It is an exercise by which the assessee legally takes advantage of. Tax evasion, tax avoidance and tax planning.

Relationship Between Tax Planning Tax Avoidance And Tax Evasion Download Scientific Diagram

The first one is the.

What is tax planning and tax evasion. Tax planning can be defined as an arrangement of one’s financial and business affairs by taking legitimately. Tax planning can be understood as the activity undertaken by the assessee to reduce the tax liability by making optimum use of all permissible allowances, deductions, concessions, exemptions, rebates, exclusions and so forth, available under the statute. Pummy wadhawan bba 4th sem meaning of tax planning tax planning is an art and the exercise of arranging financial affairs of tax payers so as to reduce or delay the tax payment which would be necessary, if the words if tax laws were to be followed in the obvious manner.

The use of tax payers is to guarantee tax. Tax planning is legitimate way to save taxes whereas tax evasion is basically stealing information to avoid paying taxes. It is a way to reduce tax liability by taking full advantages provided by the act through various exemptions,deductions,rebates and relief.

Tax planning is a completely logical and legal way of minimising one’s tax liability by availing the benefits of all the concessions, provisions, deductions and exemptions provided under the income tax act. Tax planning refers to financial planning for tax efficiency. Tax planning includes making financial and business decisions to minimise the incidence of tax.

Tax evasion is a crime for which the assesse could be punished under the law. A) economic planning b) tax evasion c) tax planning d) tax avoidance 8. Put simply, it is an arrangement of an assessee’s business or.

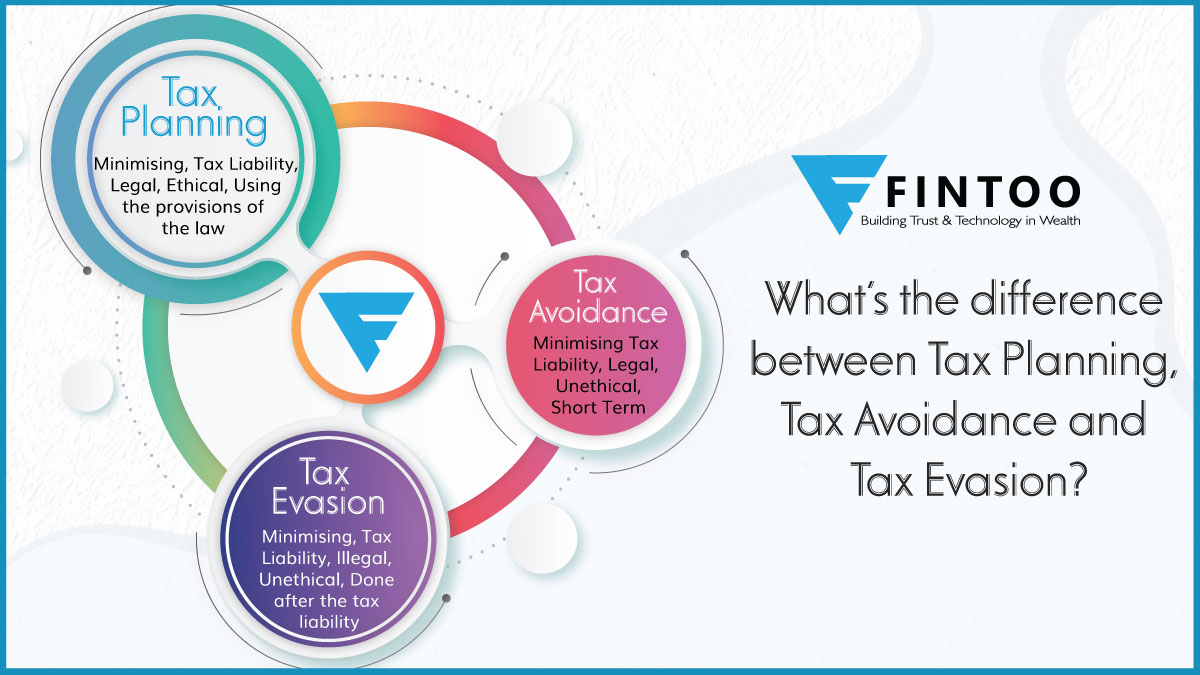

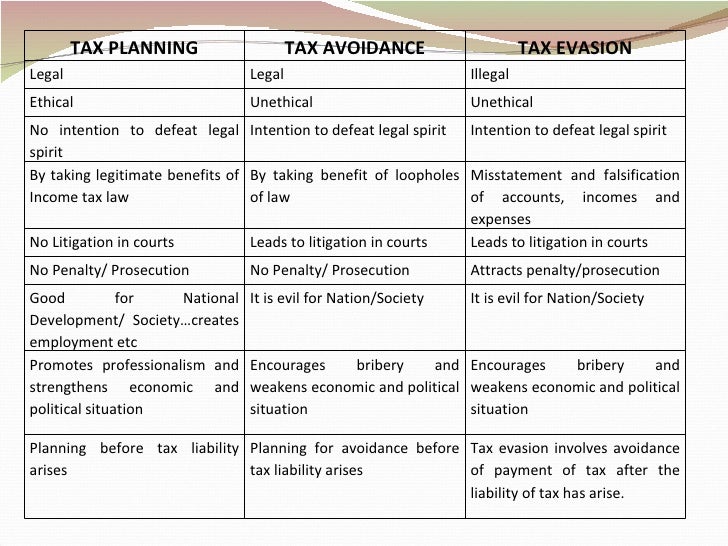

There are mainly two types of tax evasion. A great deal of confusion prevails in corporate sector about correct connotations of these terms. The difference between tax planning and tax avoidance can be drawn clearly on the following grounds:

Unlike tax avoidance, tax planning is the practice of minimising tax liability with no intention of deceit. Hence, we shall attempt to explain these terms to show tax planning is absolutely legal. The example may be investment in let say insurance premium qualify for 80 c dedication which reduce tax liability by lowering gross total income whereas when you report lesser income is tax evasion.

Tax planning allows a taxpayer to make the best use of the different tax exemptions, deductions and benefits to minimize his tax liability each financial year. Through tax planning one can reduce one’s tax liability. Tax evasion is an unlawful way of paying tax and defaulter may punished.

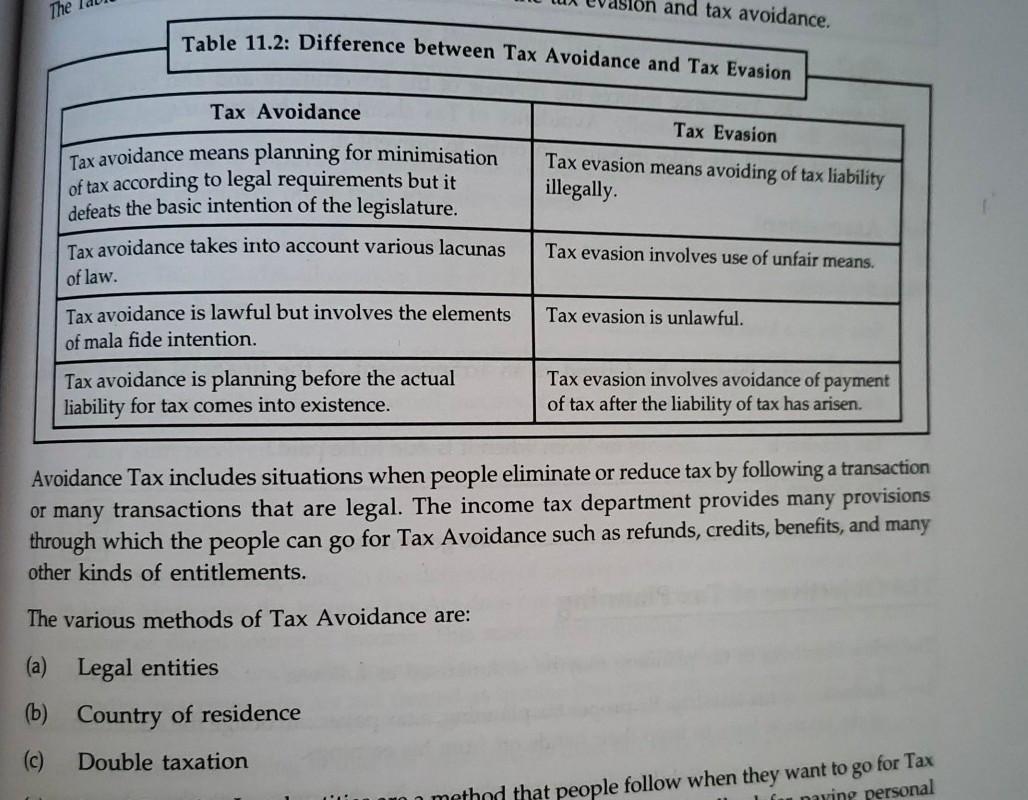

Tax planning either reduces it, or does not increase your tax risk. (iv) tax avoidance looks like a tax planning and is done before the tax liability arises. Tax planning is the logical analysis of a financial position from a tax perspective.

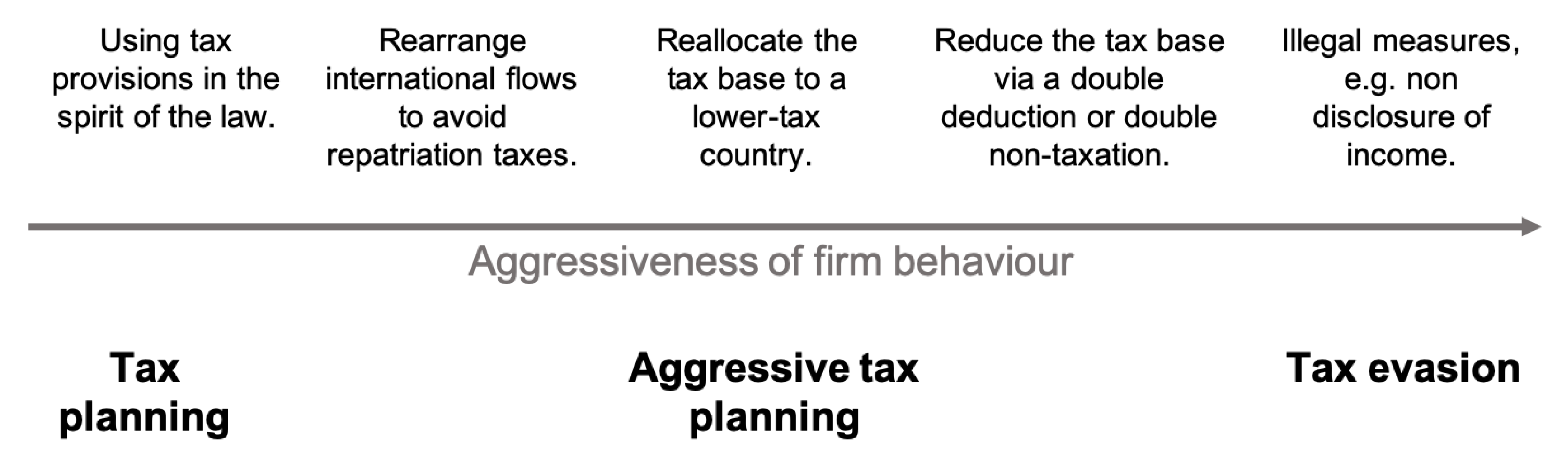

Tax evasion is the act of not paying your due taxes on time to the irs. Three methods of saving taxes have been developed in most countries of the world in the past few decades: Others might wish to keep their money to themselves, rather than giving it to the government.

It refers to tax mitigation by the use of tax preferences given under the law or by means that the tax law did not intend to tax. Tax planning tax planning is an exercise undertaken to minimize tax liability through the best use of all available exemptions, deductions, rebates and reliefs to reduce income. Some practices of tax avoidance have been found to have the intention to deceive.

Individuals may engage in tax evasion for many reasons, such as seeing them as an unnecessary burden on their income. Tax planning is basically arranging ones financial affairs in such a way that benefit of all the eligible exemptions, deductions, allowances and concessions given under income tax act can be taken effectively to minimize tax liability. Planning, tax management, tax evasion and tax avoidance.

The difference between tax planning and tax avoidance is that tax avoidance always increases your tax risk. A closely held company a ltd. It involves planning one’s income in a legal manner to avail various exemptions and deductions.

Tax planning is process of analyzing one’s financial situation in the most efficient manner. Tax planning tax avoidance & tax evasion. Is a banking institution in ltj (low tax jurisdiction) and india and ltj tax treaty provides that interest payment to a ltj banking company is not taxable in india.

Which is wos of indian Whereas tax planning is the legal way of mitigation of taxes tax evasion is the avoidance of tax liability illegally through dishonest means. It aims to reduce one’s tax liabilities and optimally utilize tax exemptions, tax rebates , and benefits as much as possible.

The article tries to explore into the ethical dimension of tax planning and the resultant deviant taxpayer’s behaviour to. Difference between tax planning,tax avoidance and tax evasion. Tax evasion is blatant fraud and is done after the tax liability has arisen.

Tax planning involves activities like income analysis, restructuring and investing, as particular. Tax planning refers to a mechanism through which one can intelligently plan his/her financial affairs in such a manner that all the eligible deductions, exemptions and allowances, as per law, can be enjoyed.

Solved The And Tax Avoidance Table 112 Difference Between Cheggcom

Explain The Difference Between Tax Avoidance And Tax Evasion - Tax Walls

Difference Between Tax- Planning Avoidance Evasion - Fintoo Blog

Ctp Ques 1 - The Difference Between Tax Planning And Tax Management Tax Planning Tax Managementi The Objective Of Tax Planning Is To Minimize The Tax Course Hero

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Difference Between Tax Planning And Tax Evasion L Tax Evasion

Games Free Full-text Gaming The System An Investigation Of Small Business Owners Attitudes To Tax Avoidance Tax Planning And Tax Evasion Html

Tax Planning Tax Evasion Tax Avoidance

Tax Planning Tax Evasion Tax Avoidance And Tax Management - Avs Associates

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Examples Of Tax Planning Tax Avoidance And Tax Evasion - Tax Walls

![]()

As Uae Implements Vat We Look At Tax Planning Versus Tax Evasion - Gulf Business

Explain The Difference Between Tax Avoidance And Tax Evasion - Tax Walls

Difference Between Tax Planning Pdf

Examples Of Tax Planning Tax Avoidance And Tax Evasion - Tax Walls

Explain The Difference Between Tax Avoidance And Tax Evasion - Tax Walls

Ca Foundation - Tax Planning Tax Evasion And Tax Avoidance In Hindi Offered By Unacademy

Explain The Difference Between Tax Avoidance And Tax Evasion - Tax Walls

Explain The Difference Between Tax Avoidance And Tax Evasion - Tax Walls

Comments

Post a Comment