However, the federal estate tax exemption for 2014 is $5,340,000. Covington, bills to remove cloud on title and quieting title in arkansas, 6 ark.

Mitchellwilliamslawcom

The process, however, can take longer for contested estates.

Arkansas estate tax statute. Most short falls of tax are concidered acts of ommission. However, like any state, arkansas has its own rules and laws surrounding inheritance, including what happens if the decedent dies without a valid will. If something was not added in to the tax return that should have been this is considered fraudulent and they do.

Census figures, the median annual income for arkansas residents is $40,531. Explore data on arkansas's income tax, sales tax, gas tax, property tax, and business taxes. Counties and cities can charge an additional local sales tax of up to 5.5%, for a maximum possible combined sales tax of 12%

Individuals who earn less then $10,682 per year, married couples earning less then $18,012 per year, and heads of household earning less then $15,185 per year do not have to submit an arkansas income tax return. Homeowners in arkansas may receive a homestead property tax credit of up to $375 per year. However, the statute of limitations does not apply if a return was not filed, or if the tax is based on fraud or acts of ommission.

In some states, including arkansas, when the lender is the high bidder at the sale but bids less than the total debt, it can get a deficiency judgment against the borrower (see below). While there aren’t any specific amounts or percentages for the fees, they do have limits. Property owners, heirs, and assigns

Arkansas, the magic words are, grant, bargain and sell! use of these four words magically implies most of the common law covenants of title: Arkansas does not collect an estate tax or an inheritance tax. Prescription drugs are exempt from the arkansas sales tax;

If the lender is the highest bidder, the property becomes what's called real estate owned. The homestead property may be owned by a revocable or irrevocable trust. Since the federal and state work closely together, feeding off the same information, the same applies to state taxes as to federal taxes.

Search arkansas county property tax and assessment records by owner name, parcel number or address. Collection of small estates by. The statute of limitations is the time a plaintiff in a civil action or a prosecutor in a criminal matter has to file a claim or charges.

No estate tax or inheritance tax. This site is maintained by the arkansas bureau of legislative research, information systems dept., and is the official website of the arkansas general assembly. The top estate tax rate is 12 percent and is capped at $15 million (exemption threshold:

The state has general statute of limitations for tax collections of six years. (1) covenant of seisin, (2) covenant of the right to convey, (3) special covenant against encumbrances, (4) covenant of. No estate tax or inheritance tax.

The credit is applicable to the “homestead”, which is defined as the dwelling of a person used as their principal place of residence. This is a quick summary of arkansas probate and estate tax laws. If you need more time to complete your arkansas income tax return, an extension can be granted by.

The arkansas state sales tax rate is 6.5%, and the average ar sales tax after local surtaxes is 9.26%. Contact us| privacy policy| site map. This article covers probate, how to successfully create a valid will in arkansas, and what happens to your estate if you die without a will.

That means that only the amount of the estate that exceeds $5.34 million will be taxed. No estate tax or inheritance tax. According to law, they cannot be more than 10 percent on the first $1,000 value of the estate and five percent on the next $4,000 and three percent of the remaining amount.

Arkansas probate and estate tax laws. (there by avoiding the issue of. The following table outlines probate and estate tax laws in arkansas

1 capitol mall, fifth floor. Not just anyone can redeem tax delinquent property. An executor can charge a reasonable fee for managing an estate in arkansas.

In arkansas, small estates are valued at $100,000 or less and bypass probate proceedings entirely. Arkansas has laws that limit who can redeem property once it has been certified to the commissioner of state lands. Learn about arkansas tax rates, rankings and more.

5standards for examination of real estate titles in arkansas, appendix “a”, 5(c) (arkansas bar association, 2000). The exemption amount will rise to $5.1 million in 2020, $7.1 million in 2021, $9.1 million in. 6for a very extensive and thoughtful article covering the history and development of quiet title actions, see joe e.

Your spouse’s estate is subject to federal estate tax. Welcome to findlaw's section on the statutes of limitations in arkansas. View the 2019 arkansas code | view other versions of the arkansas code.

Arkansas does not have a state inheritance or estate tax. Homestead and personal property tax exemption: However, if you are inheriting property from another state, that state may have an estate tax that applies.

Keep reading to find out whether you might be able to redeem the tax deed property that you are interested in.

Arklegstatearus

Liens And Mortgages On Tax Deed Property - The Hardin Law Firm Plc

How Is Arkansas Probate Law Different

Estate Planning And Taxation - National Agricultural Law Center

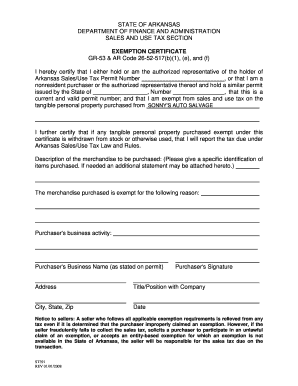

Resale Certificate Arkansas - Fill Out And Sign Printable Pdf Template Signnow

Cfmas 2021 Guide To State Tax Laws - Arkansas - Cfma Store

Dfaarkansasgov

Arklegstatearus

Cleveland County Arkansas - Arcountydatacom - Arcountydatacom

Is There An Inheritance Tax In Arkansas

Tax Deed Properties In Arkansas - The Hardin Law Firm Plc

Recent Changes To Estate Tax Law Whats New For 2019

Arklegstatearus

Arkansas Property Tax Calculator - Smartasset

New Arkansas Laws Taking Effect In January Katv

Arklegstatearus

Uaexuadaedu

Jonesboro Arkansas Estate Tax Planning Attorneys Quraishi Law Firm Wealth Management

The Ultimate Guide To Arkansas Real Estate Taxes

Comments

Post a Comment