Iowa, kentucky, maryland, nebraska, new jersey and pennsylvania. Complete, edit or print your forms instantly.

Tax Concerns For North Carolina Inheritances - North Carolina Estate Planning Blog

Estate tax or inheritance tax.

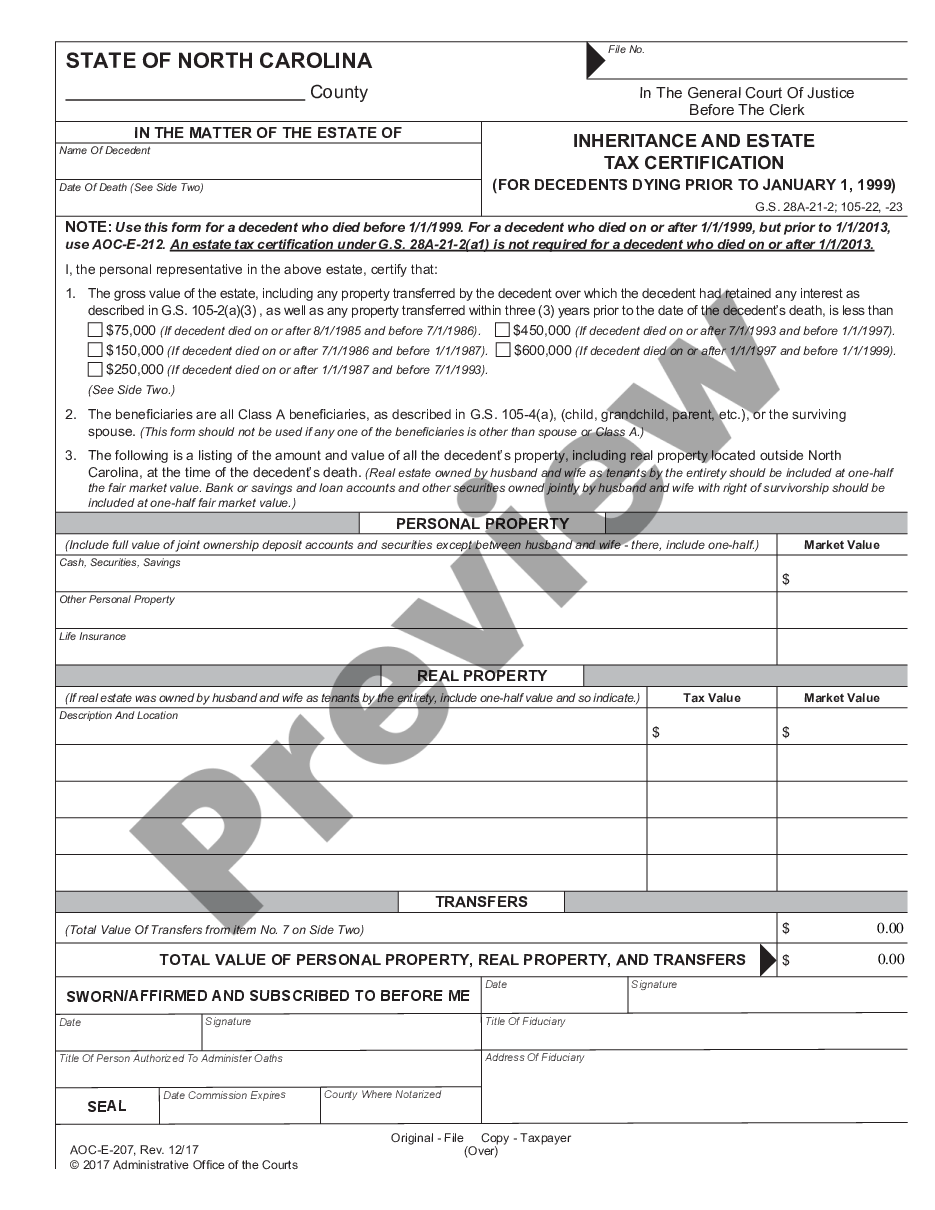

Inheritance tax waiver nc. (a) to be a qualified disclaimer for federal and state inheritance, estate, and gift tax purposes, an instrument renouncing a present interest shall be filed within the time period required under the applicable federal statute for a renunciation to be given effect as a. An inheritance and estate tax waiver or other consent to transfer issued by the secretary of revenue bearing the signature of the secretary of revenue or the official facsimile signature of the secretary of revenue may be registered by the register of deeds in the county or counties Download or email fillable forms, try for free now!

Washington has the highest estate tax at 20%, applied to the portion of an estate's value greater than $11,193,000. Inheritance and estate tax certification | north carolina judicial branch. An inheritance tax waiver is form that may be required when a deceased person's shares will be transferred to another person.

If you’re confident the template fits your needs, click buy now. Ad a tax advisor will answer you now! You might inherit $100,000, but you would pay an inheritance tax on just $50,000 if the state only imposes the tax on inheritances over $50,000.

Each form was current as of the date appearing in the lower left hand corner of side one of page one of the form, but is subject to Most states have been moving away from estate or inheritance taxes or have raised their exemption levels, as estate taxes without the. Inheritance, estate, gift, and the unauthorized substances taxes.1 the good compliance reason in the general waiver criteria does not apply to these taxes because these taxes lack the compliance history that is the basis of the good compliance reason.

Twelve states and washington, d.c. The basics of nc inheritance law. Maryland is the only state to impose both.

Ad access any form you need. Questions answered every 9 seconds. Registration of inheritance and estate tax waiver.

Federal estate tax could apply as well. Download or email fillable forms, try for free now! An inheritance and estate tax waiver or other consent to transfer issued by the secretary of revenue bearing the signature of the secretary of revenue or the official facsimile signature of the secretary of revenue may be registered by the register of deeds in the county or counties where the real estate described in the inheritance.

In addition to the federal estate tax, with a top rate of 40 percent, some states levy an additional estate or inheritance tax. The category of special circumstances applies in limited circumstances to all penalties Questions answered every 9 seconds.

Iowa, kentucky, maryland, nebraska, new jersey and pennsylvania. Impose estate taxes and six impose inheritance taxes. (1) all the beneficiaries are either a spouse, child, grandchild, or parent and (2) the gross value of the estate, including property transferred within three years of the decedent’s death without adequate valuable

Judicial branch offices and courts are closed thursday, november 11, for veterans day holiday. Ad a tax advisor will answer you now! Aall official court forms are reproduced by permission of the north carolina administrative office of the courts.

Registration of inheritance and estate tax waiver. Ad access any form you need. The inheritance tax of another state may come into play for those living in north carolina who inherit money.

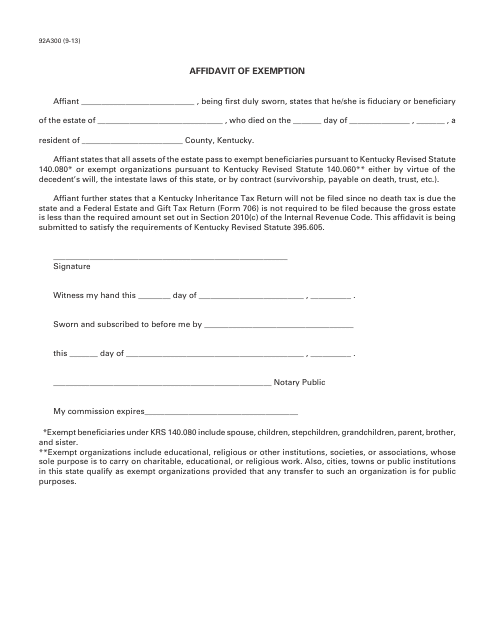

Inheritance tax waiver form nc. Complete, edit or print your forms instantly. Kentucky inheritance and estate tax laws can be found in the kentucky revised statutes, under chapters:

North carolina estate forms index the following statement is provided by order of the n.c. Inheritance tax rates depend on. An inheritance tax return is not required when:

If available, read the description and make use of the preview option well before downloading the sample. Inheritance tax waiver form nc. An inheritance tax waiver is form that may be required when a deceased person's shares will be transferred to another person.

An inheritance and estate tax waiver or other consent to transfer issued by the secretary of revenue bearing the signature of the secretary of revenue or the official facsimile signature of the secretary of revenue may be registered by the register of deeds in the county or counties where the real estate described in the inheritance and estate. Kentucky inheritance and estate tax laws can be found in the kentucky revised statutes, under chapters: The probate process in north carolina collect and.

Penalty Waiver Policy - Pdf Free Download

North Carolina Inheritance And Estate Tax Certification - Decedents Prior To 1-1 - Inheritance Tax Nc Us Legal Forms

Penalty Waiver Policy - North Carolina Department Of Revenue

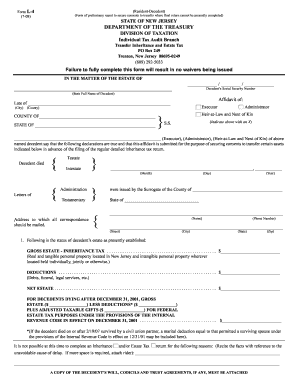

L9 Form - Fill Online Printable Fillable Blank Pdffiller

2013-2021 Form Tn Rv-f1400301 Fill Online Printable Fillable Blank - Pdffiller

Guide To Nc Inheritance And Estate Tax Laws - Hopler Wilms Hanna

Sample Affidavit Of Heirship Form From Pdf Affidavit Probate

States With An Inheritance Tax Recently Updated For 2020

Nj Inheritance Waiver Tax Form 01 Pdf - Fill Online Printable Fillable Blank Pdffiller

States With No Estate Tax Or Inheritance Tax Plan Where You Die

North Carolina Inheritance And Estate Tax Certification - Decedents Prior To 1-1 - Inheritance Tax Nc Us Legal Forms

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Do State Estate And Inheritance Taxes Work Tax Policy Center

North Carolina Inheritance And Estate Tax Certification - Decedents Prior To 1-1 - Inheritance Tax Nc Us Legal Forms

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

2013-2021 Form Tn Rv-f1400301 Fill Online Printable Fillable Blank - Pdffiller

Is There An Inheritance Tax In Nc An In-depth Inheritance Qa

91 Direct Debit Form Template Page 4 - Free To Edit Download Print Cocodoc

Form 92a300 Download Printable Pdf Or Fill Online Affidavit Of Exemption Kentucky Templateroller

Comments

Post a Comment