Vanguard mutual fund (admiral shares) mutual fund expense ratio corresponding vanguard etf ® etf expense ratio savings to you u.s. Vwalx) (nasdaq mutual funds) as of dec 1, 2021 08:00 pm et.

Best Mutual Funds For 2018

Stay up to date on the latest stock price,.

Vanguard high-yield tax-exempt fund admiral shares. The fund seeks to provide high current income that is exempt from federal income taxes and to preserve investors' principal. There is one other fund which has a pratically identical return profile to vwalx, which is vwahx, a mutual fund from vanguard mutual funds. As of august 18, 2021, the fund has assets totaling almost $18.78 billion.

Investment, market cap and category. For people who invest directly in individual accounts (including iras and rollovers); Stock funds 500 index fund (vfiax) 0.04% s&p 500 etf (voo) 0.03% 25% dividend appreciation index fund (vdadx)

The fund invests at least 80%. For people who invest through their employer in a vanguard 401 (k), 403 (b), or other retirement plan. | supreet grewal | mar 17, 2021.

The investment seeks a high and sustainable level of current income that is exempt from federal personal income taxes.

Vteax - Vanguard Tax-exempt Bond Index Fund Admiral Shares - Portfolio Holdings Aum 13f 13g

How To Invest In Bonds White Coat Investor

Vanguard Municipal Bond Funds Form 485bpos Filed 2019-02-26

Vwiux - Vanguard Intermediate-term Tax-exempt Fund Admiral Shares Vanguard Advisors

Vanguard Limited Term Tax Exempt Fund Vmltx Mepb Financial

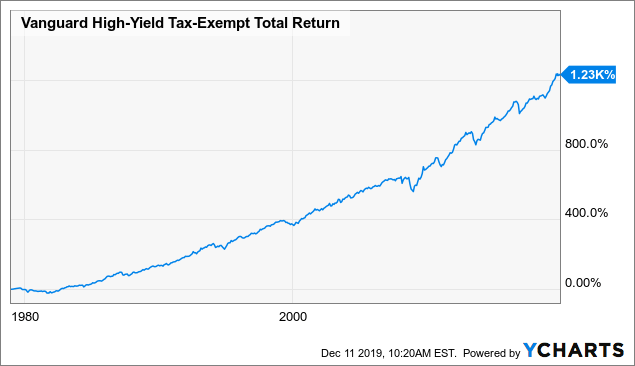

Vwahx 41 Years Of High-yield Municipal Income For Retirement Mutfvwahx Seeking Alpha

Charlottefunds485ahtm - Generated By Sec Publisher For Sec Filing

/financial-services--viewing-financial-markets-for-investing-507826251-5a085f464e4f7d003620bca0.jpg)

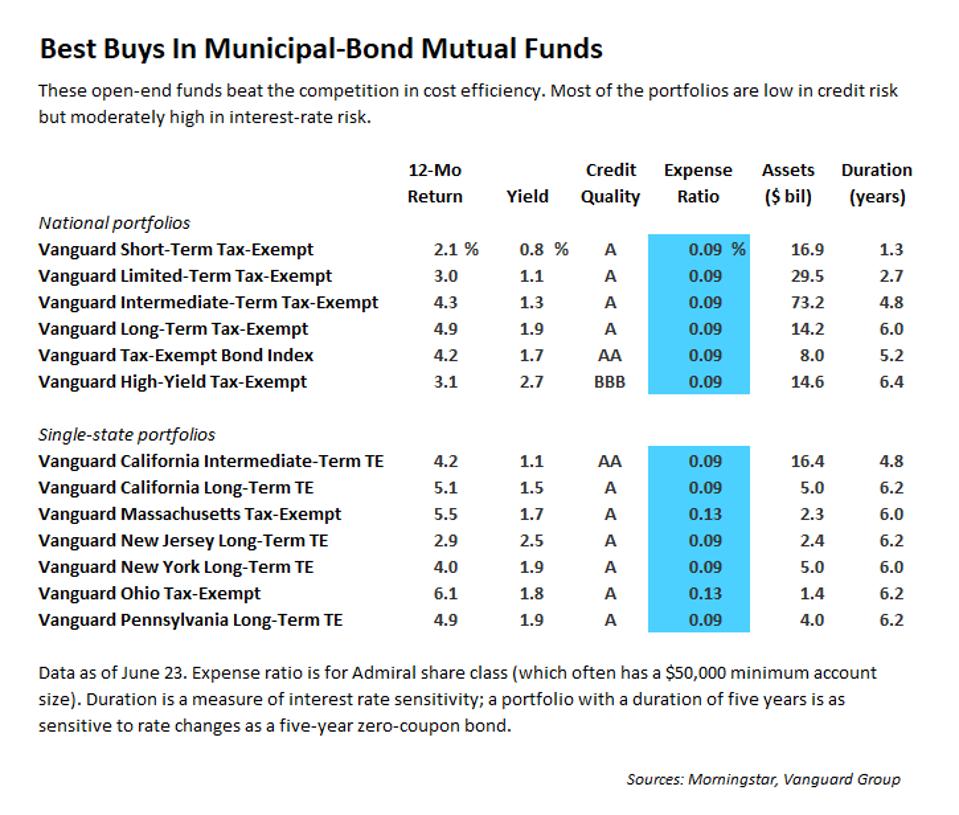

A Comprehensive List Of Vanguard Bond Funds And Etfs

Guide To Municipal Bond Funds

Vwalx Vanguard High-yield Tax-exempt Fund Admiral Shares - Class Info - Zackscom

Ux3zywitawlium

Vanguard High-yield Tax-exempt Fund Summary Prospectus Investor

Personalvanguardcom

Vwalx - Vanguard High-yield Tax-exempt Fund Admiral Shares - Cnnmoneycom

Vanguard Energy Fund Prospectus Investor Shares And Admiral

Vwalx - Vanguard - Product Detail - High-yield Tax-exempt Fund Admiral Shares

3 Best Mutual Funds For Retirement Updated December 2021 Benzinga

Vanguard High-yield Tax-exempt Fund Admiral Shares Vwalx Latest Prices Charts News Nasdaq

Vwlux - Vanguard Long-term Tax-exempt Fund Admiral Shares Vanguard Advisors

Comments

Post a Comment