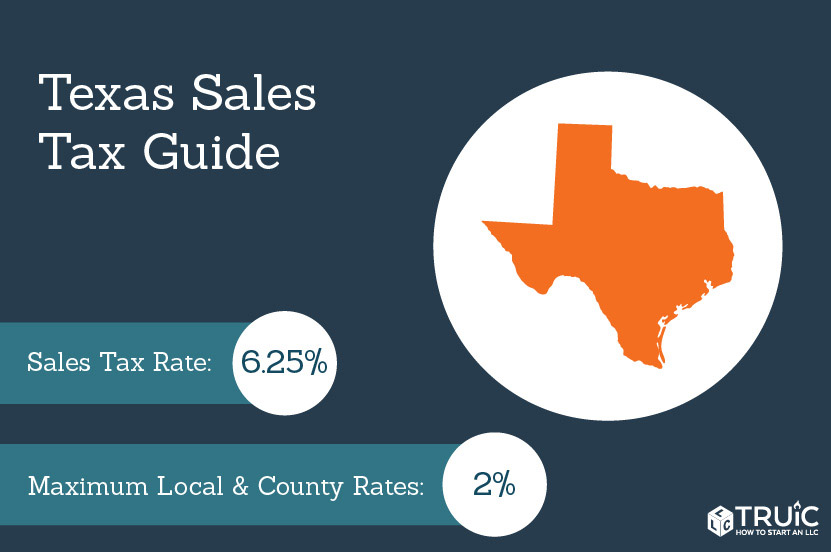

Texas has recent rate changes (thu jul 01 2021). The 8.25% sales tax rate in san antonio consists of 6.25% texas state sales tax, 1.25% san antonio tax and 0.75% special tax.

Hotel Occupancy Tax San Antonio Hotel Lodging Association

The county sales tax rate is %.

San antonio sales tax rate 2020. Anticipate any tax rate impact. Every 2021 combined rates mentioned above are the results of texas state rate (6.25%), the county rate (0% to 1.5%), the texas cities rate (0% to 2%), and in some case, special. The minimum combined 2021 sales tax rate for san antonio, texas is.

Let more people find you online. 1.000% city of san antonio; The december 2020 total local sales tax rate was also 8.250%.

The us average is 7.3%. The rates are given per $100 of property value. San antonio has an unemployment rate of 6.6%.

The texas sales tax rate is currently %. This is the total of state, county and city sales tax rates. The texas sales tax rate is currently %.

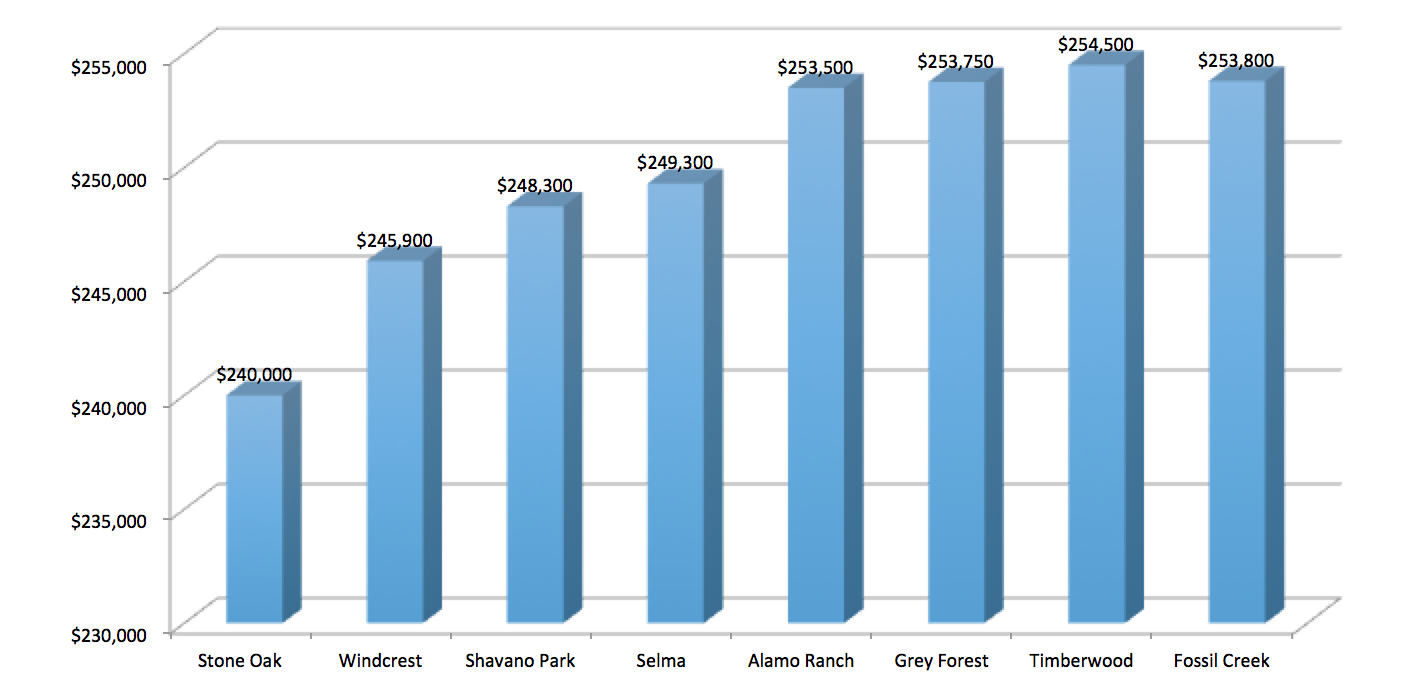

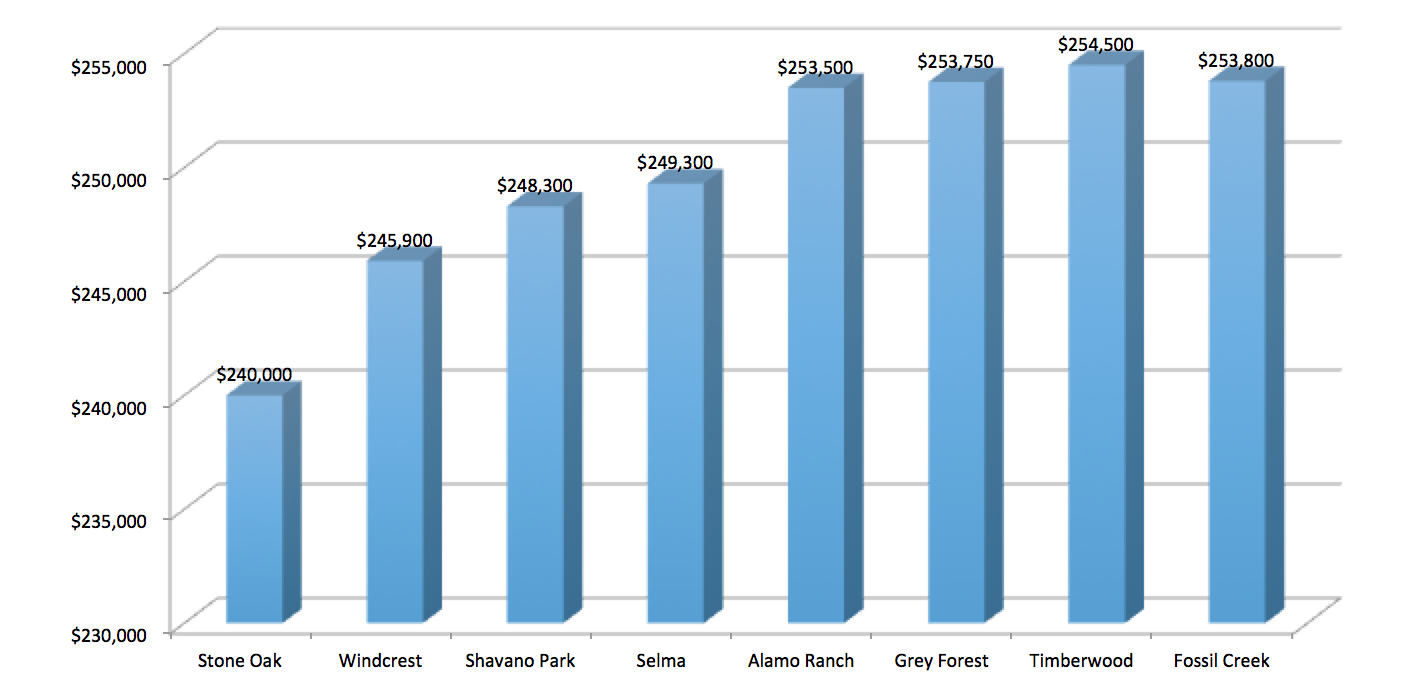

The following table provides 2017 the most common total combined property tax rates for 46 san antonio area cities and towns. 0.250% san antonio atd (advanced transportation district); The sales tax jurisdiction name is san antonio atd transit, which may refer to.

San antonio cities/towns property tax rates. The state general sales tax rate of texas is 6.25%. Ad earn more money by creating a professional ecommerce website.

Start yours with a template!. The san antonio sales tax rate is %. 65 rows san antonio isd:

In each case, these rates are calculated by dividing the total amount of taxes by the current taxable value with adjustments as required by state law. Future job growth over the next ten years is predicted to be 39.6%, which is higher than the us average of 33.5%. Ad earn more money by creating a professional ecommerce website.

The current total local sales tax rate in san antonio, tx is 8.250%. The county sales tax rate is %. Use leading seo & marketing tools to promote your store.

San antonio has seen the job market increase by 1.6% over the last year. The us average is 6.0%. 0.125% dedicated to the city of san antonio ready to work program;

This is the total of state, county and city sales tax rates. Can adopt without holding an election. But as the city recoups, plans have changed.

Let more people find you online. Texas has recent rate changes (thu jul 01 2021). Taxing units preferring to list the rates can expand this section to include an explanation of how these tax rates were calculated.

The city of von ormy withdrew from the san antonio mta effective september 30, 2009. To see the full calculations, please. , tx sales tax rate.

The sales tax jurisdiction name is san antonio atd transit, which may refer to a local government division. 1568 rows combined with the state sales tax, the highest sales tax rate in texas is 8.25% in the cities. 11 rows the wood trace management district is located in the southwest portion of.

Start yours with a template!. 0.500% san antonio mta (metropolitan transit authority); The sales tax jurisdiction name is san antonio atd transit, which may refer to a local government division.

San antonio’s current sales tax rate is 8.250% and is distributed as follows: There is no applicable county tax. Cities and/or municipalities of texas are allowed to collect their own rate that can get up to 2% in city sales tax.

Current sales tax rates (txt). Property taxes typically are paid in a single annual payment that is due on or before december 31, the final day of the tax year. The san antonio mta, texas sales tax is 6.75%, consisting of 6.25% texas state sales tax and 0.50% san antonio mta local sales taxes.the local sales tax consists of a 0.50% special district sales tax (used to fund transportation districts, local attractions, etc).

San antonio in texas has a tax rate of 8.25% for 2021, this includes the texas sales tax rate of 6.25% and local sales tax rates in san antonio totaling 2%. Use leading seo & marketing tools to promote your store.

Which Texas Mega-city Has Adopted The Highest Property Tax Rate

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

Which Cities And States Have The Highest Sales Tax Rates - Taxjar

Florida Sales Tax Rates By City County 2021

Texas Sales Tax - Small Business Guide Truic

How To Calculate Sales Tax - Video Lesson Transcript Studycom

Texas Sales Tax Rates By City County 2021

How High Are Cell Phone Taxes In Your State Tax Foundation

13 Form Sample 13 Disadvantages Of 13 Form Sample And How You Can Workaround It Quarterly Taxes Tax Software Small Business Accounting

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

Which Cities And States Have The Highest Sales Tax Rates - Taxjar

Sales Tax Rates In Major Cities Tax Data Tax Foundation

2

Texas Sales Tax - Taxjar

Annual Change In Energy-related Co2 Emissions 2011-2020 From Iea Report In 2021 Emissions International Energy Agency Dirtier

Hotel Occupancy Tax San Antonio Hotel Lodging Association

Pin On Home

A State-by-state Analysis Of Service Taxability

How To Get Tax Refund In Usa As Tourist For Shopping 2021

Comments

Post a Comment