Since contributions are pretax, the internal revenue service (irs) doesn’t tax contributions and related benefits until the employee withdraws them from the plan. The employee is not taxed on the contribution until he/she begins to make withdrawals after retirement.

Tax-sheltered Annuity Definition How Tsa 403b Plan Works

See also tax deferred annuity (tda).

/annuity-c64facb507ac4b1c99b1ac5ba9bac1a8.jpg)

Tax sheltered annuity definition. These organizations can set up a tsa program for their employees so they can save for retirement. As a result of the contributions are pretax, the internal revenue service (irs) doesn’t tax the contributions and associated advantages till the worker withdraws them from the plan. Tax sheltered annuity definition gallery this link for present value future value ordinary is still working perfect picture with future value ordinary life you may want to see this photo of ordinary life due high quality photo of life due retirement neat.

Also known as a section 403 (b) plan. Employers can also contribute to employees' accounts. Generally, the plan is funded by employee salary reduction contributions and it's earnings are tax deferred until withdrawal.

Tax sheltered annuity definition a form of annuity set up an employer for their employee; Employees save for retirement by contributing to individual accounts. Description and definition of tax sheltered annuity.

A type of retirement plan under section 403 (b) of the internal revenue code that permits employees of public educational. Tax sheltered annuities for employees of section 501(c)(3) organizations and. The tax sheltered annuity is a deferred tax arrangement expressly granted by congress in irc section 403(b).

This annuity plan is also known as a section 403 (b) plan. Contributions serve to reduce taxable income in the year they are contributed. Because the employee contributes to the annuity from their own income, taxes are deferred until the funds are eventually withdrawn, usually at retirement.

When an employee makes a contribution, they get a tax deduction for it. Because the contributions are pretax, the internal.

Tax Sheltered Annuity A Term That Should Die - Educator Fi

Is A Tax Sheltered Annuity Qualified

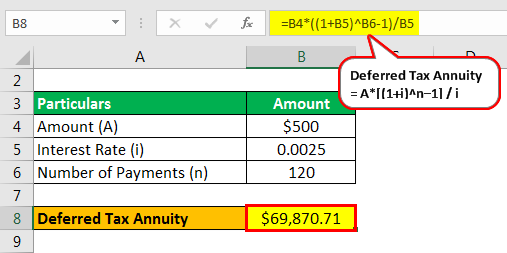

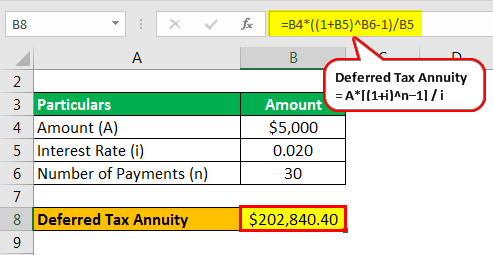

Tax Deferred Annuity Definition Formula Examples With Calculations

Tax Deferred Annuity Definition Formula Examples With Calculations

Annuity Definition What Is An Annuity - Lifeannuitiescom

Ntsaa Definition National Tax Sheltered Annuity Association Abbreviation Finder

What Tax-deferred Annuities Are And How They Work

Taxsheltered Annuity Plans Also Known As 403b Plans

Tsa -- Tax-sheltered Annuity -- Definition Example Investinganswers

/annuity-c64facb507ac4b1c99b1ac5ba9bac1a8.jpg)

Tax-sheltered Annuity Definition

Tax Deferred Annuity Definition Formula Examples With Calculations

Tax-sheltered Annuity Definition Bankratecom

How To Invest In An Annuity Morningstar

Tax Sheltered Annuity

The Tax Sheltered Annuity Tsa 403b Plan

Tax-sheltered Annuity Definition Bankratecom

What You Should Know About Tax-sheltered Annuities The Motley Fool

Tsa -- Tax-sheltered Annuity -- Definition Example Investinganswers

Tax-sheltered Annuity Faqs About Tax Sheltered Annunities Employee Benefits

Comments

Post a Comment