2022 annual gift tax exclusion will increase to $16,000. The annual exclusion covers gifts you make to each recipient each year.

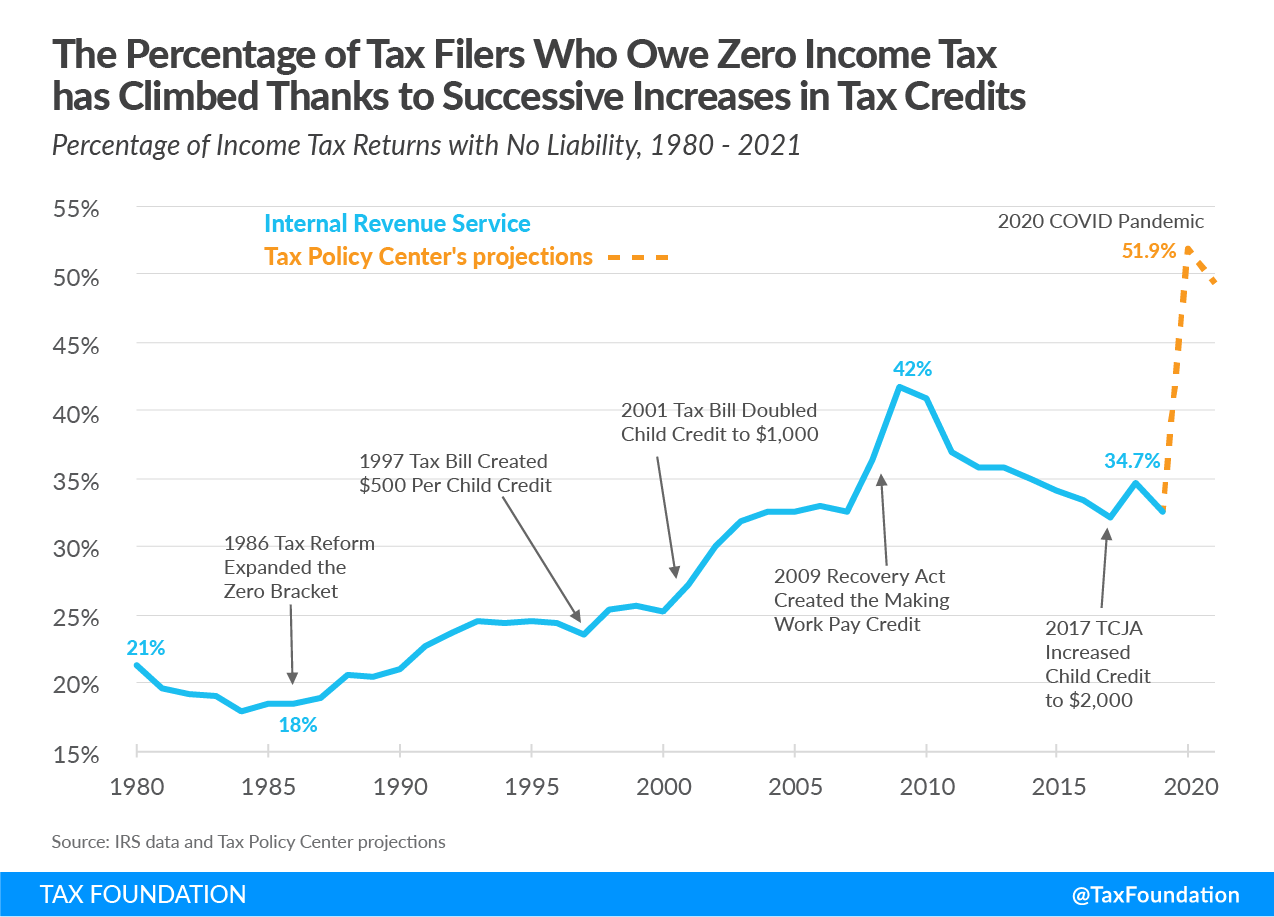

Increasing Share Of Us Households Paying No Income Tax

This means a person can give any other person at least $16,000 before it is subject to the federal gift tax.

Annual federal gift tax exclusion 2022. If the only gifts made during a year are excluded in this fashion, there’s no need to file a federal gift tax return. The annual gift tax exclusion will be $16,000—the highest ever. The federal government imposes a tax on gifts.

The irs is raising the gift tax limit for 2022. These payments do not count against your annual gift exclusion. It'll also limit the donor to $20,000 annual exclusion gifts in total.

If such proposal is adopted, the resulting federal gift and estate tax exemption would reduce to just over $6 million as of january 1, 2022. The annual gift tax exclusion was indexed for inflation as part of the tax relief act of 1997, so the amount can increase from year to year to keep pace with the economy, but only in increments of $1,000. The annual exclusion on the federal gift tax will increase to $16,000 in 2022 from 2018 to 2021 the exclusion was $15,000.

For this reason, individuals may want to consider using any remaining gift tax exemption prior to the end of the 2021. For 2022, the annual gift exclusion is being increased to $16,000. In 2022, the annual exclusion is $16,000.

The internal revenue service has announced that the annual gift tax exclusion is increasing next year due to inflation. There are no state gift taxes. Two things keep the irs’s hands out of most people's candy dish:

Do note that you can continue to gift unlimited amounts by making direct payments to educational institutions and medical providers for another person’s qualifying expenses. The annual exclusion ($15,000 in 2021 and $16,000 in 2022), and the lifetime exclusion ($11.7 million in. The existing annual exclusion of $15,000 per person, per recipient, could also see a reduction to $10,000 per donee.

The annual gift exclusion is applied to each donee. This means that an individual can give away $16,000 to any person in a calendar year ($32,000 for a married couple) without having to file a federal gift tax return. Federal tax law allows each taxpayer to gift up to $16,000 per year to one individual without incurring federal gift taxes.

And the gift tax annual exclusion amount jumps to $16,000 for 2022, up from $15,000 where it’s been stuck since 2018. In 2018, 2019, 2020, and 2021, the annual exclusion is $15,000. Gifts that is not more than the annual exclusion for the calendar year.

The maximum credit allowed for adoptions for tax year 2022 is the amount of qualified adoption expenses up to $14,890, up from $14,440 for 2021. The gift tax limit for individual filers for 2020 is $15,000. Gift tax rules for 2022 onwards.

And the gift tax annual exclusion amount jumps to $16,000 for 2022, up from $15,000 where it’s been stuck since 2018. The gift tax annual exclusion allows taxpayers to make certain gifts without eroding the taxpayer’s lifetime exemption amount. The annual exclusion is the aggregate amount of present interest gifts that can be given without using lifetime gift tax exemption.

For the first time in several years, the annual exclusion from gift tax will increase from $15,000 to $16,000 per year per donee effective january 1. If annual gifts exceed $15,000, the exclusion covers the first $15,000 per recipient, and only the. Starting in 2022, currently proposed legislation would reduce the annual gift tax exclusion to $10,000 per year per donee (recipient).

The gift tax annual exclusion in 2022 will increase to $16,000 per donee. For 2022 the annual gift tax exclusion has increased to $16,000. This amount is known as the annual exclusion amount, which for 2021 is $15,000 per beneficiary [2].

The general rule is that any gift is a taxable gift, except for: The federal gift tax limit goes up to $16,000 in 2022. There has been no legislation passed which would change the amount of gift that can be given in 2022 from the current exclusion amount of $15,000 per individual per year.

Gift tax is a federal tax on any gifts you give during the year that are worth more than the annual gift tax exclusion, which is $16,000 for gifts given in 2022 (the exclusion was the same last year). Therefore, a taxpayer with three children can transfer $45,000 to the children every year free of federal gift taxes. What is the gift tax annual exclusion amount for 2022?

This exemption is tied to inflation but can only increase to the nearest $1,000 amount. After four years of being at $15,000, the exclusion will be $16,000 per recipient for 2022—the highest exclusion amount ever. Despite the large federal estate tax exclusion amount, new york.

This means a person can give any other person at least $16,000 before it is subject to the federal gift tax. For example, assume that in 2022 you give gifts totaling $16,000 to each your three children, for a total of $48,000. The estate and gift tax lifetime exemption amount is projected to increase to $12,060,000 (currently $11,700,000) per individual.

The annual exclusion for gifts increases to $16,000 for calendar year 2022, up from $15,000 for calendar year 2021. However, as the law does not concern itself with trifles [1] congress has permitted donors to give a “small” amount to each beneficiary of their choosing before facing the federal gift. According to the wolters kluwer projections, in 2022 the gift tax annual exclusion amount will increase to $16,000 (currently $15,000) per donee.

The new numbers essentially […]

Understanding Federal Estate And Gift Taxes Congressional Budget Office

Amazoncom South-western Federal Taxation 2022 Corporations Partnerships Estates And Trusts Corporations Partnerships Estates And Trusts Intuit Proconnect Ria Checkpoint 1 Term Printed Access Card Ebook Raabe William A Young James

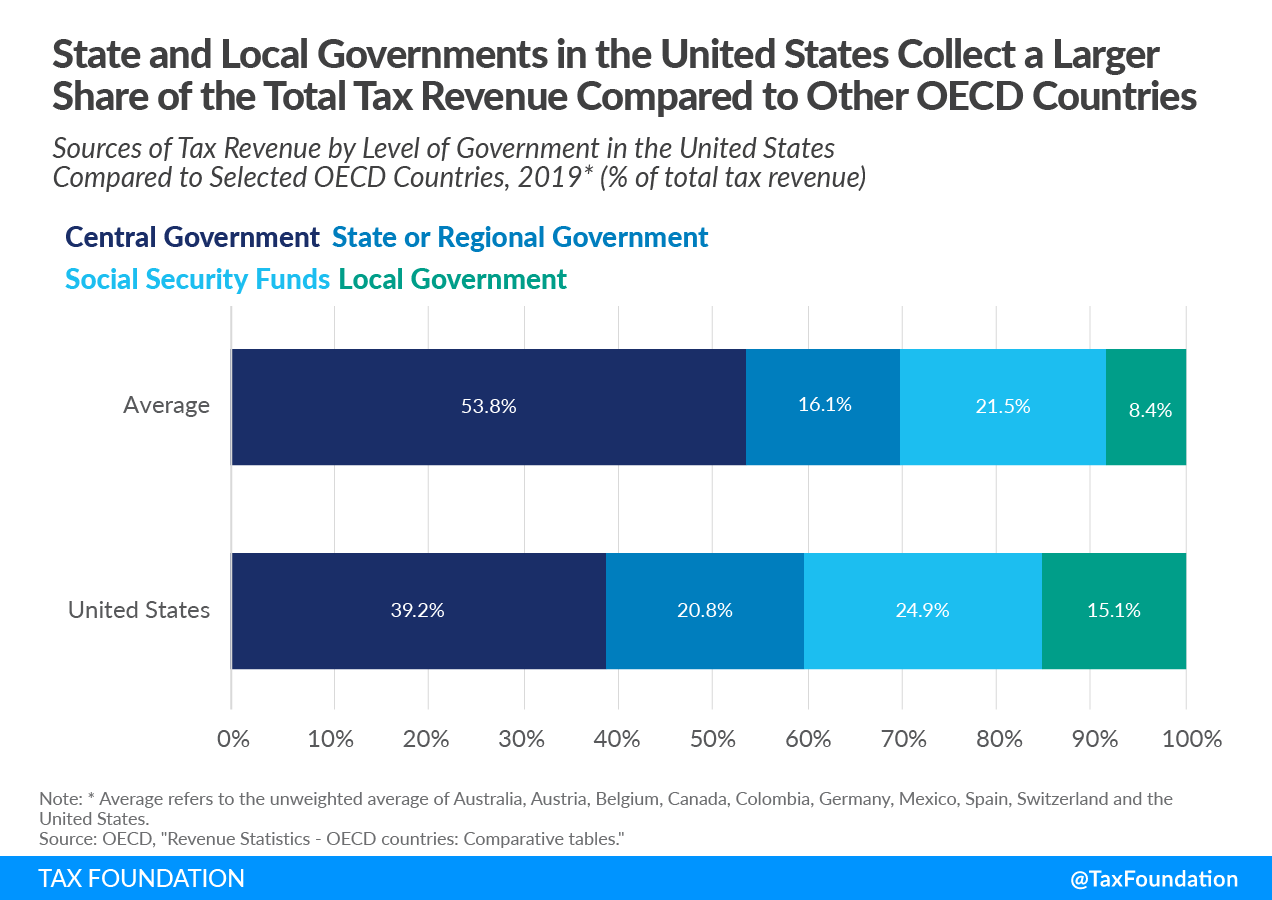

Sources Of Government Revenue In The United States Tax Foundation

Understanding The Budget Revenues

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Sources Of Government Revenue In The United States Tax Foundation

:max_bytes(150000):strip_icc()/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

Form 709 United States Gift And Generation-skipping Transfer Tax Return

New Higher Estate And Gift Tax Limits For 2022 Couples Can Pass On 720000 More Tax Free

What You Need To Know About The 11 Million Estate Tax Exemption Going Away

2021 Guide To Potential Tax Law Changes

Essentials Of Federal Income Taxation For Individuals And Business 2022 - Wolters Kluwer

Budget 2019 - Revised Section 87a Tax Rebate - Tax Liability Calculation Illustration Income Tax Tax Deductions List Tax Deductions

2021 Guide To Potential Tax Law Changes

Thoughtful Gifting Part 1 Use It Or Lose It Now Could Be The Time To Use Your Gift And Estate Tax Exemption

Inflation Updates For 2022 - Federal Estate And Gift Tax

Pin On Cats Small Business Success Tips

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Average Tax Rate Definition Taxedu Tax Foundation

Comments

Post a Comment