Any earned income over that amount is not subject to the social security payroll tax of 6.2%. This could result in a.

Social Security Wage Base 2021 And Estimation For 2022 - Uzio Inc

Social security is america's national pension system.

Social security tax limit 2022. Anyone who earned above that amount paid social security taxes only on $142,800 of income, so anything earned above that wasn’t subject to the tax. “the social security deduction is only allowed for a married couple filing a joint return, not over $100,000, or $50,000 for. Remember, both an employer and an employee must pay social security and medicare taxes.

The social security wage base means that you’ll only ever pay social security taxes on $147,700 and nothing else. The wage base is the point at which annual wages are no longer subject to ss tax. From there, you'll have $1 in social security withheld for every $3 you earn above that threshold.

In 2022, that limit will rise to $51,960. Below are federal payroll tax rates and benefits contribution limits for 2022. From there, you'll have $1 in social security withheld for every $2 you earn.

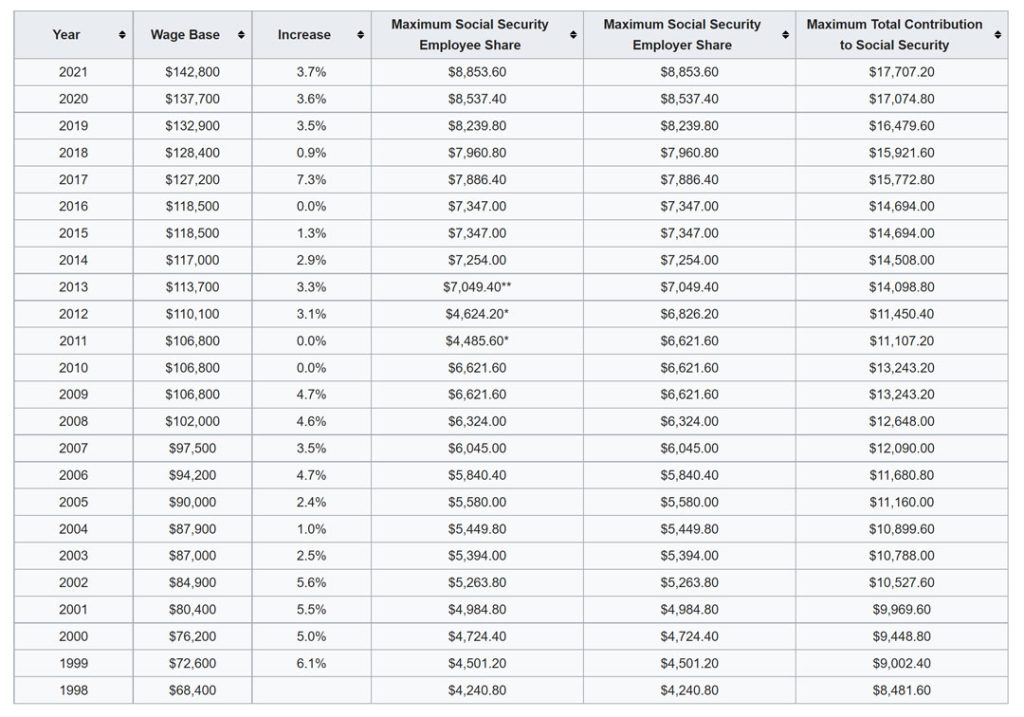

The maximum social security tax per worker will be $18,228—or a maximum $9,114 withheld from a highly paid employee’s 2022 paycheck. The social security taxable wage base for 2022 will increase to $147,000 from $142,800, according to a recent announcement from the social security administration (ssa). Other important 2022 social security information is as follows:

If you earned more than $147,700 in 2021, you won’t have to pay any tax on the income above this limit. In 2022, the social security tax limit increased significantly, to $147,000. Social security payroll tax limit for 2022 the rise in the social security payroll tax threshold from $127,200 in 2017 to $147,000 in 2022 indicates a 15.6 percent increase over the last five years.

Maximum social security tax for 2022 for workers who earn $147,000 or more in 2022: Ssa announces social security taxable wage base for 2022. The income limit for maximum social security tax goes up every year, because social security is underfunded by roughly 25% as of 2021.

Social security tax is paid as a percentage of net earnings and has an annual limit. That’s according to the ss administration office of the chief actuary, which issues three forecasts. Social security tax is paid as a percentage of net earnings and has an annual limit.

Thus, an individual with wages equal to or larger than $147,000 would contribute $9,114.00 to the oasdi program in 2022, and his or. The social security (ss) wage base for 2022 is projected to rise to at least $146,700. A higher earnings threshold to score work credits.

We call this annual limit the contribution and benefit base. The maximum amount of an individual's taxable earnings in 2022 subject to social security tax will be $147,000, the social security administration (ssa) announcedwednesday. The highest projection is $147,300.

Currently, the wage base is $142,800. If bloomberg’s report is to be believed then as per the united states social security administration (ssa) the wage base can increase by up to 2.7% in 2022 which is approximately $146,700. For earnings in 2022, this base is $147,000.

Workers and their employers each pay a 6.2% social security. In 2021, the payroll tax for social security applies to all earned income up to $142,800. An employee will pay a total of $9,114 in social security tax ($147,000 x 6.2 percent);

What you need to know about the social security tax rate and limit. Quarter of 2020 through the third quarter of 2021, social security and supplemental security income (ssi) beneficiaries will receive a 5.9 percent cola for 2022. In 2022, the social security tax limit increased significantly, to $147,000.

This is the maximum amount of earnings subject to the social security tax for 2022. Withheld benefits won't be lost forever. For those of you who believe the government is efficient and benevolent, the good news is that the income limit for maximum social security tax rises to $147,000 for 2022, up from $142,800 in 2021, and.

Social security wage base 2022 estimation by ssa. The oasdi tax rate for wages paid in 2022 is set by statute at 6.2 percent for employees and employers, each. In 2022, the social security tax limit increased significantly, to $147,000.

That number goes up to 65% in 2021, before the full 100% in 2022. This could result in a higher tax bill for some taxpayers. In 2022 the maximum amount increases to $147,000.

In 2022, you can earn up to $19,560 a year without it impacting your benefits. For 2022, that amount will be $147,000 (up from $142,800 for 2021). This amount is also commonly referred to as the taxable maximum.

The social security administration recently announced that the wage base for computing social security tax will increase to $147,000 for 2022 (up from $142,800 for 2021).

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

How To Calculate The Value Of Your Pension Pensions The Value Calculator

The Suzuki Swace Sport Answers A Question No One Asked Carscoops Suzuki Suzuki Swift Sport Corolla Wagon

Social Security Wage Base 2021 And Estimation For 2022 - Uzio Inc

A Big Change Is Coming To Social Security In 2022 Are You Prepared Personal Finance Wacotribcom

What Is Taxable Income In 2021 Income Federal Income Tax Filing Taxes

2 In 1 Liquid Eyeliner With Wing Stamp Eyeliner Liquid Eyeliner Pen Eyeliner Pen

Us Federal Income Tax Forms 3 Five Things You Probably Didnt Know About Us Federal Income T In 2021 Income Tax Federal Income Tax Tax Forms

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

What Are Income Limits That Will Allow You To Qualify For Medi-cal Or Coveredca Health Plans Income Health Plan How To Plan

Pin On Uber News

Bpaas Market Revenues Worth 6876 Billion By 2022 Business Process Management Marketing Digital Asset Management

Licagenthyderabad Lic Insurance Tax Savings Plans Free Enquiry 9912359818 Hyderaba Life Insurance Quotes Insurance Investments Life Insurance Corporation

What Is Taxable Income In 2021 Income Federal Income Tax Filing Taxes

Here Is A A Way-too-early Look At Social Securitys 2021 Cola As July Kicks Of The 2021 Measurement Period Which Determines Any Military Benefits Cola Increase

Pin On These Are The Taxes That Exist In India

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Qi0dgiw7f9lsxm

Comments

Post a Comment