For a detailed overview of the new law, see washington enacts new capital gains tax for 2022 and beyond. The new tax proceeds are earmarked exclusively for early education and childcare.

Irs Tax Brackets 2022 What Do You Need To Know About Tax Brackets And Standard Deduction To Change In 2022 Marca

It creates a 7% tax on the capital gains of sales of assets — like bonds and stocks — above $250,000.

Washington state capital gains tax 2022. New capital gains tax to go into effect in washington. Only individuals are subject to payment of the tax, which equals seven percent multiplied by an individual's washington capital gains. Under this legislation, washington residents must pay a 7% tax on the sale of stocks, bonds, and other capital assets of.

The new law will take effect january 1, 2022. If you sell stocks, mutual funds or other capital assets that you held for at least one year, any gain from the sale is taxed at either a 0%, 15%. It’s currently facing some legal challenges but is scheduled to go into effect at the beginning of 2022.

Washington state 7% capital gains tax. Shortly after the act was signed into law by governor inslee, a lawsuit was filed by the freedom foundation, represented by seattle law firm lane powell. 5096), which was signed by governor inslee on may 4, 2021.

Governor inslee signed washington’s new capital gains tax (“the tax” or “the cgt”) into law on may 4, 2021. Last may, clark nuber published an overview of washington state’s capital gains tax that takes effect on january 1, 2022. The new tax revenue is reserved solely for early education and childcare (see “ where does this.

The lawsuit alleges the new tax violates the washington state constitution, as well as the. New capital gains tax to go into effect in washington. You would be required to pay capital gains tax if your taxable capital gains exceed:.

A new excise tax on capital gains in excess of $250,000 beginning january 1, 2022 has passed the washington legislature and is expected to be signed into law by washington governor inslee shortly. Washington enacts new capital gains tax for 2022 and beyond. The tax would equal 9 percent of your washington capital gains.

What is washington’s new capital gains tax? This tax applies to individuals only, though individuals can be liable for the tax because of their ownership interest. As previously reported on may 7 and june 17 of this year, washington state lawmakers enacted a new capital gains tax, set to go into effect on january 1, 2022, but two lawsuits were initiated to.

Washington's legislature passed a new capital gains tax in april (engrossed substitute s.b. Douglas county superior court judge brian huber last month ruled that a suit challenging the law can move forward. As a result of governor jay inslee signing s.b.

By dirk giseburt, michael e.

Washington State Approves Excise Tax On Capital Gains

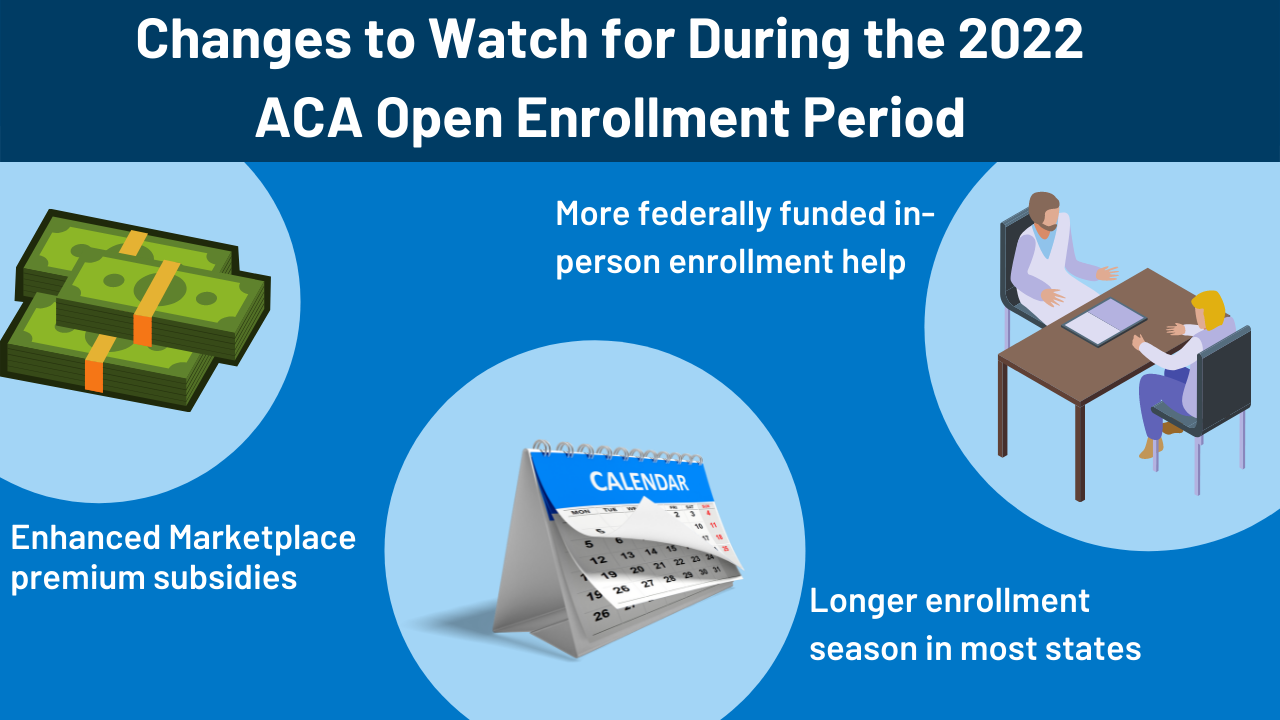

Ten Changes To Watch In Open Enrollment 2022 Kff

Faq Washington State Capital Gains Tax

How To Calculate The Value Of Your Pension Pensions The Value Calculator

Mq3_ywsz62lphm

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step-up In Basis Among Others

Fn9llddqvsyyxm

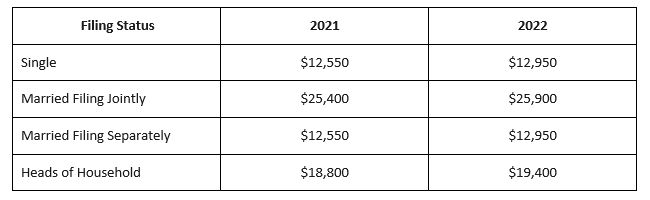

2022 Tax Brackets 2022 Federal Income Tax Brackets Rates

The Proposed Changes To Cgt And Inheritance Tax For 20212022 - Bph

Crowdstreet Review A Leading Commercial Real Estate Platform Real Estate Commercial Real Estate Real Estate Investing

Washington Dc Us Capitol Building Washington Dc Capitol Capitol Building Capital Gains Tax

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Coming In 2022 New Wa State Payroll Tax For Long-term Care Trust Fund - Laird Norton Wealth Management

Irs Releases Income Tax Brackets For 2022 Kiplinger

Necvd0r25cgnam

Irs Tax Brackets 2022 What Are The Capital Gains Tax Rate Thresholds Marca

Washington State Enacts Capital Gains Tax Beginning January 1 2022 2021 Articles Resources Cla Cliftonlarsonallen

Irs Provides Tax Inflation Adjustments For Tax Year 2022 - Tax - United States

House Democrats Tax On Corporate Income Third-highest In Oecd

Comments

Post a Comment