Estate taxes are levied on the total value of a decedent’s property and must be paid out before distributions are made to the decedent’s beneficiaries. To beneficiaries of an estate, learning that inherited property is located in nevada can feel like watching all three wheels of a slot machine land on the number 7.

States With An Inheritance Tax Recently Updated For 2020

Nv does not have state inheritance tax;

Nevada estate and inheritance tax. In addition to the federal estate tax, with a top rate of 40 percent, some states levy an additional estate or inheritance tax.twelve states and the district of columbia impose estate taxes and six impose inheritance taxes. Contact inheritance advanced to receive your inheritance money in nevada now. No estate tax or inheritance tax.

Nrs 375a, tax is imposed in the amount of the maximum credit allowable against the federal estate tax for the payment of state death taxes. The good news also is that the irs does not impose an inheritance tax. Nevada does not levy an inheritance tax.

Maryland is the only state to impose both now that new jersey has repealed its estate tax. Data were drawn from mcguire woods llp, “state death tax chart” and indicate the presence of an estate or inheritance tax as. The difference between an inheritance tax and an estate tax.

Maryland imposes both an estate tax and an inheritance tax. That’s why nevada is such a tax friendly state. This variable assesses if a state levies an estate or inheritance tax.

If you are entering into the probate process in nevada and you need cash immediately, inheritance advanced is here for you. Not all estates must go through probate in nevada. Inheritance taxes are not levied in addition to federal estate taxes because the federal law allows an offset for the payment of state death taxes.

Each has its own laws dictating who is exempt from the tax, who will have to pay it, and how much they'll have to pay. The state of nevada does not have an inheritance tax, so no waiver is required. Estate taxes are paid by the decedent’s estate before assets are distributed to heirs, and are thus imposed on the overall value of the estate.

No estate tax or inheritance tax. States that collect an inheritance tax as of 2020 are iowa, kentucky, maryland, nebraska, new jersey, and pennsylvania. Here's how estate and inheritance.

Inheritance advanced has worked with more than 1,700 satisfied clients across the country, including [state]. If the estate was placed in a trust, you can avoid probate. Whereas, the inheritance tax is calculated separately for each individual beneficiary, and the beneficiary is responsible.

For small estates up to $20,000 with no real property, an affidavit is all that. For example, let's say a family member passes away in an area with a 5% estate tax and a 10% inheritance tax. Since nevada collects so much in gaming taxes, they do not impose an inheritance tax or a gift tax.

At the moment, the inheritance tax is at 40% and there are also talks about increasing the tax rates to 45% or even having a tiered structure that gets up to 65% inheritance tax on estates over a billion dollars. Inheritance taxes are remitted by the recipient of a bequest, and are thus based on the amount distributed to each beneficiary. We have helped them obtain money to pay for the funeral,.

Who must file for estate taxes in nevada? It is one of the 38 states that does not apply an estate tax. Under nevada law, there are no inheritance or estate taxes.

No estate tax or inheritance tax. Here are the answers to five common inheritance tax questions as it applies to beneficiaries that are residents of. Nevada filing is required in accordance with nevada law nrs 375.a for any decedent who has property located in nevada at the time of death, december 31, 2004 or prior, and whose estate.

Inheritance tax is different from estate taxes, which is also different from (although related to) the gift tax. Whether or not you will be required to pay an inheritance tax depends on which state you, the beneficiary, live in. For specific advice regarding your situation, please consult a qualified attorney in your area.

In 2021 the first $11.7mil per individual is exempt at the federal level and therefore your estate will only pay tax if it is more than $11.7mil. An estate tax is based on the overall value of the deceased person’s estate, all gifts made to all beneficiaries. However, you should know that the inheritance tax of another state may apply to you if someone living in that state leaves you something in their will.

The difference between inheritance and estate tax is a matter of who is responsible for paying the tax. But 17 states and the district of columbia may tax your estate, an inheritance or both, according to the tax. This is a tax that is assessed when beneficiaries receive money from an estate.

Every state except nevada imposes either an estate tax or an inheritance tax; It is one of the 38 states that does not apply an estate tax. However, an estate in nevada is still subject to federal inheritance tax.

En español | most people don't have to worry about the federal estate tax, which excludes up to $11.7 million for individuals and $23.4 million for married couples in 2021 (up from $11.58 million and $23.16 million, respectively, for the 2020 tax year). The maximum taxes in states with. The information provided is for educational purposes only.

Does nevada have an inheritance tax or estate tax? Since the state does not impose an estate or inheritance tax upon death, less money is deducted during probate than if the property was located in any other state in america. Even if the estate must go through probate, you have options.

Does nevada have an inheritance tax or estate tax? No estate tax or inheritance tax. The top inheritance tax rate is18 percent (exemption threshold:

They leave you their estate that's worth $1 million. Under nevada law, there are no inheritance or estate taxes. Basically, it is a tax on the right to receive the property.

State Estate And Inheritance Taxes Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How To Avoid Estate Taxes With A Trust

Pdf Taxation Of Wealth And Wealth Transfers

State Estate And Inheritance Taxes Itep

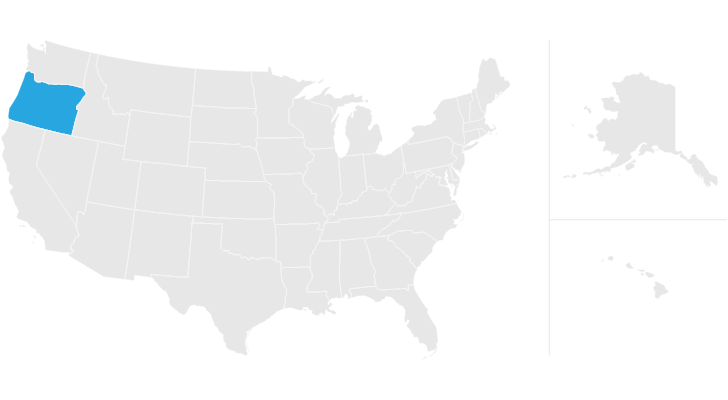

Oregon Estate Tax Everything You Need To Know - Smartasset

Trusts In The Age Of Trump Time To Re-engineer Your Estate Plan

Do I Have To Worry About A Nevada Inheritance Tax No Nevada Is Among The Majority Of States That Does Not Impose An I Inheritance Tax Nevada Tax Questions

What Is The Death Tax And How Does It Work - Smartasset

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Arizona Real Estate

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Estates And Trust Services 801 676-5506 Free Consultation Tax Lawyer Inheritance Tax Divorce Attorney

How Is Tax Liability Calculated Common Tax Questions Answered

Is Inheritance Taxable In California California Trust Estate Probate Litigation

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Estate And Inheritance Taxes Itep

Pdf Taxation Of Wealth And Wealth Transfers

Exploring The Estate Tax Part 2 - Journal Of Accountancy

Which Us States Tweet The Most About Tesla Data Dataviz Gluuio Tesla Infographic Piktochart Us States Texas Usa Data

Comments

Post a Comment