For families who received their first payment in september, it may have been a larger amount of $375 or $450 per kid to make up for lost payments. I wish mine said issued.

Wheres My Child Tax Credit Payment A Guide For Frustrated Parents - The Washington Post

This third batch of advance monthly payments, totaling about $15 billion, is reaching about 35.

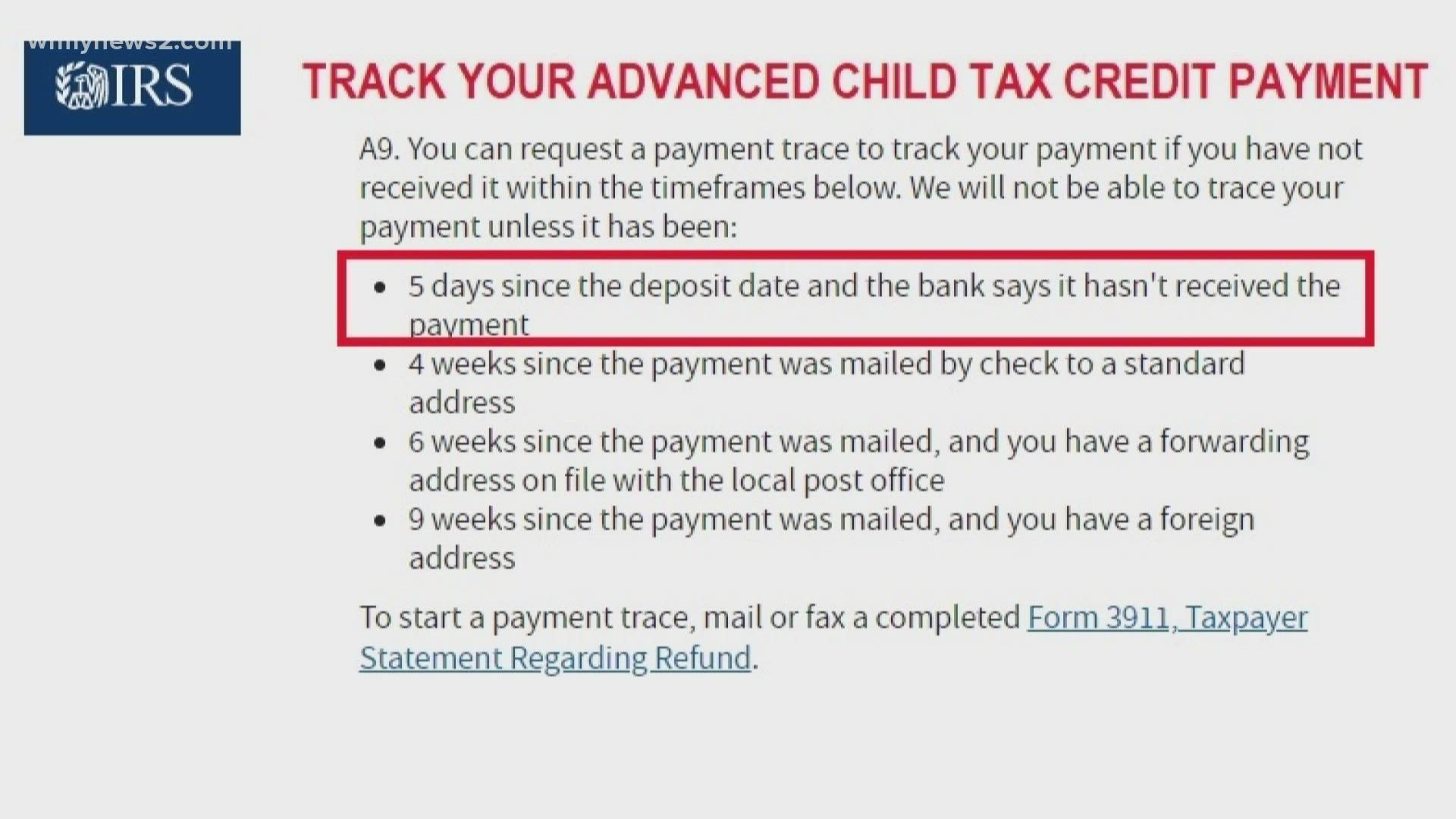

September child tax credit payment not issued. Make sure to specify that you’re looking to trace a child tax credit check and the month the payment was disbursed. I got people sending referrals to get this looked at but it could take 30 days apparently. Many parents continued to post their frustrations online friday about not receiving their september payments yet for the advance child tax credit.

But the irs did not detail what went wrong or state how many. Washington — the internal revenue service and the treasury department announced today that millions of american families are now receiving their advance child tax credit (ctc) payment for the month of september. August child tax credit payments issued:

For your future september payment—or you’re still waiting for a payment from july or august—you can use the child tax credit portal to check if they were sent or are pending. Child tax credit payments still haven’t arrived for many eligible families in the us. Many parents have been spending the money as soon as they get it on things like rent and uniforms, and already the payments have helped fewer children go hungry.

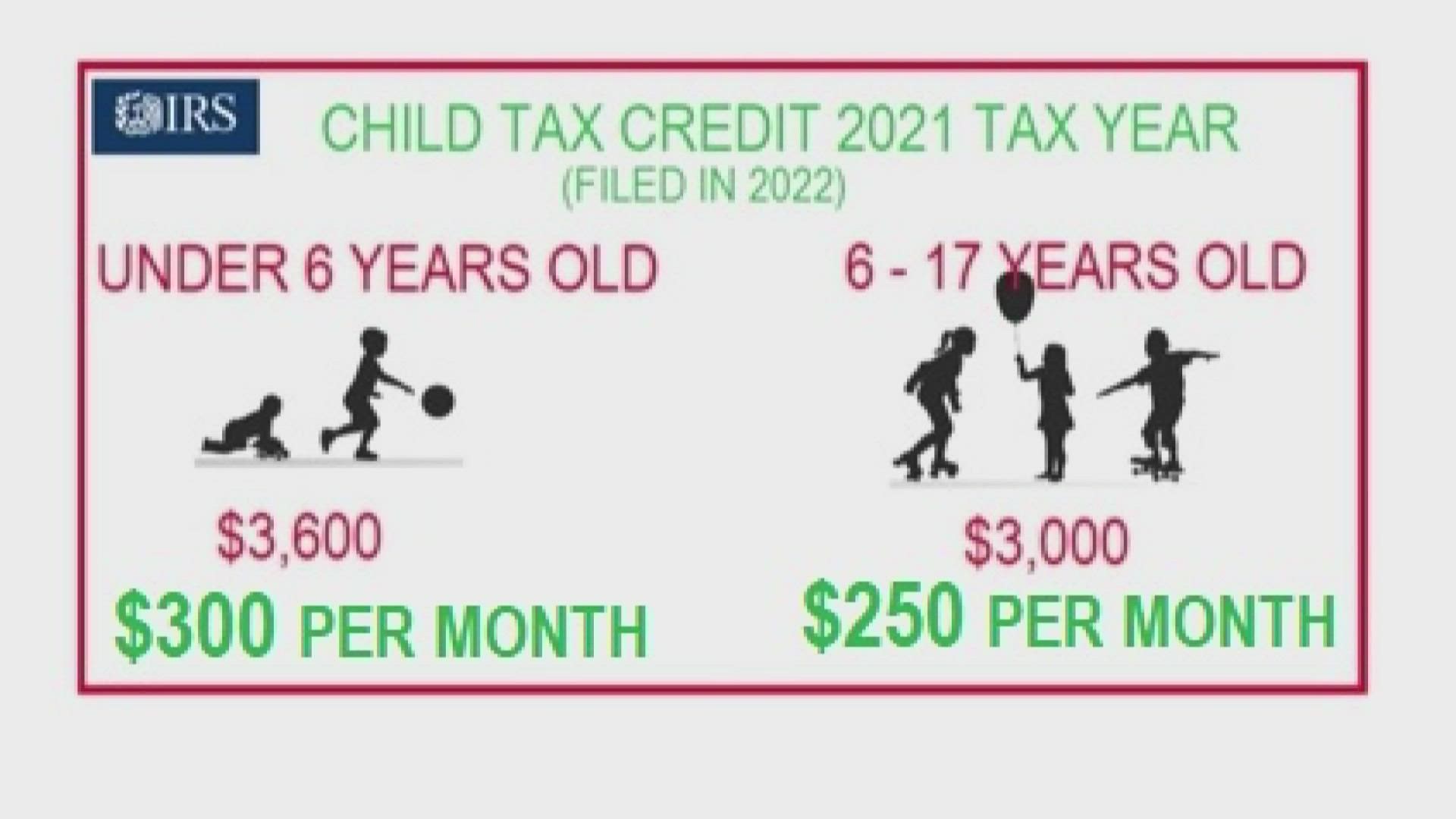

Parents should have received the most recent check from the irs last week for up to $300 per child. Eligible families should have received their third payment from the irs this week of up to $250 or $300 per child. You should not request a payment trace to determine your eligibility or to confirm your child tax credit amount.

Many parents continued to post their frustrations online friday about not receiving their september payments yet for the advance child tax credit. If you do not receive your september payment, continue to check your payment status using the irs child tax credit update portal as this is where you should see any new information about your. If your child tax credit payment for september not processed yet, then you really should watch this video with update on why so many payments weren't issued.

If you need help completing the. Be sure to check whether or not your money was sent via direct deposit or check. However, the irs stated on september 17 that certain taxpayers who have not yet received their september payment may be.

Visit the child tax credit update portal to see if you’re receiving a direct deposit or paper check this month: For those affected, no additional action is needed for the september payment to be issued by direct deposit. It could take up to 60 days to receive a response.

Here’s why yours might be delayed including the last half of the tax credit, recipients could get a total of up to $3,600 per child 5 years old and younger, and $3,000 for every child between 6 to 17 years old. Basically not receiving payments for sept. September 19, 2021 by erin fox.

And late friday, the internal revenue service acknowledged that a group of people are facing roadblocks. You'll need to print and mail the completed form 3911 from the irs (pdf) to start tracing your child tax credit payment. My spouse and i are married, filing jointly, received our july and august payments via dd, and still have not received our september payments.

For those parents who never received money in july or august, the september payment could be their first — and that means it could. If you filed taxes jointly, both parents will need to sign the form to start the payment trace process. The irs employee i spoke with on friday stated that a trace can be submitted y the 21st if the payment is not received by that date.

September’s child tax credit payments go out to eligible families who have not opted out of receiving the direct payments on wednesday, either through direct deposit or a paper check sent in the. This sucks because no one knows why mine changed from eligible for the first 2 months to pending and. Anyone may verify if they'll get a direct deposit or a paper check this month by going to the child tax credit update portal.

The irs sent out the third child tax credit payments on wednesday, sept. If a qualified person finds his or her credit issued but never received when making a payment, you will need to reconfirm that the address and bank account information provided on the irs is correct.if so, the irs then recommends request a.

Child Tax Credit Mystery Parents Report No September Check

Child Tax Credit Updates Why Are Your October Payments Delayed Marca

Irs Child Tax Credit Payments Start July 15

Child Tax Credit Children 18 And Older Not Eligible 13newsnowcom

Child Tax Credits Go Out Soon How To Check September Payment What To Do If One Hasnt Been Received Wfla

Child Tax Credit Checks Going Out July 15 Why Some Parents May Want To Opt Out Khoucom

Child Tax Credit Mystery Parents Report No September Check

Nmc Gets Notice On Property Tax Bunglings Property Tax Tax Income Tax Return

Child Tax Credit Did Not Come Today Issue Delaying Some Payments 10tvcom

Where Is My September Child Tax Credit 13newsnowcom

Child Tax Credit Missing A Payment Heres How To Track It - Cnet

Child Tax Credit 2021 How To Track September Next Payment Marca

Child Tax Credit Delayed How To Track Your November Payment Marca

August Child Tax Credit Payments Issued Heres Why Yours Might Be Delayed Wavycom

Child Tax Credit Missing A Payment Heres How To Track It - Cnet

When Parents Can Expect Their Next Child Tax Credit Payment

Tatkal Ticket Booking Aadhar Card Application Note One Time Password

Weakest Part Of Presidential Cycle The Big Picture Stock Market Chart Marketing

Child Tax Credit Dates Next Payment Coming On October 15 Marca

Comments

Post a Comment