Assessors estimate the value of each parcel of real property in the county and revisit them every few years. The assessor is required by the louisiana constitution to list, value and enumerate all property subject to ad valorem taxation (of the levying of tax or customs duties) in proportion to the estimated value of the goods or transaction concerned, on an assessment roll each year.

Jefferson Parish Assessors Office - Home

You must submit your change of address, in writing, to the address below:

Jefferson parish tax assessor gretna. Current tax represents the amount the present owner pays, including exemptions and special fees. A disclaimer will open before you get to the map. Jefferson parish assessor tax assessor office address:

The jefferson parish assessor's office, located in gretna, louisiana, determines the value of all taxable property in jefferson parish, la. Jefferson parish makes no warranty as to the reliability or accuracy of the base maps, their associated data tables or the original data collection process and is not responsible for the inaccuracies that could have occurred due to errors in the. Public property records provide information on homes, land, or commercial properties, including titles, mortgages, property deeds, and a range of other documents.

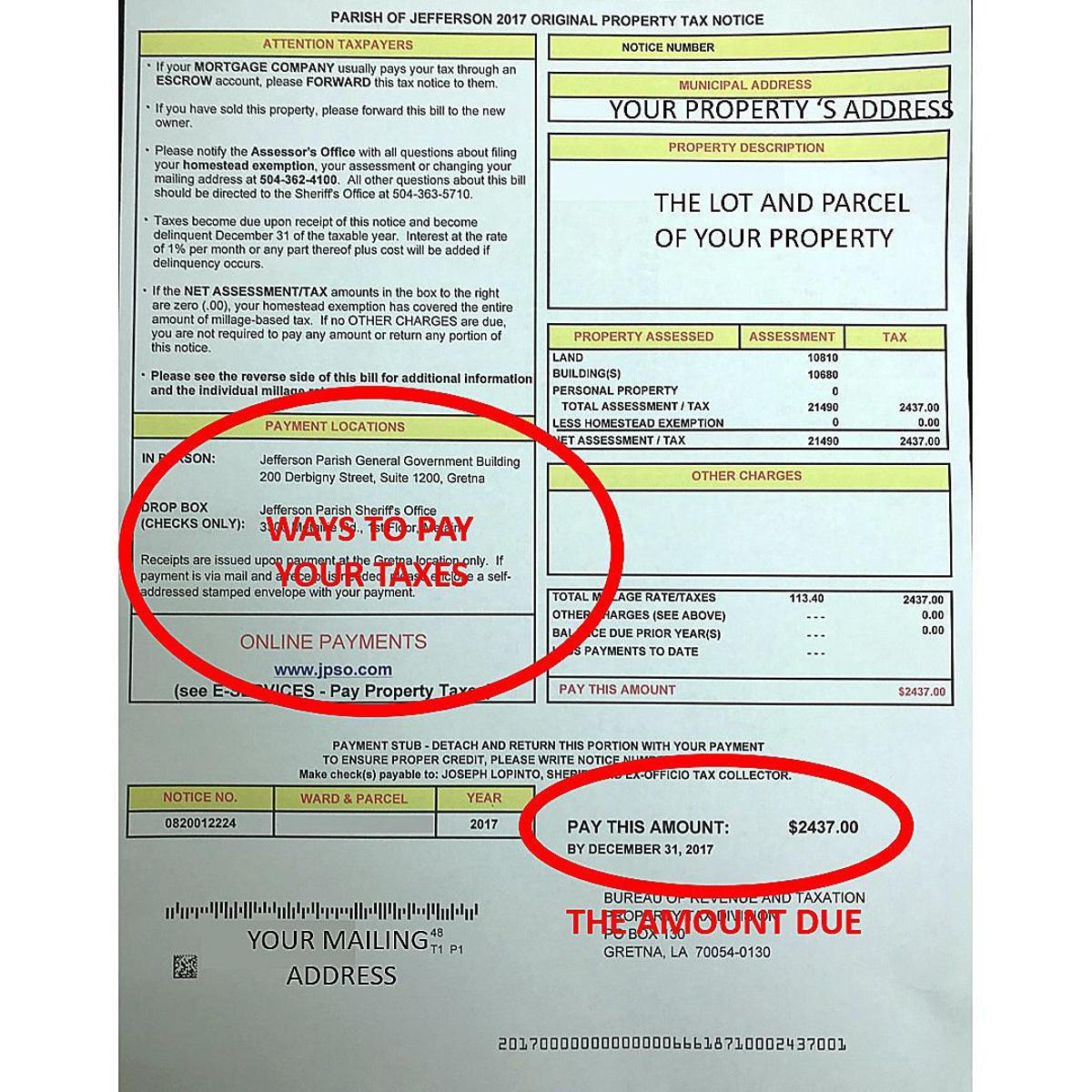

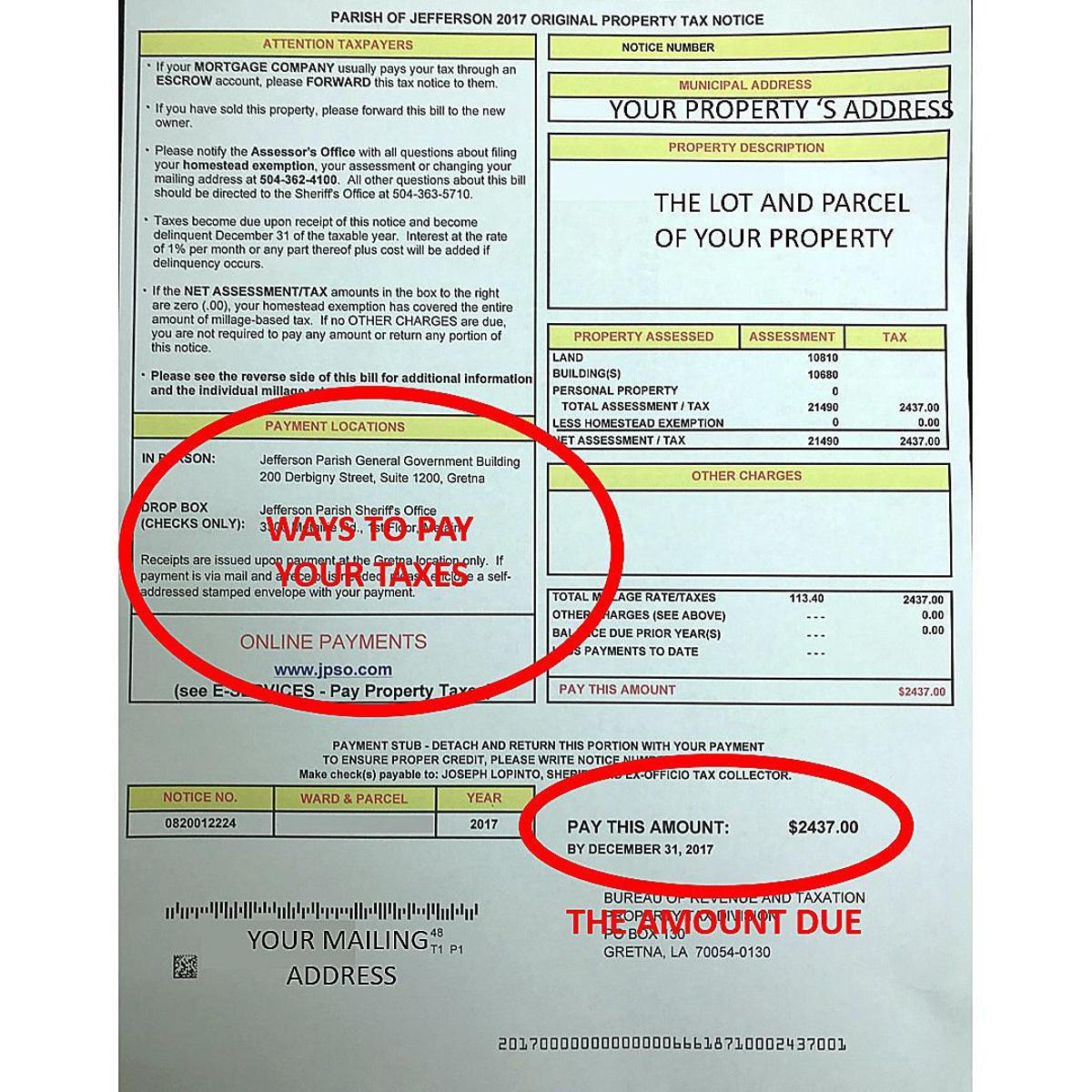

Its office is located in the jefferson parish general government building, 200 derbigny street, suite 1200, in gretna and is open to the public from 8:30 a.m. Jefferson parish property records provided by homeinfomax: Real property is the combination of land and any structures on it.

Once you’ve read through the disclaimer, click continue to map. A variety of property tax exemptions are available in jefferson parish county, and these may be deducted from the assessed value to give the property's taxable value. The assessor does not assess a tax.

8 hours ago jefferson parish assessor's office services. The assessed value is a percentage of “fair. Property values are assessed through the jefferson parish assessor’s office.

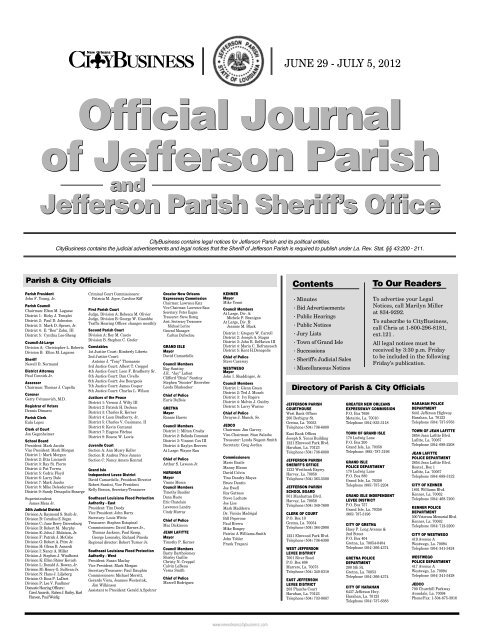

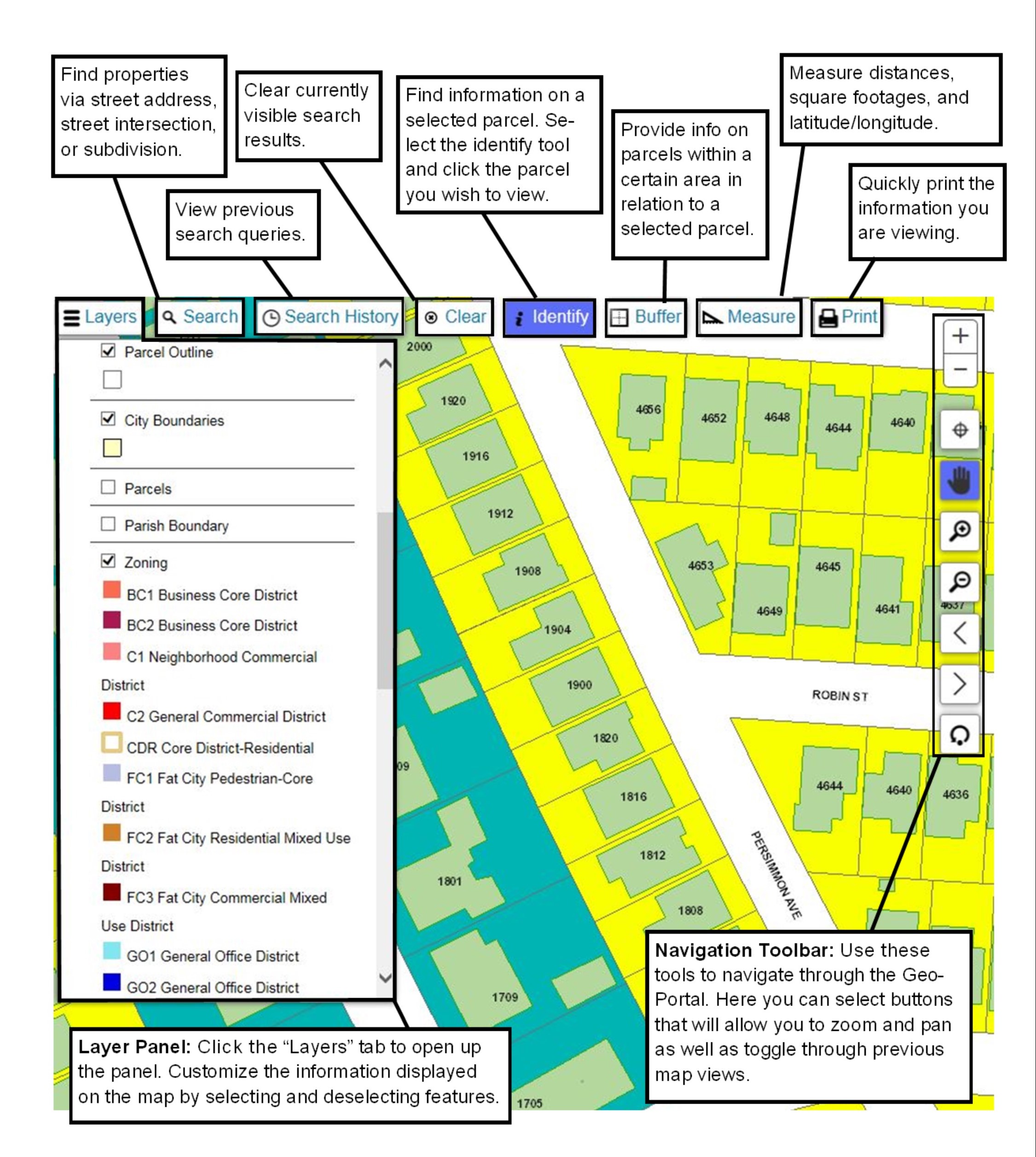

To 4:30 p.m., monday through friday. New orleans assessor new orleans 8.1 miles away. Jefferson parish has developed a geographic information systems (gis) database using aerial photography and field investigations.

Their website, www.jpassessor.com, provides access to property search tools, millage rates, assessment formulas and homestead exemptions.please note that the city of gretna does not offer a homestead exemption for property taxes specific to the city’s jurisdiction. Jefferson parish assessor's office services. 6 days ago jefferson parish, louisiana tax assessor & property.

The jefferson parish geoportal does not include information for the incorporated cities and towns of kenner, gretna, harahan, westwego, lafitte, or grand isle. Taxable property includes land and commercial properties, often referred to as real property or real estate, and fixed assets owned by businesses, often referred to as personal property. When contacting jefferson parish about your property taxes, make sure that you are contacting the correct office.

The jefferson parish tax assessor is the local official who is responsible for assessing the taxable value of all properties within jefferson parish, and may establish the amount of tax due on that. 200 derbigny st., suite 1100, gretna, la 70053, phone: Jefferson parish property records are real estate documents that contain information related to real property in jefferson parish, louisiana.

Jeffnet Jefferson Parish Clerk Of Court

Gretna Louisiana - Wikipedia

Jefferson Parish Louisiana - Wikiwand

Revenue Taxation Jefferson Parish Sheriff La - Official Website

Millages

Revenue Taxation Jefferson Parish Sheriff La - Official Website

178815 Tax Bills Being Mailed To Jefferson Parish Property Owners Business News Nolacom

Jefferson Parish Sheriffs Office Jefferson Parish Sheriffs Office

Revenue Taxation Jefferson Parish Sheriff La - Official Website

Gretna Louisiana - Wikipedia

Jefferson Parish Assessors Office - Home

Revenue Taxation Jefferson Parish Sheriff La - Official Website

Jefferson Parish Assessors Office - Home

Geoportal

Revenue Taxation Jefferson Parish Sheriff La - Official Website

Jefferson Parish Assessors Office - Home

Jefferson Parish Clerk Of Court - Home Facebook

Geoportal

Online Property Tax System

Comments

Post a Comment