Bismarck — north dakota tax commissioner ryan rauschenberger has announced plans to resign on jan. 15, for detox, according to the roster of.

Iit Payment Help North Dakota Office Of State Tax Commissioner

2018 tax commissioner office county of cobb:

Nd tax commissioner salary. If you have not applied for webfile, you can do so by printing the application from our web site, www.state.nd.us/taxdpt you can access webfile Partnerships, corporations, estates and individuals can all pay quarterly estimated tax payments if they expect to have $1000 or more of income to report. Rauschenberger was appointed tax commissioner in 2014, and he won election later that year and in 2018.

Manage a team of supervisors and staff to handle business personal property tax, business license, specialty taxes, business audits and tax compliance matters. Tax commissioner reminds taxpayers of extension deadline. The payment installment due dates for dekalb county taxes are september 30th and november 15th.

Rauschenberger has struggled with alcohol addiction throughout his tenure in public office. Northwest ($39 + state fee) or legalzoom ($149 + state fee) ★ check out northwest vs legalzoom. Tax commissioner office county of cobb:

Infant run over, killed after falling out car door nd tax commissioner ryan rauschenberger to resign North dakota grain elevator loads longest unit train in u.s. Number of employees at office of state tax commissioner in year 2019 was 139.

“each year, taxpayers are required to pay tax owed by the april 15 deadline. 3 following an incident that landed him at a bismarck jail monday, nov. Nd state tax commissioner 39.

840 likes · 10 talking about this · 4 were here. “the individual income tax filing extension deadline is friday, october 15,” rauschenberger said. The mission of the office of state tax.

If you choose to pay the full amount in one payment, it must be paid by september 30th. Elaine cline a 2018 tax commissioner office county of cobb: North dakota office of state tax commissioner, bismarck.

Tax commissioner announces 21.2% increase in 2nd quarter taxable sales and purchases, new report. Sb 2010 and sb 2016 appropriated $16,701,207 to north dakota firefighters association, certified city and rural fire districts and department of emergency services for firefighter training stipends. Office of state tax commissioner salaries.

Average annual salary was $49,383 and median salary was $51,060. Darlene dunlap 2018 tax commissioner office county of cobb: Bismarck — north dakota tax commissioner ryan rauschenberger was taken to a bismarck jail monday, nov.

(see page 15) type of account: Checking savings i declare that this return is correct and complete to the best of my knowledge and belief. The tax commissioner’s annual salary is $121,814.

Vouchers are available and can be submitted to: Tax commissioner office county of cobb: Office of state tax commissioner average salary is 5 percent higher than usa average and median salary is 17 percent higher than usa median.

The tax commissioner’s annual salary is $121,814 facebook The office of state tax commissioner provides exceptional service while enhancing compliance with the tax laws of north dakota. Thousands of north dakota taxpayers’ returns corrected for unemployment benefits received in 2020.

Tax permit number issued to you or your business by the north dakota office of state tax commissioner.

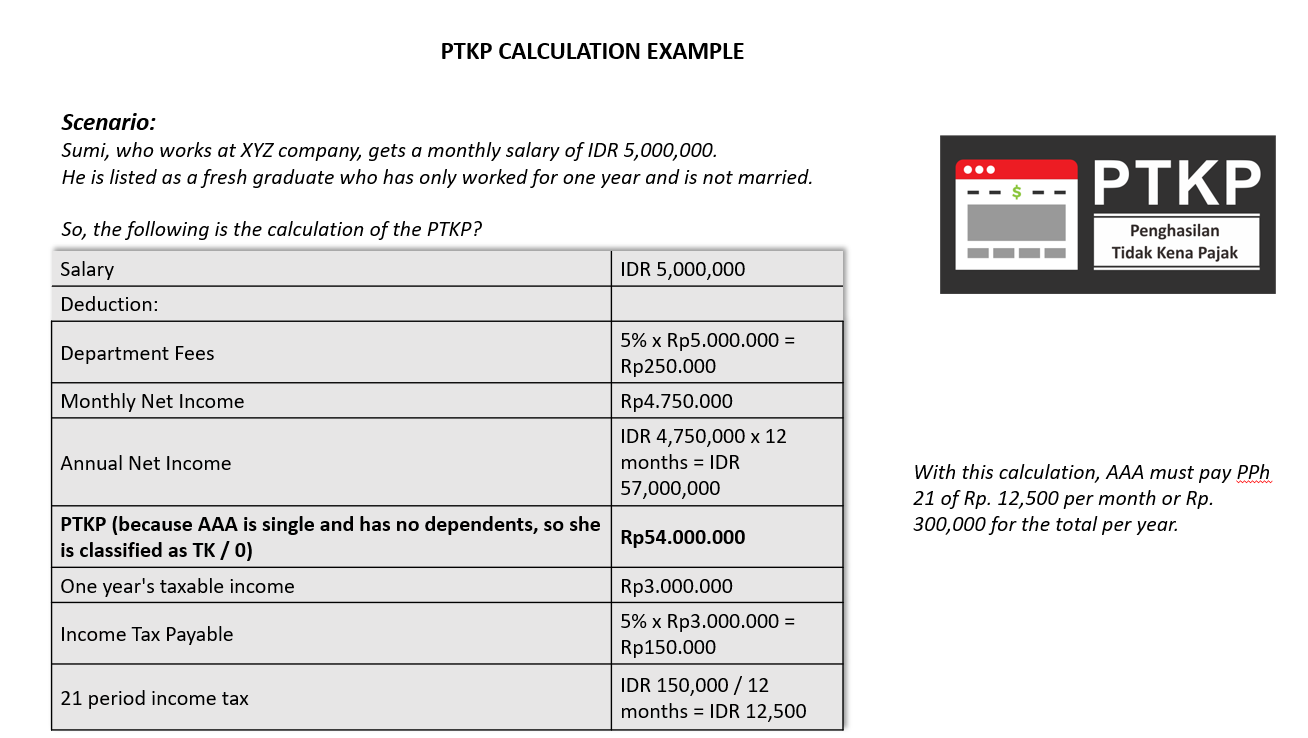

Indonesia Payroll And Tax Guide

Contact Us North Dakota Office Of State Tax Commissioner

Indonesia Payroll And Tax Guide

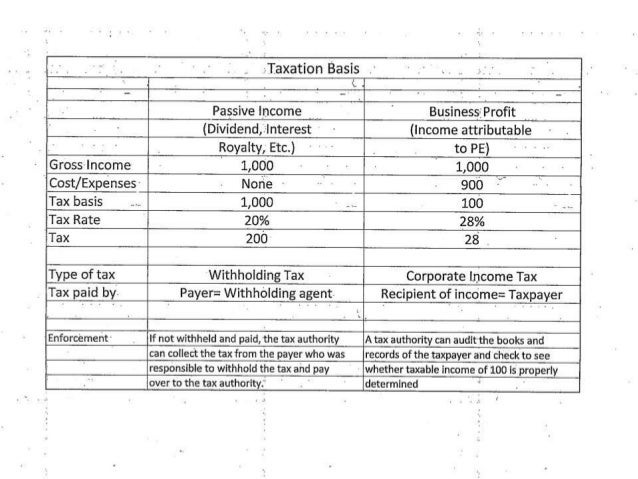

International Taxation

Iit Payment Help North Dakota Office Of State Tax Commissioner

Instruction For The Completion Of Income Tax Return For Corporate

Indonesia Vat Guide Value Added Tax Or Pajak Pertambahan Nilai Ppn

Accounting Service Indonesia Tax Reporting Auditing

Indonesia Payroll And Tax Guide

Indonesia Vat Guide Value Added Tax Or Pajak Pertambahan Nilai Ppn

Iit Payment Help North Dakota Office Of State Tax Commissioner

Contact Us North Dakota Office Of State Tax Commissioner

Iit Payment Help North Dakota Office Of State Tax Commissioner

Accounting Service Indonesia Tax Reporting Auditing

2

Job Opportunity Job Job Opportunities Limited Liability Partnership

Tax Consultant Indonesia For 100 Compliance In Tax And Payroll

Indonesia Payroll And Tax Guide

Indonesia Vat Guide Value Added Tax Or Pajak Pertambahan Nilai Ppn

Comments

Post a Comment