These are briefly described below. Numerous attempts have been made over the past decade to eliminate or modify the iowa inheritance tax.

Julian Garrett Senate Considers Repeal To Iowa Inheritance Tax

Thanks to a comprehensive tax reform bill , iowa has successfully set a date for repealing its inheritance tax.

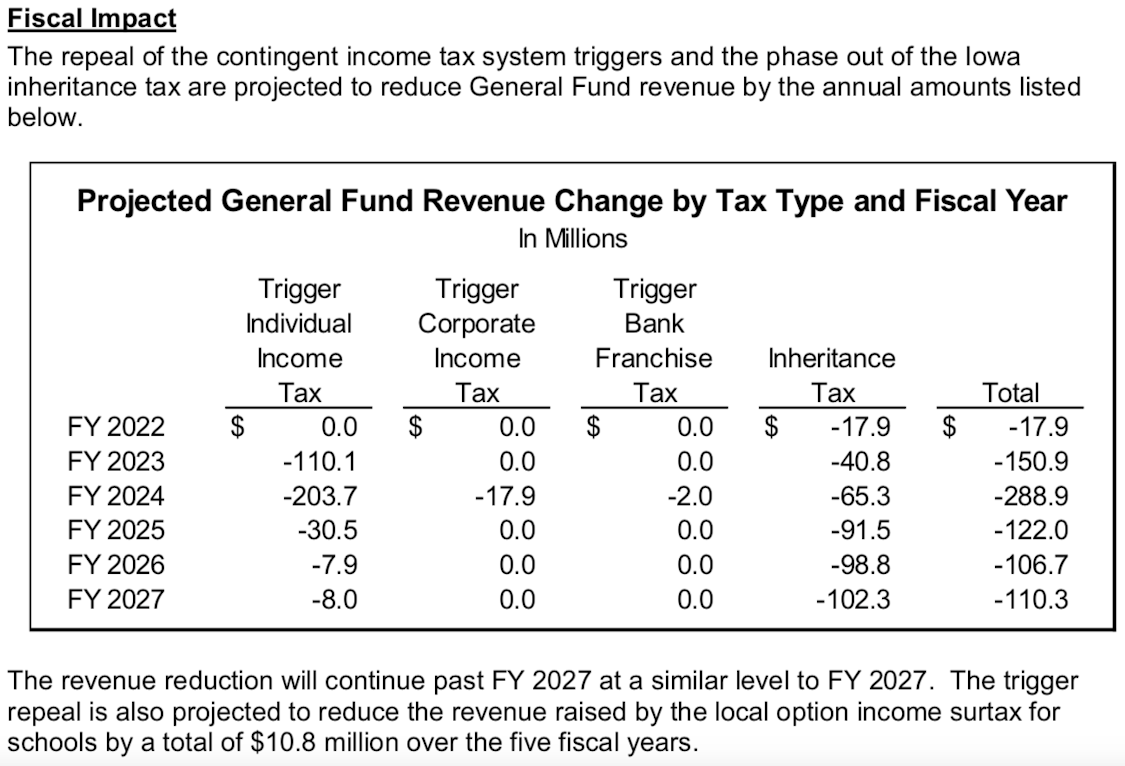

Iowa inheritance tax repeal. 30 the bill repeals code chapters 450 (inheritance tax) and 31 450b (qualified use inheritance tax) effective july 1, 2031, 32 and directs the code editor to correct references in the code 33 and the iowa acts to those code chapters and to the inheritance 34. The legislation also removes revenue triggers implemented in the 2018 tax reform law to further drop the income tax rates on january 1, 2023, with the top rate dropping from 8.53 percent to 6.5. Herman quirmbach did not support the repeal.

Thus, you only pay tax on $50,000 and you get a big tax benefit selling it after you inherit the property. Pursuant to the bill, for persons dying in the year 2021, the iowa inheritance tax. While spouses, children and parents are excluded from the inheritance tax in iowa, nieces and nephews, […]

Under the tax, beneficiaries have to pay taxes on their inheritance. In addition to the iowa inheritance tax, there are other iowa state taxes which concern estate property. The iowa senate ways and means committee has advanced legislation that would eliminate the inheritance tax in the state.

• for others, inheritance rates vary. It would also eliminate iowa's inheritance tax over three years. Inheritance tax repeal passes iowa senate committee.

Details on the iowa inheritance tax repeal. It was part of a larger tax cut package that speeds. Senate study bill 1026 sailed through a tuesday subcommittee hearing.

By shane vander hart january 19, 2021 Where do legislators stand on the repeal? Iowa will phase down the tax by 20% each year until it is repealed in 2025, leaving only 5 states in the nation left with an inheritance tax.

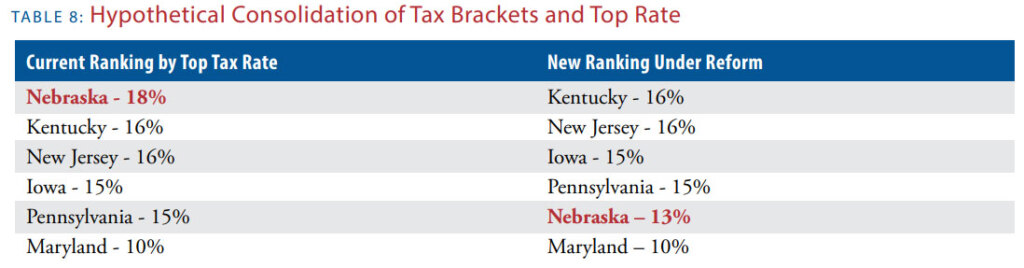

Bill introduction has ended for the 2021 nebraska legislature, and two bills were filed to reform nebraska’s antiquated, and increasingly uncommon, inheritance tax. But if the iowa senate has its way, the inheritance tax will soon expire in the hawkeye state. Iowa’s move will leave five states with an inheritance tax, and 11 states and the district of columbia with an estate tax (see where not to die in 2021 for the full list).

In the past week, the governor signed senate file 619 which repeals the iowa inheritance tax over the next five years. It is phased in with reductions for the first few years, but on january 1, 2025 the iowa inheritance tax will be fully repealed, assuming governor reynolds signs the bill (sf619). Iowa inheritance tax laws already protect family wealth • spouses and “lineal” descendants and ascendants — children, grandchildren, parents and grandparents — pay no state tax on an inheritance, no matter the size.

An iowa senate subcommittee unanimously approved ssb 1026 that, if passed, would repeal iowa's inheritance tax and the state's qualified use inheritance tax. The hawkeye state is one of six states that imposes an inheritance tax. Republican senators randy feenstra and jake chapman voted a bill to repeal iowa’s inheritance tax through subcommittee on thursday.

In 2021, iowa decided to repeal its inheritance tax by the year 2025. But if you inherit aunt bertha’s home upon her death, and you want to sell it a couple years later for $200,000, your ‘basis’ would $150,000 (the fmv upon her death), instead of $25,000. Iowa is one of only six states with an inheritance tax.

Inheritance tax repeal would take $90 million a year from services for all iowans as with debates about the federal estate tax, many misperceptions exist about the iowa state inheritance tax — who pays it, how much is paid, and how it fits in the overall structure of state and local taxes governed by state law. Lower the top individual income tax rate from 8.53% to 6.5%. The iowa legislature recently passed a bill to repeal the iowa inheritance tax.

Iowa’s inheritance tax repeal comes along while proposed federal death tax changes could mean many more estates will face federal taxes at much lower wealth levels. Quirmbach said someone who invested in stock, property or something else and dies while still owning that asset hasn’t paid any capital gains along the way. Inheritance tax repeal would take $90 million a year from services for all iowans march 11, 2019 as with debates about the federal estate tax, many misperceptions exist about the iowa state inheritance tax — who pays it, how much is paid, and how it fits in the overall structure of state and local taxes governed by state law.

The iowa senator who heads the ways and means committee wants to reduce the tax burden and inequities in the state's tax code by repealing the inheritance tax. In fact, yet another neighboring state might soon ditch its own inheritance tax. Inheritance tax will not be imposed on any property in 28 the event of the death of an individual on or after july 1, 29 2021.

Iowa’s repeal to leave nebraska with region’s only inheritance tax. Iowa advances bill to repeal inheritance tax while nebraska focuses on reform. Iowa estate tax (ia 706) the iowa estate tax is the amount of money the internal revenue service code allows as a credit against the federal estate tax owed by the estate, less the iowa inheritance tax paid.

Abolishing the state inheritance tax was a key priority for republican governor kim reynolds; If the bill becomes law, three changes could take effect on jan.

Death And Taxes Nebraskas Inheritance Tax

Does Your State Have An Estate Or Inheritance Tax

Iowa Senate Panel Unanimously Approves Inheritance Tax Repeal Bill The Iowa Torch

Iowa Capitol Digest Inheritance Tax Repeal Advanced Iowa News Siouxcityjournalcom

House Inheritance Tax Phaseout Differs From Aggressive Senate Plan - Iowa Capital Dispatch

Inheritance Tax Penalizes Those Already Suffering - Itr Foundation

Iowapolicyprojectorg

Iowas Inheritance Tax May Be Nearing An End Repeal Bill Makes It Through Iowa Senate Subcommittee - The Iowa Standard

Bleeding Heartland

Iowas Repeal To Leave Nebraska With Regions Only Inheritance Tax

Details On The Iowa Inheritance Tax Repeal - Beattymillerpccom

Should Iowa Repeal Its Inheritance Tax

Iowa House Speaker Cool To Inheritance Tax Repeal Proposal The Gazette

Iowa Inheritance Tax - A Thing Of The Past In The Future

Iowa Senate Passes Inheritance Tax Repeal Clears Path For Income Tax Cuts The Iowa Torch

Where Not To Die In 2014 The Changing Wealth Tax Landscape

Elder Law West Des Moines Archives - Beattymillerpccom

Blog

Another State Ditches Its Death Tax While Potential Backdoor Federal Estate Tax Looms

Comments

Post a Comment