Japanese corporation, and (ii) foreign taxes levied on a payment from a foreign permanent establishment (“pe”) to its japanese head office or another related party as a result of the foreign tax authorities disallowing a deduction at the local level. The income of the “tested unit” should be adjusted to u.s.

Corporate Tax Federal Budget 2016-17 Pwc Australia

Tax rates for companies with stated capital of more than jpy 100 million are as follows:

Japan corporate tax rate pwc. If passed, this amendment will apply to tax years beginning on or after april 1, 2021. Additionally, if there are multiple cfcs in the same group, for example, if a u.s. Pwc’s tax comparison tool is a quick and easy way to get an idea of tax rates for corporations and individuals.

Companies also must pay local inhabitants tax, which varies with the location and size of the firm. Beginning from 1 october 2019, corporate taxpayers are required to file and pay the national local corporate tax at a fixed rate of 10.3% of their corporate tax liabilities. Headline individual capital gains tax rate (%) gains arising from sale of stock are taxed at a total rate of 20.315% (15.315% for national tax purposes and 5% local tax).

This newsletter focuses on the corporate tax rate amendment, and Film royalties are taxed at 15%. A combination of changes published in the latest japanese tax reform on 8 december 2016, and the upcoming decrease in uk corporate tax rate to 19% could mean the japanese controlled foreign company (jcfc) rule would be triggered for many japanese groups.

Japan tax update pwc 2 1. Standard enterprise tax (and local corporate special tax) Any other royalties are taxed at 12.5%.

3 pwc’s international tax comparison contents comparison of taxes for corporations and individuals 4 comparing taxes: Corporate income tax rate exclusive of surtax. The tax treaty with brazil provides a 25% tax rate for certain royalties (trademark).

Pwc tax japan provides services to help our clients adapt to a rapidly changing tax landscape. Foreign effective tax rate greater than 90% of the u.s. Capital gains tax (cgt) rates headline corporate capital gains tax rate (%) capital gains are subject to the normal cit rate.

You can conduct comparisons on three levels: Pwc’s international tax service group, comprised of professionals who have worked internationally with pwc member firms as well as those who are seconded from overseas pwc member firms, works closely with japanese clients to solve international tax issues using the expertise of. Before 1 october 2019, the national local corporate tax rate is 4.4%.

Local corporation tax applies at 4.4% on the corporation tax payable. Legal entities 5 2019 corporate tax rates in switzerland 6 2019 corporate tax rates in the eu and switzerland 7 Information about the pwc japan group which consists of the japanese member firms of the pwc global network and their subsidiaries.

Detailed analysis of the 2020 tax proposals will be provided in a subsequent japan tax update. Corporate tax measures related to the tax rate reduction (1) reduce corporate tax rates (national tax and size based enterprise tax) from tax years beginning on or after 1 april 2015, the national corporate tax rate is reduced from 25.5% to 23.9%. The rate is increased to 10% to 15% once the tax audit notice is received.

As the market is undergo various changes, pwc tax japan is the firm that can provide services from “preventive tax medication” to “advanced front line tax therapy” using our global. 25%* if turnover/gross receipts do not exceed inr 4 billion for fy 2018/19;. Corporate income tax rate (currently 18.9%).

Our clients face a wide variety of tax challenges across their businesses. Abolishment of consolidated tax system and introduction of group tax relief (“group tax relief”) system a) group tax relief will be introduced to allow domestic corporations to allocate profits and losses Japan tax update www.pwc.com/jp/e/tax have significant financial corporate tax rate changes may statement implications december 2016 in brief on november 18, 2016, the delay in (1) the consumption tax increase, and (2) the corporate tax rate amendment were both enacted.

The articles of the corporate tax law (ctl) and ctl enforcement ordinance (ctleo) were. The inhabitants tax, charged by both prefectures and municipalities, comprises the corporation tax levy (levied Press release from the pwc japan's pressroom.

With a taxable net income of 100 000 chf,. In the case that a corporation amends a tax return and tax liabilities voluntarily after the due date, this penalty may not be levied. These challenges have become increasingly complex for companies of all sizes and industries.

Profit tax (% of commercial profits) number of visits or required meetings with tax officials (average for affected firms) other taxes payable by businesses (% of commercial profits) Tax rates for natural persons vary depending on net income. Combined corporate income tax rate.

Corporation tax is payable at 23.4%. About the pwc japan group.

Corporate Tax Rates Around The World Tax Foundation

Pwccom

Pwccom

Tax

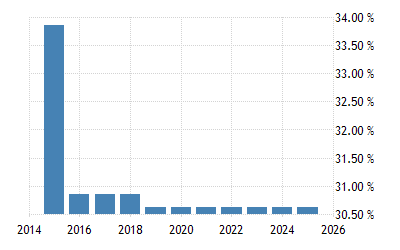

Japan Corporate Tax Rate 2021 Data 2022 Forecast 1993-2020 Historical Chart

Pwccom

Paying Taxes 2020 In-depth Analysis On Tax Systems In 190 Economies Pwc

Corporate Tax Rates Around The World Tax Foundation

Worldwide Tax Summaries Tax Services Pwc

Pwccom

Japan - Overview

Corporate Income Tax Cit Rates

Pwccom

Pwccom

Pwccom

Corporate Tax

Pwccom

Pwccom

Japan Corporate Tax Rate 2021 Take-profitorg

Comments

Post a Comment