Tax treaties details of tax treaties in force between the uk and cayman islands, provided by hmrc. 20 / 0 or 25 / 12.5 or 25:

Important Changes For Cayman Islands Investment Funds Aml Regulations Vistra

Cayman islands (last reviewed 03 august 2021) na:

Cayman islands tax treaty. (a) in the case of the united states, all federal taxes; Agreement between the government of the cayman islands and the government of the united states of america to improve international tax compliance and to implement fatca whereas, the government of the cayman islands and the government of the united states of As there are no treaties involved, there is:

The government of the cayman islands under entrustment from the government of the united kingdom of great britain and northern ireland. Cayman islands/uk double tax treaty the cayman islands/uk double taxation arrangement (dta) was signed in june 2009 and it entered into force in december 2010. It should also be obvious to the editor of the economist (and in fairness, he draws reference to the offending eu based double treaty tax jurisdictions) that the zero tax jurisdictions, notably the cayman islands, are in no way involved in the mechanics of profit shifting by way of the application of the excessive transfer pricing practices of these us corporates.

Whereas the government of the united kingdom has issued a. This protocol shall form an integral part of the agreement kingdom of the netherlands and the government of the cayman between the islands as authorised under the letter of entrustment from the united kingdom of great britain and northern ireland for. If you are having difficulty locating a treaty, please call the enquiry team on +44 (0)20 7920 8620 or email us at library@icaew.com.

Cayman does not have legal mechanisms or treaties (such as double taxation agreements) in place with other countries to legally transfer tax bases from one country to. In march 2009, the cayman islands successfully concluded technical negotiations on a series of bilateral agreements with seven nordic states, including tax information agreements, and went on to sign additional information agreements with g7 and oecd. It’s effective in the uk and the cayman islands from:

Chile (last reviewed 31 july 2021) resident: The treaties currently in force are: And (b) in the case of the cayman islands, any tax imposed by the cayman islands which is substantially similar to the taxes described in subparagraph (a) of this paragraph.

Chad (last reviewed 03 august 2021) resident: The first steps towards tax information exchange agreements (tieas) was taken in march 2009, when the cayman islands government put in place arrangements to provide access to comprehensive tax information assistance with 20 countries including the majority of cayman’s major trading partners. The cayman islands also had eight bilateral tax.

Cayman entered into a mutual legal assistance treaty with the usa, although the treaty specifically excludes financial matters. Argentina, the british virgin islands, bahamas, bermuda, cayman islands, guernsey, isle of man, jersey, liechtenstein, and san marino. 1 april 2011 for corporation tax

“the cayman islands reported that it is currently reviewing the possibility to sign the multilateral instrument and it intends to amend the tax treaties bilaterally with its treaty partners. And the government of canada for the exchange of information on tax matters. 20 / na / na;

It started to be effective in the cayman islands starting with april 2011 for the corporation tax and for the income and capital gains tax and from december 2010 for other taxes. The double taxation arrangement entered into force on 20 december 2010. It is not the cayman islands.

The taxes which are the subject of this agreement are, in the case of canada, all taxes on income and on capital imposed or administered by the government of canada, and in the case of the cayman islands, all taxes on income and on capital imposed or administered by the cayman islands, including any taxes on income and on capital imposed or administered after the date of signature of this agreement. The multilateral convention on mutual administrative assistance in tax matters, which allows tax information exchange with more than 140 countries; 1) no affect or limit on the operation of other.

In the recent years, china has concluded tiea with some jurisdictions that impose no tax on income, which includes the following: 5 cayman islands tax neutrality does not affect the domestic taxing rights of other countries, therefore other countries do not lose tax revenue as they do when allocating or giving up taxing rights to other countries under double taxation treaties. Automatic data exchange as part of the european union savings directive;

Cayman signed its first mutual legal assistance treaty with the usa in the 1980s and has tax information exchange agreements with 36 jurisdictions; This agreement shall apply to the following taxes imposed by the contracting parties. Legal and regulatory framework this report summarises the legal and regulatory framework for transparency and exchange of information for tax purposes in the cayman islands.

Prc treaty countries classified by geographic area. So far cayman islands has concluded 0 tax treaties and is party to a series of treaties under negotiation. 35 / 4 or 35 / 30.

Registration Of Company In Cayman Islands - Offshore In Cayman Islands Company Registration For Business Purposes Lawtrust International

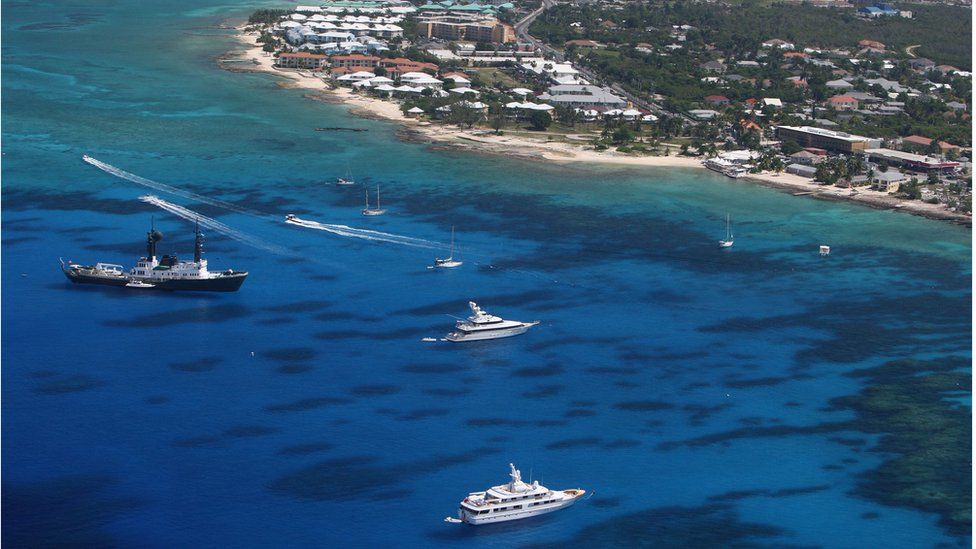

Cayman Islands Profile - Bbc News

Real Difference For Companies In The Bvi And The Cayman Islands Sinda Corporation

Cayman Islands - Exchange Of Information And Tax Enforcement

Cara Kerja Negara Surga Pajak Pajakonlinecom

Is Your Cayman Entity A Private Fund Vistra

What Makes Cayman Islands So Popular For Hedge Funds - International Finance

Taxation In The Cayman Islands Cayman Resident

Why Coronavirus In Cayman Risks Brazilian Offshore Assets By Matthew Feargrieve Medium

Letter From Brussels Pressure Builds On Tax Havens Analysis Ipe

Tax Advice For Uk Citizens Moving To Cayman Cayman Resident

Cayman Islands Profile - Bbc News

Wow Ini Negara Surga Pajak Yang Rajin Investasi Di Ri - Halaman 2

Caribbean Cruises Cayman Islands Cruise Guide Cayman Island Vacation Places Island Cruises

Cayman Resident 2021 By Acorn Media - Issuu

2

Cayman Islands And Cryptocurrency - Freeman Law

Cayman Islands Overview Top Mba Directory

The Cayman Islands

Comments

Post a Comment