If you have problems opening the pdf document or viewing pages, download the latest version of adobe acrobat reader. In india the treaty deals with the income tax and the necessary surcharges.

Pin By Claire Queenan On International Affairs In The 1920s Essay Peace Free Resume

Exemption from the withholding or a lower rate may apply if your home country has a tax treaty with the u.s.

Us germany tax treaty summary. Convention between the united states of america and the federal republic of germany for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income and capital and to certain other taxes, together with a related protocol, signed at bonn on august 29, 1989. The protocol signed at berlin on june 1, 2006 amended article 26 of the tax treaty between the united states of america and the federal republic of germany for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes. The u.s./canada tax treaty addresses those.

Income payments (dividends and payment in lieu) from u.s. A quick read both canada and the us have established beneficial tax relationships with other nations to encourage commerce and reduce overall tax burdens. In the federal republic of germany this will include sleeping partnership interests and in the united states equity.

As a result, citizens and permanent residents of these two countries may have different tax return obligations based on their location. Managing partner, global tax and legal services, pwc united states. Global tax and legal services clients & markets leader, pwc united states.

Most importantly for german investors in the united states, the protocol would eliminate the withholding The indian tax treaty with germany was signed on october 26, 1996. Certain exceptions modify the tax rates.

The complete texts of the following tax treaty documents are available in adobe pdf format. Klaster kemudahan berusaha bidang perpajakan; In germany this treaty accounts for the income tax, the capital tax, the corporation tax, and the trade tax.

Indonesian tax administration ruling of june 24, 2005 • one of the underlying objectives of tax treaties is the prevention of fiscal evasion and tax avoidance. With its tax law, germany aims to prevent both the double taxation and the. (updated to august 1, 2015) country interest

This means that if you are a us nra, you would report the interest on your us tax return, but then use the foreign tax credit to reduce any taxes owed to zero. The tax authorities can order a wht of 15.825% (including solidarity surcharge) if ultimate collection of the tax due is in doubt. In addition, the convention will provide for exemption of german residents from united states tax on united states social security benefits.

Global tax and legal services leader, pwc united kingdom. This provision will help certain. For further information on tax treaties refer also to the treasury department's tax treaty documents page.

Tax on loans secured on german property is not imposed by withholding, but by assessment to corporation tax at 15% (plus solidarity surcharge) of the interest income net of attributable expenses. The convention further provides both states with the flexibility to deal with hybrid financial instruments that have both debt and equity features. Sources into your ib account may have u.s.

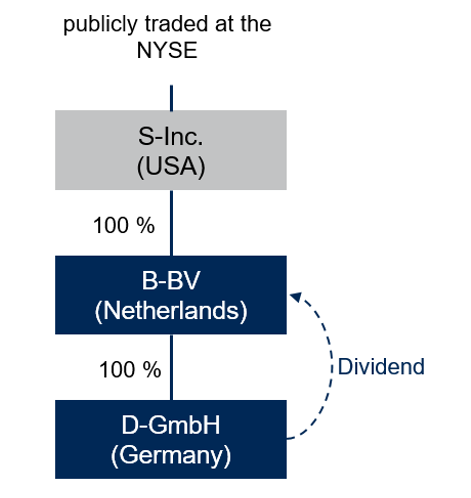

• a financing structure designed to avoid the increased withholding tax by taking advantage of a treaty with another country amounts to treaty shopping or treaty abuse. Convention between the united states of america and the federal republic of germany for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income and capital and to certain other taxes, together with a related protocol, signed at bonn on august 29, 1989. According to the 1964 double taxation agreement between germany and the united kingdom, an uk or a german resident working in the other state for more than 183 days in a calendar year, the employment taxes will levied by the other state.

This includes domestic german tax legislation such as the income tax act and the fiscal code, as well as double taxation agreements that germany has concluded with other countries. International tax treaty rates 1 (%) 1 withholding tax rates applied by canada to certain payments to residents of selected countries with which it has signed international tax treaties. For most types of income, the solution set out in the treaty for us expats to avoid double taxation in germany is that they can claim us tax credits against german taxes that they’ve paid on their income.

United states and germany sign new protocol to income tax treaty summary on june 1, 2006, the united states and germany signed a protocol (the “protocol”) to the income tax treaty between the two countries as amended by a prior protocol (the “existing treaty”).

2

The War In The Pacific - Reading Worksheet Student Handouts History Worksheets High School American History World History Lessons

The Dawes Plan 1924 The Young Plan 1929 How To Plan German Propaganda Lent

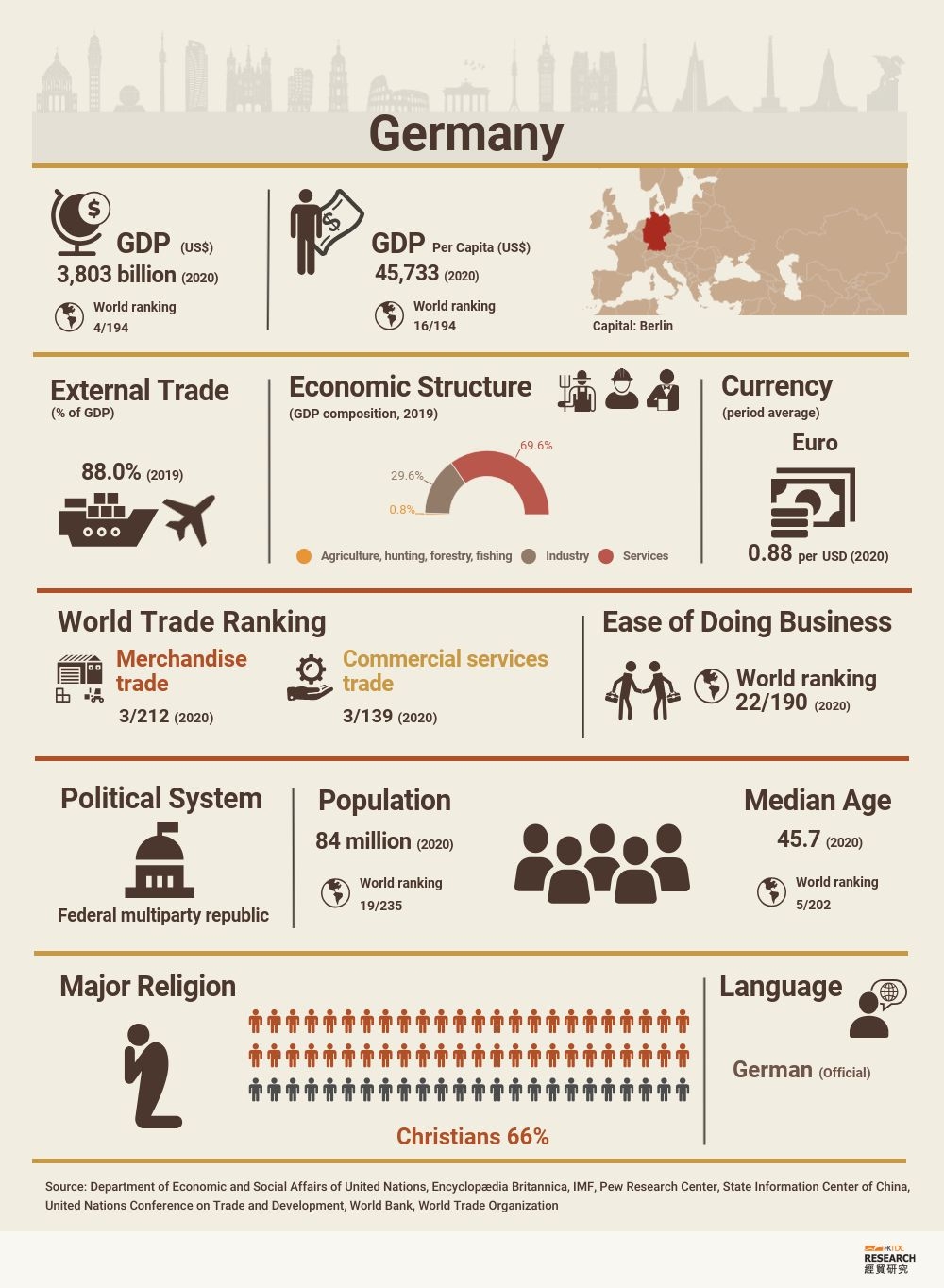

Germany Market Profile Hktdc Research

2

Rd Tax Incentive In Germany

Pin By Eris Discordia On Economics Growth American Economy Number Games

Pin By Claire Queenan On International Affairs In The 1920s How To Plan Economy Germany

2

Us Expat Taxes For Americans Living In Germany Brighttax

What Is The Us Germany Income Tax Treaty - Becker International Law

Pin On Teaching Resources

Alternate Future Of The World - Road To Ww3 - The Movie - Youtube Music Publishing Life Is Strange Movies

Psychological Disorders Note Guide Psychology Disorders Psychology Abnormal Psychology

Us Expat Taxes For Americans Living In Germany Brighttax

New Tax Return Filing Obligation For Non-residents In Germany Wts Global

Germany Stay Compliant When Working From Home Wts Global

Germany Adopts Substantial Transfer Pricing And Anti-treaty Shopping Rule Changes Mne Tax

Imgurcom Australia Map Rainfall World Geography

Comments

Post a Comment