The tiebreaker rule provides that the parent with a higher income for the given tax year has the first right to claim the children as dependents when filing taxes. Who claims a child on us taxes with 50/50 custody?

Do I Have To Pay Child Support If I Share 5050 Custody

Transferring tax credit to your ex in a 50/50 custody arrangement.

Who claims child on taxes with 50/50 custody. Whether you have primary custody or joint custody of a child after divorce, the fact remains that only one person can claim the child on each year’s tax forms. But who gets to claim the kids if you have joint custody? Which parent claims the children on taxes with equal parenting time can be decided between the parents, and with the help of an accountant, you both may be able to work out an arrangement that saves you both on taxes.

| (equal) the parent who qualifies as the “custodial parent” under federal tax law is the one who claims the children as dependents. The custodial parent, as defined by the irs, claims the child tax credit in a 50/50 division. However, most parents statethat they have joint custody or 50/50 custody.

The court that handles the child custody case can usually include the tax exemption as part of the order, giving a clear rule for who should use the exemption. Both of you could claim the child, but not for the same tax benefit. Who claims child on taxes with 50 50 custody?

The irs explains, “generally, the custodial parent is the parent with whom the child lived for a longer period of time during the year.” The internal revenue service (irs) typically allows the parent with whom the child lived most during the tax year to claim the child. When parents divorce or separate, the law allows only one of them to claim their child as a tax dependent.

As a custodial parent who spent the most time with the child during the year, you will be entitled to claim head of household, earned income credit and dependent care credit. However, most cases involve the custodial parent with joint physical custody claiming the deduction. Who gets the tax exemption in 50/50 custody cases?

The court has ruled joint “parenting time” or custody, with both you and your spouse spending approximately equal time with your child. California law states that in split 50/50 child custody agreements, the parent with the higher income can claim the child as a dependent on taxes. If you do not file a joint return together but both of you claim the child as a qualifying child, the irs will choose the parent with whom the.

(this is true for parents without an exact 50/50 custody split.) Where two or more taxpayers eligible to claim a specific dependant cannot agree on who will receive the credit, it is denied to all of them. Our firm has more super lawyers than any other organization in the lone star state.

However, there are exceptions to. Ok let me explain, uc is based on the adults circumstances on income and circumstances so it is available for unemployed or people on a low income to top up your salary, it is not available for people who earn money, ie your ex/ the child element of uc pays out for how ever many kids you have, check the gov website in actually fact it is really easy to understand. The 2021 child tax credit was temporarily expanded from $2,000 per child 16 years old and younger to $3,600 for children age 5 and younger and to.

By default, the irs gives this right to the custodial parent—that is, the parent with whom the child lives for more than half of the year. Having a child may entitle you to certain deductions and credits on your yearly tax return. In california joint custody cases where parents share parenting time evenly, it may not be clear who should benefit from the tax exemption.

Who claims child on taxes with joint custody? This can free up some extra money in tax. Whether you have primary custody or joint custody of a child after divorce, the fact remains that only one person can claim the child on each year’s tax forms.

The parent with the higher adjusted gross income (agi) gets to claim the child if custody is split exactly 50/50, which is technically difficult when there are 365 days in a year. The parent who has a higher income for the tax year in question should claim the child. Again, the rule for claiming children on your taxes is relatively simple:

If only one of you is the child's parent, the child is treated as the qualifying child of the parent; When there is no signed document by the custodial parent then the irsrecognizes the custodial parents claim to dependency. The irs developed a tiebreaker rule to help divorced parents avoid disputes regarding claiming the kids as dependents on their taxes in a 50/50 custody order.

50/50 custody is usually the preferred solution for the colorado divorce courts as it is seen as beneficial to the child for both parents to contribute equally to his or her upbringing. For a confidential consultation with an experienced child custody lawyer in dallas, contact orsinger, nelson, downing & anderson, llp. If the 50/50 agreement was made outside of court following a separation (not divorce or never married) the location or home or party responsible for where the child primarily resides in or sleeps at should claim the child on their taxes.

The one who had custody for more than 1/2 of the year can claim the child as a dependent, child care expenses, earned income tax credit and, if eligible, head of household. In general, the parent who houses the child for most of the year is going to count as the custodial parent. 50/50 following divorce, the tax filing and claiming of the shared child can be discussed and may be able to be added as terms of the official.

Who claims the child with 50/50 parenting time? The parent who has custody for the greater part of the year typically gets to claim the child as a dependent for tax purposes. To determine which parent can treat the child as a qualifying child in order to claim tax benefits, irs rules employ the following tiebreakers:

The irs has developed a basic tiebreaker rule to deal with this: It is the parent who spends the most time with the children. Often, the parent with the higher income will gain a larger tax benefit from claiming a child.

5050 Custody Not Working Negative Effects Of Co Parenting Timtab

What Is Form 8332 Releaserevocation Of Release Of Claim To Exemption For Child By Custodial Parent - Turbotax Tax Tips Videos

Who Claims Child On Taxes With 50 50 Custody Colorado Legal Group

Does 50 50 Custody Pay Child Support In Wisconsin - Youtube

50 50 Custody Child Support Calculator - Family Lawyer Winnipeg

5050 Equal Time Shared Parenting In Tn Child Support

Are You Considering 50 50 Custody Schedule In St Louis Missouri Jr

Who Claims A Child On Taxes With 5050 Custody In California - Her Lawyer

Do I Have To Pay Child Support If I Share 5050 Custody

Does Joint Custody Mean Neither Parent Pays Child Support Renkin Law

5050 Joint Custody Schedules Sterling Law Offices Sc

Is Missouri A 50-50 State For Child Custody

Wva House Sends 50-50 Custody Bill To Senate Wvpb

Florida 5050 Parenting Plan 5050 Custody And Child Support -

Child Support And 5050 Custody In Illinois - Russell D Knight Family Law

Who Claims A Child On Taxes In A 5050 Custody Arrangement

2-2-3 Visitation Schedule How Does It Work Why Would You Choose It

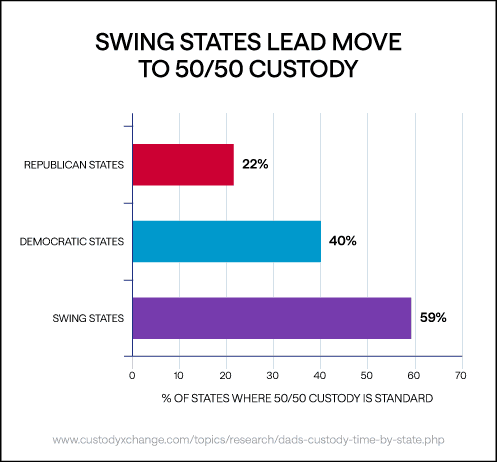

How Much Custody Time Does Dad Get In Your State

5050 Custody Not Working Negative Effects Of Co Parenting Timtab

Comments

Post a Comment