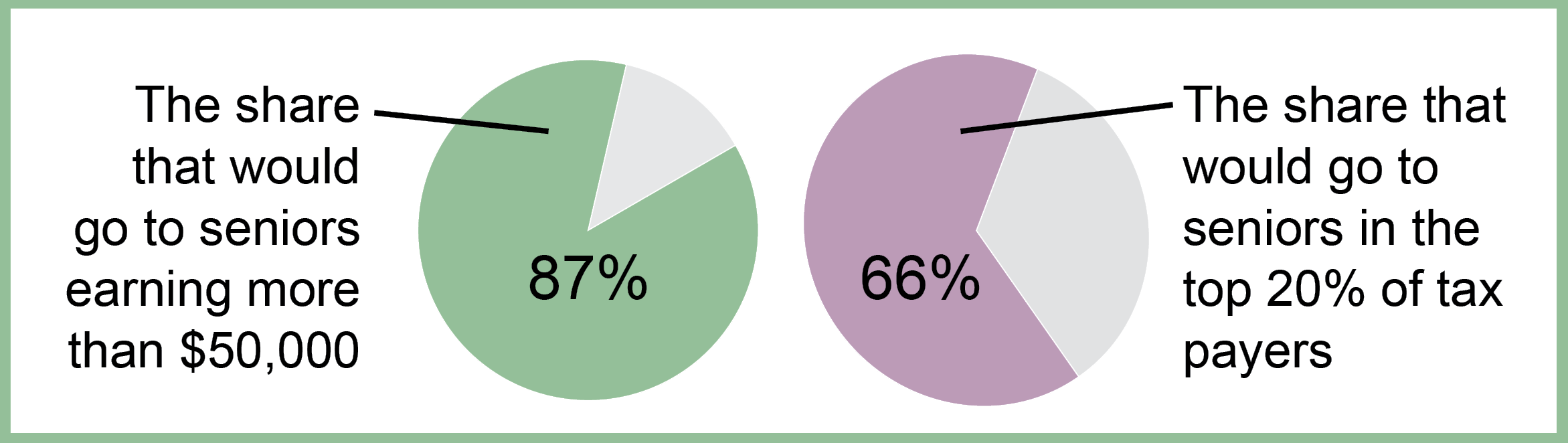

New mexico has taxed social security benefits since 1990, when the legislature imposed the tax to close a $13 million shortfall in the state budget. The state also provides an income tax exemption of up to $3,000 to those 65 and older for medical expenses for either that person or his or her spouse or dependents.

New Mexico State Veteran Benefits Militarycom

Is my pension taxable in new mexico.

New mexico pension taxes. If hb 49 gets passed, then it would extend to all retirees with social security income. Finally, in new mexico, as with most states, teacher pensions are not portable. New mexico allows you to exclude your retirement income of up to $8,000 based off of your filing status and your federal adjusted gross income if you meet one of the following:

As with social security, these forms of retirement income are deductible. Nys pension exempt as a defined benefit plan. Delivered groceries may not be taxable.

Less than $50,000 (single) and $60,000 (married), you can subtract social security. Tax policy advisory committee meets wednesday. You are not 65 but are considered blind for federal tax purposes.

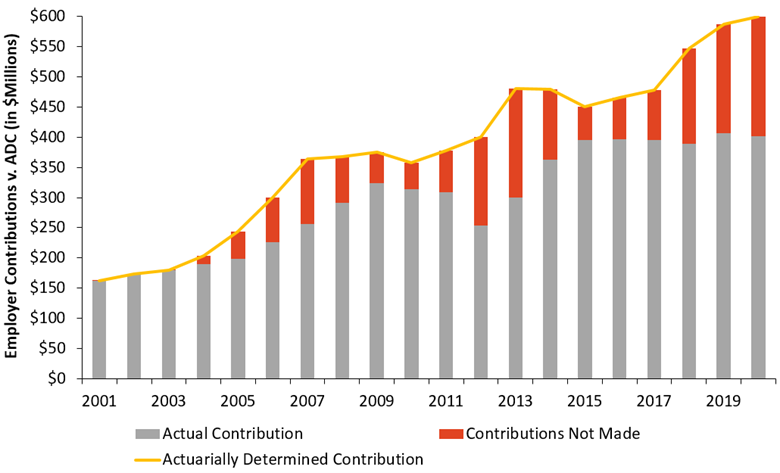

The remaining 17.8 percent state contribution is to pay down the pension fund's debt. Trd audit and compliance division to start outbound calling. Because you are now a new mexico resident, your retirement income is taxable in new mexico.

The columns labeled benefits, withdrawals, and other are subsets of total payments. Retirement income from a pension or retirement account, such as an ira or a 401 (k), is taxable in new mexico. In new mexico, low income retirees are not taxed on their social security income.

However, for 2021 taxes, a new bracket is being introduced. I moved to texas, which has no state income tax (for all of 2020). Is my retirement income taxable to new mexico?

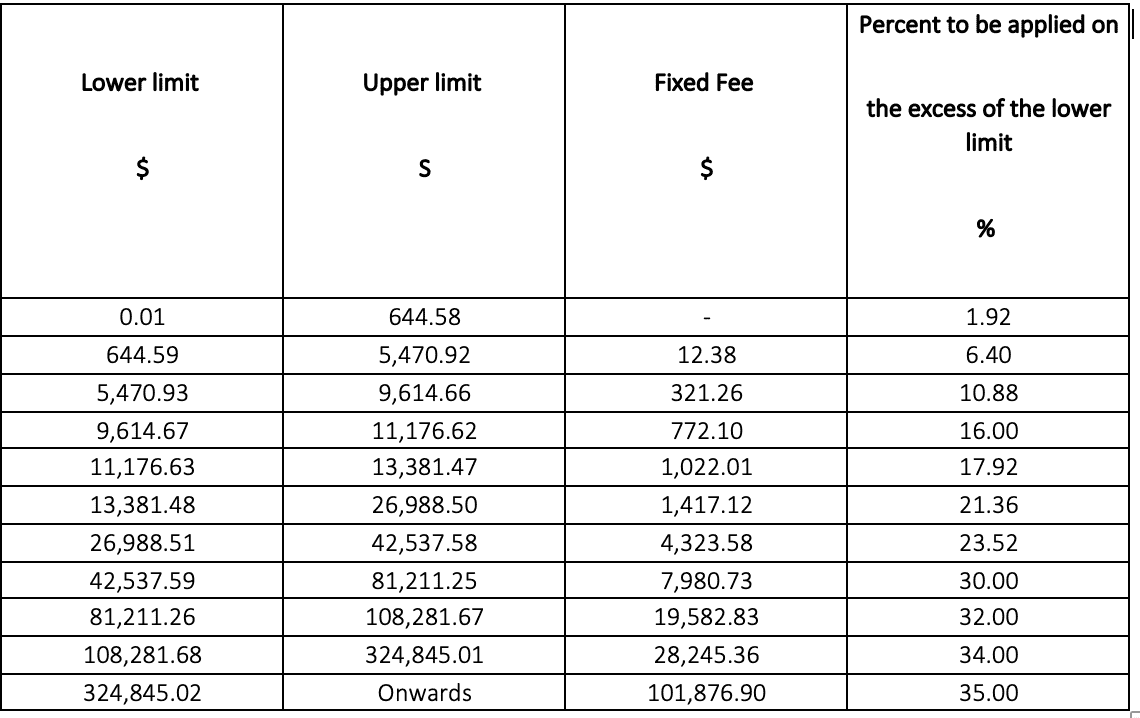

Income in excess of the deduction, which is $8,000 for seniors, is taxed at new mexico’s income tax rates. Beginning with tax year 2002 persons 100 years of age or more who are not dependents of other taxpayers are exempt from filing and paying new mexico personal income tax. According to article 93(iv) of the income tax law,.

With respect to the contribution increase, reason explains that the state sets its contributions as a fixed percent of payroll, which varies across divisions but averages out to. The income of new mexico residents from pensions and annuities is subject to new mexico personal income tax. My educational retirement pension is from new mexico.

My educational retirement pension is from new mexico. The table below provides pension payment information for new mexico and surrounding states in fiscal year 2016. Your tax rate can be as low as 1.7 percent or as high as 4.9 percent.

You are 65 or older. Property taxes in new mexico go to support local governments and schools. What are the tax consequences for employers and participants of occupational pension schemes?

In fiscal year 2016, new mexico's state and local pension systems made payments totaling $2.2 billion. New mexico does not, however, require the payors of such income to withhold new mexico income tax unless requested to do so by the recipients of the payments. The new mexico income tax has marginal rates from 1.7% to 4.9% (on a couple with $24,000 income).

While the full 10.7 percent of salary contributed by individual teachers is for benefits, the state contributes only 2.98 percent. For example, if you receive a pension from your former california employer and you now reside in new mexico, california may not tax your retirement income. There is a modest reduction in taxes for people 65 or over with incomes less than $51,000 (couples).

As Debt Grows New Mexico Pension Plan Considers Retirement Benefit Reductions For Teachers - Reason Foundation

Mexico The New Tax Rates For Individuals - Immedis

Taxation Of Social Security Benefits - Mn House Research

Xpc9kuks2cth7m

Tax Withholding For Pensions And Social Security Sensible Money

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Retirement Security Think New Mexico

2

37 States That Dont Tax Social Security Benefits The Motley Fool

States That Dont Tax Military Retirement Pay Military Benefits

States That Dont Tax Military Retirement Pay Military Pension State Taxes

New Mexico Retirement Tax Friendliness - Smartasset

How Taxes Can Affect Your Social Security Benefits Vanguard

Wheres My State Refund Track Your Refund In Every State

Montana Retirement Tax Friendliness - Smartasset

New Mexico Property Tax Calculator - Smartasset

New Mexico Retirement Tax Friendliness - Smartasset

Oil And Gas Generated 31 Billion In State Revenue Last Year - New Mexico Oil Gas Association

2

Comments

Post a Comment