The county, its elected officials, officers, employees, and. The georgia real estate tax year runs on a calendar year basis (i.e.

Realtymonks One Stop Real Estate Blog Property Tax Tax Consulting Tax Payment

160 rows georgia gas tax.

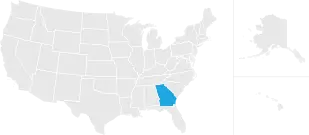

Georgia estate tax calculator. Georgia imposes six major taxes, no one of which exceeds 20%. In atlanta, as well as in most of the counties in the state assessment ratio of 40% is used. Our georgia property tax calculator can estimate your property taxes based on similar properties, and show you how your property tax burden compares to the average property tax on similar properties in georgia and across the entire united states.

Georgia is ranked number thirty three out of the fifty states, in order of the average amount of property taxes collected. It all ensured that no estate tax returns were required by georgia. Here's the math we used to calculate that tax payment:

Atlanta title company llc 945 east paces ferry road suite 2250, resurgens plaza For diesel purchases, the tax rate is 31.3 cents per gallon. Federal estate tax calculator intestacy evaluators™ select a state to see who inherits the intestate estate of someone who dies without a will according to that state’s intestacy laws.

2 the top tax rate is 12%. A change in millage rates, values and fees can affect the total tax amount. The state income tax rates in georgia ranges from 1% to 6%.

Once market value is calculated for each piece of real estate, the georgia assessment ratio is applied. The estate tax is a tax levied by the federal government and some local governments on the estate of a recently deceased person. In a county where the millage rate is 25 mills the property tax on that house would be $1,000;

From january 1st through december 31st). Georgia title insurance rate & intangible tax calculator easily estimate the title insurance premium and transfer tax in georgia, including the intangible mortgage tax stamps. This means that if the marginal tax bracket you’re in is 22% and your rental income is $5,000, you’ll end up paying $1,100.

The georgia county ad valorem tax digest millage rates have the actual millage rates for each taxing jurisdiction. To use the calculator, just enter your property's current market value (such as a current appraisal, or a recent purchase price). The real estate transfer tax is based upon the property's sale price at the rate of $1 for the first $1,000 or fractional part of $1,000 and at the rate of 10 cents for each.

The georgia department of revenue is responsible for publishing the latest. Georgia's estate tax for estates of decedents with a date of death before january 1, 2005 is based on federal estate tax law. Calculate your state income tax step by step 6.

Historical tax rates are available. Georgis is one of 38 states with no estate tax. Title insurance is a closing cost for purchase and refinances mortgages.

Georgia has no inheritance tax, but some people refer to estate tax as inheritance tax. Counties in georgia collect an average of 0.83% of a property's assesed fair market value as property tax per year. Fulton county property tax calculator (atlanta city) property tax spreadsheet.

As of july 1st, 2014, the state of georgia has no estate tax. No warranties, expressed or implied, are provided with the use of this worksheet. Rental income is taxed as ordinary income.

Georgia does not have an estate tax or an inheritance tax on its inheritance laws. Chief appraiser elaine garrett tax assessors office / property evaluation office 25 justice way, suite 1201 dawsonville, ga. More specifically, georgia levies the following taxes:

Free estate tax calculator to estimate federal estate tax in the u.s. Georgia title insurance rate & intangible tax calculator easily estimate the title insurance premium and transfer tax in georgia, including the intangible mortgage tax stamps. Atlanta title company llc 945 east paces ferry road suite 2250, resurgens plaza

Uncover the hidden tax benefits related to rental property ownership. Just click click to edit button at the top of the sheet. It is not paid by the person inheriting the assets.

Georgia collects gasoline taxes of 27.90 cents per gallon of regular gasoline. Seller transfer tax calculator for state of georgia. $25 for every $1,000 of assessed value or $25 multiplied by 40 is $1,000.

The median property tax on a $194,200.00 house is $1,942.00 in gwinnett county. Intangibles mortgage tax calculator for state of georgia. Taxes are assessed on a current year basis.

Title insurance is a closing cost for purchase and refinances mortgages. This calculator can only provide you with a rough estimate of your tax liabilities based on the. We do not certify the tax computation as true and accurate.

Georgia title insurance rate & intangible tax calculator. Alpharetta georgia real estate atlanta town homes for sale atlanta condos for sale dunwoody georgia homes for sale sandy springs georgia real estate lawrenceville real. The median property tax in georgia is $1,346.00 per year for a home worth the median value of $162,800.00.

The tax is paid by the estate before any assets are distributed to heirs. For example, a tax bill issued on july 1st of a given year would cover taxes for that specific year. The median property tax on a $194,200.00 house is $2,039.10 in the united states.

The median property tax on a $194,200.00 house is $1,611.86 in georgia. This means that if your home’s market value is. The tax calculation worksheet is a tool to estimate taxes only.

A guide through the tax deferred real estate investment process. What is the estate tax? The georgia state tax tables for 2021 displayed on this page are provided in support of the 2021 us tax calculator and the dedicated 2021 georgia state tax calculator.we also provide state tax tables for each us state with supporting tax calculators and finance calculators tailored for each state.

It is sometimes called the “death tax.” the estate tax is applied before the people inheriting the money receive it.

Property Taxes Milton Ga

Free Corporation Tax Filing With Accounting Package Available At Abacconsulting Taxation Tax Accounting Account Filing Taxes Income Tax Income Tax Return

Vat Registration In Georgia - 2021 Procedure

Georgia Paycheck Calculator - Smartasset

A Taxattorney Needs To Be More Punctual Because You Are Dealing With Taxes Taxes Come With A Deadline You Should Try To Be Available Tax Lawyer Tax Attorney

2

Dekalb County Ga Property Tax Calculator - Smartasset

Your Guide On Property Taxes In Atlanta Georgia Farkas Real Estate Group

Georgia Property Tax Calculator - Smartasset

Tax Rates Gordon County Government

Free Investment Property Spreadsheet For Tax This Spreadsheet Will Help You Calculate Your Income Ex Investment Property Budget Spreadsheet Being A Landlord

Home Of A Brave Mansions Luxury Homes Dream Houses Baseball Field

Abacconsulting Offering Sensible Assistance At Reasonable Rates Taxeseason Georgia Taxprep Georgiataxes Succe Tax Services Bookkeeping Services Tax Prep

Tax Free Shopping And How To Get A Tax Refund In Tbilisi Batumi And Kutaisi Airports In Georgia

What Does Frugal Living Mean - The Imperfectly Happy Home In 2021 Frugal Saving Money Budget Frugal Living

Georgia Veterans Benefits Military Benefits

Tax Rates Gordon County Government

Georgia Used Car Sales Tax Fees

State-by-state Guide To Taxes On Retirees Retirement Locations Map Retirement Advice

Comments

Post a Comment