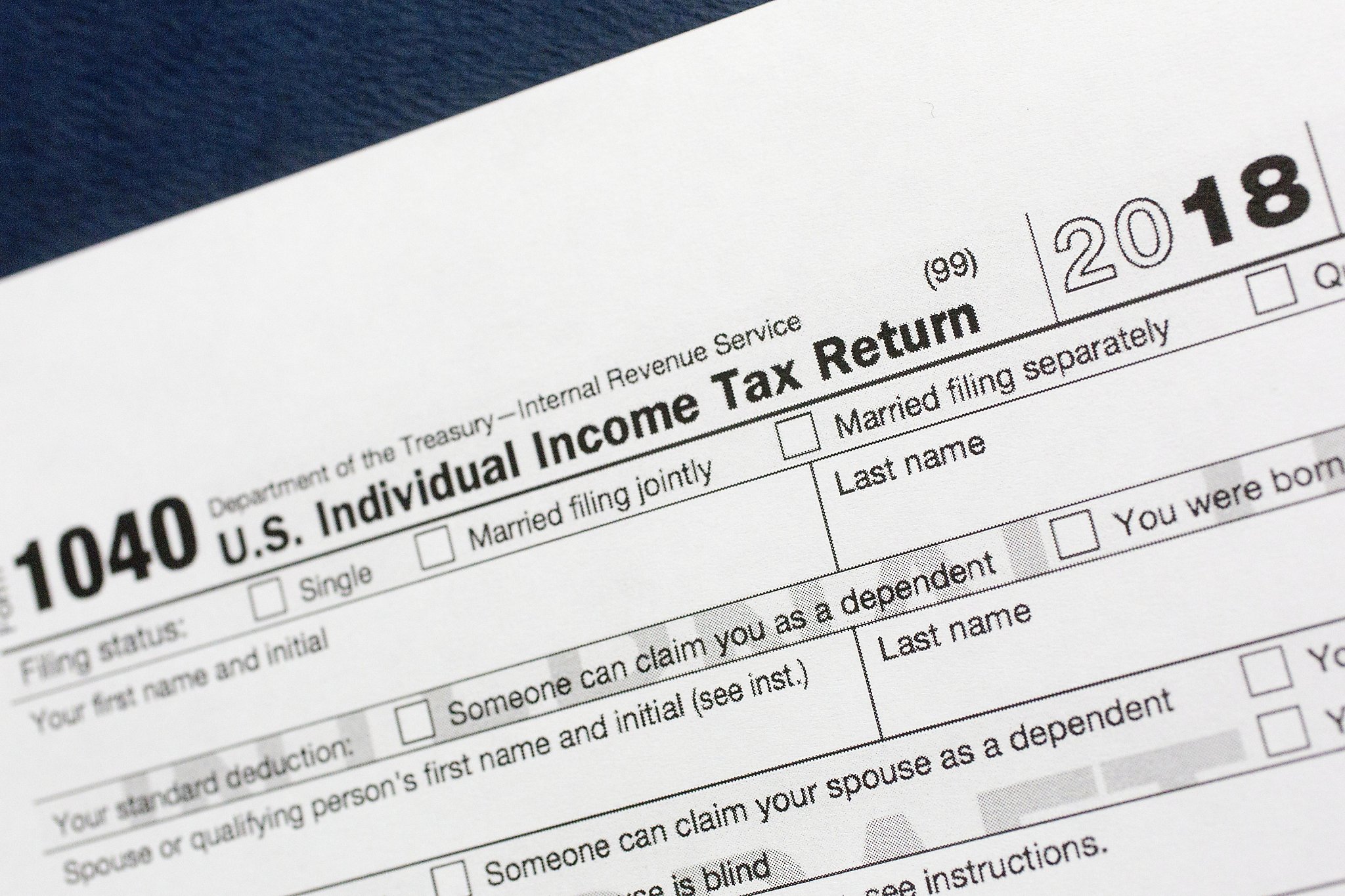

This new threshold was part of the tax cuts and jobs act which went into effect on january 1, 2018. Census bureau) number of cities that have local income taxes:

Tax Withholding For Pensions And Social Security Sensible Money

Learn how to fill out a w4 form before you begin a new job, so you can make sure the correct amount of money is deducted from each paycheck.

How much tax is deducted from a paycheck in missouri. There are no income limits for medicare tax, so all covered wages are subject to medicare tax. In 2020, the threshold for federal estate tax is $11.58 million, a slight increase from 2019 when the threshold was $11.4 million. All that matters—from the standpoint of the internal revenue service (irs)—is whether you earn an income.

Do missouri residents pay personal income tax? Amount taken out of an average biweekly paycheck: Taxpayers can choose either itemized deductions or the standard deduction, but usually choose whichever results in a higher deduction, and therefore lower tax payable.

Your home state of mo can tax all your income, regardless of where you earned it. Medicare taxes, unlike social security tax, go to pay for expenditures for current medicare beneficiaries. The percentage rate for the medicare tax is 1.45 percent, although congress can change it.

Employers also must match this tax. Your employer sends the money withheld to the irs and the department. If you have a salary, an hourly job, or collect a pension, the tax withholding estimator is for you.

Medicare tax is levied on all of your earnings, with no upper income threshold or limit. Employers also must match this tax. If you are an employee, tax withholding is the amount of federal income tax that is deducted from your paycheck each pay period.

For employees who more than $200,000 per year, you’ll need to withhold an additional medicare tax of 0.9%, which brings the total employee medicare withholding above $200,000 to 2.35%. Income tax deducted if you receive employment income or any other type of income, your employer or payer will deduct income tax at source from the amount paid. Median household income $57,409 (u.s.

Yes, missouri residents are subject to state personal income tax as well as local income tax in some counties. Learn more about the extension. The due date for the 2020 missouri individual income tax return is extended from april 15, 2021 to may 17, 2021.

The social security tax is 6.2 percent of your total pay until you reach an annual income threshold. The result is that the fica taxes you pay are still only 6.2% for social security and 1.45% for medicare. Use the tax withholding estimator

You'll be able to take a credit on your home state. Fica taxes (% of employee gross pay) employee pays: 1.45% 1.45% additional medicare tax 0.9% on gross pay over $200,000:

For medicare tax, withhold 1.45% of each employee’s taxable wages until they have earned $200,000 in a given calendar year. The missouri hourly paycheck calculator will show you the amount of tax that will be withheld from your paycheck. Does missouri have state and local income tax?

This notice requirement does not apply if an employee is asked to work fewer hours or changes to a different position with different duties. Your income is taxable by both states. The missouri department of revenue online withholding tax calculator is provided as a service for employees, employers, and tax professionals.

The standard deduction dollar amount is $12,550 for single households and $25,100 for married couples filing jointly for the tax year 2021. Your employer pays an additional 1.45%, the employer part of the medicare tax. There are paycheck calculators to help you determine how much your paycheck will be after deductions and to help you decide how much you should have deducted to cover taxes.

Yes, missouri has a progressive state personal income tax system as well as local county taxes. Employers can use the calculator rather than manually looking up withholding tax in. Age is not a factor when determining whether a person has to pay income tax or not.

Social security tax and medicare tax are two federal taxes deducted from your paycheck. If a teenager receives money from an employed position, income tax will be deducted from their paycheck. If your household has only one job then just click exit.

Luckily, when you file your taxes, there is a deduction that allows you to deduct the half of the fica taxes that your employer would typically pay. Social security tax 12.4% (up to annual maximum) 6.2% 6.2% medicare tax 2.9% up to $200,000: Exit and check step 2 box otherwise fill out this form.

Fiscal year filers must file no later than the 15th day of the fourth month following the close of their taxable year. Your employer withholds 1.45% of your gross income from your paycheck. Any company or corporation violating this requirement shall pay each.

If you have a household with two jobs and both pay about the same click this button and exit. Your employer or payer will calculate how much income tax to deduct by referring to your total claim amount on form td1 , personal tax credits return and using approved calculation methods.

Missouri Income Tax Rate And Brackets Hr Block

Payroll Software Solution For Missouri Small Business

An Easier Way To Get The Right Tax Withheld From Your Paycheck This Year

Payroll Software Solution For Missouri Small Business

Payroll Taxes Explained - Cashay

Form 4282 Employers Tax Guide - Missouri Department Of Revenue

Free Missouri Payroll Calculator 2021 Mo Tax Rates Onpay

Paycheck Calculator - Take Home Pay Calculator

Payroll Software Solution For Missouri Small Business

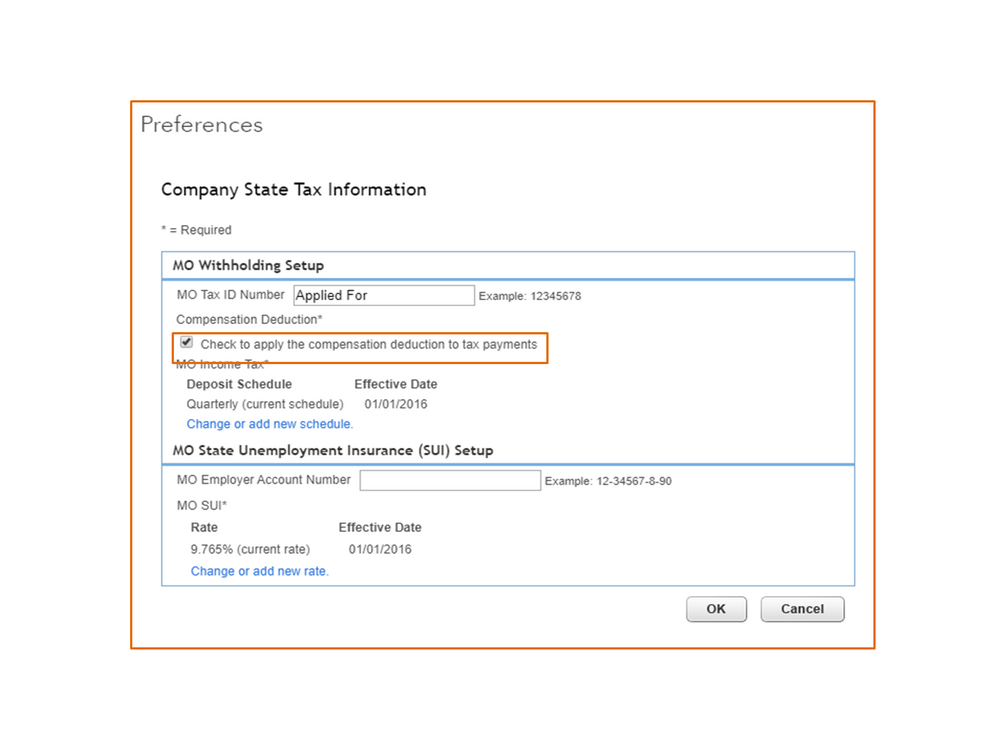

Missouri Withholding Tax Compensation Deduction

2021 State Income Tax Cuts States Respond To Strong Fiscal Health

Missouri Withholding Tax Compensation Deduction

Payroll Software Solution For Missouri Small Business

Missouri Paycheck Calculator - Smartasset

Missouri Paycheck Calculator - Smartasset

Employer Payroll Tax Calculator Gusto

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

How Much Tax Is Taken Out Of My Paycheck Indiana - Tax Walls

How To Do Payroll In Missouri

Comments

Post a Comment