The bill would boost the cap to $80,000 from 2021 through 2030 before dropping it back to $10,000 in 2031. The salt deal appeared to remove one obstacle to.

Tpc Analyzes Five Ways To Replace The Salt Deduction Cap Tax Policy Center

The house, controlled by democrats, voted largely along party lines to remove the $10,000 cap on state and local tax (salt) deductions for tax years 2020 and 2021.

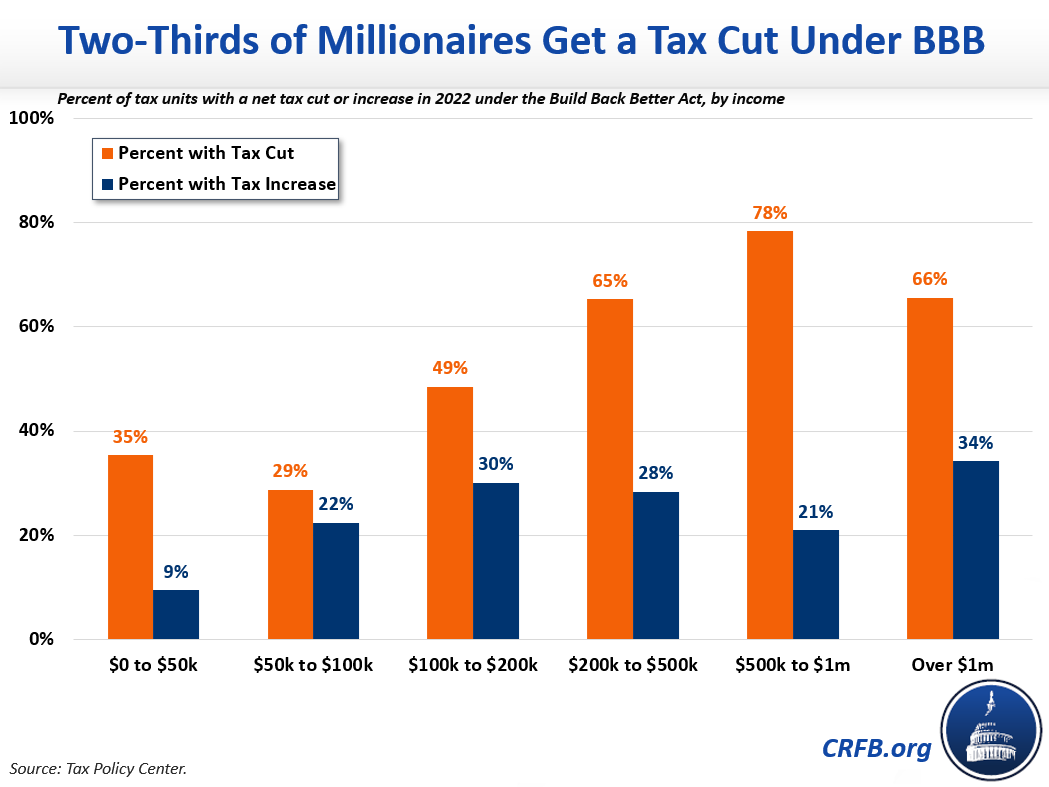

Salt tax cap removal. Increasing the salt cap higher than $10,000 is no better, with the tax foundation finding that if congress were to increase the cap to $15,000 ($30,000 for couples), only 0.3 percent of the benefit would go to the bottom 60 percent of earners, while the top 10 percent of all earners would capture 85 percent of the benefit. But the top 1 percent would get only 0.1% of the benefit if the $10,000 salt cap is gradually restored starting at $400,000.” corporate democrats keep lying Democrats have republicans to thank for clearing the way for the budgeting tricks that will allow them to do that.

Between 2022 and 2025, the cost of repealing the cap would be $380 billion, according to the tax foundation. The state and local tax deduction cap — commonly known as salt — was enacted as part of president donald trump's 2017 tax reforms. The relaxed cap, an increase from the current $10,000 limit, would last for a decade until 2031.

Taxpayers can deduct up to $10,000 of the state and local. 5377), which calls for the removal of the salt deduction cap for the 2020 and 2021 tax years. As president biden’s tax plans are considered in congress, the future of the $10,000 cap for state and local tax deductions (salt) is becoming an important part of the tax debate.

The state and local tax deduction cap, set to expire at the end of 2025, limits the amount of state and local taxes that taxpayers can deduct from their federal taxes to $10,000. It also aims to double the salt deduction to $20,000 for married couples filing jointly in 2019. For tax year 2019, it would raise the cap for married couples filing taxes jointly to $20,000.

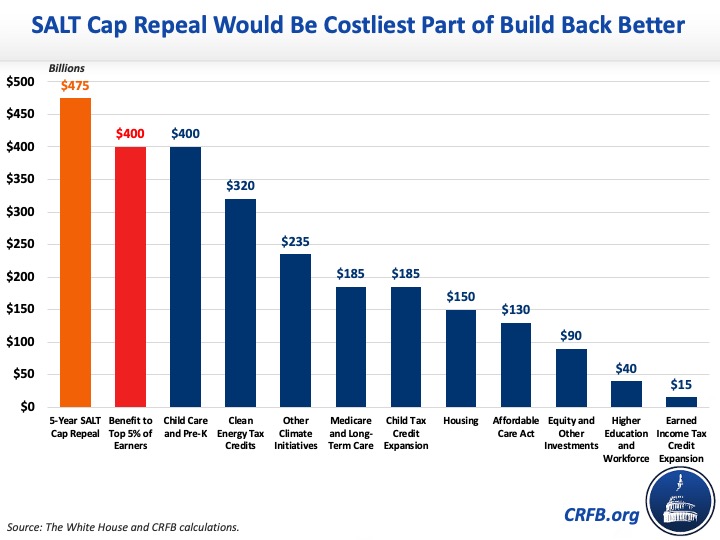

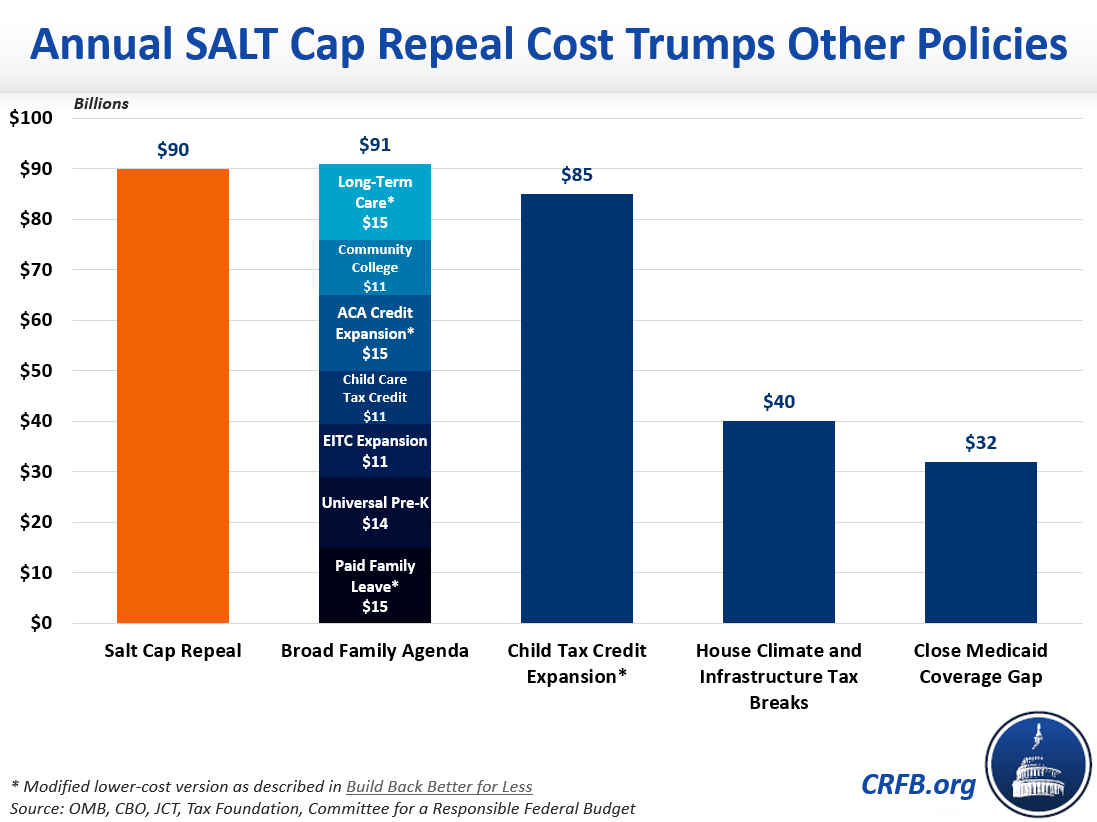

The senate approach would likely replace the salt measure in the house version of the bill that calls for lifting the cap to $80,000 from $10,000. Under the package the democrats are now pushing, the annual salt deduction cap would be raised to $80,000 through 2030, before reducing it back to $10,000 in 2031. The committee for a responsible federal budget described the repeal of the salt cap as a “regressive” tax cut, estimating that it would cost.

Certain members of the house and senate want the salt deduction cap removed, which would benefit primarily higher earners—and result in a $380 billion reduction of federal revenue. In late december 2019, the u.s. As alternatives to a full repeal of the cap, lawmakers and experts have proposed a number of changes to the salt deduction.

House of representatives passed the restoring tax fairness for states and localities act (h.r. Repealing the salt deduction cap is an expensive proposition. 57 percent would benefit the top one percent (a cut of $33,100);

Almost all (96 percent) of the benef its of salt cap repeal would go to the top quintile (giving an average tax cut of $2,640); Reconciliation should not be allowed to add. The $10,000 cap would remain in place for taxpayers who earn more than $100 million.

A host of moderate democrats say they won't support president joe biden's $3.5 trillion package without a repeal of the cap on state and local tax deductions, known as salt. The omission disappoints a group of democratic lawmakers pushing to remove the $10,000 cap on state and local tax, or salt, deductions that went to help pay for a slice of president donald trump. In a letter sent to the white.

Then it would expire permanently. Fully eliminating the cap for one year would cost $88.7 billion in 2021, according to.

5-year Salt Cap Repeal Would Be Costliest Part Of Build Back Better Committee For A Responsible Federal Budget

The Salt Deduction The Second-biggest Item In Democrats Budget That Gives Billions To Rich - The Washington Post

Repealing The Salt Cap Should Not Be A Top Priority In Reforming 2017 Tax Law - Center For American Progress

Oxo Salt And Pepper Shaker Set Pepper Shaker Salt And Pepper Shaker Salt And Pepper Set

300pcs Mosquito Repellent Patches Stickers Natural Non Toxic Pure Essential Oil Unbrand Mosquito Repellent Patch Mosquito Repellent Natural Mosquito Repellant

Tpc Analyzes Five Ways To Replace The Salt Deduction Cap Tax Policy Center

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Repealing Salt Caps Would Cost Another 500 Billion Committee For A Responsible Federal Budget

Salt Break Would Erase Most Of Houses Tax Hikes For Top 1 - Bloomberg

312 Snapback Snapback Mens Accessories Accessories Hats

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

House Of Representatives Passes Build Back Better Bill That Raises Salt Deductions Cap From 10000 To 80000 Cbs New York

How An 80000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400000 Or Less

Features Freshbooks Feature Used Tools

Calls To End Salt Deduction Cap Threaten Passage Of Bidens Tax Plan

Two-thirds Of Millionaires Get A Tax Cut Under Build Back Better Due To Salt Relief Committee For A Responsible Federal Budget

Pin On Career Infographics

Importance Human Values Essay In 2021 Writing Software Essay Report Writing

Salt Cap Repeal Does Not Belong In Build Back Better Committee For A Responsible Federal Budget

Comments

Post a Comment