Over $2,600 but not over $9,450 $260 plus 24% of the excess over $2,600 58 930 + 28% of the amount above 550 000.

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

The capital gain tax rates for trusts and estates are as follows:

Trust capital gains tax rate 2020 table. In 2020 the capital gains tax rates are either 0%, 15% or 20% for most assets held for more than a year. Capital gains tax rates on most assets held for less than a year correspond to ordinary income tax brackets (10%, 12%, 22%, 24%, 32%, 35% or 37%). 7% of taxable income above 78 150.

R2 million gain or loss on the disposal of a primary residence; 2020 capital gains brackets for single individuals, taxable capital gains over for married individuals filing joint returns, taxable capital gains over for heads of households, taxable capital gains over 0% $0 $0 $0 Capital gains tax rates on most assets held for.

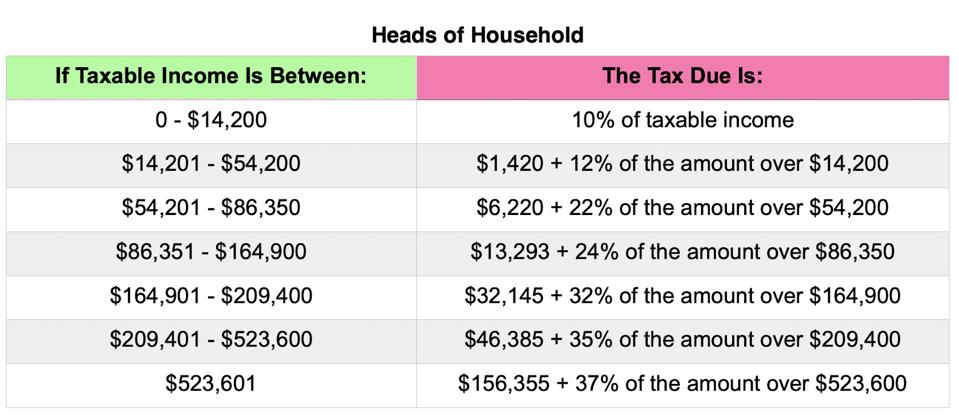

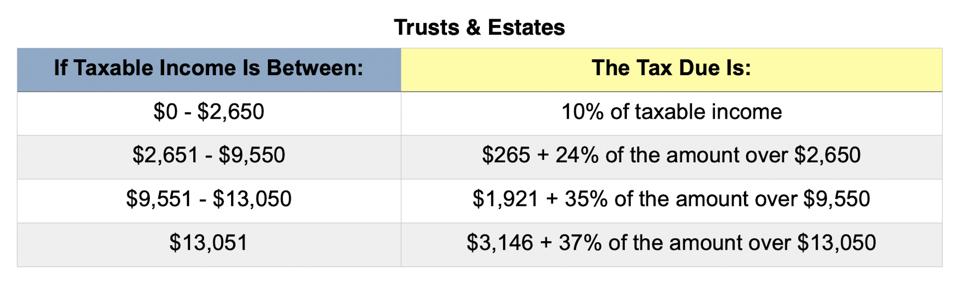

$3,011.50 plus 37% of the excess over $12,500 Not over $2,600 10% of the taxable income. For tax year 2020, the 20% rate applies to amounts above $13,150.

$1,839 plus 35% of the excess over $9,150: Estates and trusts taxable income $ 0 to 2,600 maximum rate = 0% 2,601 to 12,700 maximum rate = 15% 12,701 and over maximum rate = 20% The income of the trust estate is therefore $300 ($100 interest income + $200 capital gain) and the net income of the trust is $200 ($100 interest income + $100 net capital gain because the cgt discount is applied to halve the $200 capital gain).

The tax rate works out to be $3,146 plus 37% of income over $13,050. The 0% rate applies to amounts up to $2,650. $255 plus 24% of the excess over $2,550:

Are trusts taxed at a higher rate? It applies to income of $13,050 or more in 2021. The rate remains 40 percent.

Where a trust is a special trust, only 40% of the capital gain is included in the taxable income with an effective tax rate similar to that of an individual, but discretionary family trusts do not qualify as special trusts. Financial years ending on any date between 1 april 2017 and 31 march 2018: At basically $13,000 in income, they hit the highest tax rate.

20 080 + 21% of taxable income above 365 000. It continues to be important to obtain date of death values to support the step up in basis which will reduce the capital gains realized during the trust or estate administration. Capital gains taxes on collectibles.

See below for the current tax rates versus the tax rates for 2021. In 2020 the capital gains tax rates are either 0%, 15% or 20% for most assets held for more than a year. They may also get relief when.

Although irrevocable trusts are complex trusts, which means they can accumulate income they make on trust assets, the trustees normally reduce taxes by distributing all the trust income each year to the beneficiaries in the year the income is earned. The 0% and 15% rates continue to apply to amounts below certain threshold amounts. Where the capital gain is attributed to the trust, the effective rate of tax on a capital gain is 36%.

Irs form 1041 gives instructions on how to file. Capital gains and qualified dividends. The following are some of the specific exclusions:

The information presented here is not intended to be a comprehensive analysis. Trustees pay 10% capital gains tax on qualifying gains if they sell assets used in a beneficiary’s business, which has now ended. The highest trust and estate tax rate is 37%.

Chernoff diamond is a benefits advisory firm and does not. Trusts and estates pay capital gains taxes at a rate of 15% for gains between $2,600 and $13,150, and 20% on capital gains above $13,150.00. Events that trigger a disposal include a sale, donation, exchange, loss, death and emigration.

1 surtax applies to lesser of net investment income or modified adjusted gross income over threshold 2 surtax applies to the lesser of (1) undistributed net investment income or (2) the excess of adjusted gross income over $12,750.

Distributable Net Income Tax Rules For Bypass Trusts

The Tax Impact Of The Long-term Capital Gains Bump Zone

The Tax Impact Of The Long-term Capital Gains Bump Zone

Wyoming Tax Benefits - Jackson Hole Real Estate - Ken Gangwer

The Tax Impact Of The Long-term Capital Gains Bump Zone

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Allan Gray 2020 Budget Speech Update

Tax Hikes Lessons From Past Tax Hikes Fidelity

Capital Gains Tax Reporting And Record-keeping Low Incomes Tax Reform Group

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

The Tax Impact Of The Long-term Capital Gains Bump Zone

How Do Taxes Affect Income Inequality Tax Policy Center

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More The Wealthadvisor

2021 Estate Income Tax Calculator Rates

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Irs Releases 2021 Tax Rates Standard Deduction Amounts And More The Wealthadvisor

The Right Path Tax Adviser

Rethinking How We Score Capital Gains Tax Reform Bfi

Capital Gains Tax Commentary - Govuk

Comments

Post a Comment