Connecticut continues to phase in an increase to its estate exemption, planning to match the federal exemption by 2023. There is no city sale tax for las vegas.

Pin On Real Estate

However, as the exemption increases, the minimum tax rate also increases.

Nevada estate tax rate 2021. Nevada filing is required in accordance with nevada law nrs 375.a for any decedent who has property located in nevada at the time of death, december 31, 2004 or prior, and whose estate value meets or exceeds the level. The tax rate levied on net proceeds of minerals is the rate determined from the table at nrs 362.140 or the total tax rate for the county in which the mining operation is located, whichever rate is higher. The median property tax also known as real estate tax in carson city is 1 224 00 per year based on a median home value of 270 500 00 and a median effective property tax rate of 0 45 of property value.

Explore data on nevada's income tax, sales tax, gas tax, property tax, and business taxes. The nevada sales tax rate is 6.85% as of 2021, with some cities and counties adding a local sales tax on top of the nv state sales tax. Under nevada law, the “manufacturing” tax rate of 0.091% applies to business entities primarily engaged in the transformation of materials, substances, or components into new products for sale.

It will increase to $11.40 million in 2019. In 2021, federal estate tax generally applies to assets over $11.7 million. The tax is collected by the county recorder.

Compared to the 1.07% national average, that rate is quite low. 2 so, the wholesale rate is around 11% higher. Paradise, nv sales tax rate:

The same threshold and tax rate apply to gift taxes. Pahrump, nv sales tax rate: Laughlin, nv sales tax rate:

The las vegas, nevada, general sales tax rate is 4.6%. Depending on the zipcode, the sales tax rate of las vegas may vary from 8.25% to 8.375%. The median nevada property tax is $1,749.00, with exact property tax rates varying by location and county.

The state’s average effective property tax rate is just 0.53%. Tax rates can be above and below these numbers. Carson city nevada real estate taxes.

Nellis air force base, nv sales tax rate: Nevada does not have an estate tax, but the federal government has an estate tax that may apply if your estate has sufficient value. In practical terms, if you buy a home for $200,000, your real estate transfer taxes will only be $780.

Some counties in nevada, such as washoe and churchill, add $0.10 to the rate. New jersey finished phasing out its estate tax at the same time, and now only imposes an inheritance tax. Who must file for estate taxes in nevada?

Learn about nevada tax rates, rankings and more. Reno, nv sales tax rate: In 2020, rates started at 10 percent, while.

The estate tax is a tax on a person's assets after death. Detailed nevada state income tax rates and brackets are available on this page. This is the total of state, county and city sales tax rates.

The state's exclusion amount is $5,000,000 as of 2021, and it was $4,250,000 in. The nevada sales tax rate is currently %. Exemptions to the nevada sales tax will vary by state.

The top estate tax rate is 12 percent and is capped at $15 million (exemption threshold: The tax rate, as of 2019, typically starts at 10% and then increases in steps up to about 16%. Every 2021 combined rates mentioned above are the results of nevada state rate (4.6%), the county rate (3.65% to 3.775%).

1 in contrast, the “wholesale trade” tax rate of 0.101% applies to business entities primarily engaged in wholesaling goods without transformation. In 2020, revenues from federal estate and gift taxes totaled $17.6 billion (equal to 0.1 percent of gross Spanish springs, nv sales tax rate:

The minimum combined 2021 sales tax rate for las vegas, nevada is. Homeowners in nevada are protected from steep increases in property tax bills by nevada’s property tax abatement law, which limits annual increases in property tax bills to a maximum of 3% for homeowners. The exemption amount will rise to $5.1 million in 2020, $7.1 million in 2021, $9.1 million in 2022, and is scheduled to match the federal amount in 2023.

Estate tax rate ranges from 18% to 40%. The county sales tax rate is %. The las vegas sales tax rate is %.

The federal estate tax exemption is $11.18 million for 2018. 2021, estates face a 40 percent tax rate on their value above $11.7 million, although various deductions reduce the value subject to the tax. Mesquite, nv sales tax rate:

Las vegas, nv sales tax rate: Delaware repealed its estate tax at the beginning of 2018. General property tax information and links to county assessors and treasurers.

Nevada's statewide real property transfer tax is $1.95 per $500 of value over $100. North las vegas, nv sales tax rate: Sparks, nv sales tax rate

The nevada income tax has one tax bracket, with a maximum marginal income tax of 0.00% as of 2021. Nrs 375a, tax is imposed in the amount of the maximum credit allowable against the federal estate tax for the payment of state death taxes. The estate tax rates in connecticut are the lowest, starting at 7.80% and rises to 12%.

Vermont's estate tax is a flat rate of 16% on the portion of a taxable estate that exceeds the exclusion amount. Estate tax rates are typically assessed in brackets after the exemption threshold, like income tax is assessed.

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax States Tax

The States With The Highest Capital Gains Tax Rates The Motley Fool

25 Percent Corporate Income Tax Rate Details Analysis

Does Your State Have A Corporate Alternative Minimum Tax

House Democrats Tax On Corporate Income Third-highest In Oecd

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

Property Taxes City Of North Vancouver

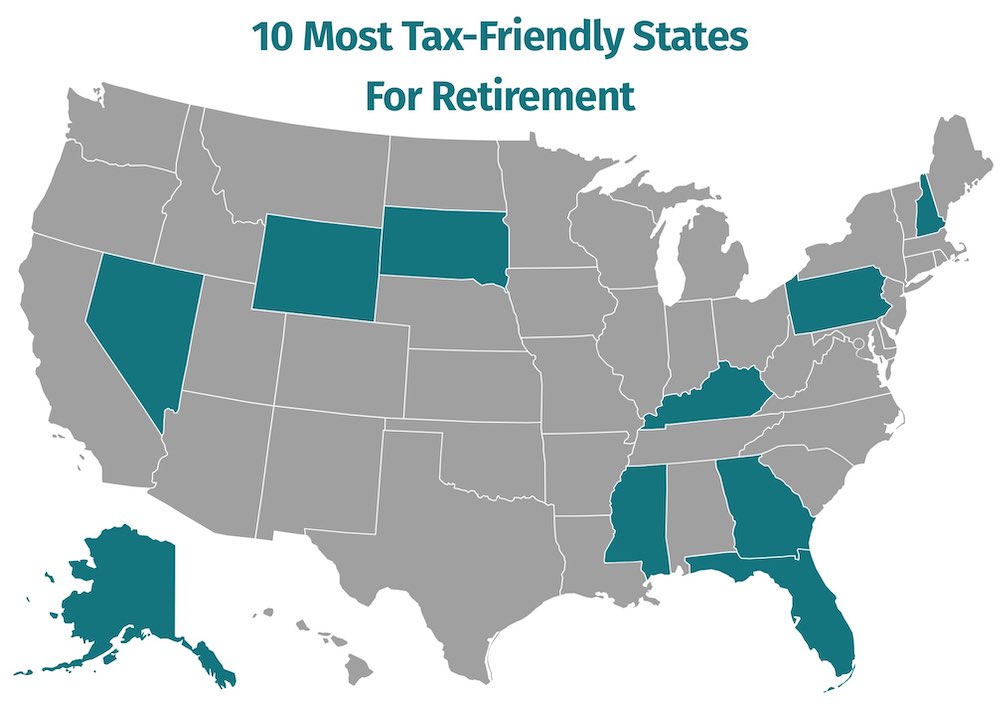

Top 10 Most Tax-friendly States For Retirement 2021

Tax Benefits Of Living In Wyoming - Wyoming Real Estate Blog

Shrinking The Delaware Tax Loophole Other Us States To Incorporate Your Business

2021 Guide To Potential Tax Law Changes

How Is Tax Liability Calculated Common Tax Questions Answered

2021 Guide To Potential Tax Law Changes

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Where Are The Best And Worst States To Retire Bankratecom Clark Howard Retirement Life Map

States With No Estate Tax Or Inheritance Tax Plan Where You Die

10 Most Tax-friendly States For Retirees Retirement Locations Retirement Advice Retirement Planning

How Is Tax Liability Calculated Common Tax Questions Answered

Are There Any States With No Property Tax In 2021 Free Investor Guide

Comments

Post a Comment