For tax rates in other cities, see north dakota sales taxes by city and county. The state sales tax rate in north dakota is 5.000%.

Berkassouthdakota-statesealsvg - Wikipedia Bahasa Indonesia Ensiklopedia Bebas

Fortunately, there are several states with low car sales tax rates, at or below 4%:

North dakota sales tax on vehicles. The 7.5% sales tax rate in fargo consists of 5% north dakota state sales tax, 0.5% cass county sales tax and 2% fargo tax. The following are exempt from payment of the north dakota motor vehicle excise tax: Abandoned motor vehicle disposal fee of $1.50 applies upon initial application for north dakota certificate of title.

The office of state tax commissioner is working to update the guidelines and new versions of guidelines will be available as soon as possible. Select the north dakota city from the list of popular cities below to see its current sales tax rate. Dealers are not required to collect or pay the motor vehicle excise tax on motor vehicles they sell.

In the state of north dakota, sales tax is legally required to be collected from all tangible, physical products being sold to a consumer. The states with the highest car sales tax rates are: Taxes would be due on the purchase price (based on exchange) at a rate of 5%.

This page describes the taxability of occasional sales in north dakota, including motor vehicles. North dakota farm plated vehicles may be exempt when travelling into minnesota west of a line drawn north to south from mn highway 72 to us highway 71 to cass lake, then south on mn highway 371 to One exception is the sale or purchase of a motor vehicle which is subject to the motor vehicle excise tax.

If the vehicle was purchased outside of the united states there is no tax reciprocity. With respect to any lease for a term of one year or more of a motor vehicle with an Dealers are required to collect the state sales tax and any

South dakota collects a 4% state sales tax rate on the purchase of all vehicles. In addition to taxes, car purchases in north dakota may be subject. North dakota collects a 5% state sales tax rate on the purchase of all vehicles.

You can find these fees further down on the page. The purchase price of any motor vehicle for use on north dakota streets or highways is subject to a motor vehicle excise tax if the vehicle is required to be registered in north dakota. There is no applicable special tax.

While north dakota's sales tax generally applies to most transactions, certain items have special treatment in many states when it comes to sales taxes. North dakota has a statewide sales tax rate of 5%, which has been in place since 1935. With local taxes, the total sales tax rate is between 5.000% and 8.500%.

Higher sales tax than 98% of north dakota localities. Recreational travel trailers purchased for use in north dakota are required to be registered with the department of transportation, and the purchase price is subject to 5 percent motor vehicle excise tax. In addition to taxes, car purchases in south dakota may be subject to other fees like registration, title, and plate fees.

Dakota are subject to sales tax or use tax. Motor vehicle excise tax (5%) must be remitted when applying for a certificate of title. North dakota (nd) sales tax rates by city.

When you buy a car in north dakota, be sure to apply for a new registration within 5 days. The north dakota 5 percent sales tax applies on the rental charges of any licensed motor vehicle, including every trailer or semi trailer as defi ned in n.d.c.c. North dakota has recent rate changes (thu jul 01 2021).

You can print a 7.5% sales tax table here. What transactions are generally subject to sales tax in north dakota? You will also need to pay a $5 title transfer fee, 5% sales tax,.

Tax imposed on motor vehicle lease. Any motor vehicle owned by or in possession of the federal or state government, including any Of north dakota are not subject to north dakota sales tax, but are subject to motor vehicle excise tax of 5 percent.

If you have recently purchased a vehicle in another state, and taxes were paid to that state, we would require proof of tax paid to exempt you from north dakota excise tax. Some examples of items that exempt from north dakota sales tax are prescription medications, some types of groceries, some medical devices, and machinery and chemicals. The purchase price of any motor vehicle for use on north dakota streets or highways is subject to a motor vehicle excise tax if the vehicle is required to be registered in north dakota.

Licensed motor vehicles are not subject to local option taxes. The north dakota 5 percent sales tax applies on the rental charges of any licensed motor vehicle, including every trailer or semi trailer as defi ned in n.d.c.c. Any motor vehicle purchased or acquired either in or outside of the state of north dakota for use on the streets and highways of this state and required to be registered under the laws of this state.

Dotndgov

Ndgov

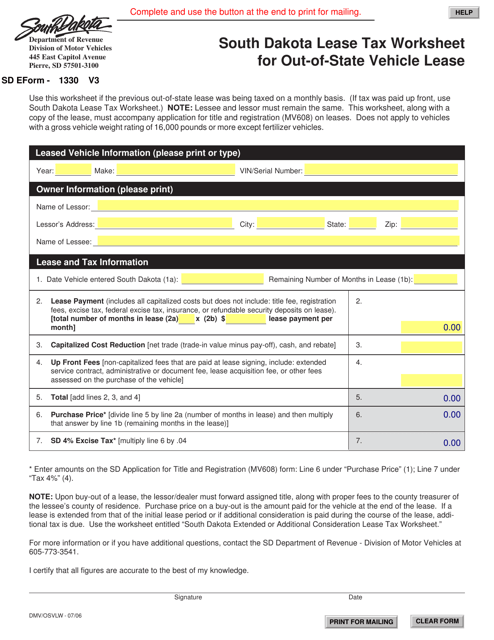

Sd Form 1330 Download Fillable Pdf Or Fill Online South Dakota Lease Tax Worksheet For Out-of-state Vehicle Lease South Dakota Templateroller

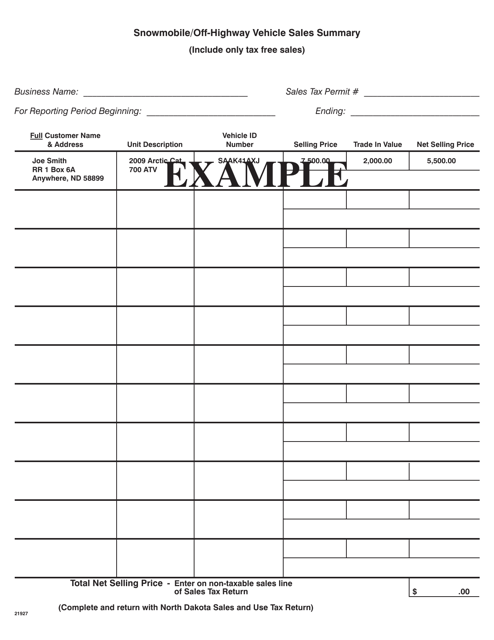

North Dakota Snowmobileoff-highway Vehicle Sales Summary Download Fillable Pdf Templateroller

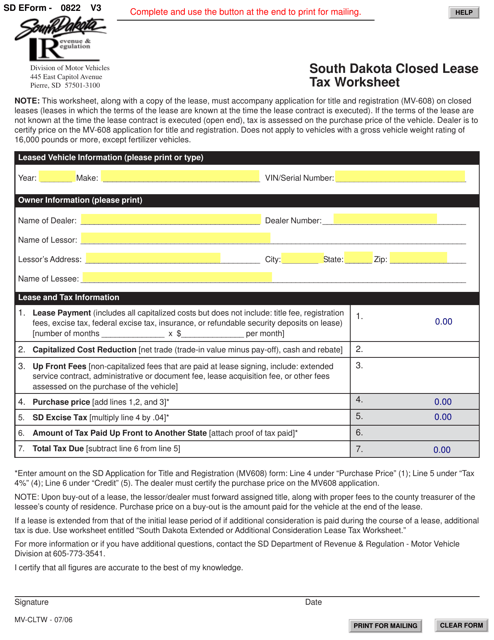

Sd Form 0822 Mv-cltw Download Fillable Pdf Or Fill Online South Dakota Closed Lease Tax Worksheet South Dakota Templateroller

Port With Budget Problems Looming Gov Burgum Needs To Call A Special Session Of The Legislature To Address Coronavirus The Dickinson Press

Sales Use Tax - Businesses North Dakota Office Of State Tax Commissioner

Car Tax By State Usa Manual Car Sales Tax Calculator

North Dakota - Sales Tax Handbook 2021

Ndgov

Terry Jones Residency Pdf

Ndgov

Ndgov

North Dakota Surety Bonds

Nj Car Sales Tax Everything You Need To Know

Ndgov

North Dakota Sales Tax - Small Business Guide Truic

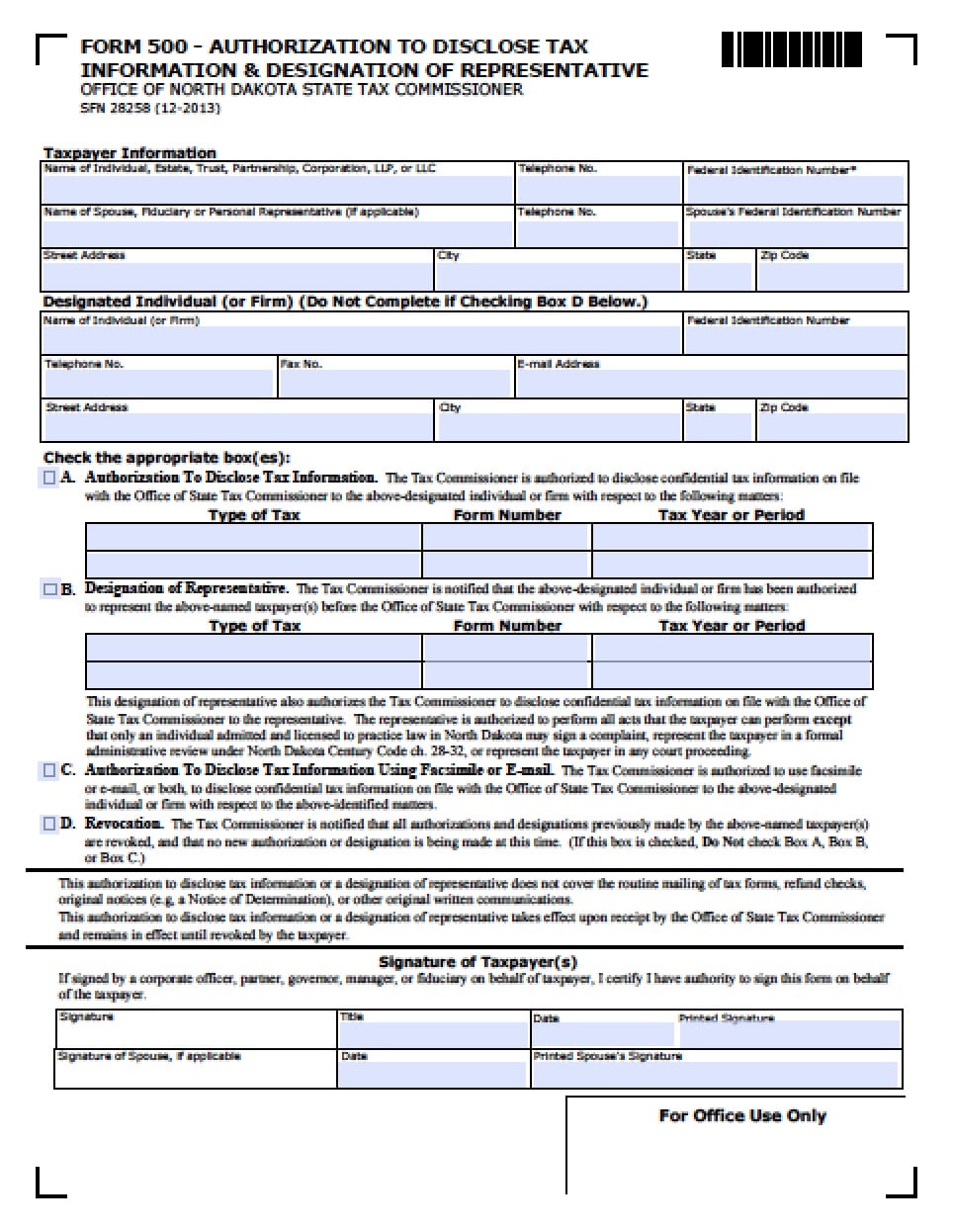

North Dakota Tax Power Of Attorney Form - Power Of Attorney Power Of Attorney

Dorsdgov

Comments

Post a Comment