Tax refund deposit through tax products sbtpg llc. When a financial institution has a questionable or potentially suspicious ach credit from a tax agency, it should follow one of the above methods for alerting the.

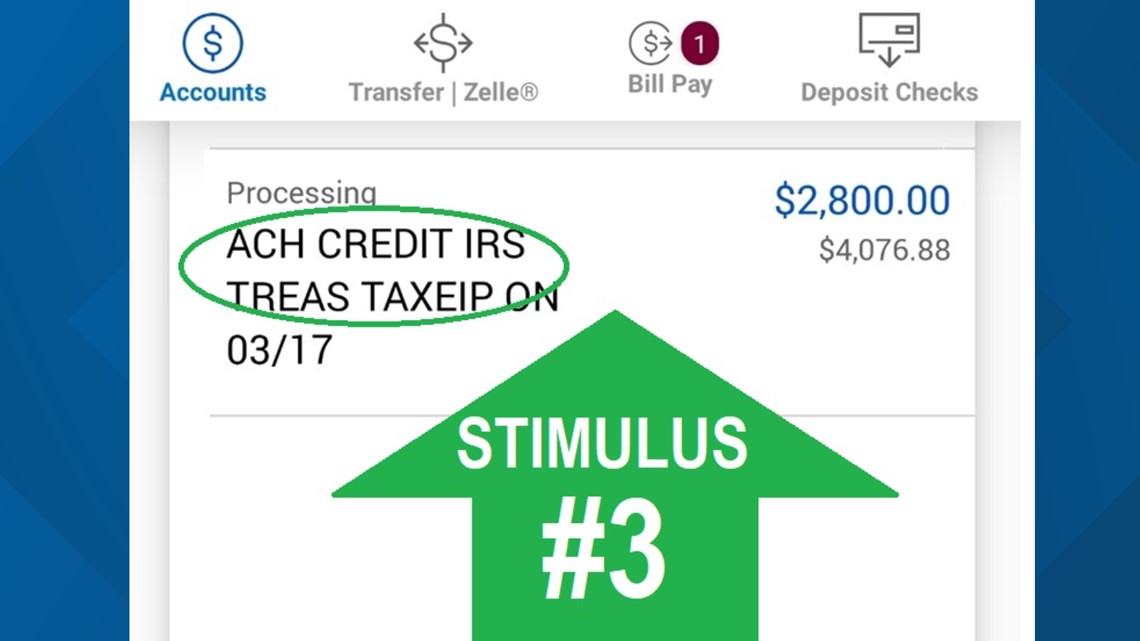

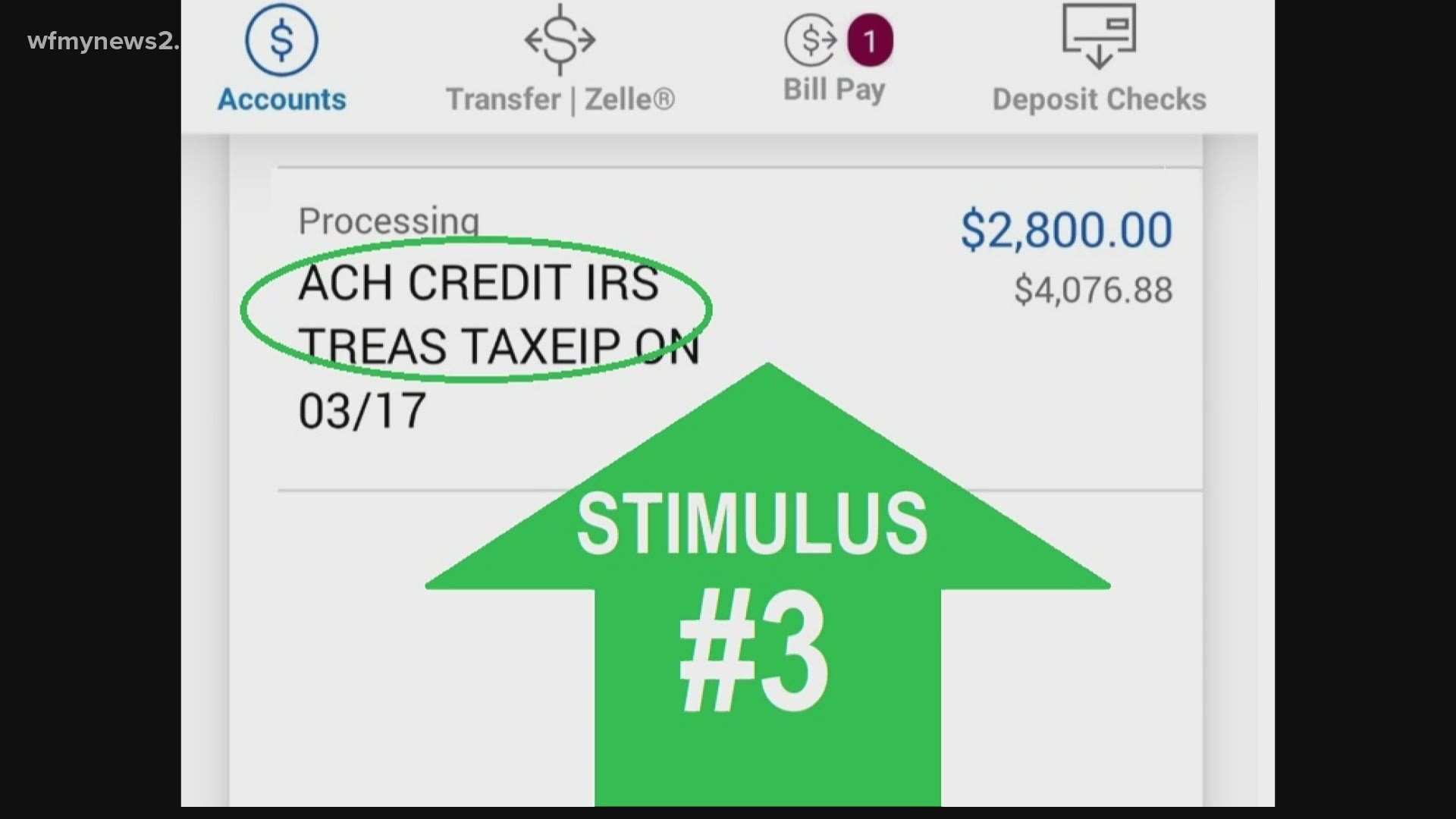

Did You Get The Stimulus Look For Ach Irs Treas Tax Eip Wfmynews2com

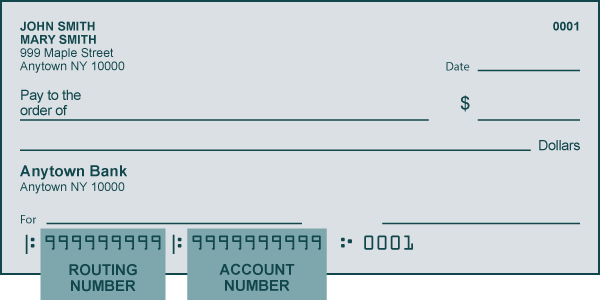

The payer initiates a payment through his or her bank, which then electronically transmits the payment through the ach to the recipient's bank account.

Ach credit tax products pr gss. If you sign up for ach refund, your refund will automatically be deposited directly into your bank account. Nacha estimates that 113 million eip2s will be made by ach direct deposit. They take a fee out of the deposit, then the funds are.

Cbp offers the opportunity to receive refunds, resulting from overpayment of customs duties, taxes, and fees, electronically through automated clearinghouse (ach). Get the most out of your thomson reuters tax & accounting products. How many eip2s will be made by ach?

Greg test thatcher 85552 az usa; Ach refund automates the time consuming process of depositing treasury checks, as well as eliminating the The state's financial institution submits the ach credit files to the federal reserve bank (frb).

Eftps must receive your customers’ ach credit tax payments by 2:15 a.m. Our continued learning packages will teach you how to better use the tools you already own, while earning cpe credit. But it seems as tho the additional fee for having turbo tax fees abducted from my federal tax return isnt includdd with that total amount.

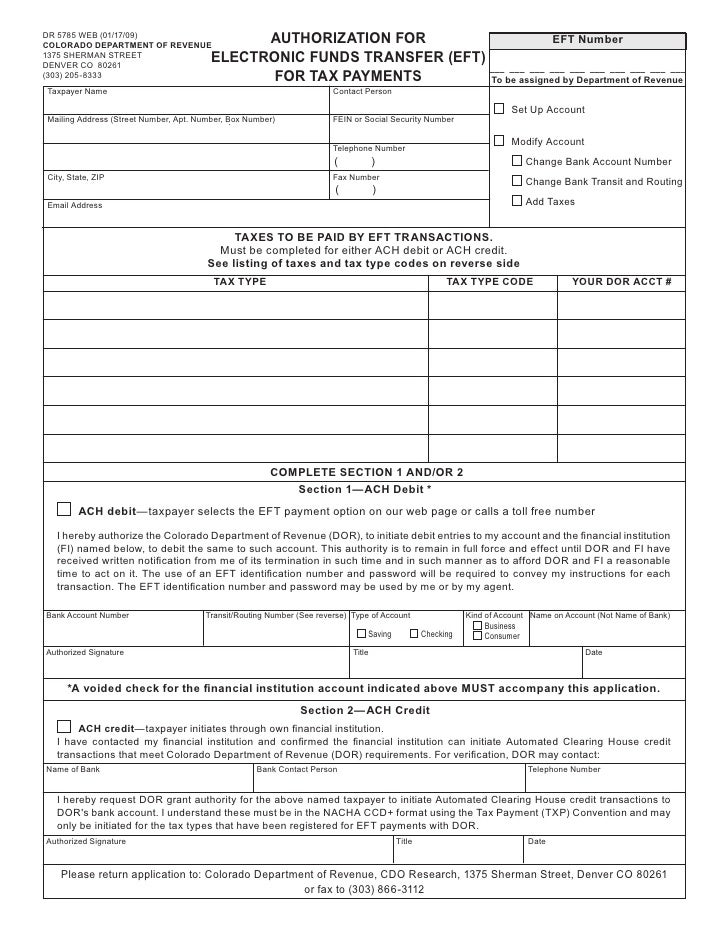

• ensure that payments are directed to eftps—not the. When you scroll down and hit order details for the tax year, it then says total fees (taxes included) and lists an amount. The ach credit option allows states to submit ach credit transactions on behalf of taxpayers that have had a state refund levied by irs.

You'll naturally pay less if you have higher volumes, but the same is true for credit card payments. Tax liability net of credits (line 17 less lines 18(e) and 19(d)) 21. Global blue schweiz ag zürichstrasse 38 8306 brüttisellen/zh switzerland t:

Odfi’s requesting that an rdfi return an ach credit related to a tax refund credit using the r06 return reason code should also ensure that the tax agency (originator) is aware. What do tax products pe4 sbtpg llc means? An ach debit transaction is the converse of the ach credit.

Enter a term in the find box. Local federal reserve bank to conirm ach deadlines. Its on the home screen.

Sgml files are typically used by programmers. The average cost for sending and receiving ach payments are around $0.29 per transaction. (in the rdfi’s local time) on that date.

Vp at a credit_union ($162musa) we have a customer that prepares taxes. 044 805 60 79 e: 044 805 60 70 f:

An ach credit occurs when funds are deposited electronically into an account. For eip2s made by ach direct deposit with a settlement date of monday, january 4, 2021, an rdfi is required to make funds available for cash withdrawal by 9 a.m. We may also ask to see your driver’s license or other identifying documents.

Date of birth and social security or tax identification number as well as other information that will allow us to identify you. My refund from federal was due to come today and 1000's short of what federal refund site says it. Once you receive authorization and the state or locality has provided their bank account and routing number information, this data should be verified in the tax agents screen and the bank account should then be set to approved status.

Pdf files are available for all products. The ach debit transaction is then initiated and posts against the taxpayer's bank account on the date specified by the She just received a very large ach deposit from tax products sbtpg llc.

19(b) credit from line 33 of form as 2915.1 a of the same taxable period 19(c) total available credit (add lines 19(a) and 19(b)) 19(d) amount of credit used in this return (see instructions) = = + 20. Richtig ausgefüllt rempli correctement compilato correttamente. The refund is sent to them, the fees are.

Companies that have an ach debit block account will need to contact their financial institutions to provide the prtd with the company id to authorize. What is tax products pe1 sbtpg llc???????? Miscellaneous ach credit ach credit :

If you opted to pay your turbo tax fees by using your refund, the refund processing service used is santa barbara tax products group. Select a category (column heading) in the drop down. Frb sends the ach credit file information to eftps for processing.

The ach debit method allows you to transfer funds by giving the treasury permission to electronically debit a bank account you control for the amount of your tax deposit. As a general rule, the 11.5 percent import use tax is applicable to goods imported into puerto rico by any importer of record of such goods, except items introduced by postal service or air carrier, which shall be paid before the taxpayer takes possession of the article. Sales tax of merchants who do not have commercial location in puerto rico or

It appears this is a third party used with turbo tax and other companies to get tax refunds quicker. Miscellaneous ach credit ach credit : Et on the due date.

Californians who received the earlier gss i payment could be eligible for a gss ii check for $500 or $1,000 only if they claimed a qualifying child or relative as a dependent on their 2020 tax return. Because of this, all bank accounts added to the tax agents for ach credit purposes are set to prenote status. Setting up ach credit tax payment services.

Ach is an option for businesses of any size.

Natural Gas Tax Guide - Texas Comptroller Of Public Accounts

Testing The Impact Of Value-added And Global Income Tax Reforms On Korean Tax Incidence In 1976 An Input-output And Sensitivity Analysis In Imf Staff Papers Volume 1981 Issue 002 1981

Stimulus Check What Is An Ach Credit From The Irs - Ascom

Did You Get The Stimulus Look For Ach Irs Treas Tax Eip Wfmynews2com

2

Direct Deposit Of Your Income Tax Refund

Coloradogov Cms Forms Dor-tax Dr5785f

Zillionformscom

Industry 40 Technologies Deloitte Insights

Pdf Potential Implementation Of Goods And Services Tax As A Substitute For Value Added Tax In Indonesia

2

Pdf Buku Metodologi Penelitian Edisi Revisi Tahun 2021

2

2

Why Do Businesses Choose Ach The Benefits Of Ach Payments Plaid

Why Submit Electronic Sales Tax Payments Via Ach Credit

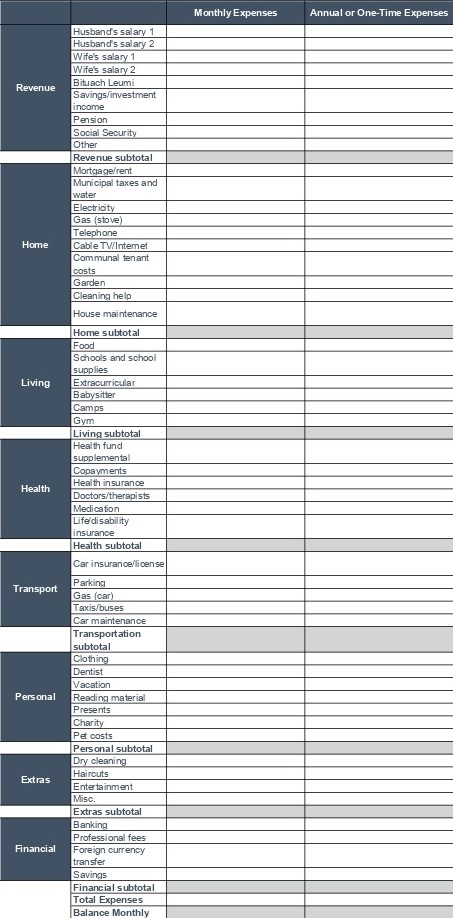

Building Your Own Budget - Financial Guide To Aliyah And Life In Israelcom

Pdf Navigating Transfer Pricing Risk In The Oil And Gas Sector Essential Elements Of A Policy Framework For Trinidad And Tobago And Guyana

Iraq Request For Stand-by Arrangement In Imf Staff Country Reports Volume 2006 Issue 015 2006

Comments

Post a Comment