How to file your personal income tax online in malaysia gone are the days of queuing up in the wee hours of the morning at the tax office to complete your filing. Within 15 days after the due date.

Individual Income Tax In Malaysia For Expatriates

Individual who has income which is liable to tax;

How to open tax file malaysia. Adalah dimaklumkan bahawa lembaga hasil dalam negeri malaysia (lhdnm) akan menaik taraf sistem atas talian bagi membolehkan akses berterusan ke semua sistem lhdnm. The ezhasil facilities are available 24 hours a day, 7 days a week, and 365 days a year. This is the responsible agency operated by the ministry of finance malaysia.

Form to be received by irb within 3 working days after the due date. How to file your income tax. Then select the tax forms tab and choose form ea and year 2020.

Employee who is subject to monthly tax deduction (mtd) If you fail income tax, you will be. File their completed income tax return forms to the inland revenue board (irb) together with the payment of the balance of tax payable (if any).

An application via internet for the registration of income tax file for individuals, companies, employer, partnership and limited liability partnership (llp). You need a suitable software like tax form to open a tx file. How can i open a tx file?

Individual who has business income; Please click here for more information on tax registration for individuals; A sdn bhd must first obtain approval from ssm malaysia to use its proposed name.

If your annual income is over rm 34000, you need to register a tax file. All companies are registered with suruhanjaya syarikat malaysia (ssm) our registration process is just 3 simple steps. However, you will be required to use the form m/mt (borang m/mt) instead of the form b/be.

You can file your taxes on ezhasil on the lhdn website. Registering for a malaysian tax number is not very complicated. Here you get to reduce your taxable income by any expenses that are entitled to tax exemptions.

Tax file register your llp for a tax file at a nearby lhdn branch: Apply for pin number → login for first time For ease of filing, you can use ezhasil to file your taxes online.

What tax exemption or deductions are foreigners entitled to? It also saves a lot of time and very easy to complete it online rather than conventional methods by manually filling up the form because all the calculation is automatic. Unfortunately, ezhasil is not a single password for all online services.

A copy of identification card (ic) / police ic / army ic / international passport. It is a quick and secure facility to register for tax, pay tax liabilities, file tax returns, access your tax details and claim repayments. What is a tx file.

A sdn bhd must file income tax return (form c) with lembaga hasil dalam negeri (lhdn). You can stamp your llp agreement at any lhdn branch. You’ll also need to submit copies of your llp certificate (from step 1) and stamped llp agreement.

Without proper software you will receive a windows message how do you want to open this file? or windows cannot open this file or a similar mac/iphone/android alert.if you cannot open your tx file correctly, try. Once you’re done use the blue “go” button to generate your form and choose where to save it. Tx files mostly belong to tax form.tax form file, mainly used in india.

Within 1 month after the due date What are the annual requirements? Malaysian income tax number (itn) or functional equivalent in malaysia, both individuals and entities who are registered taxpayers with the inland revenue board of malaysia (irbm) are assigned with a tax identification number (tin) known as “nombor cukai pendapatan” or income tax number (itn).

The process of registering is as follows. It costs rm 10, and takes just a few minutes. Tax deductions include eligible charitable donations and membership subscriptions of professional bodies.

Sila klik 'ya' untuk teruskan atau klik 'tidak' dan lakukan log masuk kali pertama atau semak semula no. Who are required to register income tax file ? A copy of the latest salary statement (ea/ec form) or latest salary slip.

How To File Income Tax Manually Online E-filing In Malaysia 2021

Pin By Annie Wong On Income Tax Education In Malaysia Further Education Income Tax Return

Heres A How-to Guide File Your Income Tax Online Lhdn In Malaysia

Heres A How-to Guide File Your Income Tax Online Lhdn In Malaysia

10 Things To Know For Filing Income Tax In 2019 Mypfmy

Malaysia Personal Income Tax Guide 2021 Ya 2020

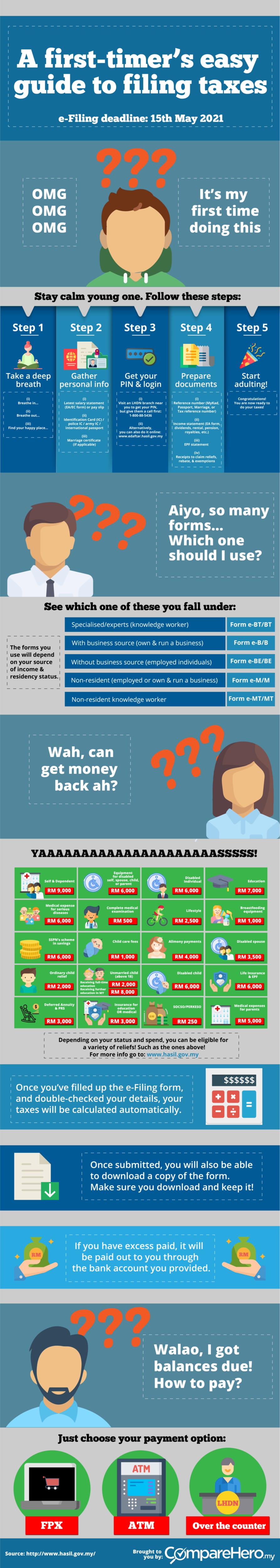

How To File Your Taxes For The First Time

Business Income Tax Malaysia Deadlines For 2021

Tax Guide For Expats In Malaysia - Expatgo

Malaysia Personal Income Tax Guide 2021 Ya 2020

How To File Your Income Tax Manually In Malaysia

Personal Income Tax E-filing For First Timers In Malaysia Mypfmy

Guide To Tax Clearance In Malaysia For Expatriates And Locals - Toughnickel

How To File Your Income Tax Manually In Malaysia

Personal Income Tax E-filing For First Timers In Malaysia Mypfmy

Personal Income Tax E-filing For First Timers In Malaysia Mypfmy

What You Need To Know About Income Tax Calculation In Malaysia

Personal Income Tax E-filing For First Timers In Malaysia Mypfmy

How To File Your Income Tax Manually In Malaysia

Comments

Post a Comment