Home services cwwh history make an online appointment our staff contact tax tips and news resources our tax and accounting staff. General land office (glo) plat maps are derived from original surveyor notes of the state of michigan.

Opelika Tax Service - Home Facebook

344 south jefferson street # 1, mason, mi 48854, united states phone:

Freedom tax service mason mi. Search across a wide variety of disciplines and sources: Filing a foia (freedom of information act request) leelanau chamber of commerce. Search for other tax return preparation on the real yellow pages®.

Please contact your local municipality if you believe there are errors in the data. It does not represent all. The tax id is also known as an employer i.d.

Please contact your local municipality if you believe there are errors in the data. Cdc's recommendations now allow for this type of mix and match dosing for booster shots. This service provides the following property tax information from mason county’s assessment and tax roll records:

And will care for your cleaning needs to do the job right and yet in the least amount of time to accord a reasonable cleaning fee. Operating for 10 or more years, they have an annual income of up to $500000. This data is provided for reference only and without warranty of any kind, expressed or inferred.

Find the most relevant information, video, images, and answers from all across the web. President biden and congressional democrats have plans to tax the rich more heavily and make them pay their fair share of taxes. Move the map and view the results.

The internal revenue service issues employers a tax id for their business. Freedom tax service llc is considered a small business with 1000 to 4999 square footage of space. Eins are used by the irs, the government, and other companies, agencies, and systems, to.

The company's filing status is listed as active and its file number is 463864. Google scholar provides a simple way to broadly search for scholarly literature. All documents pertaining to the original survey of michigan can be found in the state archives of michigan.

Click one of the icons on the map to get details about that item. For over 400 years, this. When you give liberty tax® the honor of preparing your taxes, you’re choosing to work with dedicated tax professionals who’ll help get you every deduction you’re entitled to.

The survey was conducted in the early to mid 1800's. Located in mason, mi, freedom tax service llc is in the accountants & accounting services business. We're hearing a lot lately about creating a more fair and equitable tax system.

Governmental jurisdiction (city, village or township) and parcel identification number. Get reviews, hours, directions, coupons and more for freedom tax services at 344 s jefferson st, mason, mi 48854. The long list of proposals to increase taxes on wealthier americans include raising the top income.

Back in may, as part of a discussion about the tradeoff between free markets (efficiency) and redistribution (equity), i put together a chart to show how poor people are better off in.12/03/2021. Articles, theses, books, abstracts and court opinions. The list includes 15 most wanted fugitives and local fugitives wanted by u.s.

Freedom tax services llc address: The search engine that helps you find exactly what you're looking for. Ingham county / eastern time zone.

To view a map, select a county from. Current and prior tax year taxable value, assessed value and state equalized. And with 2400+ locations, our fast, friendly, and guaranteed accurate tax.

Get reviews, hours, directions, coupons and more for freedom tax services. Freedom tax services is a michigan assumed name filed on april 6, 2012. This data is provided for reference only and without warranty of any kind, expressed or inferred.

We provide you with a house cleaner, better than any maid. Serving lansing, east lansing, dewitt, okemos, holt, haslett, mason, grand ledge and surrounding. Bs&a software provides bs&a online as a way for municipalities to display information online and is not responsible for the content or accuracy of the data herein.

Current property owner, mailing address and property address. Bs&a software provides bs&a online as a way for municipalities to display information online and is not responsible for the content or accuracy of the data herein. The following is a consolidated and partial listing of the fugitives which are profiled on the u.s.

The registered agent on file for this company is daniel schlattman and is located at 344 s jefferson, mason, mi 48854. Subscribe to leelanau county youtube video service. Casper willson wilson & holmes, inc.

Pin On Places Ive Been And Other Interesting Travel Stuff

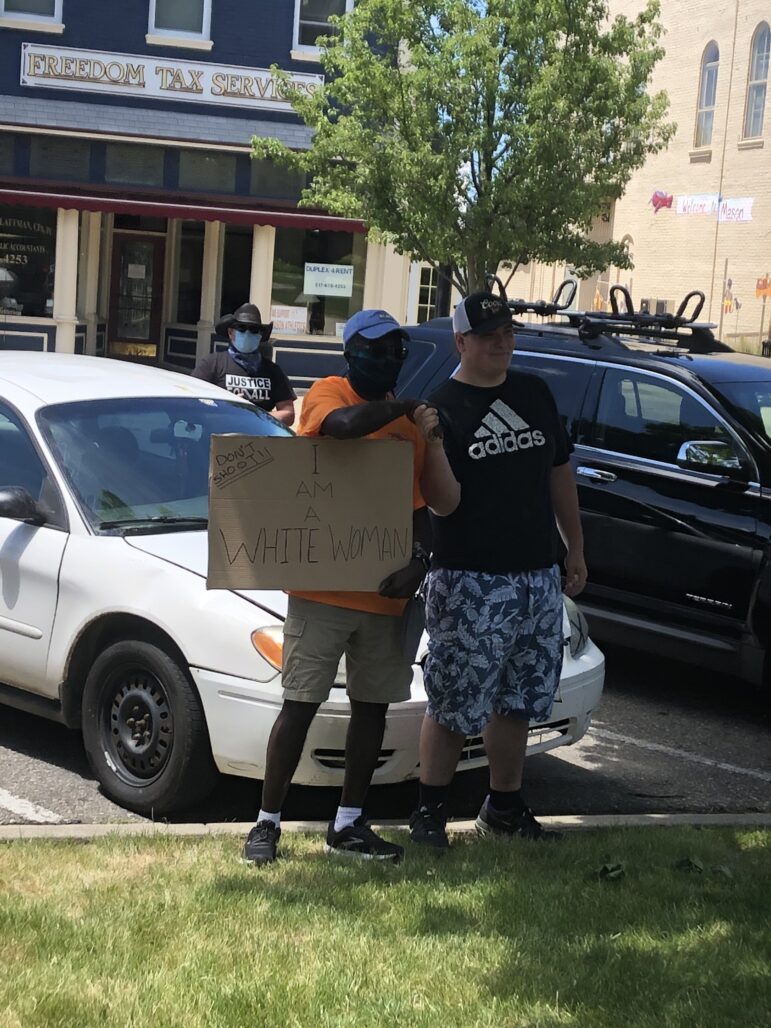

Protesters And Counter-protesters Connect At Blm Event - Spartan Newsroom

.jpg)

Welcome To City Of Mason Mi

2

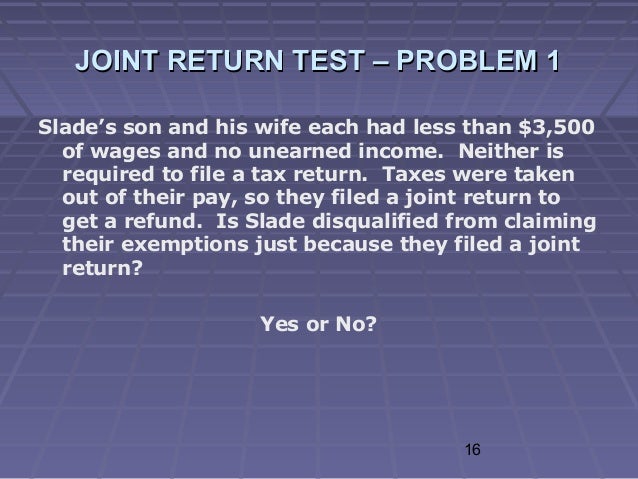

Liberty Tax Service Chapter 2

Freedom Tax Services - Home Facebook

Welcome To City Of Mason Mi

Motor City Freedom Riders Transportation Is Freedom

Welcome To City Of Mason Mi

Welcome To City Of Mason Mi

Freedom Tax Services - Home Facebook

Top 100 Must-follow Tax Twitter Accounts For 2020

Welcome To City Of Mason Mi

Mason Michigan Mi 48854 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Charles Flaishans Freedom Tax Service - Fenton Mi Tax Preparation And Accounting

2

Welcome To City Of Mason Mi

Liberty Tax Service Chapter 2

Freedom Tax Services - Home Facebook

Comments

Post a Comment