Your annual federal business tax return is due march 15th instead of april 15th. How s corporations help save money.

Income Tax Calculator Fy 2018 19 Pdf Tax Deduction Income

Corporate tax rate calculator for 2020.

S corp dividend tax calculator. Dividend tax rates for the 2020 tax year. The same principles above apply to dividends earned in the 2020 tax year. This calculator helps you estimate your potential savings.

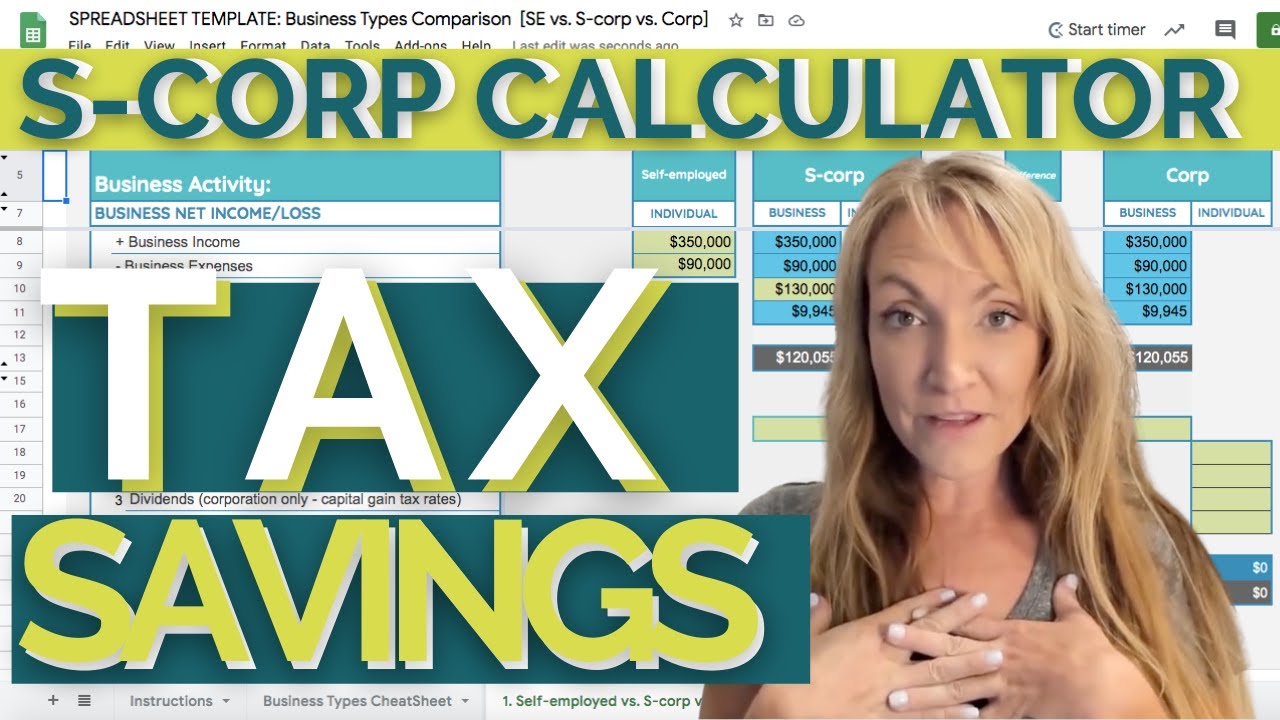

We strive to make the calculator perfectly accurate. This offers you an estimate for your business net income for the year to use in our s corp tax savings calculator. Our small business tax calculator has a separate line item for meals and entertainment because the irs only allows companies to deduct 50% of those expenses.

You can view the annual value of your property at mytax.iras.gov.sg. learn to use fannie mae’s form 1084 to calculate supportable income using tax returns. You can calculate your property tax from five preceding years up to the following year.

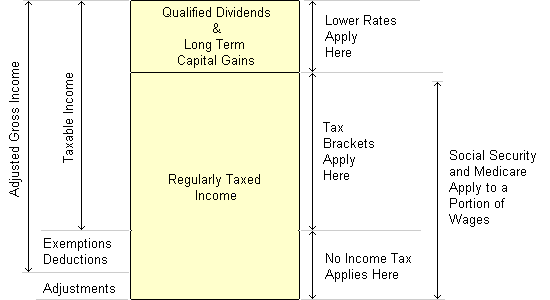

This page and calculator are not intended to be used and cannot be used by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Let's calculate your canadian corporate tax for the 2020 financial year. (if you have a high income, you may pay a 20% dividend tax and the 3.8% net investment income tax, also known as the obamacare tax.) exception #2:

Income is taxed only once, when the income is earned by the s corporation, whether the income is reinvested or distributed. The provided information does not constitute financial, tax, or legal advice. From the authors of limited liability companies for dummies.

The tax rate on nonqualified dividends the same as your regular income tax bracket. The s corp tax calculator. Since c corporations are treated as separate taxable entities, the corporation pays corporate income tax on its income, and shareholders pay personal income tax on their dividends.

This tax calculator shows these values at the top of. Distribution is not taxed if you have a stock basis. You pay taxes on the net income, not the distribution.

S corp qualified dividends usually refer to the dividends paid out of earnings accumulated during the tax years when an s corporation operated as a c corporation.they are often taxed at a special rate in the hands of the shareholders. The calculator will help you estimate your property tax payable, based on the annual value of your property. It is taxed at a normal ordinary income tax rate.

How s corps create savings. We strive to provide you with the most robust tools possible, noting that there are many variables to consider, assumptions to be made, legislative changes to incorporate, and limitations to online calculating. S corps create tremendous savings because they reduce the biggest expense many llc owners face:

How an s corporation saves you money. Now, if $50 of those $75 in expenses was related to meals and. You might be asking about the net income (after you pay yourself).

Money › taxes s corporation distributions. Rates again vary from 0% up to 20%, though most taxpayers will likely fall in the middle 15% bracket. The tax rate on qualified dividends is 0%, 15% or 20%, depending on your taxable income and filing status.

For example, if you have a business that earns $200 in revenue and has $75 in expenses, then your taxable income is $125. Get the spreadsheet template here: This calculation is only valid if your business income is $132,000.

The s corporation tax calculator below lets you choose how much to withdraw from your business each year, and how much of it you will take as salary (with the rest being taken as a distribution.) it will then show you how much money you can save in taxes.

S Corp Vs Llc Calculator - When To Elect S Corp How To Start An Llc Guide

Updated 2021 Take Home Pay Calculator Employee Vs Limited Company

S-corporation Tax Calculator Spreadsheet--when How The S-corp Can Save Taxes Vs Sole-proprietor - Youtube

S Corp Tax Calculator - Llc Vs C Corp Vs S Corp

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Determining The Taxability Of S Corporation Distributions Part Ii

Marginal Tax Rates How To Calculate Ontario Income Tax Kalfa Law

Quickly Discover How Incorporating An Llc Can Save Money On Taxes Using An S Corporation Tax Calculator

Income Tax Calculator Basics For Beginners By Corwhite Corp - Issuu

How Much Tax Do You Pay On Dividends - Jf Financial

Tax Semi Pdf Corporate Tax In The United States Dividend

Updated 2021 Take Home Pay Calculator Employee Vs Limited Company

Dividend Tax Calculator Taxscouts

Free Tax Estimate Excel Spreadsheet For 201920202021 Download

S-corporation Tax Calculator Spreadsheet--when How The S-corp Can Save Taxes Vs Sole-proprietor - Youtube

S Corp Tax Calculator - Llc Vs C Corp Vs S Corp

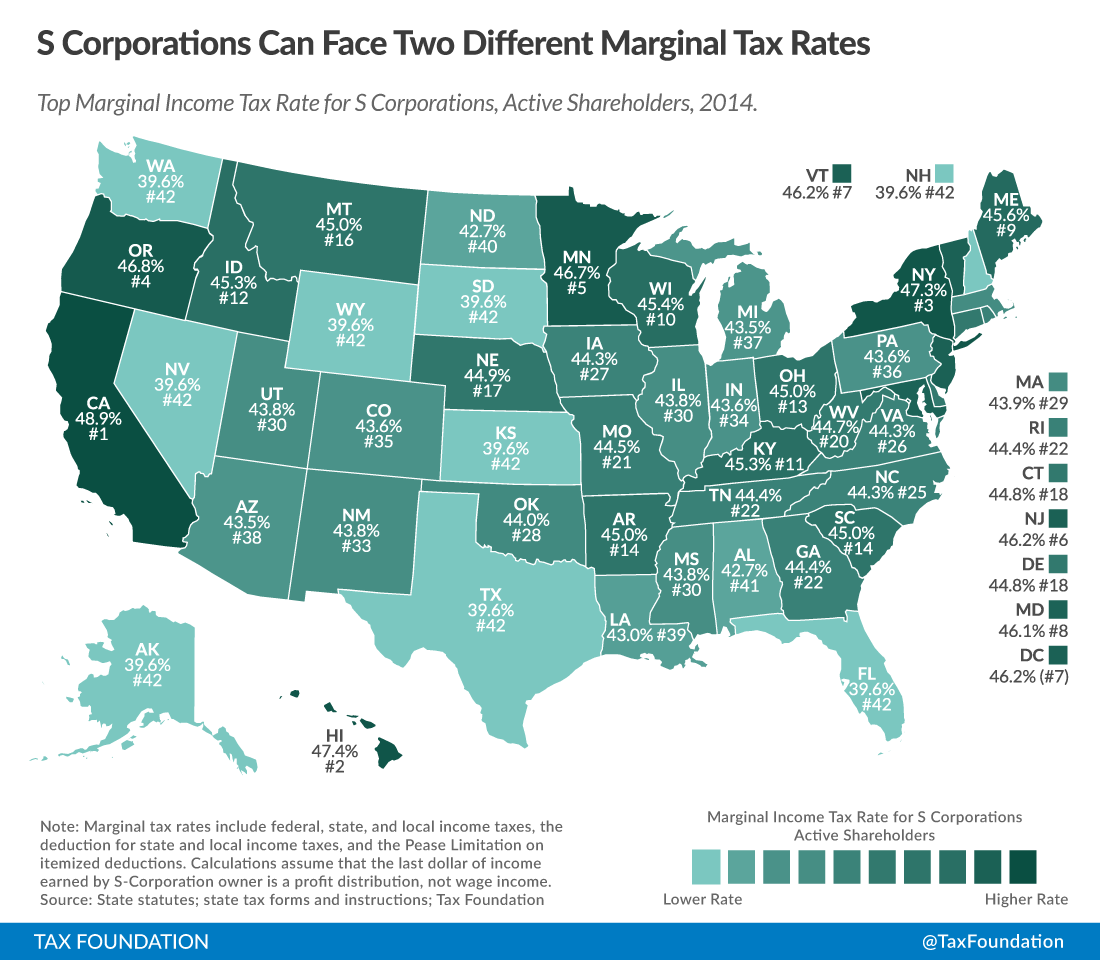

The Dual Tax Burden Of S Corporations Tax Foundation

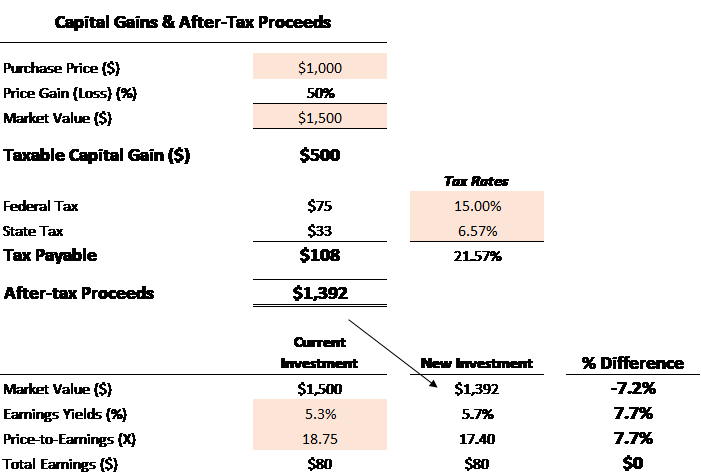

Capital Gains Tax Calculator For Relative Value Investing

Dividend Tax Calculator - Earn More Sleep Peacefully

Comments

Post a Comment