No, the gift is not taxable — but it is reported on form 3520. Gifts received from an individual are not reported on a tax return, regardless of the amount received.

Gifts From Foreign Corporations Included As Gross Income

Person’s gross income under us international tax regulations.

Are foreign gifts taxable in the us. The gift tax does not apply to any transfer by gift of intangible property by a nonresident not a citizen of the united states (whether or not he was engaged in business in the united states), unless the donor is an expatriate and certain other rules apply. Is gift received by a us citizen from a foreign relative taxable? The internal revenue code’s regulations specifically state that when a “purported gift or bequest” is received “directly or indirectly,” the amount is included in the u.s.

Tax on gift with no income generated. It generally falls to the foreign party giving gifts to pay applicable taxes. The income generated from the inheritance is not the inheritance, but rather new income — and therefore it is taxable.

Because as foreign persons who are not otherwise subject to us tax or us tax laws (aka no u.s. Moreover, the united states has no reach over the foreign person who issued the foreign gift. That is because fred, a u.s.

A general rule is that , a foreign gift (money or other property received) received by a u.s. No gift tax applies to gifts from foreign nationals if those gifts are not situated in the u.s. Person who received foreign gifts of money or other property, you may need to report these gifts on form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts.

Available exemption will offset taxable gifts or bequests. In legal terms, the gift isn't u.s. Person receives certain gifts or bequests from foreign corporations, those amounts may be considered as part of the u.s.

The united states internal revenue service says that a gift is any transfer to an individual, either directly or indirectly, where full compensation (measured in money or money's worth) is not received in return.. Person is required to report the receipt of gifts from a nonresident or foreign estate only if the total amount of gifts from that nonresident or foreign estate is more than $100,000 during the tax year. Gift and estate tax “rules” against them.

As mentioned earlier, the exemption amount is $11,400,000 in 2019 for us citizens and domiciliaries. There are no taxes owed on the gift received but the gift must be reported to the irs. Just keep in mind that you may need to pay inheritance tax on the inherited assets to the foreign nation or.

Are gifts from foreign persons taxable? Person’s gross income “as if it were a distribution from. Form 3520 is an information return, not a tax return, because foreign gifts are not subject to income tax.

Citizen, and lives and works in beijing, china. As to the taxation of foreign gifts, the general rule is that gifts from foreign persons are not taxed. Person, received a gift from a foreign person individual that exceeded the form 3520 threshold if $100,000.

Examples of foreign gift reporting & tax example 1: Person is excluded from his gross income. Corporation, and gives the stock of the

Chris is not a u.s. Some foreign gifts may be taxable. Recipient of a foreign cash gift, on the other hand, has an obligation to report it to the irs, but will not owe tax on it.

Once the $100,000 threshold has been surpassed, the recipient must separately identify each gift/inheritance that is more than $5,000. This is true regardless of the amount, whether the gift is given during the lifetime of the donor or, if it is received as an inheritance. Michelle graduated medical school and her parents transferred her $800,00 to buy a house.

The gift relates to u.s. Property owned), the internal revenue service and government as a whole have no right to enforce u.s. Parent purchases a house in the u.s.

However, there are exceptions to the. Foreign citizens generally don't have liability for u.s. A gift tax is a tax imposed on the transfer of ownership of property during the giver's life.

If you are a nonresident not a citizen of the united states who made a gift subject to u.s. Parent purchases a house in the u.s., transfers the house to a newly created u.s. However, separate irs regulations require recipients to report a.

The tax law on foreign cash gifts. When a taxable gift in the form of cash, stocks, real estate, or other tangible or. While the gift is not taxable, income earned & reporting gifts is required.

If you are a citizen of the united states or a resident alien and have received inherited foreign property or gifts of money from a foreign national, the internal revenue service (irs) does not impose taxes on these foreign inheritances. However, gifts received from a foreign individual in the amount more than $100,000 have to be reported to the irs using form 3520. If you are a u.s.

You gave any gifts of future interests. Gift tax and therefore don't need to report gifts for those purposes. Is this a reportable gift?

This applies whether they be a cash gift from parents overseas or the transfer of real estate or other tangible properties. Yes, a us person (resident, citizen or a green card holder) can definitely receive gifts from a foreign person, say from his relatives in india. The internal revenue service imposes a tax when you make cash gifts to any recipient, regardless of their nationality or country of residence.

You must review the requirements to determine whether you should include gifts received from a foreign person in your taxable income.

Form 3520 Is Must From Tax Free Gifts Or Bequests

Receiving A Foreign Gift You May Need To Tell The Irs - The Wolf Group

Tax Season Is Upon Us And When Youre Part Of A Small Business You May Feel Like All Odds Are A Small Business Tax Small Business Tax Write Offs Business Tax

Us Tax Implications On Money Gifts What You Need To Know - Ulink Remit

Us Capital Gains Tax For Foreign Investors - United States Taxation Of Foreign Investors With Richard S Lehman Tax Attorney

Foreigners Can Avoid Us Gift Tax With Proper Planning Meg International Counsel Pc

Common Tax Mistakes Made By Us Citizens Working For International Organizations - The Wolf Group

World Law Reporter Direct Tax Amendments From 2015-16 Directions Tax Project Finance

How The Us Gift Tax Applies To Foreign Nationals Bny Mellon Wealth Management

Form 3520 Us Taxes On Gifts And Inheritances Nomad Capitalist

Nonresident Individual Income And Transfer Taxation In The United States

Gifts From Foreign Persons New Irs Requirements 2021

Taxes Reporting A Foreign Gift Or Bequest - Strategic Finance

Gift Tax Rules For Us Resident Giving To Or Receiving From A Foreigner - Mercisf

Pin On Sdg 10 Reduced Inequalities

Foreign Gift Tax - Ultimate Insider Info You Need To Know

Us Gift Taxation Of Nonresident Aliens Kerkering Barberio Co Certified Public Accountants Sarasota Fl

Us Tax Implications And Reporting Requirements - Icici Nri Community

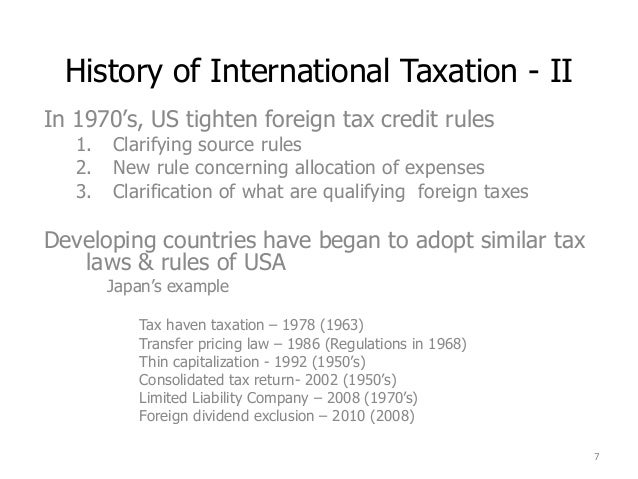

International Taxation

Comments

Post a Comment