Sales tax and use tax rate of zip code 94104 is located in san francisco city, san francisco county, california state. The minimum combined sales tax rate for san francisco, california is 8.5%.

Understanding Californias Sales Tax

More than $100 but less than or equal to $250,000.

San francisco county sales tax rate. The local sales tax rate in san francisco county is 0.25%, and the maximum rate (including california and city sales taxes) is 9.375% as of november 2021. $3.40 for each $500 or portion thereof. In san francisco, the tax rate will rise from 8.5% to 8.625%.

San francisco county collects a 2.5% local sales tax, the maximum local sales tax allowed under california law. The california sales tax rate is currently 6%. The sales and use tax is rising across california, including in san francisco county.

Automating sales tax compliance can help your business keep compliant with changing sales tax laws. The san francisco, california, general sales tax rate is 6.5%. That's because on wednesday, sales tax goes up to ten percent.

$2.50 for each $500 or portion thereof. $1,000,000 or more but less than $5,000,000. The 2018 united states supreme court decision in south dakota v.

The california state sales tax rate is currently %. Utilize quick add to cart and more!. Ad create an online store.

City of san rafael (located in marin county) 9.000%: San francisco county has a higher sales tax than 60.4% of. More than $250,000 but less than $1,000,000.

City of concord (located in contra costa county) 8.750%: The city of san mateo charges a tax of $5.00 per $1,000, while the city of hillsborough charges a rate of $.30 per $1,000. Your brand can grow seamlessly with wix.

The san francisco sales tax rate is 0%. Has impacted many state nexus laws and sales tax collection requirements. Your brand can grow seamlessly with wix.

[ 2 ] state sales tax is 7.25%. Depending on the zipcode, the sales tax rate of san francisco may vary from 6.5% to 9.25%. The state then requires an additional sales tax of 1.25% to pay for county and city funds.

Utilize quick add to cart and more!. All in all, you'll pay a sales tax of at least 7.25% in california. Every 2021 combined rates mentioned above are the results of california state rate (6.5%), the county rate (0.25%.

This is the total of state, county and city sales tax rates. Sales tax in california counties county san luis obispo state rate 7.25% county rate 0% total sales tax 7.250% City of petaluma (located in sonoma county) 8.250%:

94104 zip code sales tax and use tax rate | san francisco {san francisco county} california. Metro counties sales and use tax rate guide effective 10/01/2021 ‐ 12/31/2021 other local rate city rate county transit rate state rate combined sales tax county/city hastings*……………………… 0.25% 6.875% 7.125% inver grove heights…………. Buyers pay for the recording fee, escrow, title and half of the city taxes.

1788 rows san francisco* 8.625%: You can find more tax rates and allowances for san francisco county and california in the 2022 california tax tables. San francisco county in california has a tax rate of 8.5% for 2022, this includes the california sales tax rate of 7.5% and local sales tax rates in san francisco county totaling 1%.

Estimated combined tax rate 8.50%, estimated county tax rate 0.25%, estimated city tax rate 0.00%, estimated special tax rate 2.25%. Ad create an online store. Tax rate for entire value or consideration is.

The county sales tax rate is 0.25%. The december 2020 total local sales tax rate was 8.500%. The san francisco county sales tax rate is %.

In san mateo county, sellers typically pay for the county transfer tax ($1.10 per $1,000) and half the city taxes. The true state sales tax in california is 6.00%. San francisco county, ca sales tax rate the current total local sales tax rate in san francisco county, ca is 8.625%.

How To Calculate Sales Tax In Excel

How To Calculate Sales Tax In Excel

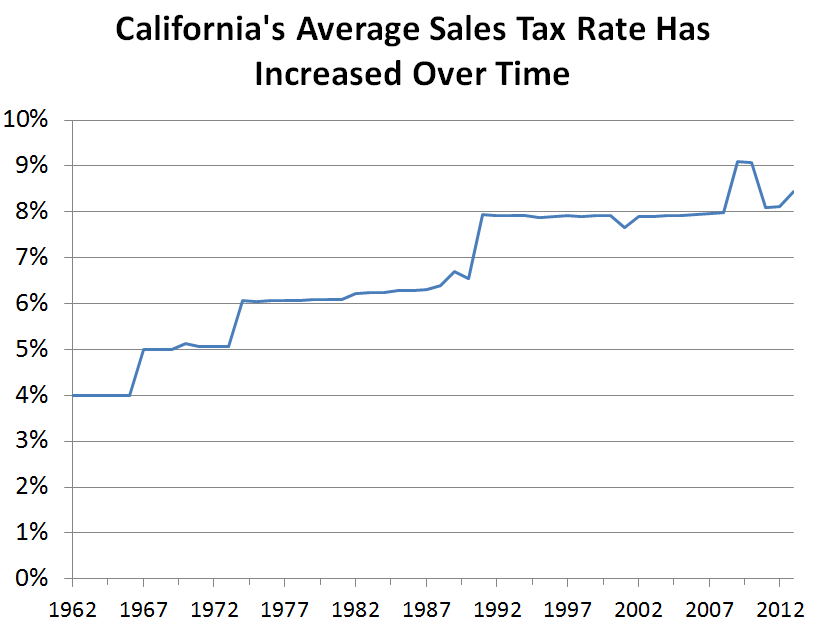

Californias Sales Tax Rate Has Grown Over Time Econtax Blog

2

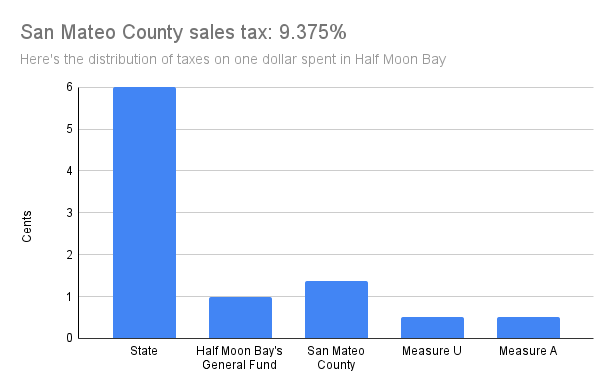

Pin By Ava Cat On Urban Planning Data Viz Budgeting City Urban Planning

How To Charge Your Customers The Correct Sales Tax Rates

County Begins Collecting Higher Sales Tax Local News Stories Hmbreviewcom

How To Charge Your Customers The Correct Sales Tax Rates

Understanding Californias Sales Tax

How High Are Capital Gains Taxes In Your State Tax Foundation

States With Highest And Lowest Sales Tax Rates

Understanding Californias Sales Tax

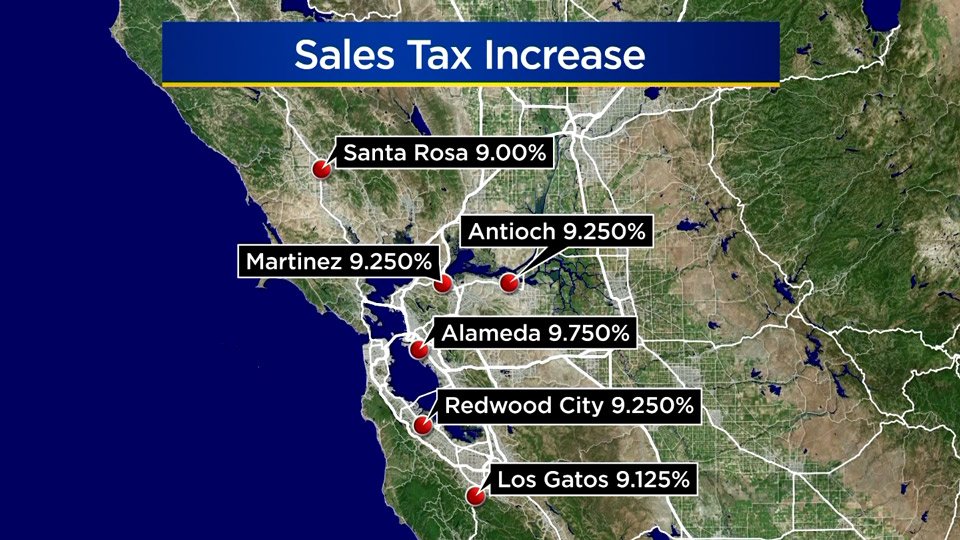

Sales Gas Taxes Increasing In The Bay Area And California

Which Cities And States Have The Highest Sales Tax Rates - Taxjar

Sales Tax Rates Rise Monday Out-of-state Online Sellers Included Cbs San Francisco

California Sales Tax Rates By City County 2021

Sales Tax Collections City Performance Scorecards

Which Cities And States Have The Highest Sales Tax Rates - Taxjar

How To Calculate Sales Tax In Excel

Comments

Post a Comment