Hello, my name is ruth and i'm the founder of taxtwerk.com. Residents at 964 main st, hamilton oh:

East New York Tax Service - Home Facebook

Hamilton city sd serves this city with an aa credit rating.

Instant tax service hamilton ohio. Opens in 21 h 5 min. According to the court, its financial had about 150 franchisees that filed over 100,000 tax returns each year in 2011 and 2012. Get reviews, hours, directions, coupons and more for joann's instant tax service at 964 main st, hamilton, oh 45013.

Instant tax service is located at 4142 hamilton ave, cincinnati, oh 45223. Check out our recommendations for more. Instant tax servicerelationship manager team lead since apr 2009.

The top 10 tax preparers in hamilton county by the prime buyer's report. Hamilton county, sycamore oh,… services: They also told me that they made a mistake and file my taxes because they mix up my twin sister and i taxes.

964 main st, hamilton, oh. Neighbors, property information, public and historical records. Tax return preparation and filing.

Get paid by paypal or check: Instant refund tax service, 4347 roosevelt blvd middletown, 1790 s erie hwy hamilton, 1924 allentown rd lima, 1014 e. Instant tax service 2839 monroe street toledo.

J a haney & co inc 4955 oberlin avenue lorain. Opening hours for tax services in hamilton, oh 10 results. Verified insured, clients surveyed for satisfaction.

Office manager at instant tax service hamilton, ohio, united states 19 connections. Assistant manager since nov 2008. B & b income tax & bookkeeping.

Tucson tax attorney irs tax settlement 1 s church ave, suite 1200 , tucson, az 85701 instant tax service & insurance 624 main st , delano, ca 93215 joann's instant tax. Instant tax service hamilton ohio. Get reviews, hours, directions, coupons and more for joann's instant tax service at 964 main st, hamilton, oh 45013.

1790 s erie hwy ste f, hamilton, oh. Instant tax service profile instant tax service scorecard. 1790 s erie hwy ste f, hamilton, oh, 45011.

Never gave them a verbal or written consent to file my taxes. Ad 9 tax professionals will answer now a question is answered every 9 sec. Data provided by one or more of the following:

427 main street, hamilton, oh, 45013. On february 10, 2016 i received a phone call from instant tax service, telling me i had a refund check and to come pick it up. Let me introduce you to ohio media school student and up and coming music production and video editor.

Instant refund tax service, 4347 roosevelt blvd middletown, 1790 s erie hwy hamilton, 1924 allentown rd lima, 1014 e. Manta has 8 businesses under tax return preparation and filing in hamilton, oh. 1502 university blvd, hamilton, oh.

J e wiggins & co 45 north wilson road suite a columbus Tax preparers for tax return filing,. Instant tax service 1790 south erie highway hamilton.

Get instant tax service reviews,. Interstate 77 auctions 2280 south arlington road akron. Leave a reply cancel reply.

Taxation lawyers serving hamilton, oh and nationwide ; Instant refund tax service offices lebanon 726 main street cincinnati. Search for other tax return preparation in.

I indicated that i just came in for a free estimate with my last check stub of the year of 2014. Ad 9 tax professionals will answer now a question is answered every 9 sec.

Home - Hamilton County Job Family Services

Hamilton Oh Social Security Office - 6553 Winford Ave - 45011

Hamilton Oh Tax Preparation Office - 762 Nw Washington Blvd

2

Elderly Services Program - Lifespan

Fairfield Oh - 6679 Dixie Hwy - Liberty Tax Office

File Taxes In A Walmart

12 Best Dayton Accountants Expertisecom

About - Go Metro

2

Accounting Services Business Advisory Kirsch Cpa Tax Forms

Ohio Income Tax Calculator - Smartasset

Election 2021 Races In Hamilton Warren Butler And Clermont Counties

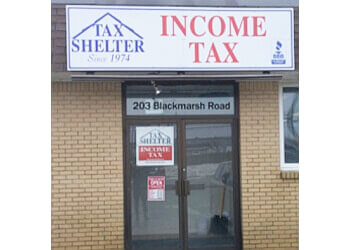

3 Best Tax Services In St Johns Nl - Expert Recommendations

Hr Block Tax Preparation Office - Hamilton Plaza Hamilton Oh

3 Best Tax Services In St Johns Nl - Expert Recommendations

12 Best Dayton Accountants Expertisecom

3 Best Tax Services In St Johns Nl - Expert Recommendations

Kfc - Home - Hamilton Ohio - Menu Prices Restaurant Reviews Facebook

Comments

Post a Comment