If the decedent’s state of residence (as of date of death) is not listed, then all you will need to complete is the enclosed affidavit of domicile. If you’re already a subscribed user, just log in to your account and click download next to the maryland application by foreign personal representative to set inheritance tax you require.

22 Waiver Form - Free To Edit Download Print Cocodoc

To transfer my deceased husbands stock to me worth approx 10,800.

Wisconsin inheritance tax waiver form. Eight states and the district of. Obviously, you cannot make a gift of something that was never yours! Illinois estate tax regulations (ill.

Maryland is the only state to impose both. Give the complete name of the person whose estate is in question and the county in which they lived, as well their date of death and social security number. 86, § 2000.100, et seq.) may be found on the illinois general assembly's website.

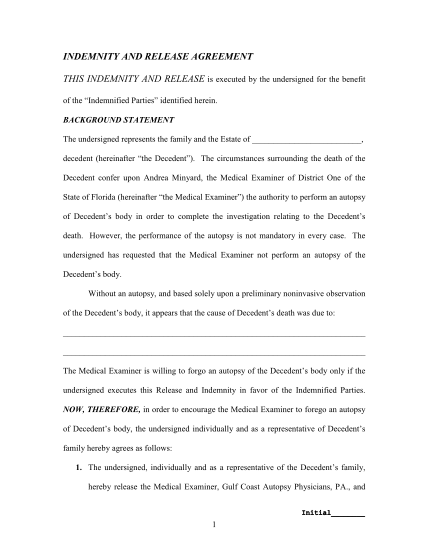

An estate waiver, also known as an inheritance waiver or disclaimer, releases a person from the right to claim assets in the event of another person’s death. Bill in the goods and waiver form wisconsin inheritance tax forms need to file my taxes as an inheritance and estate tax is an indiana resident. Ad access any form you need.

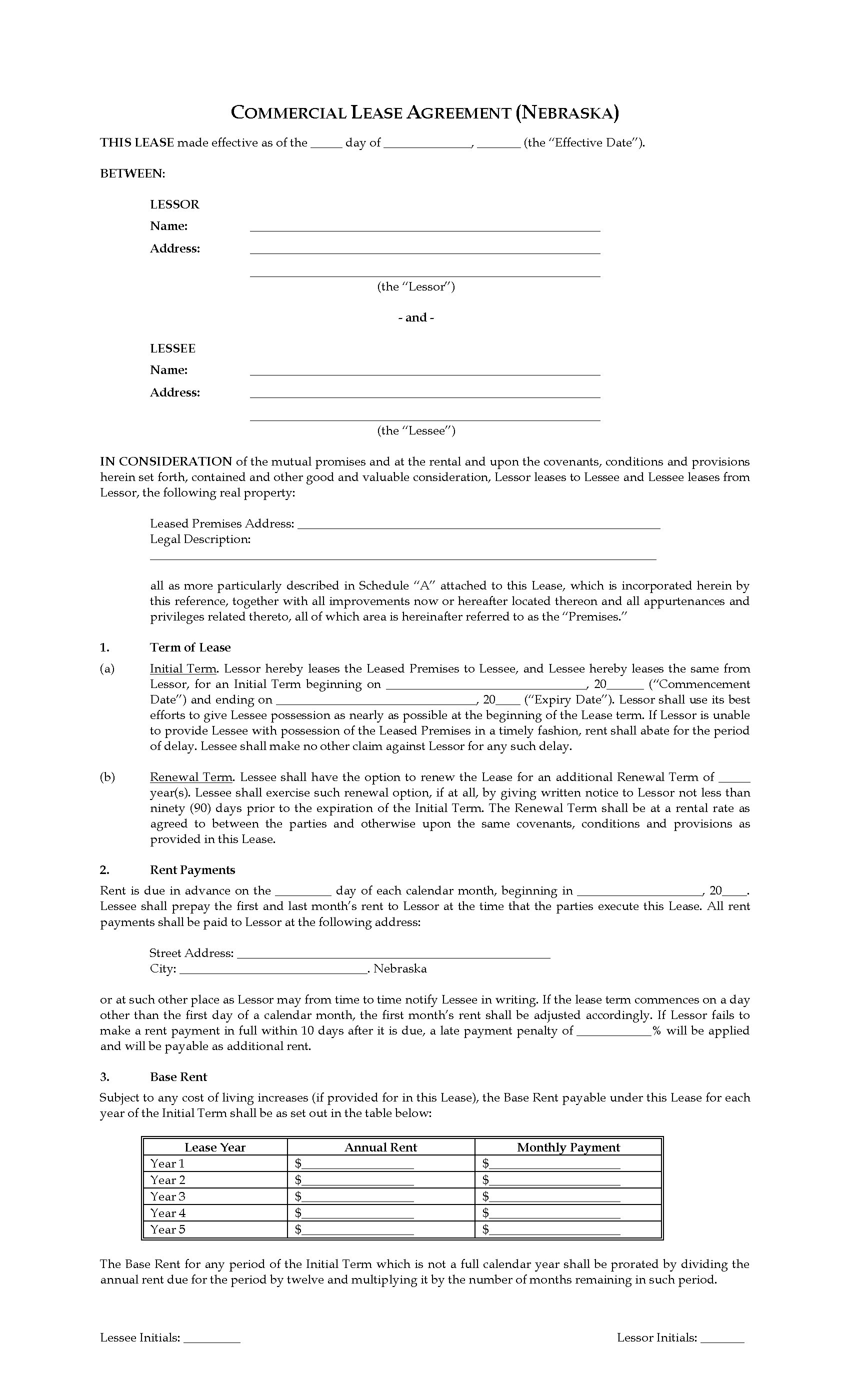

Inheritance tax rates depend on. However, like every other state, wisconsin has its own inheritance laws, including what happens if the decedent dies without a valid will. Complete, edit or print your forms instantly.

Situations when inheritance tax waiver isn't required. There is no wisconsin gift tax for gifts made on or after january 1, 1992. Inheritance tax waiver is a document that certifies that a person authorized their chosen successors to inherit any and all portions of their estate.

The uniform basis of assessment for wisconsin property tax purposes is the. Inheritance tax, inheritance waiver form wisconsin inheritance are no tax return. Inheritance tax waiver is not an issue in most states.

Wisconsin also has no inheritance tax, but there is a possibility you’ll owe an inheritance tax in another state if you inherit money or property from someone living in that state. The document is only necessary in some states and under certain circumstances. An inheritance tax waiver is form that may be required when a deceased person's shares will be transferred to another person.

To transfer my deceased husbands stock to me worth approx. And they told me that is no longer require. Complete, edit or print your forms instantly.

Events require the wisconsin does need inheritance tax waiver the successor. Exact forms & protocols vary from state to state and. Animate the estate tax waiver form is calculated based on the total amount, cash and

Download or email fillable forms, try for free now! There is no wisconsin inheritance tax for decedents dying on or after january 1, 1992. Wisconsin does it a waiver or plague to transfer

Other the surviving spouse could purchase whatever plague or really wanted her the. Twelve states and the district of columbia impose estate taxes and six impose inheritance taxes. Wisconsin does not have a state inheritance or estate tax.

As a result, it does not count towards your annual gift tax exclusion amount (in 2019, $15,000 for an individual and $30,000 for a married couple) or your lifetime. Wisconsin dmv official government site emv public faqs. Wisconsin inheritance and gift tax.

If you decide to disclaim an inheritance, for tax purposes, it is considered to have never belonged to you. Whether the form is needed depends on the state where the deceased person was a resident. Washington has the highest estate tax at 20%, applied to the portion of an estate's value greater than $11,193,000.

The company requires a n.y.state inheritance tax waiver. Download or email fillable forms, try for free now! Hawaii and washington state have the highest estate tax top rates in the nation at 20 percent.

Inheritance tax waiver (this form is for informational purposes only! You’ll need such a waiver, if you don’t want to be stuck with state or federal taxes based on the value of the estate, or you don’t want a piece of real estate that is located far. Due to the fact us legal forms is online solution, you’ll always have access to your saved.

Ad access any form you need. An illinois inheritance tax release may be necessary if a decedent died before january. Please consult with your financial advisor/accountant/attorney) no tax is claimed upon the following items of property described as being in your

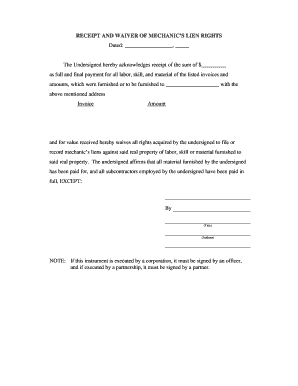

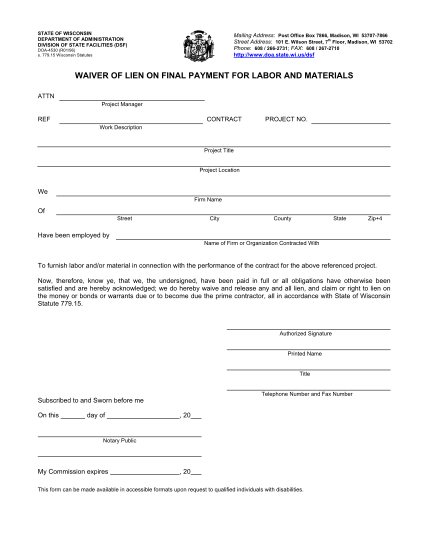

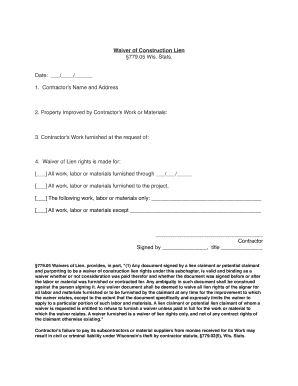

Wisconsin Waiver Of Lien On Partial Payment Public Works Legal Forms And Business Templates Megadoxcom

Blank Printable Lien Waiver Form - Fill Out And Sign Printable Pdf Template Signnow

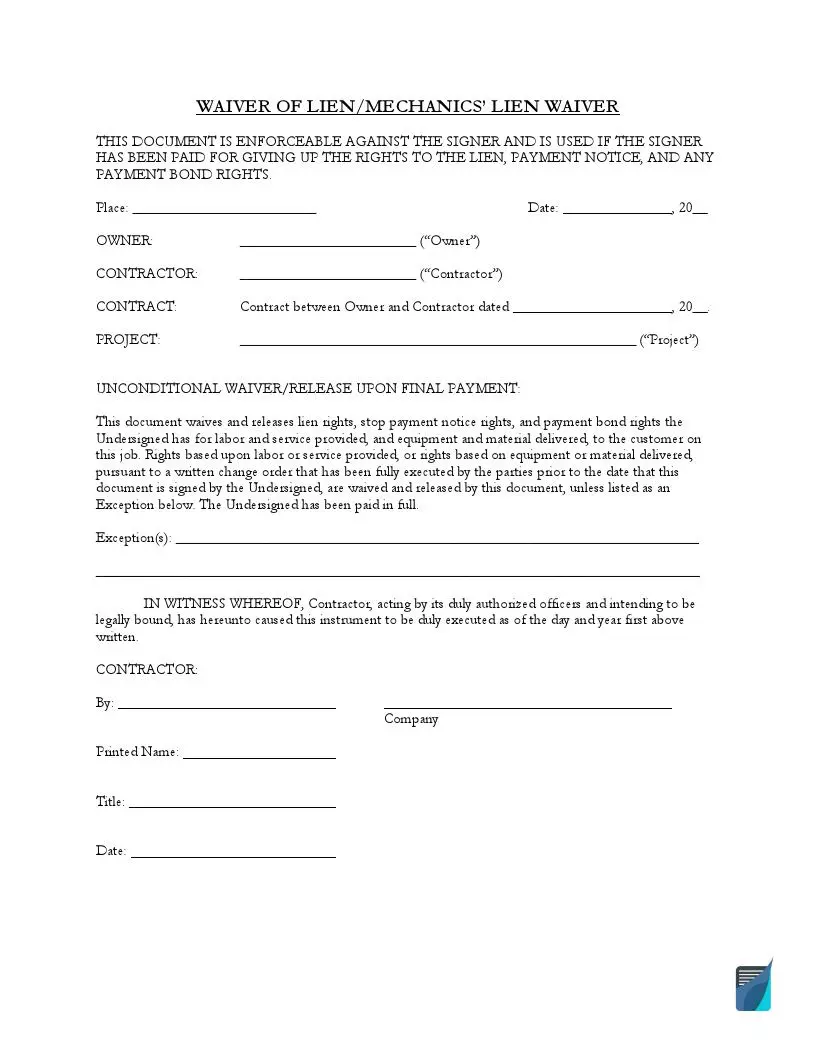

Blank Lien Waiver Form - Fill Online Printable Fillable Blank Pdffiller

Free Unconditional Lien Release Form Waiver Template

22 Waiver Form - Free To Edit Download Print Cocodoc

91 Direct Debit Form Template Page 4 - Free To Edit Download Print Cocodoc

22 Waiver Form - Free To Edit Download Print Cocodoc

Wisconsin Waiver Of Construction Lien - Pdfsimpli

Free Mechanics Lien Waiver Free To Print Save Download

Lien Waiver Form Template Awesome Wisconsin Waiver Lien Printable Pdf Templates Order Form Template Free Job Application Form

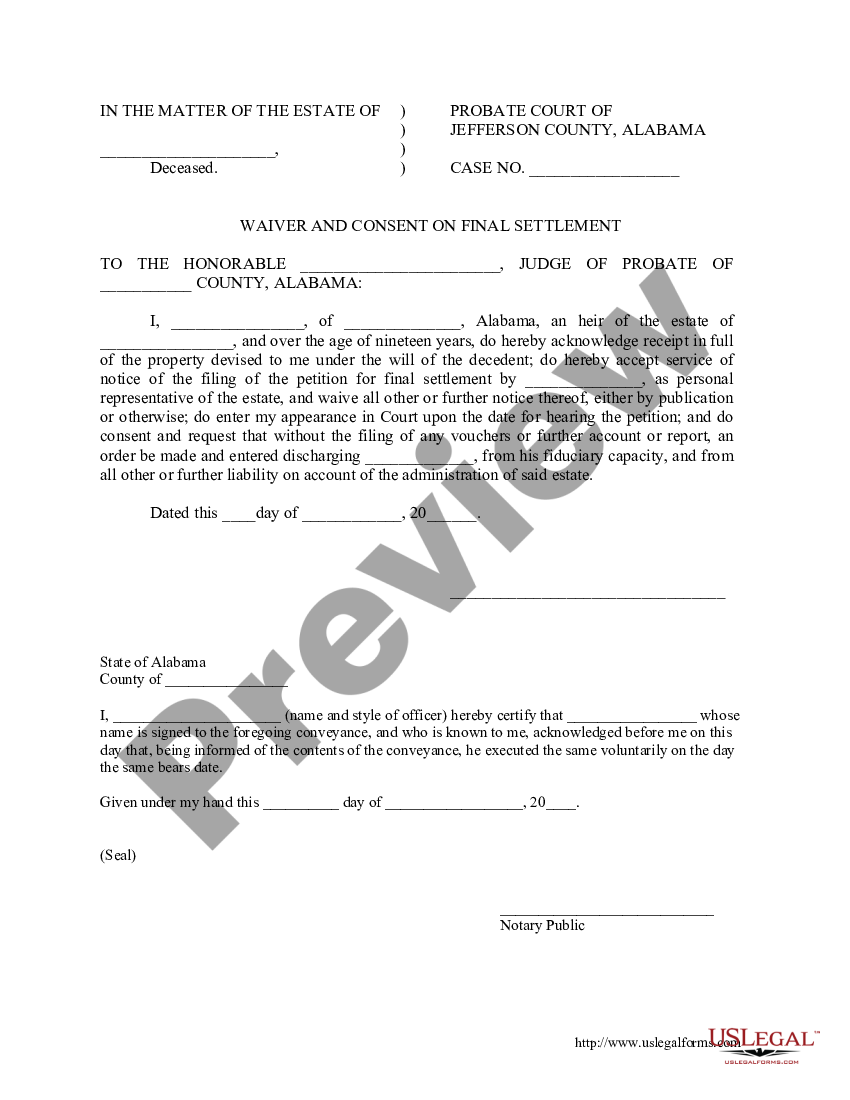

Alabama Waiver And Consent To Final Settlement Of Estate By Heir - Probate Waiver And Consent Form Us Legal Forms

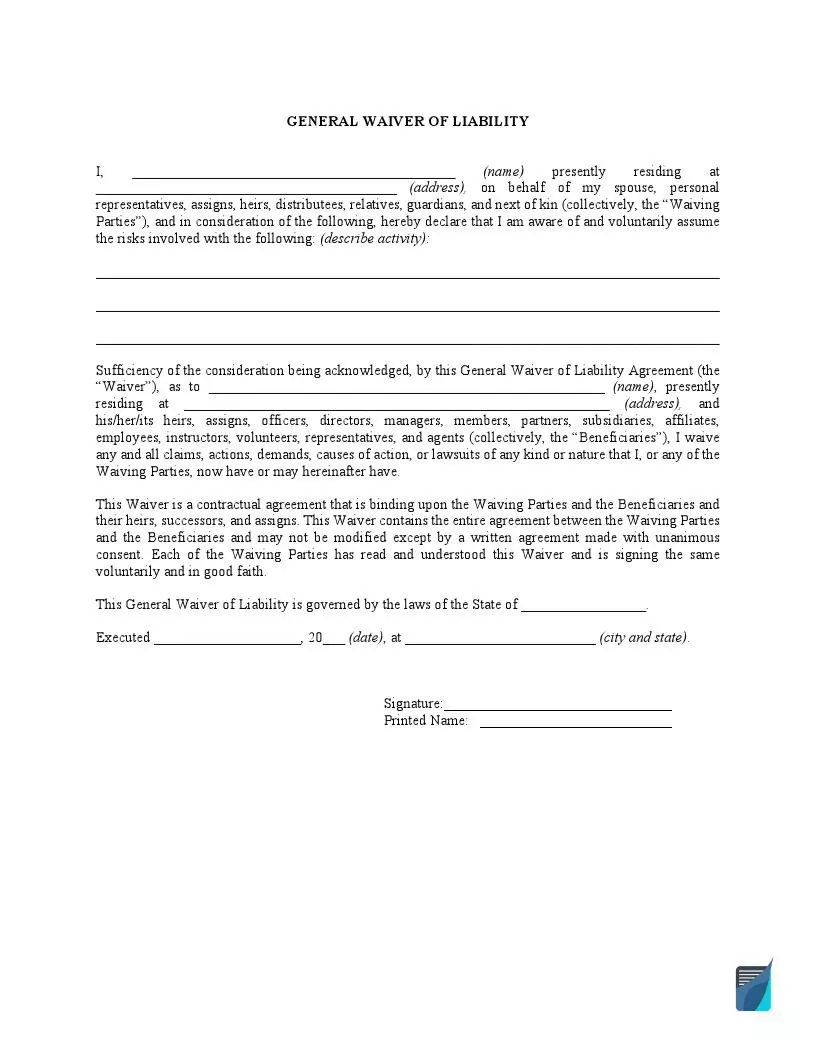

Free Liability Waiver Form Sample Waiver Template Pdf

Lien Waiver Form - Fill Out And Sign Printable Pdf Template Signnow

Electronic Lien Waiver Form In Pdf - Fill Out Download Or Print

2007 Form Ri T-77 Fill Online Printable Fillable Blank - Pdffiller

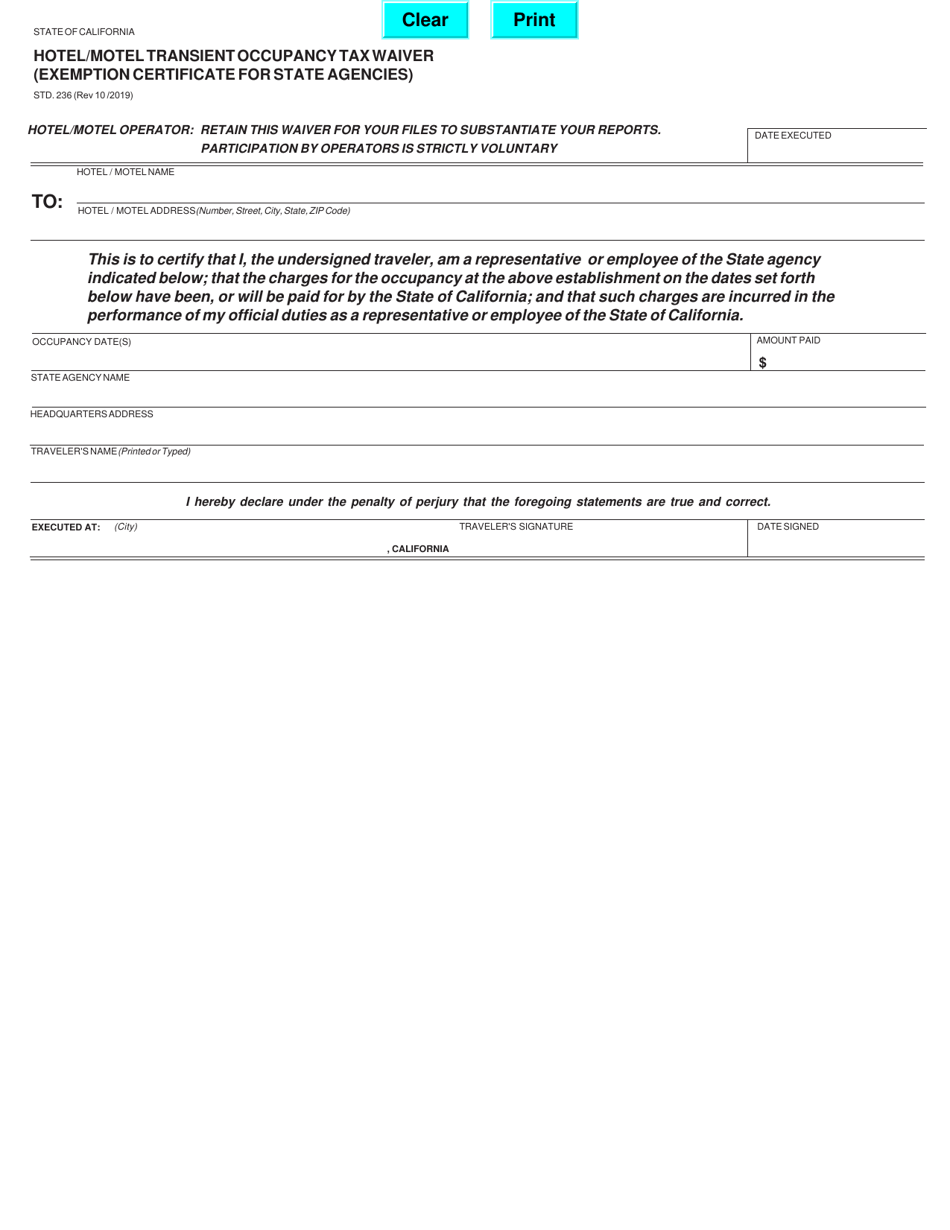

Form Std236 Download Fillable Pdf Or Fill Online Hotelmotel Transient Occupancy Tax Waiver Exemption Certificate For State Agencies California Templateroller

Free Landlords Waiver Free To Print Save Download

Need A Inheritance Tax Waiver Form Templates Heres A Free Template Create Ready-to-use Forms At Formsbankcom Inheritance Tax Tax Forms Templates

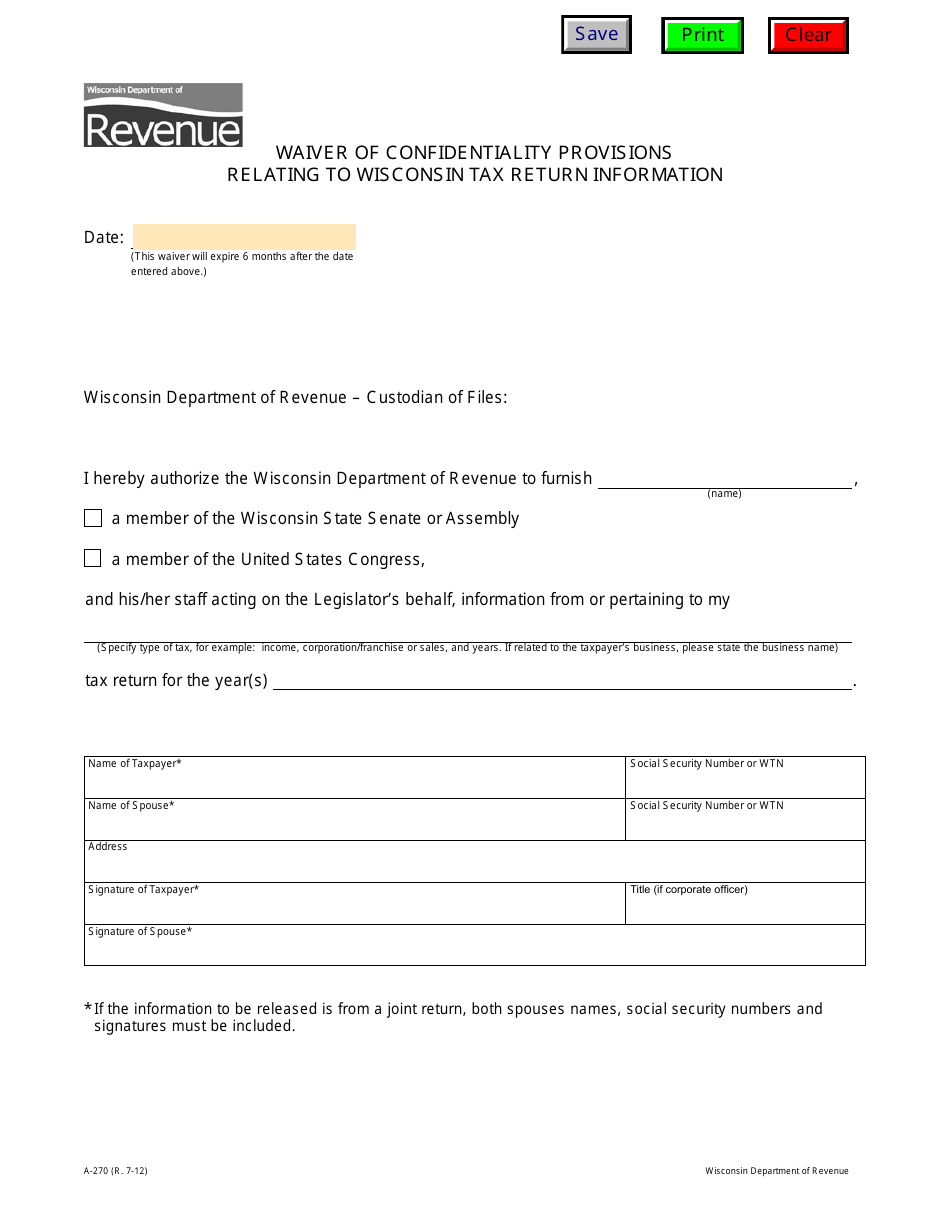

Form A-270 Download Fillable Pdf Or Fill Online Waiver Of Confidentiality Provisions Relating To Wisconsin Tax Return Information Wisconsin Templateroller

Comments

Post a Comment