Tax collector (brandon office) 211 e government st brandon, ms 39042 get directions physical address tax collector (richland location) 380 scarborough st (richland city hall) richland, ms 39218 get directions physical address tax collector (flowood location) 5417 hwy 25 suite l. Kay pace thank you, madison county voters, for allowing me the opportunity to be your tax collector of madison county, mississippi.

Title Tag - Hillsborough County Tax Collector

Rankin county tax collector office 211 east government street brandon, ms about rankin county dmv the rankin county department of motor vehicles, also known as the bureau of motor vehicles (bmv), is a government agency that is responsible for issuing driver's licenses, collecting fuel taxes, administering vehicle titling and registration, and.

Tax collector office brandon ms. Dps & mvl locations near rankin county tax collector (brandon) 5.0 miles dps driver's license location; Tax collector (brandon office) 211 e government st brandon, ms 39042 get directions physical address tax collector (richland location) 380 scarborough st (richland city hall) richland, ms 39218 get directions physical address tax collector (flowood location) 5417 hwy 25 suite l. Government st brandon ms 39042.

Jackson county is one of 17 counties in mississippi with separate tax assessors and collectors offices since the county's total assessed value is above $65 million. Brandon mississippi 39042 ms usa. The office of tax collector was established by the mississippi constitution (article 5, section 135).

Address, phone number, and fax number for rankin county tax collector's office, a treasurer & tax collector office, at east government street, brandon ms. The office of the tax collector is responsible for collection of the ad valorem taxes on real property, personal property, mobile homes, automobiles, motorcycles, motor homes, trailers and airplanes, privilege taxes on vehicles, vending machines, amusement machines and business license, as well as garbage fees, then to disburse the taxes to the. 10.5 miles commercial driver license office;

Rankin county tax collector's office contact information. See reviews, photos, directions, phone numbers and more for rankin county tax collector office locations in brandon, ms. Kay pace tax collector state certified residential real estate appraiser license no.

The official website of rankin county, mississippi. Rankin county board of supervisors ( website ) 211 e government st, suite a. Find 29 listings related to rankin county tax collector office in brandon on yp.com.

Madison county tax collector office contact information. Welcome to the holmes county tax assessor/collector's web page. The rankin county tax collector (brandon) of brandon, mississippi is located in brandon currently provides 211 e.

Rankin county tax collector (brandon) 211 e. Also called a department of motor vehicles (dmv) or bureau of motor vehicles (bmv), the office's services include administering vehicle titling and registration, enforcing mississippi. The rankin county tax assessor, located in brandon, mississippi, determines the value of all taxable property in rankin county, ms.

Address, phone number, and hours for madison county tax collector office, a dmv, at highway 51, ridgeland ms. 11.6 miles hinds county tax collector (vehicle registration & title); 14.1 miles madison branch tax collector office (registration & title)

In brandon, mississippi and provides a full array of dmv services such as road test, driving license, written cards,identification cards, commercial license, cdl driving and cdl written test. Madison branch tax collector office (registration & title) 171 cobblestone drive. Tax collector (brandon office) 211 e government st brandon, ms 39042 get directions physical address tax collector (richland location) 380 scarborough st (richland city hall) richland, ms 39218 get directions physical address tax collector (flowood location) 5417 hwy 25 suite l.

Linda rollins, tax assessor/collector 1 court square po box 449 lexington ms 39095 office: The rankin county tax collector office, located in brandon, ms, is a government agency that issues driver's licenses and offers other motor vehicle services. Taxable property includes land and commercial properties, often referred to as real property or real estate, and fixed assets owned by businesses, often referred to.

Pin On Mes Enregistrements

Car Tags Property Taxes Hinds Rankin Madison Offices Adjust

Hillsborough Tax Collector Hillstax Twitter

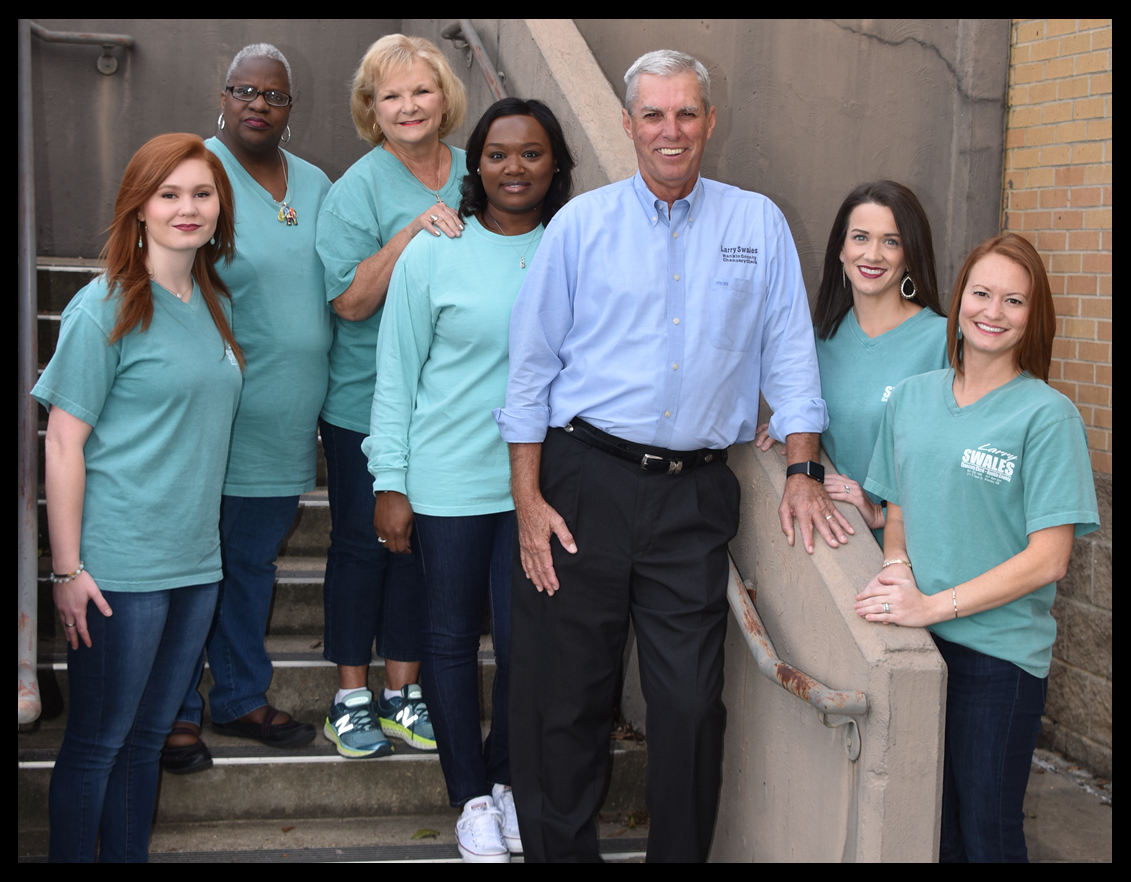

Caroline Gilbertrankin County Tax Collector Government - Rankin County Chamber Of Commerce Ms

Car Tags Property Taxes Hinds Rankin Madison Offices Adjust

Pin On Academic Paper Writing

/cloudfront-us-east-1.images.arcpublishing.com/gray/DF7EBZ3EOZCKNN2WKQJO5UFFPE.jpg)

Ex-rankin County Deputy Tax Collector Arrested For Embezzlement

Rankin County Courthouse Annex Sign In Downtown Brandon Ms Editorial Stock Photo - Image Of Entrance Judge 187787163

Caroline Gilbert Rankin County Tax Collector Facebook

Office Of The Mayor - City Of Brandon Ms - Butch Lee

Caroline Gilbert Rankin County Tax Collector Facebook

Caroline Gilbert Rankin County Tax Collector Facebook

Caroline Gilbert Rankin County Tax Collector Facebook

Land Records Rankin County Mississippi

Car Tags Property Taxes Hinds Rankin Madison Offices Adjust

City Of Brandon - Property Tax Assessment Search

Caroline Gilbertrankin County Tax Collector Government - Rankin County Chamber Of Commerce Ms

Pin By Greg Chai On 7164 Whsms Captain America Hot Toys Captain

The Tax Collector To High Resolution Stock Photography And Images - Alamy

Comments

Post a Comment