John has taxes withheld as detailed above and receives a net check of $790.50. Overview of colorado taxes colorado is home to rocky mountain national park, upscale ski resorts and a flat income tax rate of 4.63%.

2021 Federal State Payroll Tax Rates For Employers

Use adp’s colorado paycheck calculator to calculate net, take home pay, for either hourly or salary employment.

Colorado employer payroll tax calculator. The maximum an employee will pay in 2021 is $8,853.60. Once you set up company and employee, ezpaycheck will calculate colorado income tax for you automatically. 401k, 125 plan, county or other special deductions;

Supports hourly & salary income and multiple pay frequencies. The information provided by the paycheck calculator provides general information regarding the calculation of taxes on wages for colorado residents only. Colorado has a straightforward, flat income tax rate of 4.55% as of 2021.

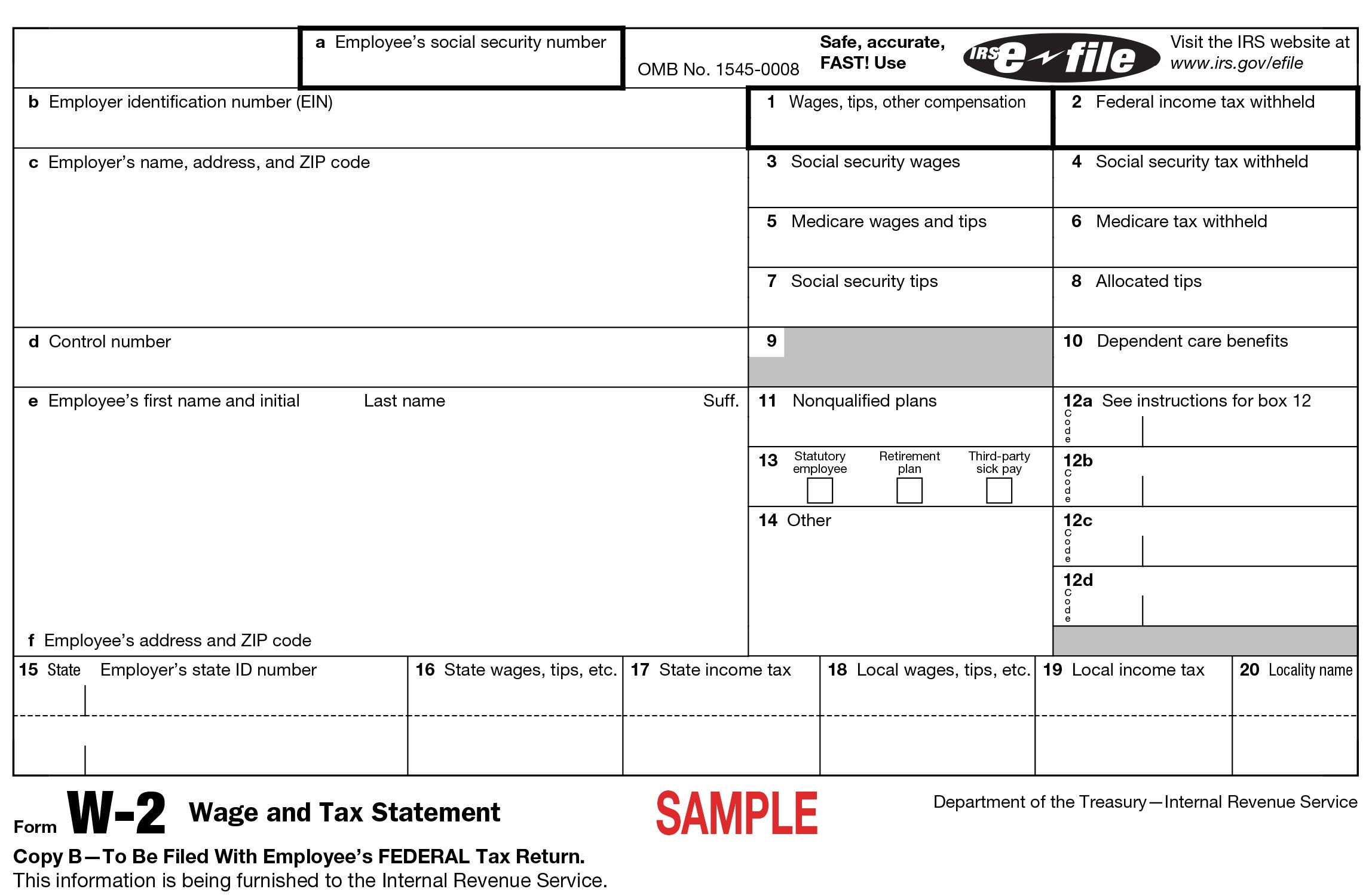

It is not a substitute for the advice of an accountant or other tax professional. As the employer, you must also match your employees. Each employee’s gross pay, deductions, and net pay for both federal and colorado state taxes will be calculated for you.

A new employer in colorado would have these additional payroll tax expenses: Federal income tax withheld : The paycheck calculator may not account for every tax or fee that applies to you or your employer at any time.

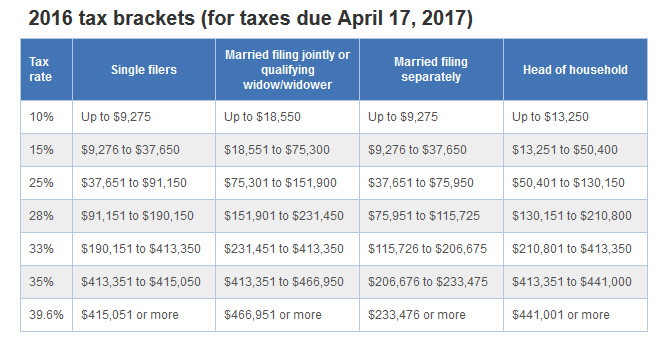

It will calculate net paycheck amount that an employee will receive based on the total pay (gross) payroll amount and employee's w4 filing conditions, such us marital status, payroll frequency of pay (payroll period), number of dependents or federal and state exemptions). Employers are required to file returns and remit tax on a quarterly, monthly, or weekly basis, depending on the employer’s total annual colorado wage withholding liability. The colorado salary calculator is a good calculator for calculating your total salary deductions each year, this includes federal income tax rates and thresholds in 2022 and colorado state income tax rates and thresholds in 2022.

Flexible, hourly, monthly or annual pay rates, bonus or other earning items; Payroll software saves co businesses time and money by calculating the taxes automatically ezpaycheck payroll software is a good choice for many small business employers. Details of the personal income tax rates used in the 2022 colorado state calculator are published below the.

The free online payroll calculator is a simple, flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes. Payroll taxes taxes rate annual max prior ytd cp ;

We offer payroll taxes software that can Paycheck manager's free payroll calculator offers online payroll tax deduction calculation, federal income tax withheld, pay stubs, and more. Here are the quick guide.

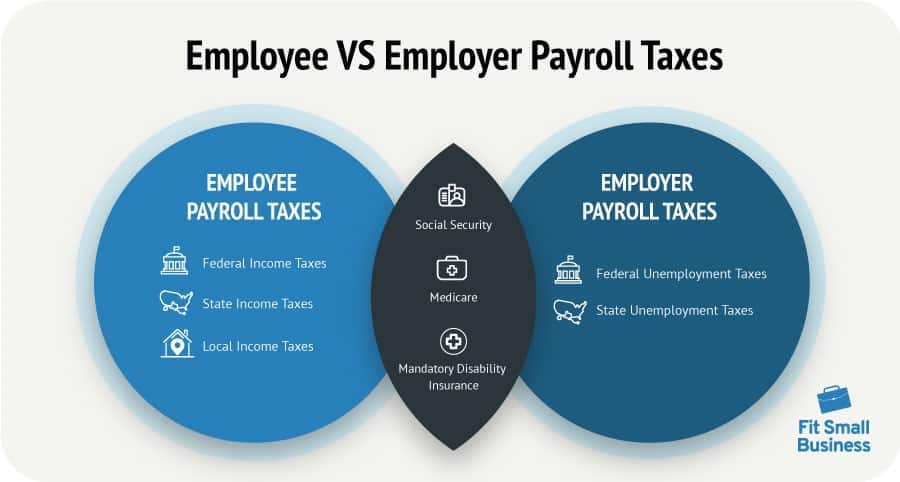

2020 payroll tax and paycheck calculator for all 50 states and us territories. Calculate net payroll amount (after payroll taxes), federal withholding, including social security tax, medicare, and state payroll withholding, such as state disability insurance, state unemployment insurance and others. With checkmark payroll services you can be confident that your payroll is safe hands.

Calculates federal, fica, medicare and withholding taxes for all 50 states. However, the actual rate that employers pay is actually 0.6%, since each state receives a credit to cover the remaining 5.4% of futa payments. Colorado income tax withholding worksheet for employers (dr 1098) prescribes the method for calculating the required amount of withholding.

The futa tax rate is 6% on the first $7,000 of wages paid to employees in a calendar year. It only takes a few seconds to calculate the right amount to deduct from each employee’s paycheck, thus saving you. We will even make your tax payments and complete all quarterly and annual tax filing and reporting requirements.

Switch to colorado hourly calculator. Withhold 6.2% of each employee’s taxable wages until they earn gross pay of $142,800 in a given calendar year. It simply refers to the medicare and social security taxes employees and employers have to pay:

Please refer to the table below for a list of 2021 payroll taxes (employee portion and employer portion) that are applicable to the city of denver in the state of colorado. 0.3% to 9.64% for 2021. Paycheck manager offers both a free payroll calculator and full featured paycheck manager for your online payroll preparation and processing needs.

Luckily, our payroll tax calculator can do all the heavy lifting so you can get back to doing what you do best. Suta (state unemployment tax act) dumping refers to tax evasion schemes where an employer paying high unemployment insurance (ui) premiums attempt to shift their payroll and employees to a company with a lower tax rate, thereby paying less unemployment insurance premiums. You pay john smith $1,000.00 gross wages.

Colorado sui rates range from. Check out our new page tax change to find out how federal or state tax changes affect your take home pay. Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes.

Payroll check calculator is updated for payroll year 2021 and new w4. Computes federal and state tax withholding for paychecks; This free, easy to use payroll calculator will calculate your take home pay.

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Paycheck Calculator - Take Home Pay Calculator

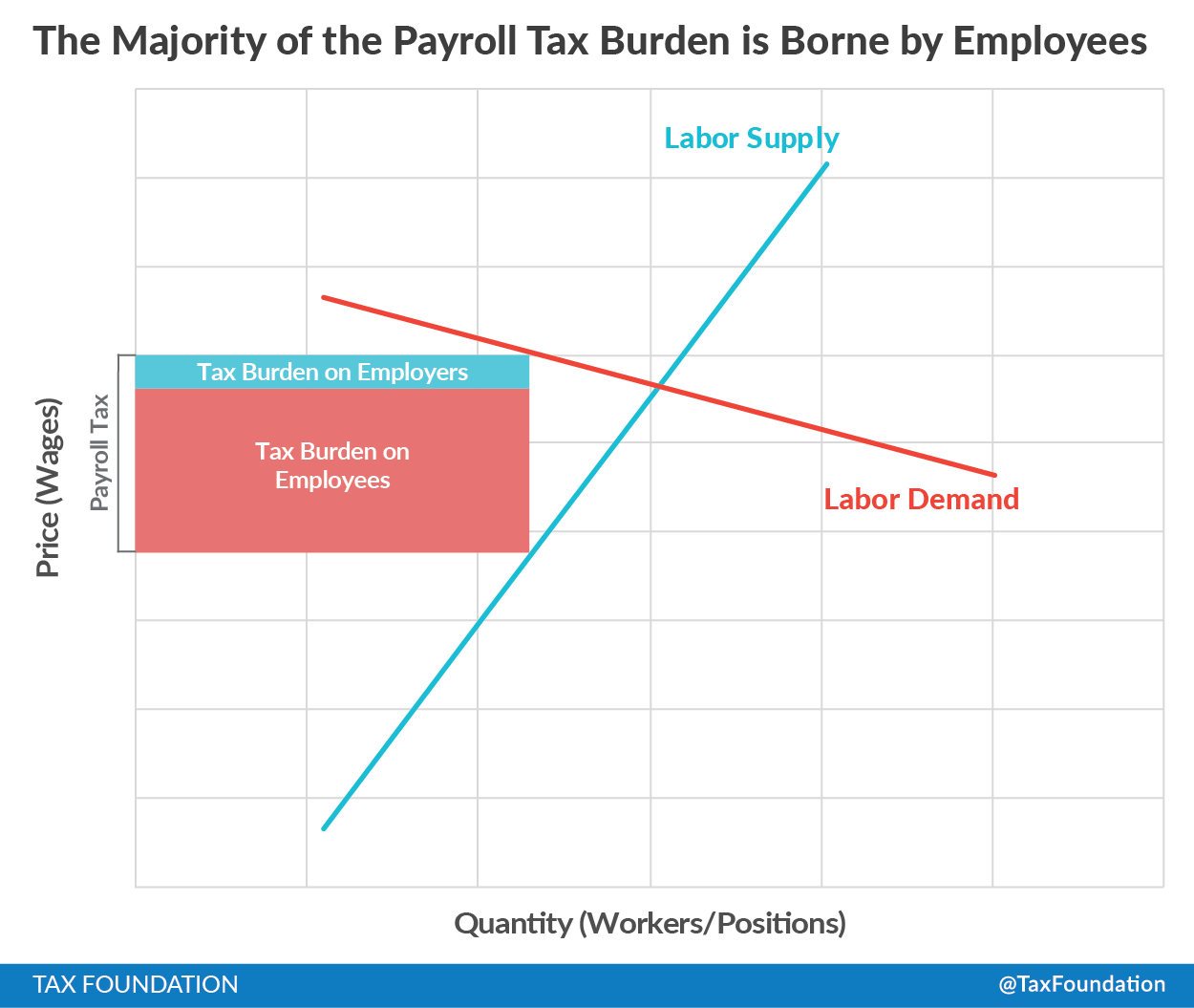

What Are Payroll Taxes And Who Pays Them Tax Foundation

Pin By Alicia Hunt On Budgeting Tax Prep Tax Prep Checklist Financial Tips

Ems Core Portal In 2021 Payroll Software Payroll Employee Engagement

Tax And Payroll Services Business Tax Deductions Accounting Services Payroll

Pdf Third-party Income Reporting And Income Tax Compliance

How Much Does An Employer Pay In Payroll Taxes Examples More

Individual Income Tax Colorado General Assembly

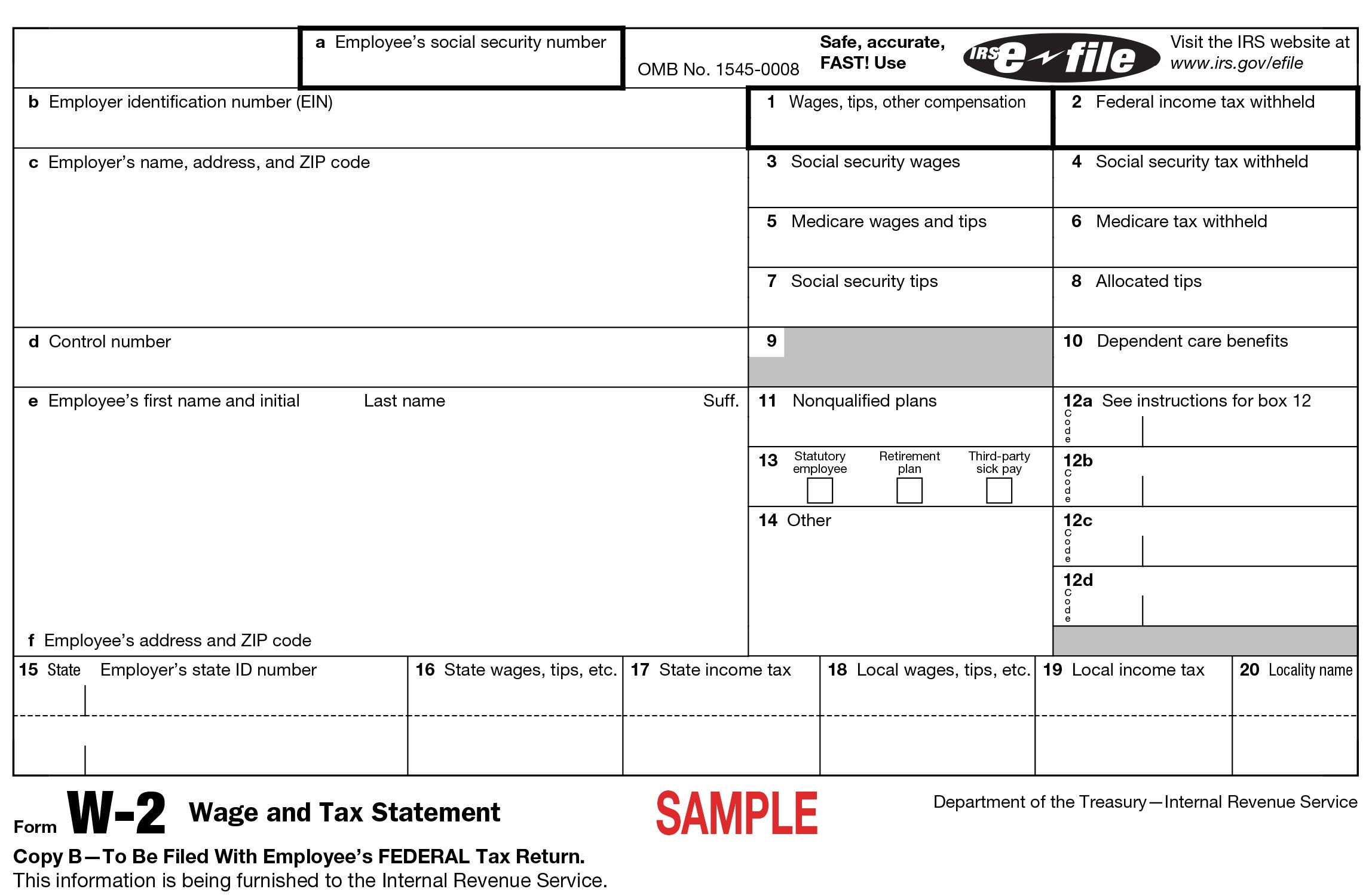

How To Read Your W-2 University Of Colorado

Free Online Payroll Calculators Surepayroll

Paycheck Calculator - Take Home Pay Calculator

2021 Federal State Payroll Tax Rates For Employers

Sap Hcm Us Payroll Tax Calculation Illustration Sap Blogs

Pin On Relevant Tax Information Epf

Sap Hcm Us Payroll Tax Calculation Illustration Sap Blogs

How To Calculate Federal Income Tax 11 Steps With Pictures

Aaa Gas Cost Calculator - Aaa Gas Prices Gas Prices Gas Disneyland Trip

Payroll Tax What It Is How To Calculate It Bench Accounting

Comments

Post a Comment