If you're getting few results, try a. Ideal candidate will have at least 5 years of corporate experience in a law firm environment, excellent client relationships and interpersonal skills, and a strong academic background.

Immigration Attorney Jobs In Houston Texas Tax Attorney Job Project Finance

Apply to associate attorney, attorney, general counsel and more!

Tax attorney jobs houston tx. Search for jobs, read career advice from monster's job experts, and find hiring and recruiting advice. Search careerbuilder for tax attorney jobs in houston,tx and browse our platform. Tax lawyers in the tax planning group provide u.s.

People who searched for tax attorney jobs in houston, tx also searched for associate attorney, tax counsel, tax lawyer, tax consultant, tax associate, vice president tax, senior associate ma tax, tax partner, wealth strategist, tax director. The median property tax in houston county, texas is $750 per year for a home worth the median value of $6. The office of the attorney general is a dynamic state agency with over 4,000 employees throughout the state of texas.

Hero images / getty images when you take on a second job, your primary goal is likely to pay. Comprehensive list of tax lawyers houston, alabama. Tax attorneys are involved in tax research and planning on a wide range of transactions and.

Tax attorney jobs governments around the world are implementing policies that demand greater financial transparency and seek higher tax revenues from corporate taxpayers. Favorite this post nov 18 highly recommend family law attorney Cantrell & cantrell, pllc home page | texas tax attorneys.

Search results for tax attorney jobs in houston, tx. Comprehensive list of tax lawyers houston. Chamberlain hrdlicka is searching for a corporate associate attorney for its corporate section in its houston, texas office.

In order to speak with an experienced tax attorney today, at no cost to you, call (832) 990 6704. 135 tax attorney jobs available in houston, tx on indeed.com. Is committed to serving the houston community and surrounding areas in domestic and international tax law matters using their expertise.

I called houston tax attorney, kreig mitchell llc after receiving an audit notice from the irs. Tax lawyers in the tax planning group provide u.s. As the old adage goes, taxes are a fact of life.

Apply now for jobs that are hiring near you. Leverage your professional network, and get hired. Navigating the evolving global tax environment requires experience and a deep understanding of the practical impact on multinational companies and investors.

New tax attorney jobs added daily. Apply for this job save job. Favorite this post nov 28.

Tax advice to exxonmobil’s worldwide business on a wide variety of domestic and international tax planning issues. We handle irs tax issues in the houston, tx and surrounding areas. Tax advice to exxonmobil’s worldwide business on a wide variety of domestic and international tax planning issues.

Our agency provides exemplary legal representation to the state, fights human trafficking, helps victims of crime, protects our constituents, and runs the most effective medicaid fraud control and child support enforcement programs in the nation. Or, if you prefer, please complete the form below and we will contact you as soon as possible. Cantrell & cantrell, pllc is a houston law firm that specializes in tax law, providing tax advice to individuals and businesses, planning complicated tax transactions, reviewing or preparing tax returns, handling irs exams and appeals, and trying cases before the united states tax court.

Today’s top 70 tax attorney jobs in houston, texas, united states.

Tax Lawyers - The Wilson Firm

Construction Attorney Jobs In Atlanta Georgia Tax Attorney Job Contract Jobs

Everything You Need To Know About Civil Rights Law Jobs In 2021 8 New

Cantrell Cantrell Pllc Home Page Texas Tax Attorneys

Telecommunications Attorney Jobs In Houston Texas Job Attorneys Illinois

Top 10 Reasons Most General Practice Firms Have No Idea How To Hire And Evaluate Patent Attorneys Bcgsearchcom

Cantrell Cantrell Pllc Home Page Texas Tax Attorneys

Find The Best Entertainment Law Jobs In 2021 8 New

Tax Law Salary Northeastern University Online

Renesha Fountain Tax Controversy Attorney Tax Lawyer Chamberlain Hrdlicka Chamberlain Hrdlicka Attorneys At Law

Insurance Attorney Jobs In Atlanta Georgia Finance Jobs Project Finance Tax Attorney

My Home Away From Home Divorce Attorney Love My Job Law Firm

Attorney Resume Examples Job Descriptions Resume Summary Templates Cakeresume

Tax Attorney Jobs Glassdoor

Tax Attorney Houston The Woodlands San Antonio Austin

Find The Best Human Rights Lawyer Jobs In 2021 8 New

Different Types Of Lawyers - Slide Share

Intellectual Property Law Jobs - What Are The Prospects 12 New

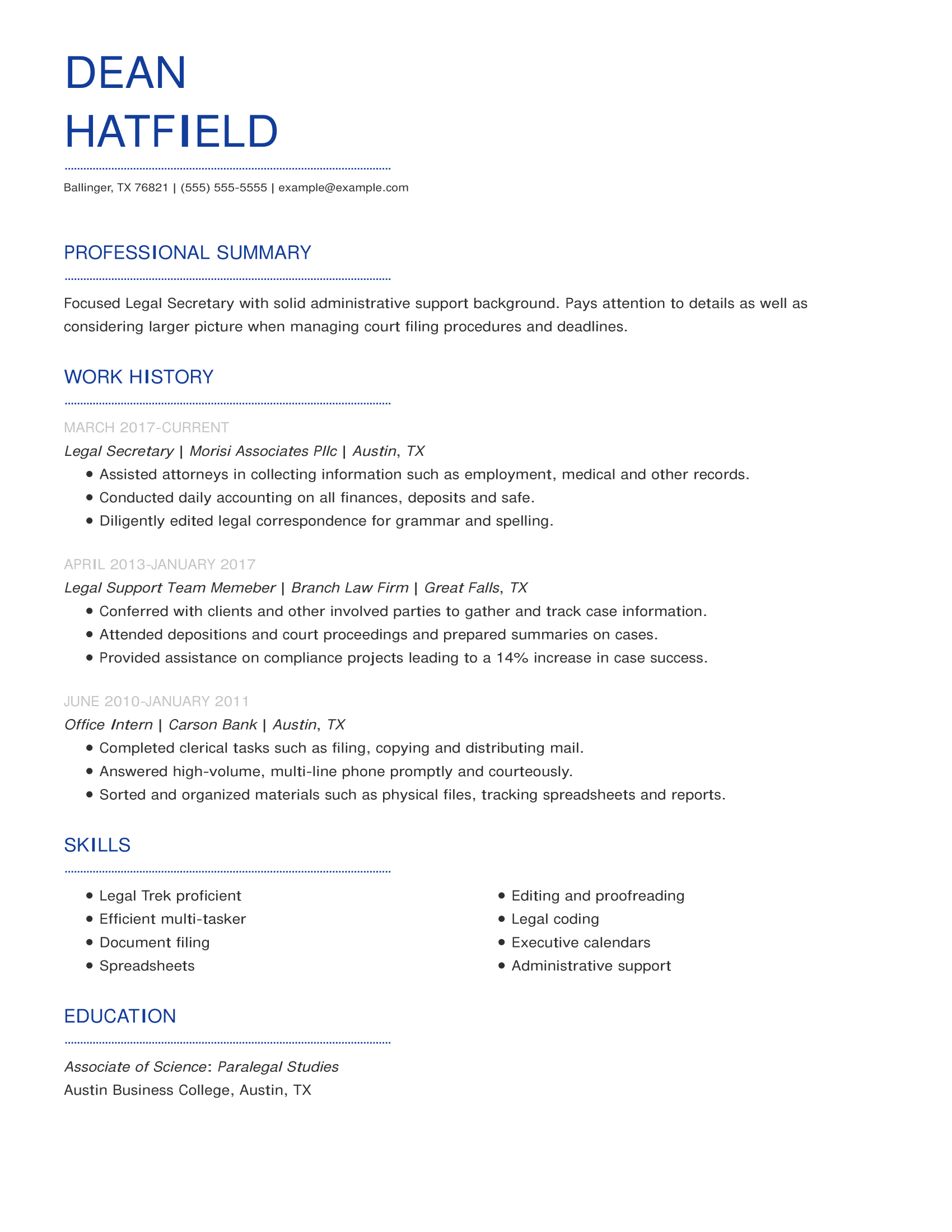

Professional Law Resume Examples For 2021 Livecareer

Comments

Post a Comment