(link is external) download user guide. This breakdown will include how much income tax you are paying, state taxes, federal taxes, and many other costs.

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Check the history of a vehicle;

Iowa vehicle tax calculator. The tax is imposed on the iowa net income of corporations doing business within this state or receiving income from property in the state.for tax years on or after january 1, 1987, iowa imposes an alternative minimum tax equal to 7.2% of iowa tax preferences. Dealerships may also charge a documentation fee or doc fee, which covers the costs incurred by the dealership preparing and filing the sales contract, sales tax documents, etc. The highest property tax rates in the county can be found in des moines.

The federal adjusted gross income used to determine contribution limitations for iowa tax purposes is the amount from federal form 1040, line 8a, as modified by any iowa net income nonconformity adjustments from line 14 of the ia 1040 including any depreciation/section 179 adjustments, and the domestic production activities deduction on line 24. The motor vehicle division serves as an agent of the iowa department of transportation and department of revenue and. After a few seconds, you will be provided with a full breakdown of the tax you are paying.

To use our iowa salary tax calculator, all you have to do is enter the necessary details and click on the calculate button. In addition to taxes , car purchases in iowa may be subject to other fees like registration , title , and plate fees. I have moved and registered my vehicle in a different state.

Iowa has a 6% statewide sales tax rate ,. For tax years on or after january 1, 1988, the tax is imposed on the unrelated business income of nonprofit corporations. Please select a county to continue.

30.5 cents per gallon of regular gasoline, 32.5 cents per gallon of diesel. Every 2021 combined rates mentioned above are the results of iowa state rate (6%), the county rate (0% to 1%), the iowa cities rate (0%. Cities and/or municipalities of iowa are allowed to collect their own rate that can get up to 1% in city sales tax.

These fees are separate from the taxes and dmv fees. Unsurprisingly, the state's $3,384 median annual tax payment falls in the top three of iowa counties. Iowa auto loan calculator is a car payment calculator with trade in, taxes, extra payment and down payment to calculate your monthly car payments.iowa car payment calculator with amortization to give a monthly breakdown of the principal and interest that you will be paying each month.

All vehicles must be registered to legally be driven in iowa. Find your state below to determine the total cost of your new car, including the car tax. The motor vehicle division issues vehicle titles, registration renewals, personalized and other special license plates, and junking certificates.

The county’s average effective property tax rate is 1.97%, which is the highest rate in the state. How do you figure tax title and license on a vehicle? This deduction is for annual registration fees paid based on the value of qualifying automobiles and multipurpose vehicles.

Auto sales tax and the cost of a new car tag are major factors in any tax, title, and license calculator. Online calculators > financial calculators > iowa car loan calculator iowa auto loan calculator. How 2021 sales taxes are calculated in iowa.

Credits and exemptions are applied only to annual gross net taxes total. Some states provide official vehicle registration fee calculators, while others provide lists of their tax, tag, and title fees. To calculate the sales tax on a vehicle purchased from a dealership, multiply the vehicle purchase price by 6.25 percent (0.0625).

If you itemize deductions, a portion of the automobile or multipurpose vehicle annual registration fee you paid in 2014 may be deducted as personal property tax on your iowa schedule a, line 6, and federal schedule a, line 8. For more information on vehicle use tax, and/or how to use the calculator, click on the links below. The annual registration fees are determined by iowa code sections 321.109 and 321.115 through 321.124 and are to be paid to the county treasurer’s office in the county of residence.

Security interests are notated and released and refunds of credits are processed. Earlier this decade, iowa enacted one of the largest tax cuts in the state’s history. Uh oh, please fix a few things before moving on:

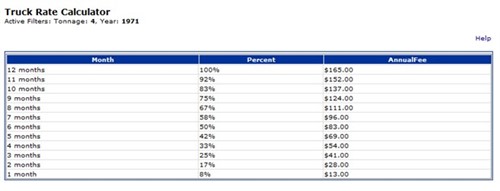

How can i apply for a refund for the unused registration in iowa? The iowa dot fee calculator is not compatible with mobile devices (smart phones). The refund is calculated from the date the vehicle is sold to the expiration of the registration.

To calculate the sales tax on a vehicle purchased from a dealership, multiply the vehicle purchase price by 6.25 percent (0.0625). Click the following link to determine registration fees, registration fees remaining on a vehicle that has been sold, traded or junked, estimate fees due on a newly acquired vehicle, and calculate truck fees by tonnage: In addition to taxes , car purchases in iowa may be subject to other fees like registration , title , and plate fees.

You can use our iowa sales tax calculator to look up sales tax rates in iowa by address / zip code. The state general sales tax rate of iowa is 6%. How do you figure tax title and license on a vehicle?

Iowa state tax quick facts. Buying & selling a vehicle. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location.

You can use the fee calculator to estimate your fee (s): This property tax calculator is for informational use only and may not properly indicate actual taxes owed.

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Car Tax By State Usa Manual Car Sales Tax Calculator

Motor Vehicles - Lake County Tax Collector

Crypto Tax In Australia - The Definitive 2021 Guide

Sales Tax On Cars And Vehicles In Iowa

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Premiere Suite - Bali Nusa Dua Hotel

Section 194q Tax Deduction On The Purchase Of Goods

Cell Phone Taxes And Fees 2021 Tax Foundation

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Registration Fees Penalties And Tax Rates Texas

Woocommerce Sales Tax In The Us How To Automate Calculations

Which Us States Charge Property Taxes For Cars - Mansion Global

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Car Tax By State Usa Manual Car Sales Tax Calculator

Calculate Your Transfer Fee Credit Iowa Tax And Tags

States With Highest And Lowest Sales Tax Rates

Tax Calculators And Forms Current And Previous Tax Years

Car Tax By State Usa Manual Car Sales Tax Calculator

Comments

Post a Comment