% of the vehicle's purchase price when you register it.

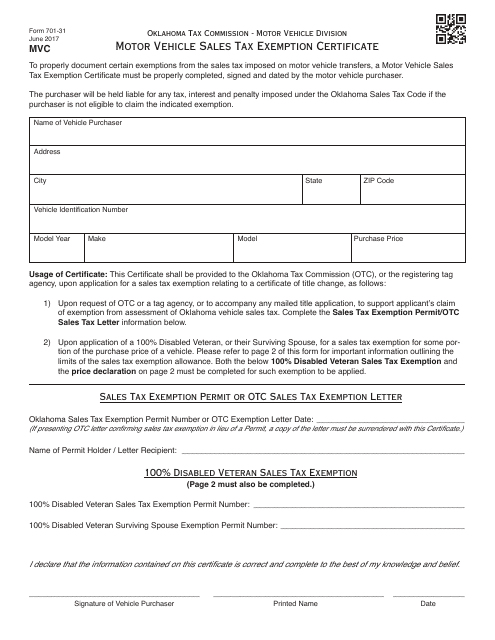

Otc Form 701-31 Download Fillable Pdf Or Fill Online Motor Vehicle Sales Tax Exemption Certificate Oklahoma Templateroller

Ad start your dropshipping storefront.

Oklahoma state auto sales tax. Click any locality for a full breakdown of local property taxes, or visit our oklahoma sales tax calculatorto lookup local rates by zip code. 3.25% of ½ the actual purchase price/current value. You can only avoid this tax if you purchase the car in a no sales tax state and then register the vehicle in that state as well.

Oklahoma has 762 cities, counties, and special districtsthat collect a local sales tax in addition to the oklahoma state sales tax. Average sales tax (with local): Where you register the vehicle:

Ad start your dropshipping storefront. 3.25% of 65% of ½ the actual purchase price/current value. Oklahoma sales and use tax okla.

The oklahoma local sales tax is generally between 3% and 4%, based on the municipality. 3.25% excise tax plus 1.25% sales tax = 4.5% total for new vehicles$20 on first $1,500 + 3.25% excise tax on balance + 1.25% sales tax on full price = total for used cars 2021 oklahoma sales tax by county.

States that do not charge a sales tax include new hampshire, oregon, delaware, montana and alaska. Which states have no auto sales tax? Until 2017, motor vehicles were fully exempt from the sales tax, but under hb 2433 , the exemption was partially lifted and motor vehicles became subject to a 1.25 percent sales tax.

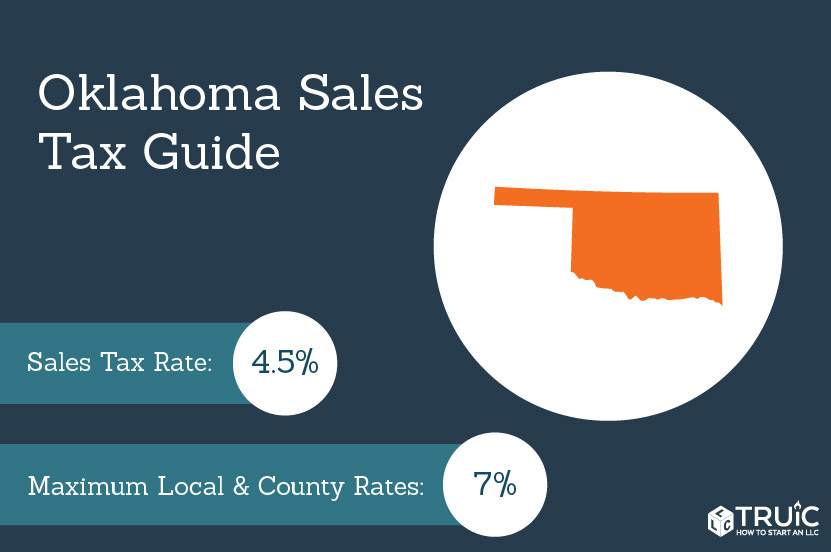

Oklahoma city, ok 73116 phone: Oklahoma first adopted a general state sales tax in 1933, and since that time, the rate has risen to 4.5 percent. 68 § 1354 ¶21,860 escort services

Oklahoma collects a 3.25% state sales tax rate on the purchase of all vehicles. This means that, depending on your location within oklahoma, the total tax you pay can be significantly higher than the 4.5% state sales tax. The maximum local tax rate allowed by oklahoma law is.

State engraving comments authority editorial reference ok not taxable engraving services are not among the services subject to oklahoma sales and use tax okla. Advantages of the motor vehicle tax are: States with some of the highest sales tax on cars include oklahoma (11.5%), louisiana (11.45%), and arkansas (11.25%).

Whether you live in tulsa, broken bow or oklahoma city, residents are required to pay oklahoma car tax when purchasing a vehicle. Oklahoma has a 4.5% statewide sales tax rate, but also has 356 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales tax of 3.205% on top of the state tax. Utilize leading marketing tools to boost your business and get found online.

Oklahoma has a statewide sales tax rate of 4.5%, which has been in place since 1933. 26 usc section 501(c)(3) are exempt from sales tax in oklahoma. The states with the highest car sales tax rates are:

As of july 1, 2017, oklahoma charges a 1.25 percent sales tax on vehicle purchases in addition to motor vehicle taxes. 8:00 am to 4:30 pm Once you have completed your application, please return it to:

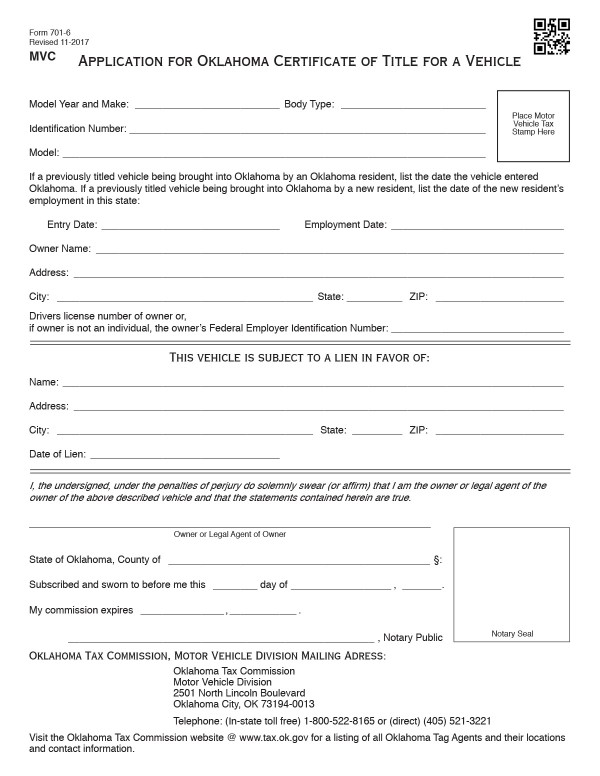

Oklahoma’s motor vehicle taxes are a combination of an excise (sales) tax on the purchase of a vehicle and an annual registration fee in lieu of ad valorem (property) taxes. Oklahoma tax commission oklahoma city, oklahoma 73194 be sure to visit us on our website at tax.ok.gov for all your tax needs including forms, publications and answers to your questions. Does the sales tax amount differ from state to state?

68 § 1354 ¶22,080 engraving services this chart shows whether or not the state taxes engraving services. On top of the state sales tax, there may be one or more local sales taxes, as well as one or more special district taxes, each of which can range between 0 percent and 7 percent. Utilize leading marketing tools to boost your business and get found online.

Oklahoma has state sales tax of. Can i buy a car out of state and drive it home? The sales tax rate for the sooner city is 4.5%, however for most road vehicles, there is a motor vehicles excise tax assessed at the time of sale or when the new oklahoma car title is issued in the new owner's name.

The cost for the first 1,500 dollars is a flat 20 dollar fee. However it must be noted that the first 1,500 dollars spent on the vehicle would not be taxed in the usual way; Unfortunately, if you live close to a state with a lower or no car sales tax, such as if you live near delaware, you cannot buy a car in that state to avoid sales.

The oklahoma state sales tax rate is 4.5%, and the average ok sales tax after local surtaxes is 8.77%. Counties and cities in oklahoma are allowed to charge an additional local sales tax on top of the oklahoma state sales tax. If you need access to a database of all.

States with high tax rates tend to be above 10% of the price of the vehicle.

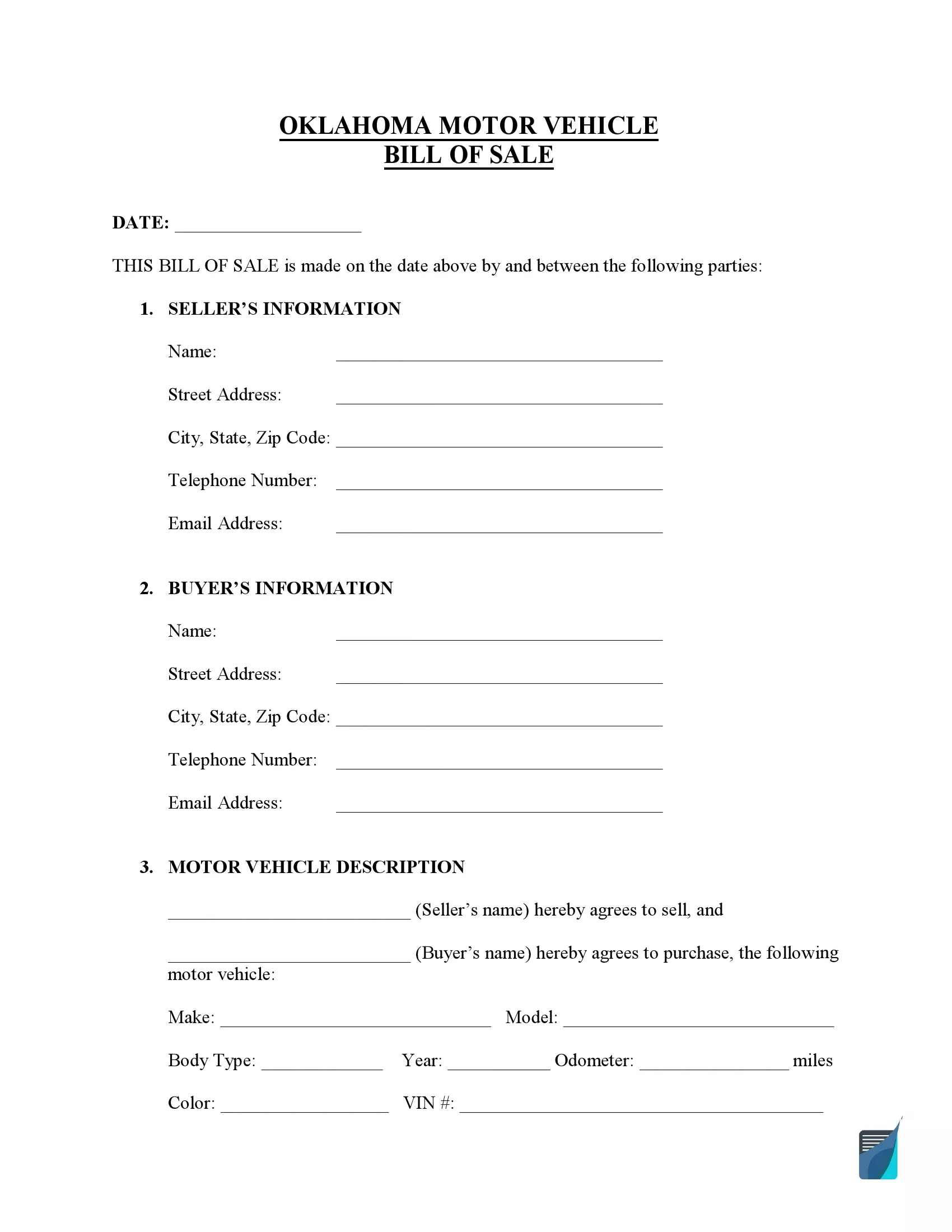

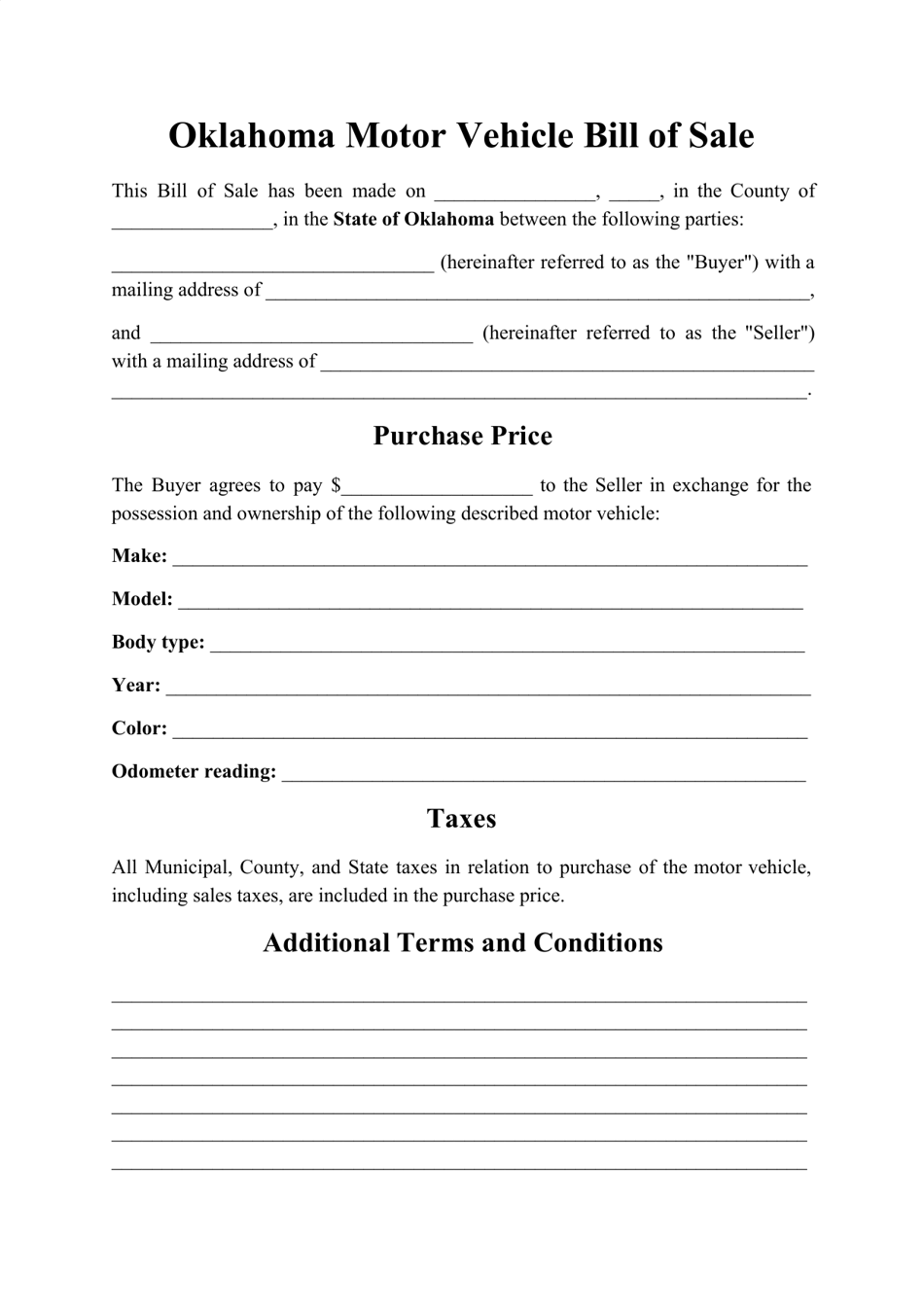

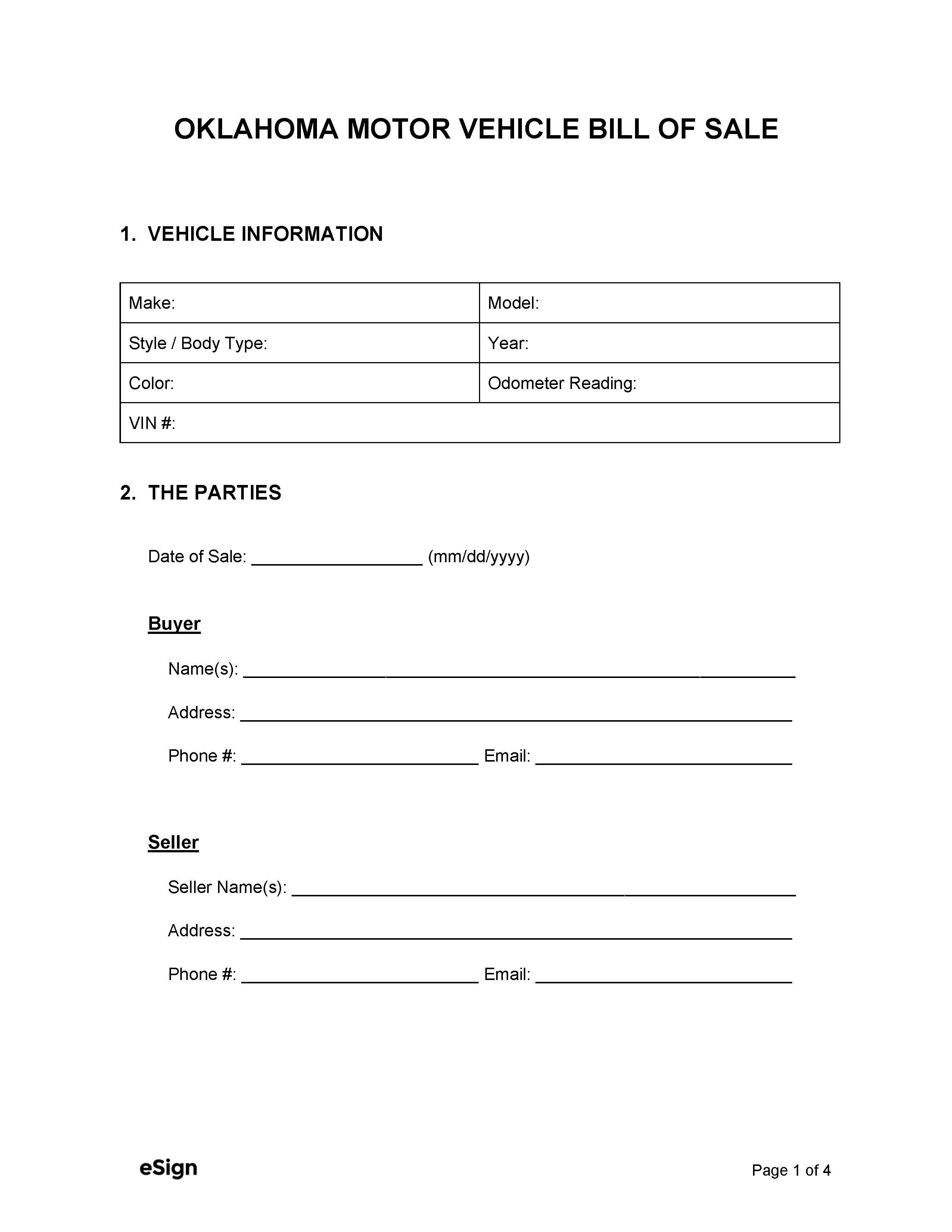

Free Oklahoma Vehicle Bill Of Sale Form Pdf Formspal

How Great An Oklahoma State Car Oklahoma State University Osu Cowboys Oklahoma State

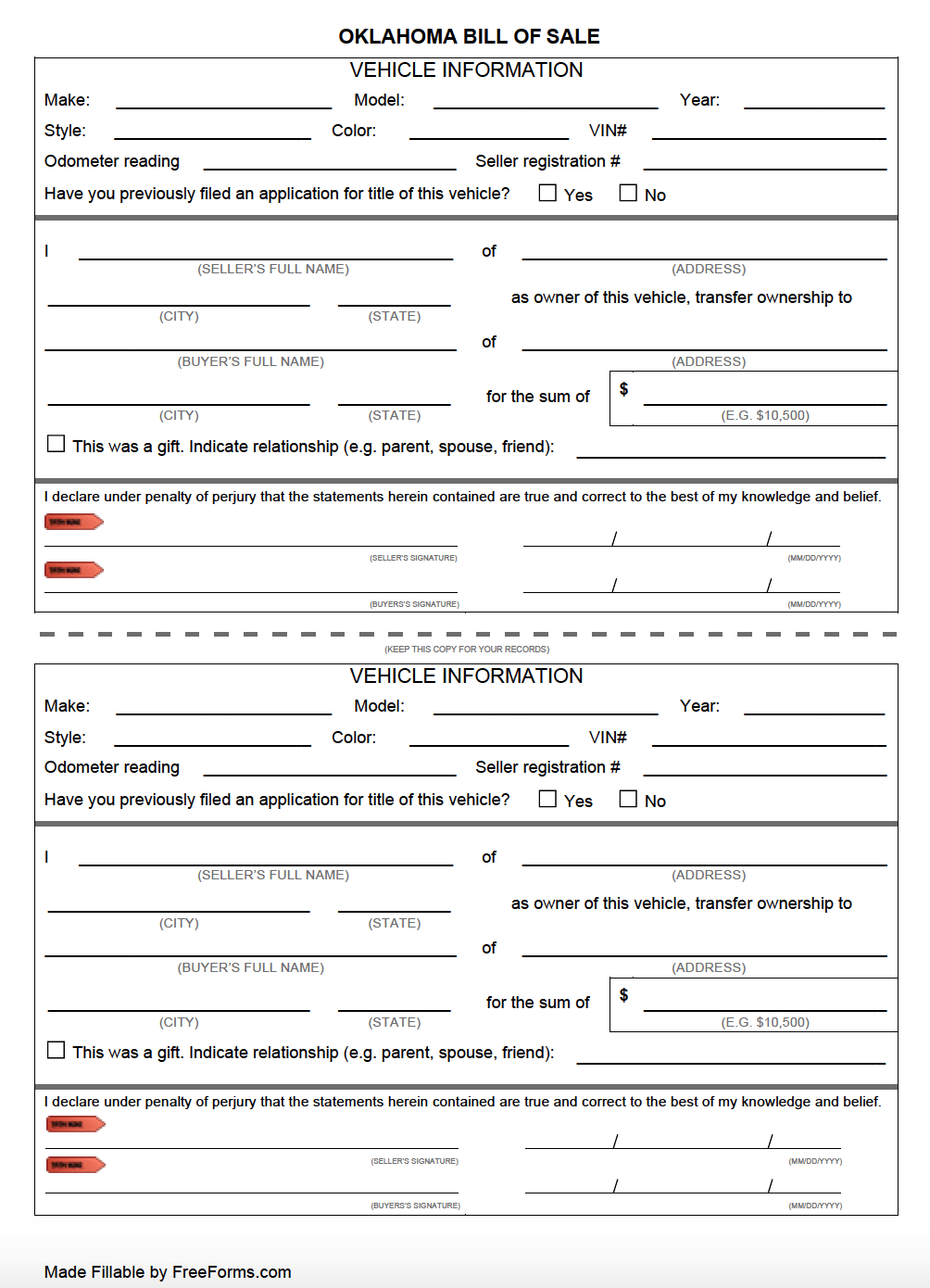

Bills Of Sale In Oklahoma The Templates Facts You Need

Car Tax By State Usa Manual Car Sales Tax Calculator

States With No Sales Tax On Cars

2

Best-selling Car In Every State Map

Free Oklahoma Motor Vehicle Dmv Bill Of Sale Form Pdf

Nj Car Sales Tax Everything You Need To Know

How To Sell A Car In Oklahoma - Documents Required And More

Oklahoma Motor Vehicle Bill Of Sale Form Download Printable Pdf Templateroller

Car Bill Of Sale Pdf Printable Template As Is Bill Of Sale

Free Oklahoma Dps Motor Vehicle Bill Of Sale Form Pdf Word Doc

Free Oklahoma Motor Vehicle Bill Of Sale Form - Pdf Word

Virginia Sales Tax On Cars Everything You Need To Know

States With Highest And Lowest Sales Tax Rates

Oklahoma Sales Tax - Small Business Guide Truic

Sell A Car In Oklahoma How To Sell A Car In Oklahoma Autotrader

2

Comments

Post a Comment