It is showing on my windows based 2020 turbotax edition. So basically it just spreads out paying the taxes on it over the.

Form 8915-e - Basics Beyond

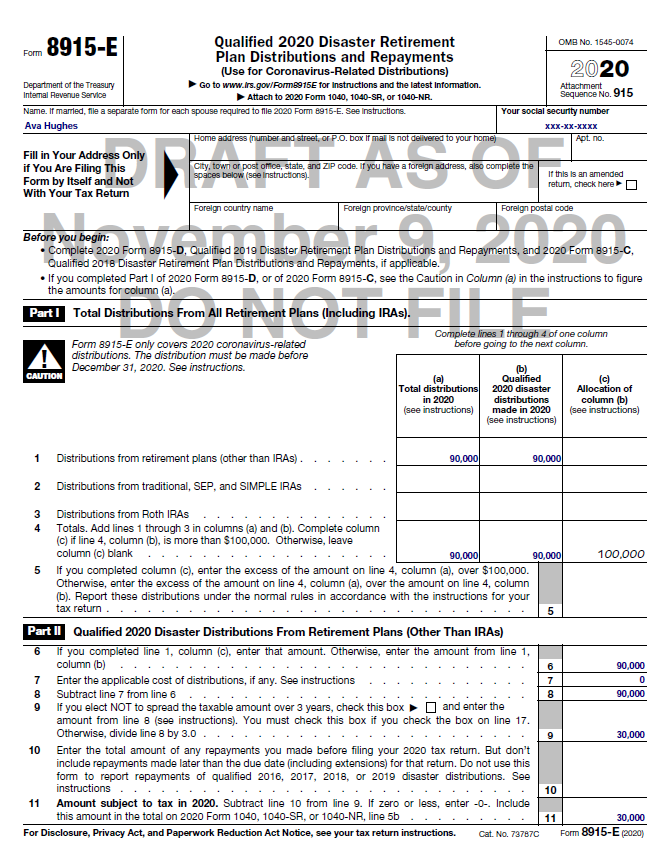

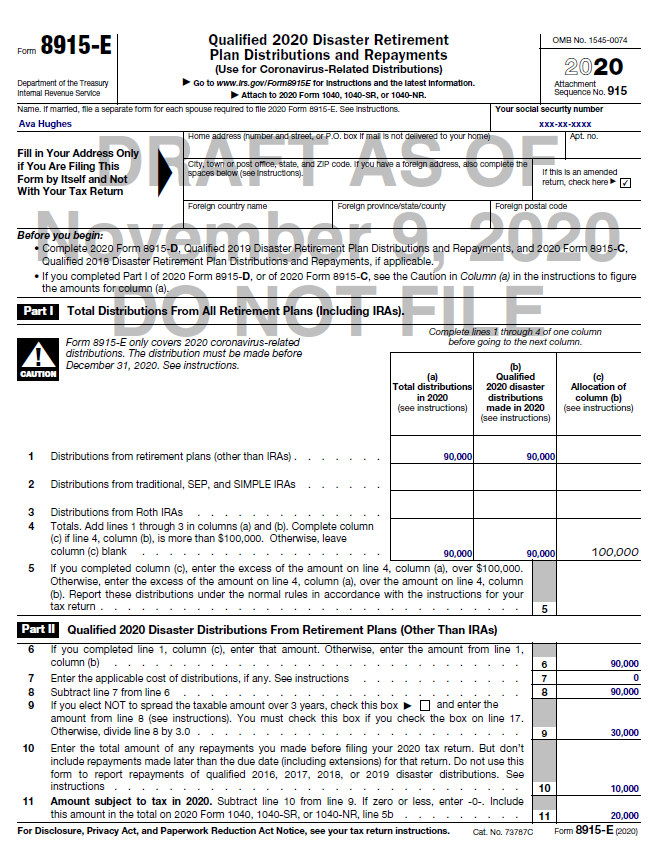

Any repayments you make will reduce the amount of qualified 2020 disaster distributions reported on your return for 2020.

Turbo tax form 8915-e 2020. Once available it will be included in the turbotax software. Qualified 2020 disaster retirement plan not included in turbo tax. The entire distribution must be reported on the 2020 tax return if the taxpayer (or spouse, if applicable) dies in 2020.

It is being prepared for release. From within your taxact return ( online or desktop), click federal. Try to run a manual update of your software to see if that will load the new forms.

To see irs update, click here: This form has not been finalized by the irs for filing with a 2020 federal tax return. I have the option to amend, and i am being prompted to answer the cares act question now but when i get this error message that the form still.

The irs has not announced when this form will be available. No, irs has not updated it's 2020 version yet, unfortunately. If your software is indicating it is up to date and you are using a windows pc, manually update the software.

Click retirement plan income in the federal quick q&a topics menu. I just wasted hours of my life and providing almost all my info to receive a note at bottom of screen that the section will need revisit and cant file. I am not going to wait any longer to file and increase my risk that a fraudster.

For instructions and the latest information.

Form 8915-e For Retirement Plans Hr Block

Anyone Know When Turbo Tax Plans To Update Their E

National Association Of Tax Professionals Blog

It Looks Like The Irs Has Released Form 8915-e For

Solved Re Form 8915-e Is Available Today From Irs When - Page 2

How To Report Backdoor Roth In Hr Block Tax Software A Walkthrough

How Do I Include Form 5329 When I E-file With Turb

How To Pay Taxes Over 3 Years On Cares Act Distributions Tax Form 8915-e Explained - Youtube

Mizecpascom

Solved Re Form 8915-e Is Available Today From Irs When - Page 2

Re When Will Form 8915-e 2020 Be Available In Tur - Page 20

Re When Will Form 8915-e 2020 Be Available In Tur - Page 19

Cannot Check Box For Covid On Form 8915e S Or T

Solved Irs Form 8915 E - Intuit Accountants Community

Re When Will Form 8915-e 2020 Be Available In Tur - Page 19

Use Form 8915-e To Report Repay Covid-related Retirement Account Distributions - Dont Mess With Taxes

National Association Of Tax Professionals Blog

Questions And Answers Intuit Turbotax Home Business Federal Efile State 2020 1-user Mac Windows Int940800f104 - Best Buy

Amazoncom Turbotax Premier Federal State Federal Efile 2009 Everything Else

Comments

Post a Comment