After the local governments determine their annual budgets, the county tax collector sends a tax bill to each property owner in late october or november. Property tax is calculated by multiplying the property's assessed value by the total millage rates applicable to it and is an estimate of what an owner not benefiting from any exemptions would pay.

Beyonce And Jay Zs Property Taxes Are So High They Boggle The Mind

Taxes are calculated by multiplying the property value less exemptions by the millage rate, which is determined by local taxing authorities.

How are property taxes calculated in orange county florida. This means that a home valued at $250,000 will pay about $1,788 in property taxes in a given year. The median property tax on a $607,900.00 house is $3,404.24 in orange county. The property appraiser determines the ownership, mailing address, legal description and value of property in orange county.

In orange county, higher sales prices are driving up property taxes rates can differ widely, even among neighbors, for a variety of reasons to estimate their tax rate, homeowners can use the. Do not enter street types (e.g. Please see this infographic for more information on florida’s property tax system.

Here are the median property tax payments and average effective tax rate by florida county. The orange county, florida sales tax is 6.50%, consisting of 6.00% florida state sales tax and 0.50% orange county local sales taxes.the local sales tax consists of a 0.50% county sales tax. Taxes are calculated by multiplying the property value less exemptions by the millage rate, which is determined by local taxing authorities.

Orange county property tax collections (total) orange county florida; Property taxes in august to each property owner. The median property tax in florida is $1,773.00 per year for a home worth the median value of $182,400.00.

Metered or bottled gas 10%. Groceries are exempt from the orange county and florida state sales taxes; The determinations made on these pages were also based on the purchase date, the purchase price.

A large portion of orange county’s general use revenue is derived from property taxes. In turn saving you approximately $750 annually. The median property tax on a $228,600.00 house is $2,148.84 in orange county.

The taxable value the local authority places on the property. To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. This equates to $1 in taxes for every $1,000 in home value.

This office is also responsible for the sale of property subject to the power to sell, properties that have unpaid property taxes that have been delinquent over five years. Not where you are from. To calculate your annual property tax, multiply your.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property. Florida is ranked number twenty three out of the fifty states, in order of the average amount of property taxes collected. The property appraiser’s office also determines exemptions for homestead, disability, widows, veterans and many others.

The property appraiser determines the ownership, mailing address, legal description and value of property in orange county. How to calculate property taxes for your property. Box 38 orlando, fl 32802 official records/recording:

Property in orange county, ca, is taxed at a rate of 0.72 percent. The office of the tax collector is responsible for collecting taxes on all secured and unsecured property in orange county. Florida real property tax rates are implemented in millage rates, which is 1/10 of a percent.

In order to receive the homestead tax exemption for 2021 you must apply before march 1, 2021. Figuring florida property tax rates by county is a multipronged calculation that includes millage rates, exemptions and something called “just value.” Tax collected is to be remitted to the orange county comptroller monthly.

The orange county sales tax is collected by the merchant on all qualifying sales made within orange county; Counties in florida collect an average of 0.97% of a property's assesed fair market value as property tax per year. The taxes are due by the following march 31.

The rates are expressed as millages (i.e the actual rates multiplied by 1000). The tax rate for the property (which will be the same % for anyone that owns the home). In order to arrive at the estimated supplemental tax amount, the taxpayer supplied the assessor parcel number or apn and/or the property address for the subject property.

Tax returns and payments are due on the first of the month following collection, and are considered delinquent if not postmarked by the twentieth of the month. Florida statutes) • if they meet certain requirements, veterans 65 or older who are partially or totally permanently disabled may receive a discount from tax on property that they own and use as homesteads. These are the only three factors that go into determining property taxes;

If you need to find your property's most recent tax assessment, or the actual property tax due on your property, contact the orange county tax appraiser's office. Florida property owners may pay a premium for seaside views, but the responsibility of paying property tax falls to everyone, even those who live inland without an ocean in sight. Some information relating to property taxes is.

The median property tax on a $607,900.00 house is $6,382.95 in the united states. Fuel oil, per gallon 4¢. Property tax in florida is determined by three factors:

The median property tax on. The property appraiser’s office also determines exemptions for homestead, disability, widows, veterans and many others. The median property tax on a $607,900.00 house is $4,498.46 in california.

Property taxes (no mortgage) $184,157,500: Please note that we can only estimate your property tax based on median property taxes in your area.

Property Tax - Orange County Tax Collector

Transfer Tax - Who Pays What In Orange County California

Estimating Florida Property Taxes For Canadians - Bluehome Property Management

Orange County Ca Property Tax Calculator - Smartasset

Orange County Ca Property Tax Calculator - Smartasset

Your Property Tax Bill - Forward Pinellas

Florida Property Tax Hr Block

Estimating Florida Property Taxes For Canadians - Bluehome Property Management

Orange County Ca Property Tax Calculator - Smartasset

Soon After Taking The Oath Dehraduns New Mayor Sunil Uniyal Gama Hinted To Revise House Tax In The City Property Tax Tax Consulting Tax Payment

Orange-county Property Tax Records - Orange-county Property Taxes Ca

Florida Property Taxes Explained

A Taxattorney Needs To Be More Punctual Because You Are Dealing With Taxes Taxes Come With A Deadline You Should Try To Be Available Tax Lawyer Tax Attorney

Homeowners Can Save 4 On Their Property Tax Bill By Paying In November - Orange County Tax Collector

Guide To Central Pennsylvania Property Taxes Century 21 Core Partners

Tax Benefits Of Living In Wyoming - Wyoming Real Estate Blog

How To Calculate Property Tax And How To Estimate Property Taxes

Buying A Home Or Condo In Orlando Metro City Realty Buying First Home Home Buying Process First Home Buyer

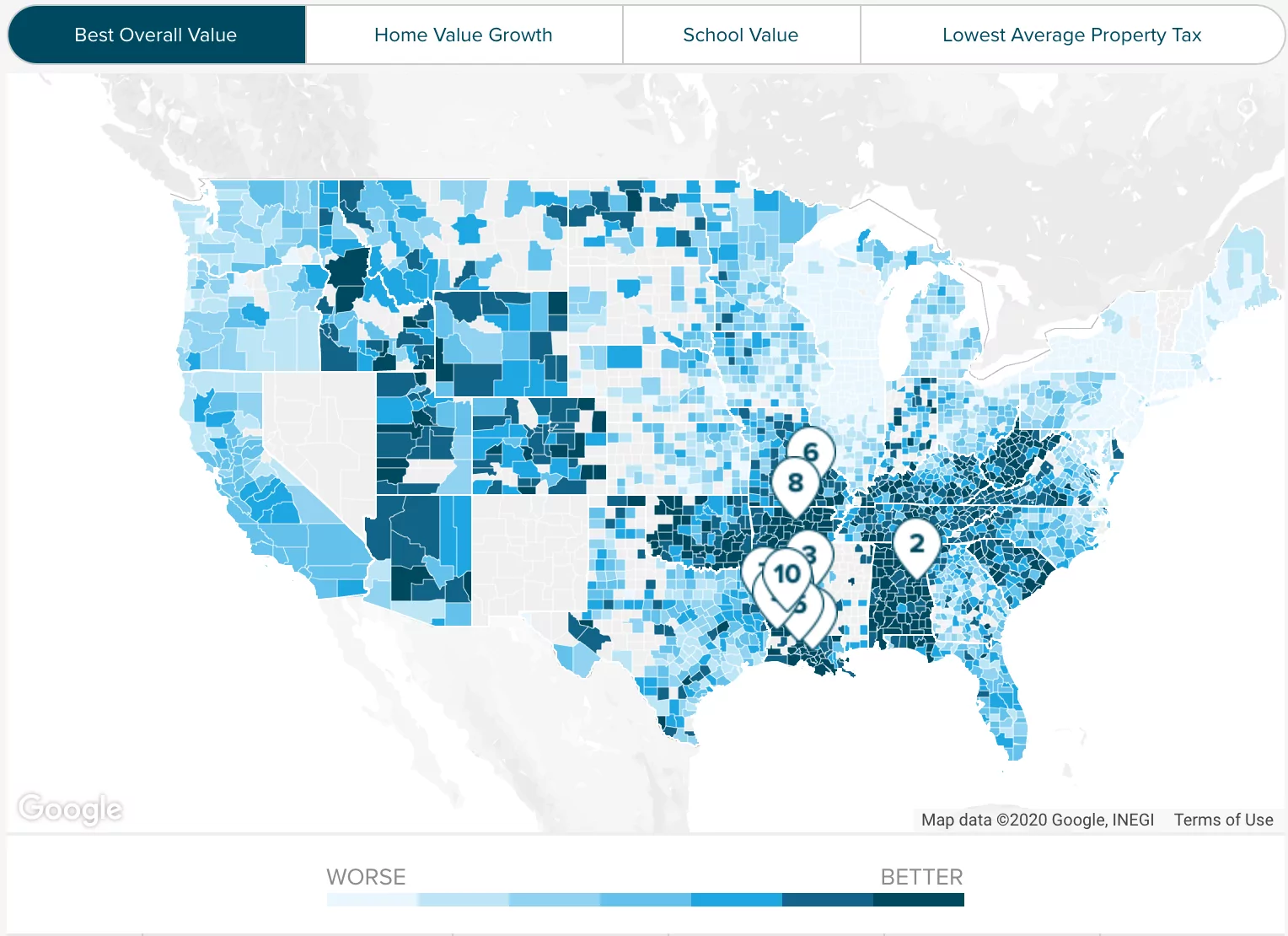

Orlando Property Tax How Does It Compare To Other Major Cities

Comments

Post a Comment