D & d tax service in worthington, reviews by real people. D & d tax service.

Home Page

Tax return preparation, accounting & bookkeeping machines & supplies.

D d tax service worthington mn. 320 lake street, worthington, mn 56187, united states phone: Found 1 colleague at h&r block. 1039 oxford st ste 6, worthington, mn.

Get reviews, hours, directions, coupons and more for lindquist tax & accounting service at 337 oxford st w, worthington, mn 56187. Categorized under accounting and bookkeeping services. D & d tax service.

My name is todd henderson. Search for other tax return preparation in worthington on the real yellow pages®. Manta has 13 businesses under financial in worthington, mn.

Yelp is a fun and easy way to find, recommend and talk about what’s great and not so great in worthington and beyond. Find more info on allpeople about peil mike and aj tax solutions llc, as well as people who work for similar businesses nearby, colleagues for other branches, and more people with a similar name. Be the first to review!

Found 1 colleague at aj tax solutions llc. D & d tax service 716 oxford st w, worthington, mn.

There are 7 other people named sherri thompson on allpeople. Categorized under tax return preparation and filing. Get h&r block reviews, ratings, business hours, phone numbers, and.

Manta has 664 businesses under tax return preparation services in minnesota. As the most trusted source for top rated businesses, resources and services relating to tax return preparation, select your state or city to browse and find the best tax return preparation businesses in your area. Find more info on allpeople about sherri thompson and h&r block, as well as people who work for similar businesses nearby, colleagues for other.

As an equitable advisors financial representative and active member of the worthington, mn community, i am dedicated to helping individuals and businesses build and protect their financial futures. D & d tax service. H&r block is located at 1039 oxford st, ste 2 worthington, mn 56187.

D & d tax service. There are 30 other people named peil mike on allpeople. Claimed categorized under tax return preparation and filing.

Categorized under tax return preparation and filing. Lindquist tax & accounting service. 909 4th ave worthington, mn 56187.

Browse 12 worthington, mn tax return preparation businesses on chamberofcommerce.com's business directory. Find tax preparation services in worthington, mn on yellowbook. 320 lake st, worthington, mn.

Categorized under tax return preparation and filing. D & d tax services address: 1433 oxford st, worthington, mn.

Get reviews and contact details for each business including videos, opening hours and more.

![]()

D D Tax Services In Worthington Minnesota Mn

D D Tax Service - Worthington Mn 507-376-9400

D D Tax Service - Home Facebook

Isd518net

D D Tax Service - Home Facebook

D D Tax Service - Home Facebook

Isd518net

Cichatfieldmnus

Recorder Nobles County Minnesota

Isd518net

Sustainability Free Full-text Corporate Social Responsibility Csr In The Travel Supply Chain A Literature Review Html

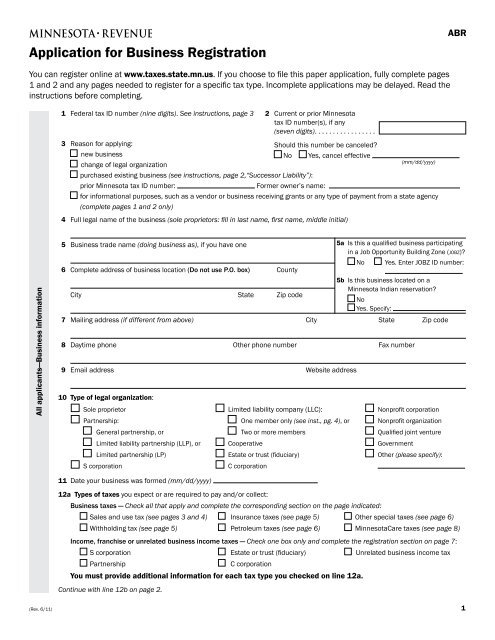

Abr Application For Business Registration - Minnesota Department

D D Tax Service - Home Facebook

Conoblesmnus

Dd Financial Services Llc

Conoblesmnus

D D Tax Service - Home Facebook

Ds Tax Service - Home Facebook

Conoblesmnus

Comments

Post a Comment