The current tax preference for capital gains costs upwards of $15 billion annually. Once again, no change to cgt rates was announced which actually came as no surprise.

Capital Gains Yield Cgy - Formula Calculation Example And Guide

On april 28, 2021, joe biden proposed to nearly double the capital gains tax for wealthy people to around 39.6%.

Capital gains tax increase 2021. Could capital gains taxes increase in 2021? There is a change on the horizon, which can take place as soon as 2022. One of the proposals congress is considering sets the top rate for taxing capital gains at 25%, up from 20% under current law.

The house ways and means committee released their tax proposal on september 13, 2021. Under the current proposal, “gains realized prior to sept. While it is unknown what the final legislation may contain, the elimination of a rate increase on capital gains in the draft legislation is encouraging.

Asset sales have increased by around 2% to 11.5% of the tax revenue over the last 12 months, largely because of the nervousness that the chancellor would bring cgt more in line with income tax but again this did not materialise. The current capital gain tax rate for wealthy investors is 20%. Single filers with income over $523,600

Gains realized after that date would be taxed at a. Currently, the capital gains tax rate for wealthy investors sits at 20%. For months now there has been speculation that capital gains tax rates will go up in the forthcoming budget.

13 will be taxed at top rate of 20%; This tax change is targeted to fund a $1.8 trillion american families plan. Potential changes to the capital gains tax rate.

Joe biden says this tax increase funds a 1.8 trillion dollar plan to. For 2021 the top tax bracket includes the following taxpayers: Another would raise the capital gains tax rate to 39.6% for taxpayers.

Capital gains tax rates for 2021 Therefore, there could be an additional 8% tax on a transaction that closes in 2022 vs 2021. A summary can be found here and the full text here.

For reference, the table below breaks down the tax rates and income brackets for tax year 2021. The proposal is bumping this up to 39.6%. Under the proposed build back better act, the top marginal tax rates will jump from 20% to 39.6% that is.

The proposal would increase the maximum stated capital gain rate from 20% to 25%. Concerns that the tax law could change—and specifically that capital gains taxes will increase—is pushing investors to sell properties before the clock strikes 2022. You’ll owe either 0%, 15% or 20% on gains from the sale of most assets or investments held for more than one year, depending on your annual taxable income (for more on how to calculate your long.

It’s time to increase taxes on capital gains. Posted on january 7, 2021 by michael smart. The white house is now calling for a 39.6% top federal tax rate, nearly double the current amount.

Will the capital gains tax rates increase in 2021? Assuming you own $75,500 worth of bmo shares in your tfsa, your. House democrats propose raising capital gains tax to 28.8% published mon, sep 13 2021 3:33 pm edt updated mon, sep 13 2021 4:06 pm edt greg iacurci @gregiacurci

Bmo also outperforms the tsx, thus far, 2021 (+36.6% versus +19.35). To address wealth inequality and to improve functioning of our tax system, tax rates on capital gains income should be increased.

Whats Your Tax Rate For Crypto Capital Gains

How To Pay 0 Capital Gains Taxes With A Six-figure Income

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Capital Gains Tax 101

Whats Your Tax Rate For Crypto Capital Gains

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

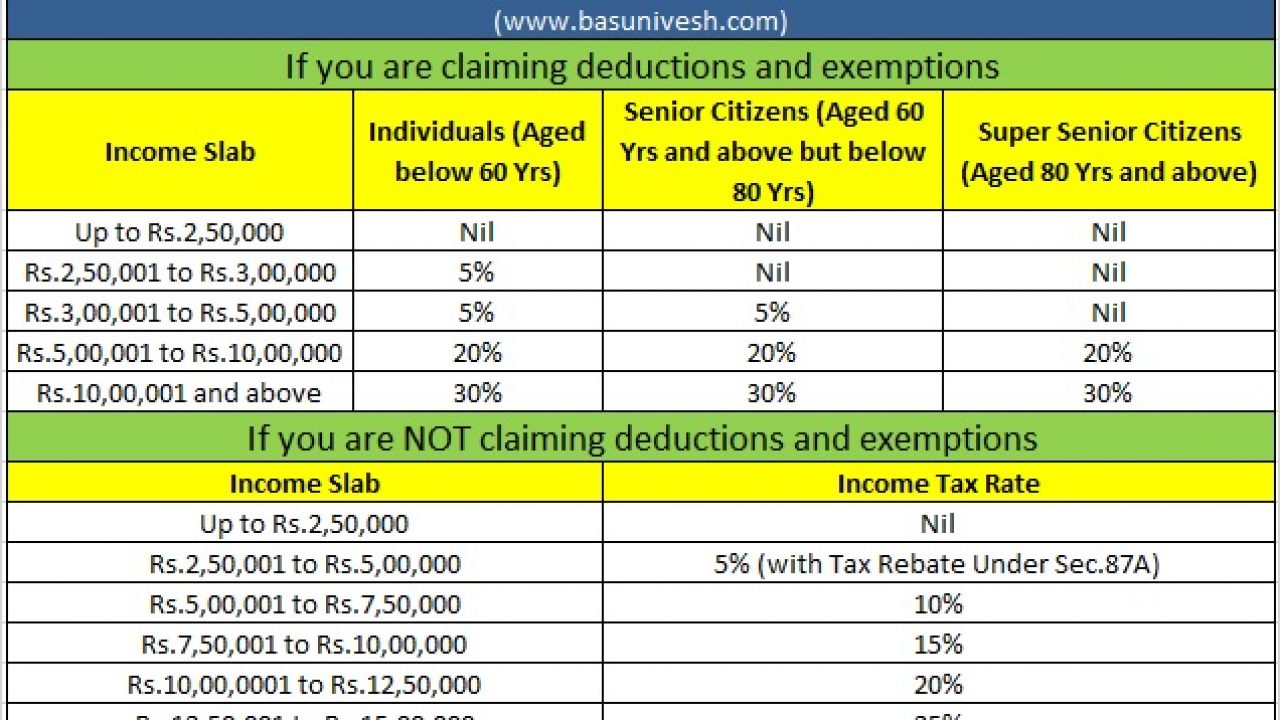

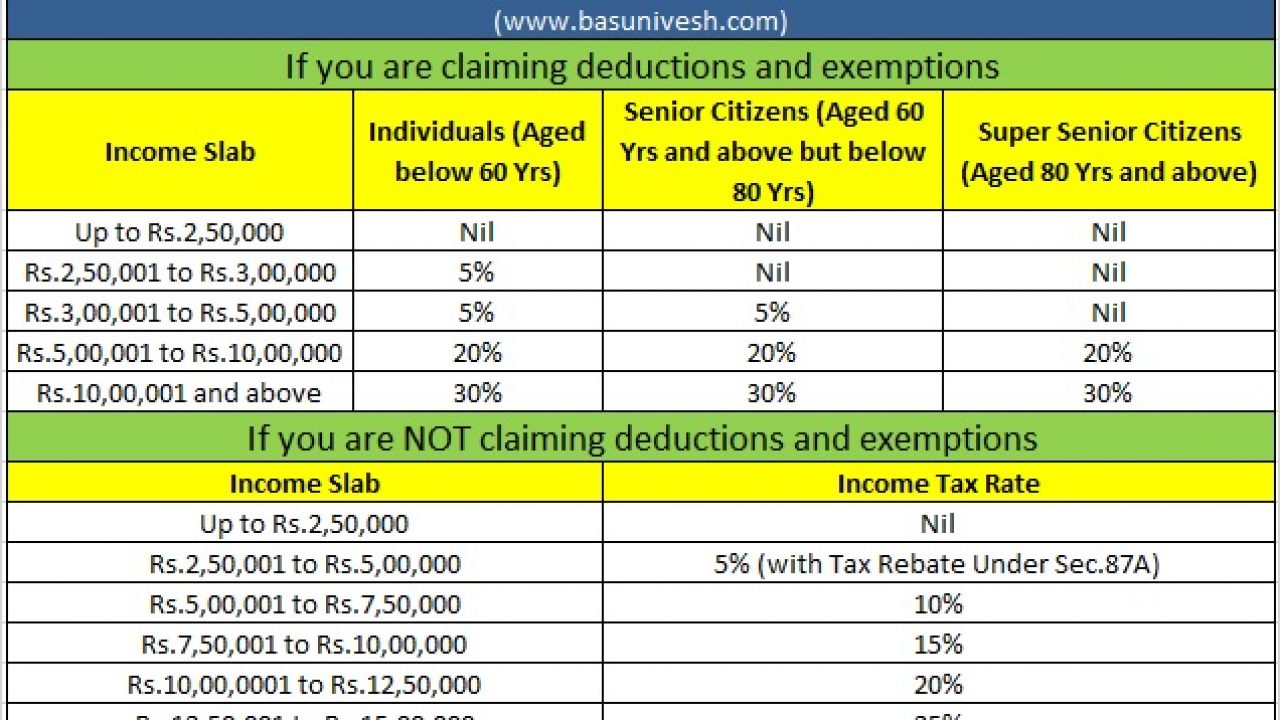

Latest Income Tax Slab Rates Fy 2020-21 Ay 2021-22 - Basunivesh

Taxtipsca - Manitoba 2021 2022 Personal Income Tax Rates

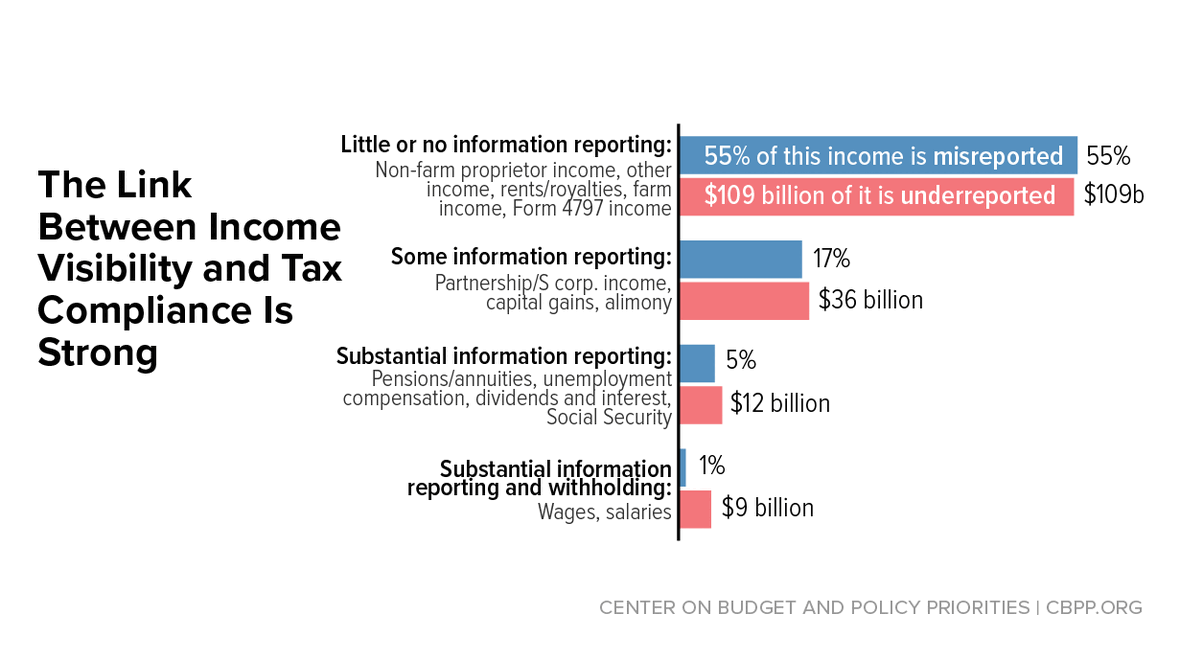

Build Back Better Requires Highest-income People And Corporations To Pay Fairer Amount Of Tax Reduces Tax Gap Center On Budget And Policy Priorities

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

How To Calculate Capital Gains Tax Hr Block

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Biden Budget Reiterates 434 Top Capital Gains Tax Rate For Millionaires

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Capital Gains Tax 101

Capital Gains Tax 101

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Taxing The Rich Econofact

Comments

Post a Comment