Florida’s capital gains tax rate depends upon your specific situation and defaults to federal rules. Citizen may exempt this amount from estate taxation on assets in their taxable estate.

Florida Estate And Inheritance Taxes - Estate Planning Attorney Gibbs Law - Fort Myers Fl

1, 2022, the corporate tax rate is scheduled to increase to 5.50%.

Florida estate tax exemption 2021. However, the new tax plan increased that exemption to $11.18 million for tax year 2018, rising to $11.4 million for 2019, $11.58 million for. When you buy a home in florida, you have until march 1st of the year following the purchase to file for homestead exemption. Good news, but makes it a little harder to do the math for mutliple gifts in your head.

For 2021, the personal federal estate tax exemption amount is $11.7 million (it was $11.58 million for 2020). If you’re a florida resident and the total value of your estate is less than $11.4 million, you will pay neither state nor federal estate taxes. Chapter 196 exemption entire chapter.

For example, if you bought a home in 2020, you’ll have until march 1, 2021, to file your homestead exemption. Exemption for certain permanently and totally disabled veterans and for surviving spouses of veterans; A married couple can pass twice that amount, or $23,400,000.

Federal unified gift and estate tax exemption. In addition, tax laws are always changing, and a survivor’s estate that is not taxable today may be taxable in the future. 31, 2021, the florida tax rate is 4.458% of the corporation’s florida net income.

In september, the state also increased it’s progressive estate tax rate to as high as 20% for estates valued at more than $10 million. Just now the estate tax exemption in 2021 is $11,500,000. However, if the current federal tax laws remain in place, the exemption amount will be decreased by 50% in 2026.

Legislation was passed in 2019 to establish the current estate tax exemption of $5,490,000. In 2021, the estate tax threshold for federal estate tax is 11 million and seven hundred thousand dollars ($11,700,000.00), meaning that if a decedent has less than 11 million and seven hundred thousand dollars in assets. The late filing date for 2021 is september 20, 2021.

Therefore, prior year’s total household income cannot exceed $30,317. The district of columbia moved in the opposite direction, lowering its estate tax exemption from $5.8 million to $4 million in 2021, but simultaneously dropping its bottom rate from 12 to 11.2 percent. The gross income limitation for the 2021 exemption is $30,317;

Ncome up to $40,400 single/$80,800 married: If you are moving from a previous florida homestead to a new homestead in florida, you may be able to Exemption for surviving spouses of first responders who die in the line of duty.

Florida inheritance and estate tax — 2021 rules alper law. Even though florida doesn’t have an estate tax, you might still owe the federal estate tax, which kicks in at $11.7 million for 2021. You can also late file in some limited circumstances.

For tax year 2017, the estate tax exemption was $5.49 million for an individual, or twice that for a couple. The september proposal accelerated this sunset to the end of 2021, so the base exemption available to taxable gifts and estates would be $5 million ($6.2 million adjusted for inflation) beginning january 1, 2022. Individuals and families must pay the following capital gains taxes.

Florida does not have an estate tax or income tax, so the only taxes that can apply to a florida estate are federal taxes. However, even with the increase, florida’s corporate tax rate will still be one of the lowest in the u.s. If you are a new florida resident or you did not previously own a home, please see this.

The estate tax exclusion is $4,000,000 as of 2021, after the district chose to lower it from $5,762,400 in 2020. Accordingly, estate planning attorneys have been scrambling to get plans in place for clients to utilize the full estate/gift tax exemption available in 2021 should it disappear. The estate tax exemption in 2021 is $11,500,000.

The exemption increases with inflation. As of november 2020, there are no plans to increase the amount of the exemption in 2021. Income over $40,400 single/$80,800 married:

29, 2021, president biden presented a “framework” for a modified bill that eliminated this change, leaving the current law to sunset in 2025. Title xiv taxation and finance. (in 2026, the federal estate tax exemption is scheduled to decrease to $5.6 million, with inflationary adjustments.

Citizen may exempt this amount from estate taxation on assets in their taxable estate. Starting in 2022, the exclusion amount will increase annually based on. What this means is that estates worth less than $11.7 million won’t pay any federal estate taxes at all.

In 2021, the federal unified estate and gift tax exemption is $11,700,000 per individual (up from $11,580,000 in 2020).

Florida Estate Planning Guide Everything You Need To Know

What You Need To Know When Filing Your Real Estate Taxes In 2021 Estate Tax Inheritance Tax Real Estate

Florida Inheritance And Estate Tax Definition Alper Law

Florida Inheritance And Estate Tax Definition Alper Law

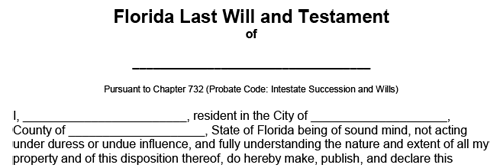

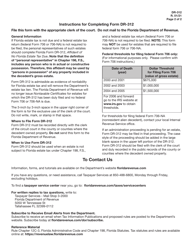

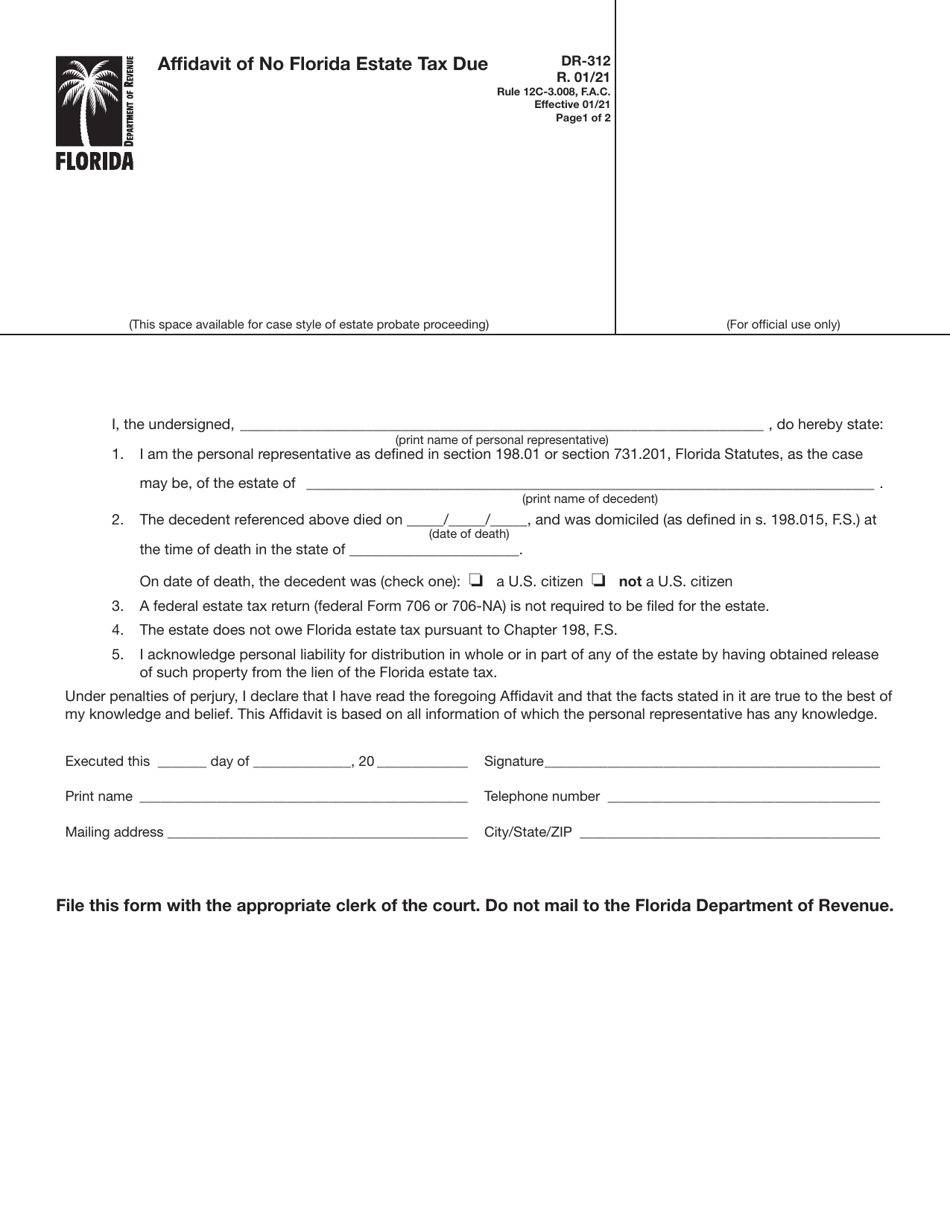

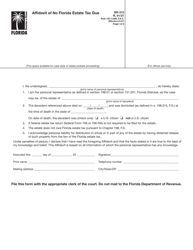

Form Dr-312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Florida Estate Tax - Rules On Estate Inheritance Taxes

Form Dr-312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

Florida Estate Planning An Ultimate Guide - Estate Planning Attorney Gibbs Law - Fort Myers Fl

Will My Florida Estate Be Taxed

Eye On The Estate Tax Nottingham Advisors

![]()

Florida Inheritance And Estate Tax Definition Alper Law

What You Need To Know About Estate Tax In Florida St Petersburg Estate Planning Lawyers

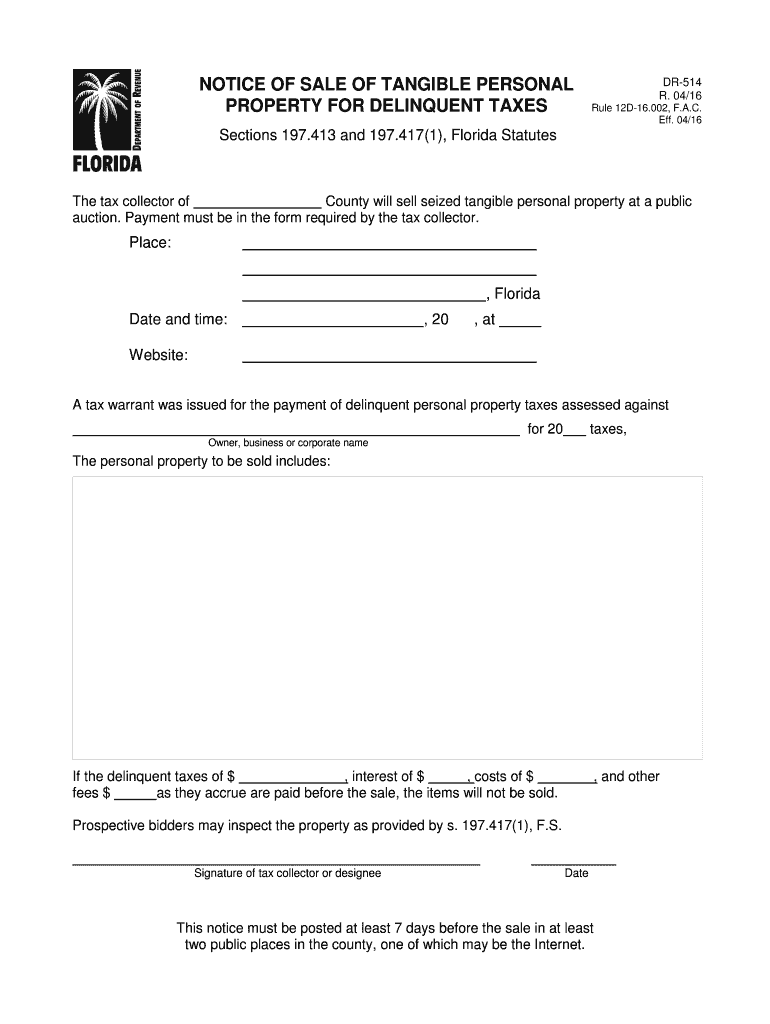

Fl Dr-514 2016-2021 - Fill Out Tax Template Online Us Legal Forms

Florida Estate Planning Guide Everything You Need To Know

Florida Attorney For Federal Estate Taxes Karp Law Firm

How Can I Avoid The Massachusetts Estate Tax - Heritage Law Center

Form Dr-312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

Estate Tax Landscape For 2021 And Beyond

Comments

Post a Comment