Drive se atlanta, ga 30334 email: Stonehenge is a thought leader in investment capital, producing strong returns for investors and impactful social returns for communities.

Film Television And Digital Entertainment Tax Credit Georgia Department Of Economic Development

Investors in tax credit projects are able to lower their effective tax rates, save money on taxes, increase cash flow and maximize.

Georgia film tax credit fund llc. Get in touch today to learn more about our team, strategies and results. How to file a withholding film tax return. We serve clients from the fortune 1000 to growing private businesses by accounting for today while advising for the future.

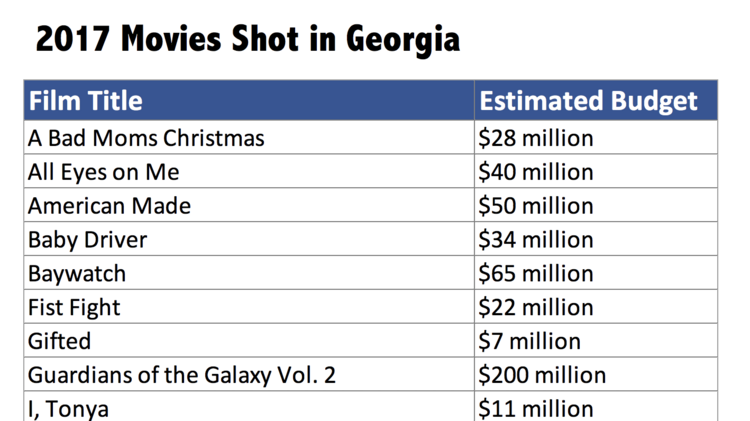

Certification may be applied for within 90 days of the start of principal photography. For a project to be eligible for the 20 percent transferable tax credit, the georgia department of economic development must certify the project. Our experienced professionals represent the best in class within their respective fields, which include “big six” accounting, investment banking and underwriting, real estate development, tax credit consulting, economic development and esg investing, ratings, and scoring.

They understand the film finance process, work with a big smile, and always have a glass that is full. The state grants an additional 10 percent tax credit if the finished project includes a promotional logo provided by the state. They go beyond just working with your budget and ep software to estimate tax credits and respond quickly and accurately.

As an example, if a $1,000,00.00 movie shoots in georgia and spends every penny in the state, the state of georgia will issue a (20% + 10%) 30% tax rebate, worth approximately $300,000.00, that can be sold for a little less than face value. Tcc manages the following state historic tax credit funds: Our specialties include institutional tax equity investment and middle market mergers and acquisitions.

City of atlanta ) pic hide this posting restore restore this posting. Georgia department of education 1562 twin towers east 205 jesse hill jr. Maryland, massachusetts, mississippi, connecticut, louisiana, virginia.

Click the manage my credits hyperlink. Because we serve the emerging needs of our clients as they evolve. We are one of the largest clearing houses of federal and state tax credits in the southeast;

Film tax credit reporting can be completed through an individual, corporate or partnership tax account. Certification for film & television projects will be through the georgia film, music & digital entertainment office. That check can then passed onto to the investors.

We offer consulting services to navigate which tax credits are suited for a client's situation Click the corporate income tax account hyperlink. Fallbrook capital securities is a nationally recognized investment bank.

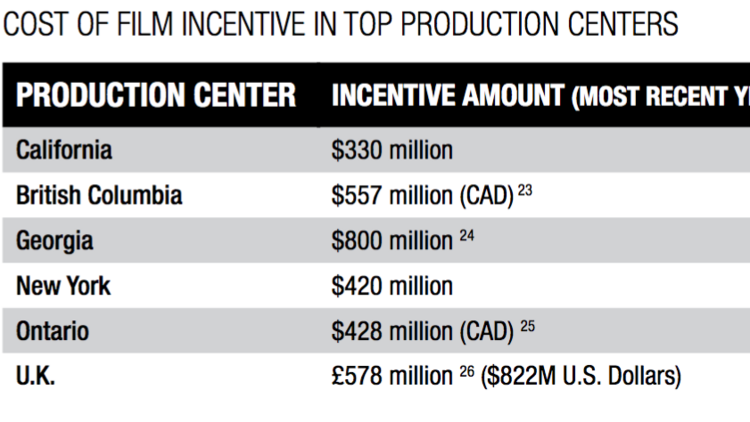

Program credits of $420 million per year can be allocated and used to encourage companies to produce film projects in new york and help create and maintain film industry jobs. How to report your film tax credit 1. This is a considerable risk minimization for the investor.

With office locations across the nation, frazier & deeter's cpas and advisors can help you or your business. A single individual can redirect up to $1,000 of his or her income tax payments to goal. State credit purchaser tax credit capital, llc has worked with accounting firms, cfos, and businesses for more than 25 years to help offset louisiana income and franchise tax liability with the use of louisiana historic tax credits.

We do this by fostering collaboration among our team of talented professionals who leverage two decades of expertise and relationships to provide innovative financing solutions, delivering a variety of debt and equity financings to spur economic growth. Third party/ bulk filers add access to a withholding film tax account. Favorite this post dec 1.

State production incentive (up to 22.5%) the texas moving image industry incentive program (tmiiip) is designed to build the economy through the moving image industry by creating jobs in texas. Comprised of cpas and tax attorneys, our team works closely with developers, state and federal tax credit syndicators, financial institutions, insurance companies, and corporations buying and selling credits with access to all states and markets that offer transferable credit programs—staying current on market pricing and legislative measures. Register for a withholding film tax account.

Find a location near you today! Iparks@doe.k12.ga.us how can i change the mailing address or other contact information for my sso? To give you tax credit options.

Georgia No Longer No 1 In Feature Film Production - Atlanta Business Chronicle

2

Georgia No Longer No 1 In Feature Film Production - Atlanta Business Chronicle

Who We Are - State Tax Incentives

Fd Fund Administration - Frazier Deeter Llc Frazier Deeter Llc

2

Film Digital Media Tax Credits Clocktower Tax Credits Llc

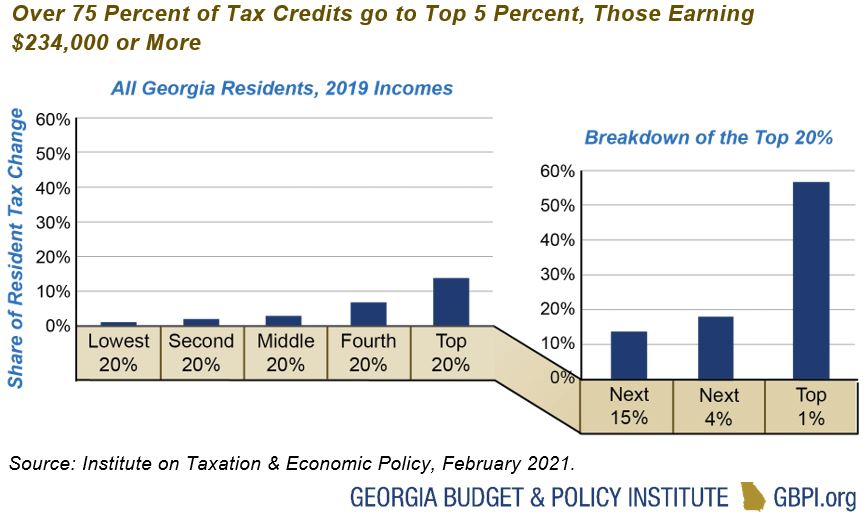

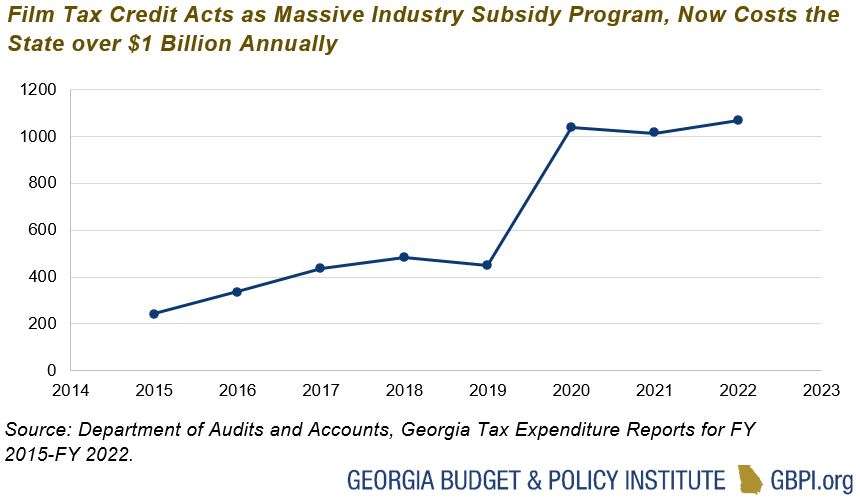

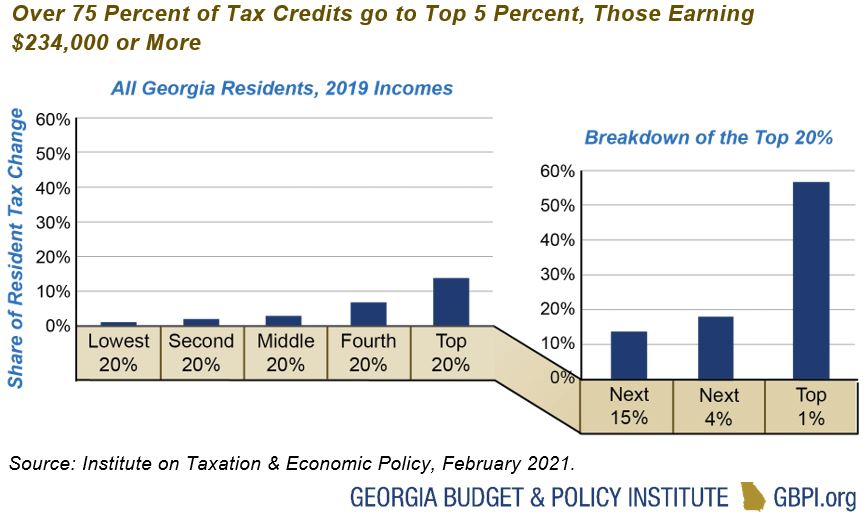

Georgia Tax Breaks Dont Deliver - Georgia Budget And Policy Institute

Film And Tv Tax Credit Battle Heats Up Across Us The Hollywood Reporter

Gftcf Logo By Merdeka Logo Design Personal Logo Design Logo Design Contest

Film And Tv Tax Credit Battle Heats Up Across Us The Hollywood Reporter

Need And Epic Modern Design For A Sba Toolbox Company And Website By Elsa_ Website Logo Design Personal Logo Design Logo Design

2

Alliant Capital Announces Closing Of 130 Million Tax Credit Fund

2

2

Georgia Tax Breaks Dont Deliver - Georgia Budget And Policy Institute

Sugar Creek Capital - Film Entertainment Tax Credits

Film Digital Media Tax Credits Clocktower Tax Credits Llc

Comments

Post a Comment