These letters are sent out within 30 days of a correction being made and will tell you if you'll get a refund, or if the cash was used to offset debt. I guess it’s time to call the irs.

Checklist Of Info And Documents Needed For Taxes Click For Full Pdf Tax Preparation Turbotax Checklist

I received benefits for the rest of that year until obviously this may.

Where's my unemployment tax refund irs. In addition to the refund on unemployment benefits, people are waiting for their regular irs tax refunds. The internal revenue service recently announced that tax refunds on 2020 unemployment benefits —part of president joe biden’s $1.9 trillion american rescue plan —are slated to start landing. Portal is updated on a daily basis, typically overnight.

One way to know the status of your refund and if one has been issued is to wait for the letter that the irs sends taxpayers whose returns are corrected. Unemployment tax refunds started landing in bank accounts in may and ran through the summer, as the irs processed the returns. Online account allows you to securely access more information about your individual account.

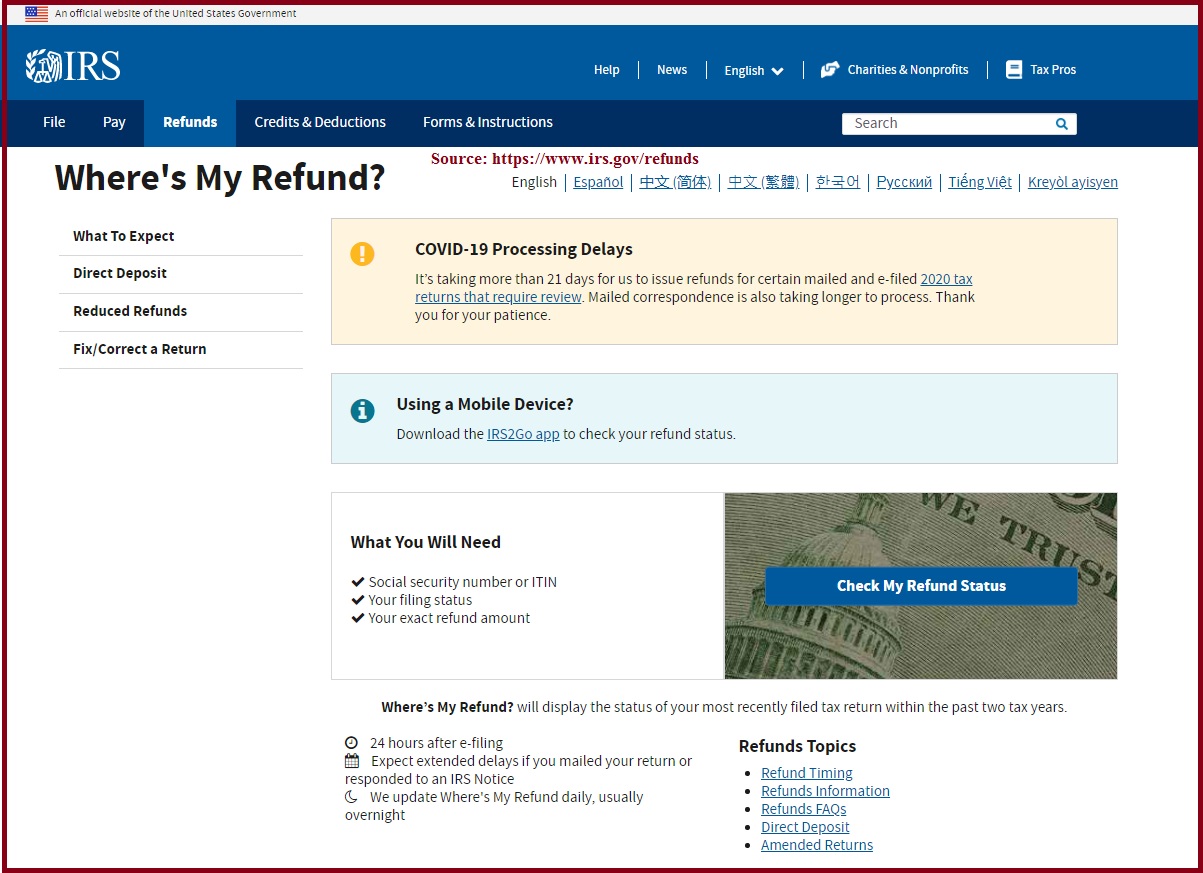

Unemployment tax refunds started to land in bank accounts in may and have continued throughout summer, as the irs processes the returns. Check your unemployment refund status using the where’s my refund tool, like tracking your regular tax refund. Check your unemployment refund status by entering the following information to verify your identity.

If you claim unemployment and qualify for the adjustment, you don’t need to take any action. If you are among the millions of americans waiting for the money, you can check the payment's status by using the irs' check my refund status tool, which is designed to people track the status of. Since may, the irs has issued over 8.7 million unemployment compensation refunds totaling over $10 billion.

Therefore, the irs might seize your unemployment tax refund to cover outstanding tax liabilities. Since then, the irs has issued over 8.7 million unemployment compensation refunds totaling over $10 billion. The first phase included the simplest returns, made by single taxpayers who didn't claim for children or any refundable tax credits.

If those tools don't provide information on the status of your unemployment tax refund, another way to see if the irs processed your refund (and for how much) is by viewing your tax records online. September 16, 2021 at 6:26 pm. Meanwhile, i still wait, with no change to my transcript since may 31.

The irs will automatically send refunds for qualified taxpayers who received unemployment benefits in 2020. The internal revenue service doesn’t have a separate portal for checking the unemployment compensation tax refunds. The irs efforts to correct unemployment compensation overpayments will help most of the affected taxpayers avoid filing an amended.

And more unemployment relief is to be expected for the rest of the year. The tax agency said adjustments would be made throughout the summer, but the last batch […] The jobless tax refund average is $1,686, according to the irs.

If those tools don’t provide information on the status of your unemployment tax refund, another way to see if the irs processed your refund is by viewing your tax records online. The irs previously issued refunds related to unemployment compensation exclusion in may and june, and it will continue to issue refunds throughout the summer. When will i get the refund?

More complicated ones took longer to process. Washington — the internal revenue service recently sent approximately 430,000 refunds totaling more than $510 million to taxpayers who paid taxes on unemployment compensation excluded from income for tax year 2020. Angela lang/cnet over summer, the irs started making adjustments on 2020 tax returns and issuing refunds averaging around $1,600 to those who can claim a $10,200 unemployment tax break.

I’m noticing a slowdown on folks that post here, which makes me think people are getting their unemployment tax refund. The first way to get clues about your refund is to try the irs online tracker applications: It comes as some families may be forced to pay back their child tax credits to the irs.

Where is my unemployment tax refund :/. I paid taxes on my benefits as well. The irs just sent more unemployment tax refund checks with the latest batch, uncle sam has now sent tax refunds to over 11 million americans for the $10,200 unemployment compensation tax exemption.

Refunds by direct deposit will begin july 14 and refunds by paper check will begin july 16. This is the fourth round of refunds related to the unemployment compensation exclusion provision. The payments will start going out in may, the agency said.

Individuals can visit the irs website or. In july of 2021, the irs announced that another 1.5 million taxpayers will receive refunds averaging more than $1600, as the irs is still processing tax returns. If those tools don’t provide information on the status of your unemployment tax refund, another way to see if the irs processed your refund is by viewing your tax records online.

I filed for unemployment last may. How to track your refund and check your tax transcript. $700+ worth of taxes for benefits last year.

You’ll receive your refund by direct deposit if the irs has your banking info Refunds by direct deposit will begin july 28 and refunds by paper check will begin july 30. Will display the status of your refund, usually on the most recent tax year refund we have on file for you.

The irs has sent 8.7 million unemployment compensation refunds so far.

Social Securitys Looming 32 Trillion Shortfall Tax Refund Money Now Social Security

What You Need To Know About Unemployment Tax Refund Irs Payment Schedule And More - Brinker Simpson

Your Tax Return Is Still Being Processed Irs Wheres My Refund 2021

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Irs Tax Refunds Who Is Getting Irs Compensation Payments Marca

Where And How To Mail Your Federal Tax Return Tax Return Tax Refund Irs

Where Is My Money Smokey Where Is My Money Tax Refund Unemployment

Unemployment Tax Refunds Irs Says Millions Will Receive One - Mahoning Matters

Irs Tax Refund Delays Persist For Months For Some Americans - Abc11 Raleigh-durham

Irs Sending Out More 10200 Unemployment Tax Refund Checks Heres How To Track Your Payment

Irs To Start Sending 10200 Unemployment Benefit Tax Refunds In May

Some May Receive Extra Irs Tax Refund For Unemployment Cpa Practice Advisor

Faqs On Tax Returns And The Coronavirus

How Will Unemployment Tax Break Refund Be Sent In Two Phases By The Irs - Ascom

Heartbreaking Stories Emerge As Millions Await Tax Refunds Or Stimulus Payments From Irs - Fingerlakes1com

Irs Now Adjusting Tax Returns For 10200 Unemployment Tax Break Forbes Advisor

Wheres My Refund - Home Facebook

How To Track Your Federal Tax Refund If It Hasnt Arrived Yet - Cnet

Stimulus Check Live Updates Unemployment Benefits Child Tax Credit Tax Refunds Marca

Comments

Post a Comment