The fremont sales tax rate is 0%. The fremont sales tax has been changed within the last year.

Prop K - Sales Tax For Transportation And Homelessness Spur

Try it now & grow your business!

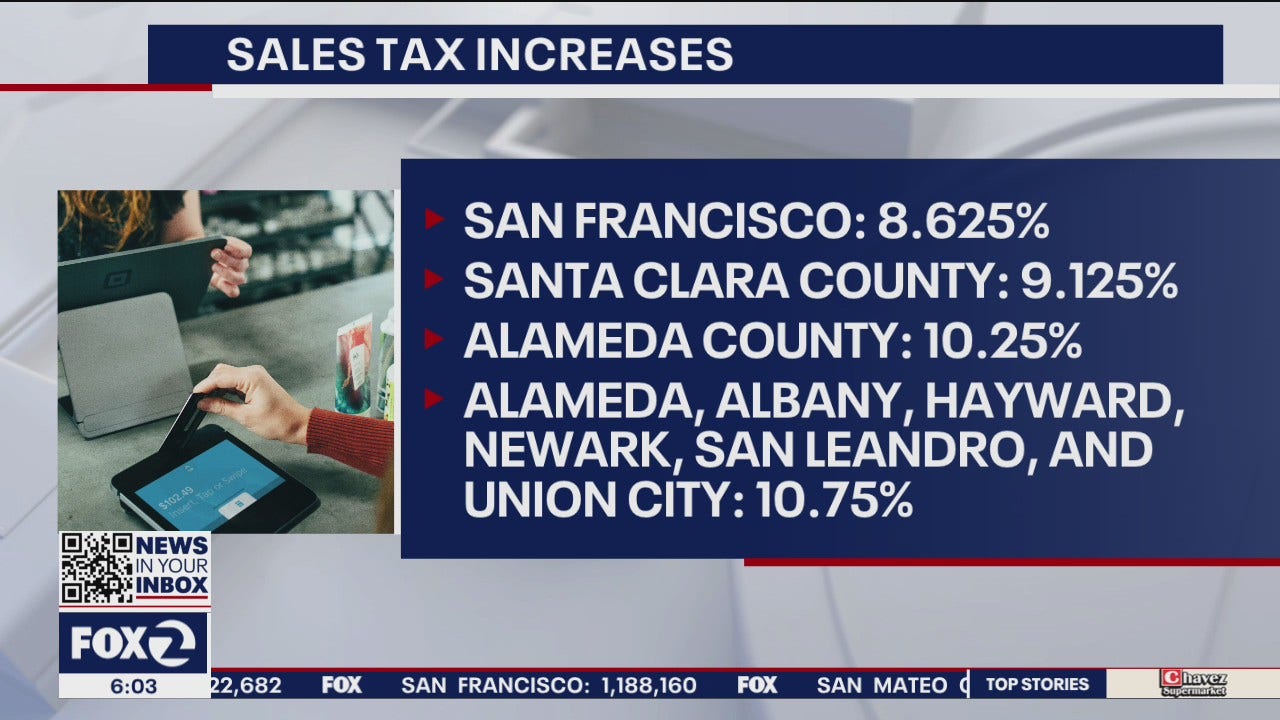

Fremont ca sales tax rate july 2021. The fremont, ohio sales tax rate of 7.25% applies in the zip code 43420. Cdtfa posts tax rates effective as of july 1, 2021. Union city is among the six alameda cities with a sales tax of 10.75%.

The cdtfa has updated its schedule of california sales and use tax rates by county and city as well as its schedule of district taxes, rates, and effective dates. Try it now & grow your business! This new toyota car is priced at $23179 and available for a test drive at fremont toyota.

| 48289 fremont blvd., fremont, ca 94538 ust 022021 certifies to the seller, who originally imported the goods into hawaii, that the purchaser will resell the imported goods at wholesale. The sales tax can be as high as 10.5 percent as of 2021 with the recent changes to the tax law. Fremont, ca — sales tax rates increased a percentage point in alameda county on thursday, bringing the countywide tax rate to 10.25 percent from.

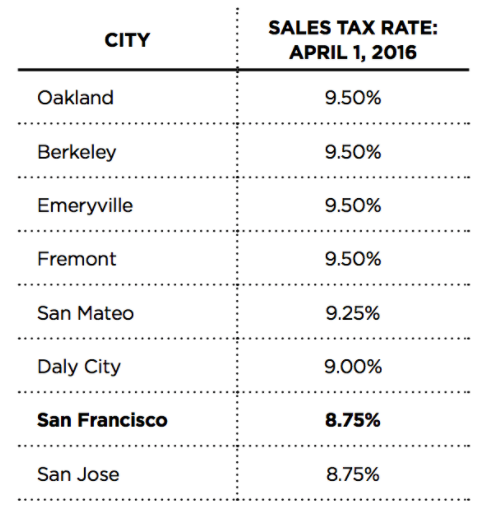

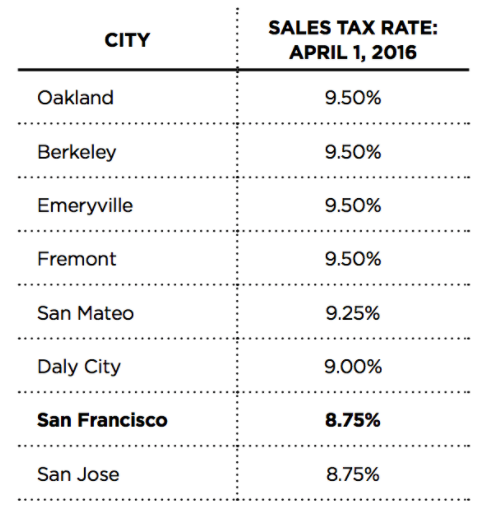

As mentioned, the sales tax rate in california can be quite different depending on where you’re purchasing items. This is the total of state, county and city sales tax rates. The average sales tax rate in california is 8.551%

Local tax rates in california range from 0.15% to 3%, making the sales tax range in california 7.25% to 10.25%. Therefore, there is no change to the tax rate. Find your california combined state and local tax rate.

It was raised 1% from 9.25% to 10.25% in july 2021. Create your own online store and start selling today. 3 the city approved a new 0.50 percent tax (srtu) consolidating the two existing 0.25 percent taxes (srgf and satg) by repealing these taxes and replacing them with a new 0.50 percent tax.

Click here to find other recent sales tax rate changes in california. The california sales tax rate is currently 6%. There are approximately 25,714 people living in the fremont area.

Every 2021 combined rates mentioned above are the results of california state rate (6%), the county rate (0.25%), and in some case, special rate (3%). Method to calculate elk grove sales tax in 2021. The county sales tax rate is 0.25%.

The minimum combined 2021 sales tax rate for fremont, california is 10.25%. 9.25% [is this data incorrect?] If the lower rate or no tax does not in fact apply to the sale, the purchaser is liable to pay the seller the additional tax imposed.

, ca sales tax rate. As we all know, there are different sales tax rates from state to city to your area, and everything combined is the required tax rate. The mandatory local rate is 1.25% which makes the total minimum combined sales tax rate 7.25%.

Most of the raises were approved by california voters in the nov. List of sales tax rates in california. The sales tax rate is always 9.25%.

San francisco (kron) — several cities will have a sales & use tax hike go into effect on july 1. Sales and use tax, lodging tax, motor fuels tax, or other tax rates are changing july 1, 2021, in the following states: The current total local sales tax rate in fremont, ca is 10.250%.

Additional information about new sales and use tax rates. All rates are general retail sales or use tax rates and do not reflect special category products or particular industry rates. As of thursday, the sales tax is now more than 8.6% in.

The rates listed on both schedules are as of july 1, 2021. The california sales tax rate is 6.5%, the sales tax rates in cities may differ from 6.5% to 11.375%. The fremont, california, general sales tax rate is 6%.

How 2021 sales taxes are calculated in fremont. *click on any state name for an overview of sales and use tax rules for that state. That means they all share the distinction of having the highest sales tax in california, at least for the moment.

July is always a busy month for sales and use tax rate changes in the u.s. The base state sales tax rate in california is 6%. Create your own online store and start selling today.

New Sales And Use Tax Rates Take Effect In Some East Bay Cities This Week San Ramon Ca Patch

Cities With Highest Sales Tax Sales Tax Rates By City Tax Foundation

List These California Cities Will See A Sales Tax Hike On July 1 - California News Times

Cities With Highest Sales Tax Sales Tax Rates By City Tax Foundation

California City And County Sales And Use Tax Rates - Cities Counties And Tax Rates - California Department Of Tax And Fee Administration

Sales Tax Is Rising In San Francisco And These Bay Area Cities This Week

California Sales Tax Rates By City County 2021

Nebraska Sales Tax - Small Business Guide Truic

New California Sales Tax Rates Start July 1 2020 Dvm Management

How To Calculate California Sales Tax 11 Steps With Pictures

Tips For Living In Fremont Ca Is Moving To Fremont A Good Idea

Cdtfacagov

List These California Cities Will See A Sales Tax Hike On July 1 Kron4

Sales Gas Taxes Increasing In The Bay Area And California

New Sales And Use Tax Rates In Fremont East Bay Effective April 1 Fremont Ca Patch

California City And County Sales And Use Tax Rates - Cities Counties And Tax Rates - California Department Of Tax And Fee Administration

How To Look Up Sales Use Tax Rates Department Of Revenue - Taxation

Cdtfacagov

Iztr-fiinhihcm

Comments

Post a Comment