German tax system is said to be one of the most complex in the world. This is a sample tax calculation for the year 2021.

German Income Tax Calculator Expat Tax

Use our income tax calculator to calculate the.

German tax calculator berlin. Your taxable (worldwide) income in fy 2021 is eur 300,000. Germany has one of the lowest minimum spending requirements, at 25 eur. The berlin city tax is due for payment for bookings made from the 1st of january 2014 and affects all private overnight stays.

In addition to calculating what the net amount resulting from a gross amount is, our gross/net calculator can also calculate the gross. But, as with almost everything, it looks much scarier that it actually is. Online calculators for german taxes.

The calculator is provided for your free use on our website, whilst we aim for 100% accuracy we make no guarantees as to the accuracy fo the calculator. Income tax, solidarity surcharge, pension insurance, unemployment insurance, health insurance, care insurance. The resulting base amount is further multiplied by municipal coefficients to calculate for.

The city tax amounts to five percent of the room rate (net price), excluding vat and fees for amenities and. Each time we go to a supermarket or café, drop by at a gas station or receive a payroll, we are paying taxes. The basic tax rate is 0.35%, multiplied by a municipal factor.

Married couple with two dependent children under age 18 years. An employee with an yearly income of 9.744 € won’t have to pay income tax, for married employees the limitation will be 19.488 €. Tax calculation example, using an income tax calculator provided by the german federal ministry of finance (bmf):

A minimum base salary for software developers, devops, qa, and other tech professionals in germany starts at € 40000 per year. Those earning royalties and dividends are taxed by withholding at source. Our gross/net calculator enables you to easily calculate your net wage, which remains after deducting all taxes and contributions, free of charge.

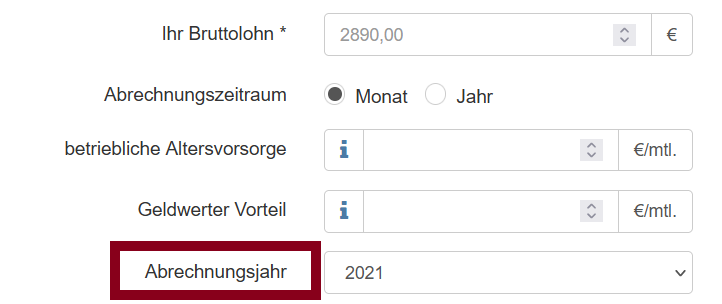

Gross salary of one spouse of eur 100,000, other spouse has no income. The german income tax calculator is designed to allow you to calculate your income tax and salary deductions for the 2021 tax year. This income tax calculator is best suited if you only have income as self employed, from a trade or from a rental property.

German income tax calculator this program is a german income tax calculator for singles as well as married couples for the years 1999 until 2019. This report is called ‘anlage eür’ in german. It is very easy to use this german freelancer tax calculator.

Property taxes (grundsteuer) real estate tax is levied on real estate in germany. Whether you’re a german citizen or an expat, you are required by law to pay taxes if you earn money while living or working in germany. Owes annual german income tax of €2,701;

The third and fourth tax brackets deal with incomes between €54,950. Personal tax allowance and deductions in. However, most double tax treaties (dtts) exempt income attributable to a foreign permanent establishment (pe).

Easily calculate various taxes payable in germany. The german state is responsible for funding kindergartens and. Germany's refund rate ranges from 6.1% to 14.5% of purchase amount, with a minimum purchase amount of 25 eur per receipt.

Taxes are levied by the federal government (bundesregierung), federal states (bundesländer) and municipalities (gemeinden).tax administration is shared between two taxation authorities: The federal central tax office (bundeszentralamt für steuern) and the. Eur 124.094,37 total tax charge (income tax + soliz) = 41.37%

Joint couple’s tax using class 3 and 5: How much income tax do you have to pay in 2020? About the 2021 german income tax calculator.

Solidarity surcharge (solidaritaetszuschlag), capped at 5.5% of your income tax. In germany, everyone’s earnings are subject to a. First, add your freelancer income and business expenses to the calculator.

A salaried person in germany pays income tax on all income for one calendar year. At the same time, more leading roles like software architect, team lead, tech lead, or engineering manager can bring you a gross annual income of € 90000 without bonuses. German tax burden for fy 2021:

This will generate your estimated amount for your profit and loss statement. You want to quickly calculate the probable amount of your income tax when working in germany? To calculate the german income tax you owe on your wages, you can use the steuergo tax calculator.

You have to enter both spouses’ gross salaries and tick the box, whether you have children. How much is the city tax? Germany taxes its corporate residents on their worldwide income.

If you have been present in germany for over 183 days. Germany has four tax brackets. What types of tax should i pay?

You are a resident of germany since 2020 (irrespective of you citizenship). For a quick estimation of whether you should consider a tax class change to 3 and 5, you can use this german tax class calculator. In the second tax bracket, incomes up to €54,949 are taxed with a rate that progresses incrementally from 14 per cent to 42 per cent.

The figures are imprecise and reflect the approximate salary range for tech professionals in. Income tax, aka lohnsteuer to give it its german gangsta name, is the most important tax for jobholders in germany. Overall tax for the couple when paying tax separately:

The effective tax rate is usually between 1.5% and 2.3%. The tax base is the assessed value of the property. Taxation is the primary source of revenue for the state and enables the government to perform its duties.

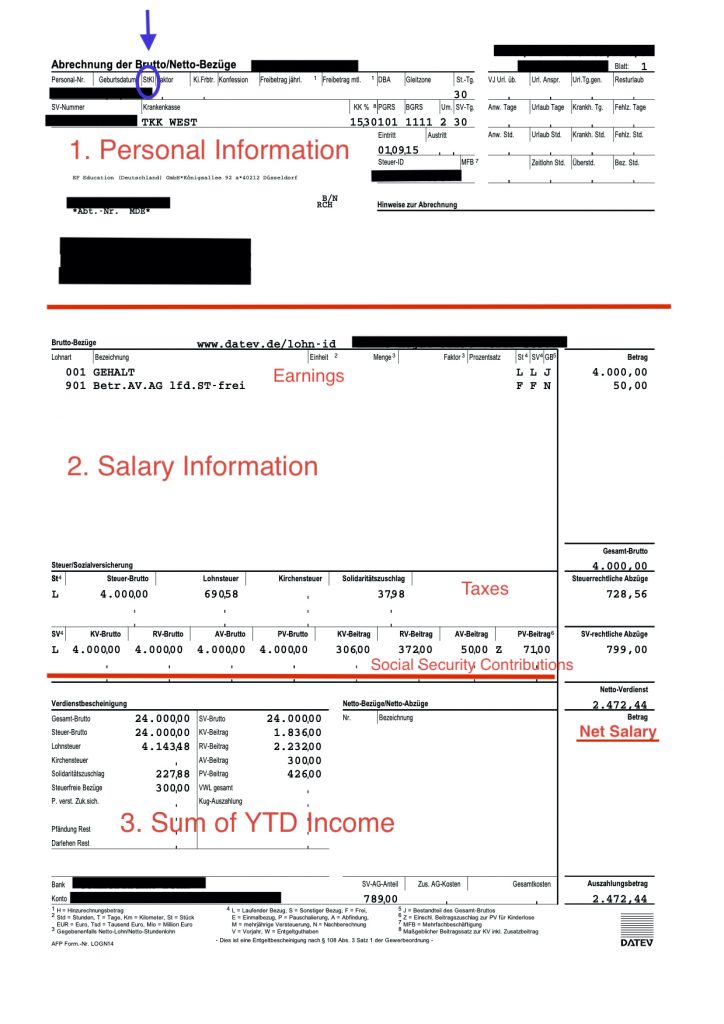

Salary Calculator Germany 2021 User Guide Concrete Examples Gsf

German Freelance Tax Calculator My Startup Germany

Amazing Series Of Still Life Photos By Berlin-based Creatives Eva Jauss And Michael Breyer The German-austrian Duo Creative Photography Grid Design Creative

German Wage Tax Calculator Expat Tax

What Is The Cost Of A Steuerberater In Germany What Are The Alternatives Germany Expat Filing Taxes

Private Liability Insurance For Expats In Germany Liability Insurance Business Liability Insurance Content Insurance

Free Best Collections Of Customer Database Excel Templates Excel Templates Templates Excel

Salary Calculator Germany 2021 User Guide Concrete Examples Gsf

German Income Tax Calculator Expat Tax

German Freelance Tax Calculator My Startup Germany

Contoh Surat Pernyataan Perusahaan Indonesia Dan Inggris Surat Laporan Keuangan Keuangan

Know Your Rental Contract And Tenant Rights In Germany Houses In Germany Germany Travel Destinations Germany

German Freelance Tax Calculator My Startup Germany

Tax Class In Germany Explained Easy 2021 Expat Guide

German Daily Salary Calculator 202122

Pin En History Of Science Technology

Salary Taxes Social Security

What Is The Cost Of A Steuerberater In Germany What Are The Alternatives Germany Work Abroad Freelance Business

Salary Calculator Germany 2021 User Guide Concrete Examples Gsf

Comments

Post a Comment