Creasy, cpa.if you are a taxpayer or a small business owner and looking for some assistance in tax filing preparation then tammy mae creasy can be of assistance to you. View tammy creasy’s profile on linkedin, the world’s largest professional community.

Exporting And Labour Demand Microlevel Evidence From Germany - Lichter - 2017 - Canadian Journal Of Economicsrevue Canadienne Dconomique - Wiley Online Library

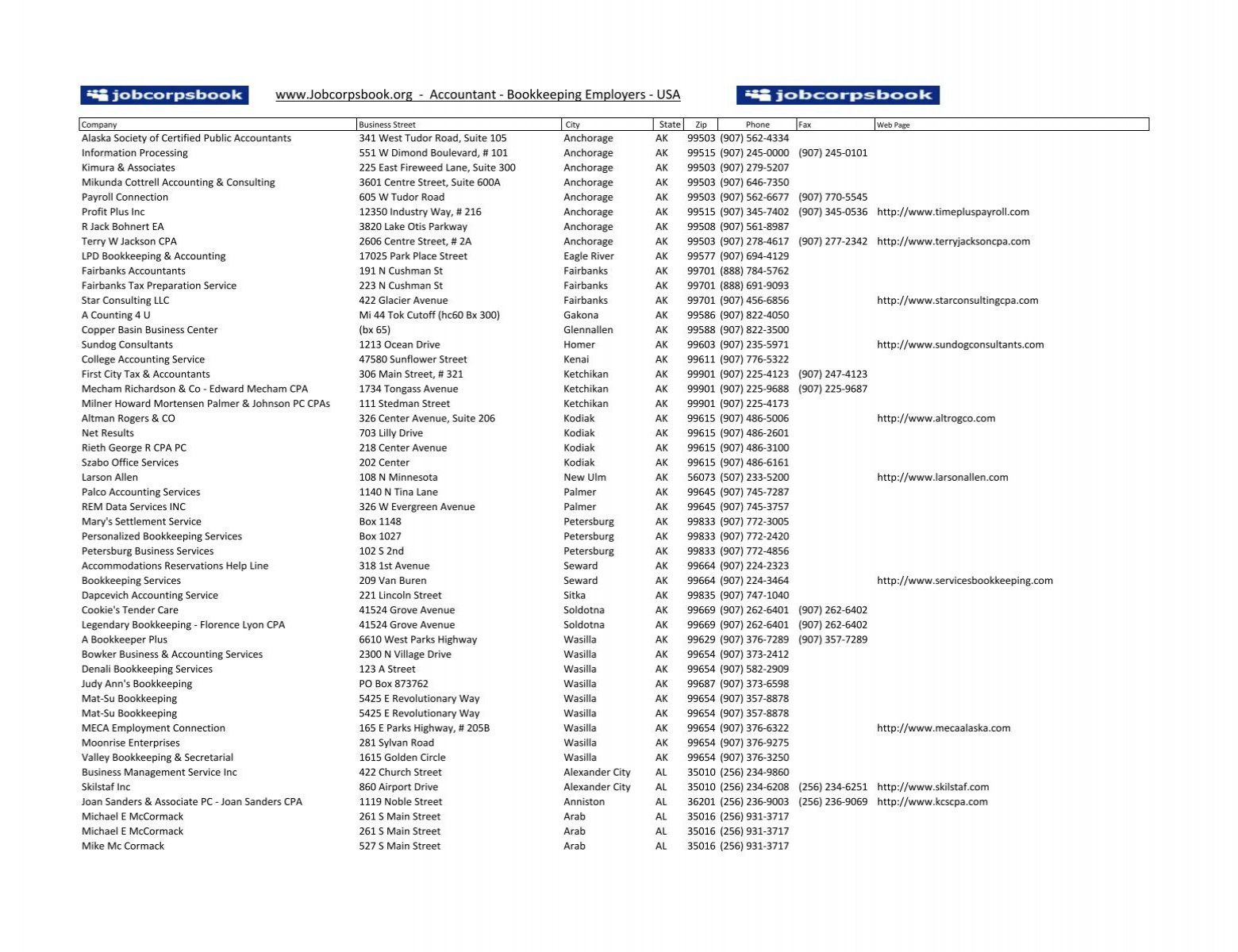

We have built our database from these public records and sources.

Tammy tax service princeton mn. Save your receipts for from school supply shopping 🖍📖📚 ️. Tammy's tax service is a minnesota assumed name filed on february 6, 2001. Heritage tax service tax preparation in princeton, minnesota primary menu.

Hours may change under current circumstances. Tammy mae creasy is associated with tammy m. 12551 313th avenue nw, princeton mn 55371 mailing address:

Welcome to the all new website for tammy's bookkeeping and tax service! General@heritagetaxmn.com services meet our staff We offer a wide array of accounting, bookkeeping, payroll, and tax preparation services.

209 n rum river dr. Tax return preparation, financial services. Tammy's bookkeeping and payroll service.

Tammy mae creasy, cpa is an irs registered tax preparer in princeton, minnesota. Princeton public schools isd 477. Tammy l trail and tammy lynn trail are some of the alias or nicknames that tammy has used.

We are conveniently located in cottage grove, mn, just minutes south of the twin cities and minutes north of hastings, just off of highway 61. Select an address below to search who owns that property on 120th avenue and uncover. Your family may qualify for one or both of these tax benefits:

1120, 1120s, 1065, 1041, 1040, 1040a, 1040ez, schedule c, schedule e 209 rum river dr n, #1, princeton, mn 55371. In the past, tammy has also been known as tammy s baker, tamy s willcoxson and tammy s willcoxson.

The aver age household income in the 120th avenue area is $68,873. In the past tammy has also lived in spicer mn and foreston mn. Tammy's bookkeeping and tax service.

71 records in 81 cities for tammy smith in minnesota. (1 rating) read reviews write a review. Tammy willcoxson is 62 years old and was born on 10/19/1958.

Tammy trail currently lives in princeton, mn; Explore our names directory to see where tammy smith may currently live along with possible previous addresses, phone. Find the best cpas and tax accounting professionals near you.

We found 32 addresses and 32 properties on 120th avenue in princeton, mn. The average property tax on 120th avenue is $1,712/yr. See the complete profile on linkedin and discover tammy’s.

Po box 399, princeton mn 55371 phone: See posts, photos and more on facebook. Tammy willcoxson lives in princeton, mn;

The top city of residence is minneapolis, followed by saint paul. The average price for real estate on 120th avenue is $123,180. Tammy trail's birthday is 04/23/1965 and is 56 years old.

Between 3rd st n and 2nd st n. File your taxes at jackson hewitt, a tax preparation service with nearly 6,000 tax offices nationwide, including 300 21st ave, princeton, mn! Tammy has 1 job listed on their profile.

Previous cities include onalaska wi and cedar rapids ia. 209 n rum river dr ste 1 princeton, mn 55371 get directions. We allow business owners to claim their listings to make sure we are showing the most.

Accountant - Usapdf - Ovoogle

Tamara L Anderson - Princeton Mn Tax Preparer

Home Tammys Bookkeeping And Tax Service

Tamara Anderson Tammys Tax Service - Princeton Mn Tax Preparation And Accounting

2

Se Hemmerich Tax And Accounting Services Cpa Llc - Home Facebook

Pdf Transnational Conservation Movement Organizations Shaping The Protected Area Systems Of Less Developed Countries

Se Hemmerich Tax And Accounting Services Cpa Llc - Strona Glowna Facebook

Se Hemmerich Tax And Accounting Services Cpa Llc - Home Facebook

Tammy Tax Service Princeton Mn

Se Hemmerich Tax And Accounting Services Cpa Llc - Home Facebook

Home Tammys Bookkeeping And Tax Service

Viking Accounting And Tax Services

2

Affidavit Of Service - Jackson Hewitt Inc Website

Tammy S Clary 763 422-4876 6821 67th St Princeton Mn Nuwber

Tammys Tax Service Better Business Bureau Profile

1ekeybz

Containerparishesonlinecom

Comments

Post a Comment